What's New in Zoho Books - October 2022

Hello users,

As we reach the last quarter of the year, we are back with updates and enhancements to meet your accounting needs. Let's take a look at what's new in Zoho Books this October:

As we reach the last quarter of the year, we are back with updates and enhancements to meet your accounting needs. Let's take a look at what's new in Zoho Books this October:

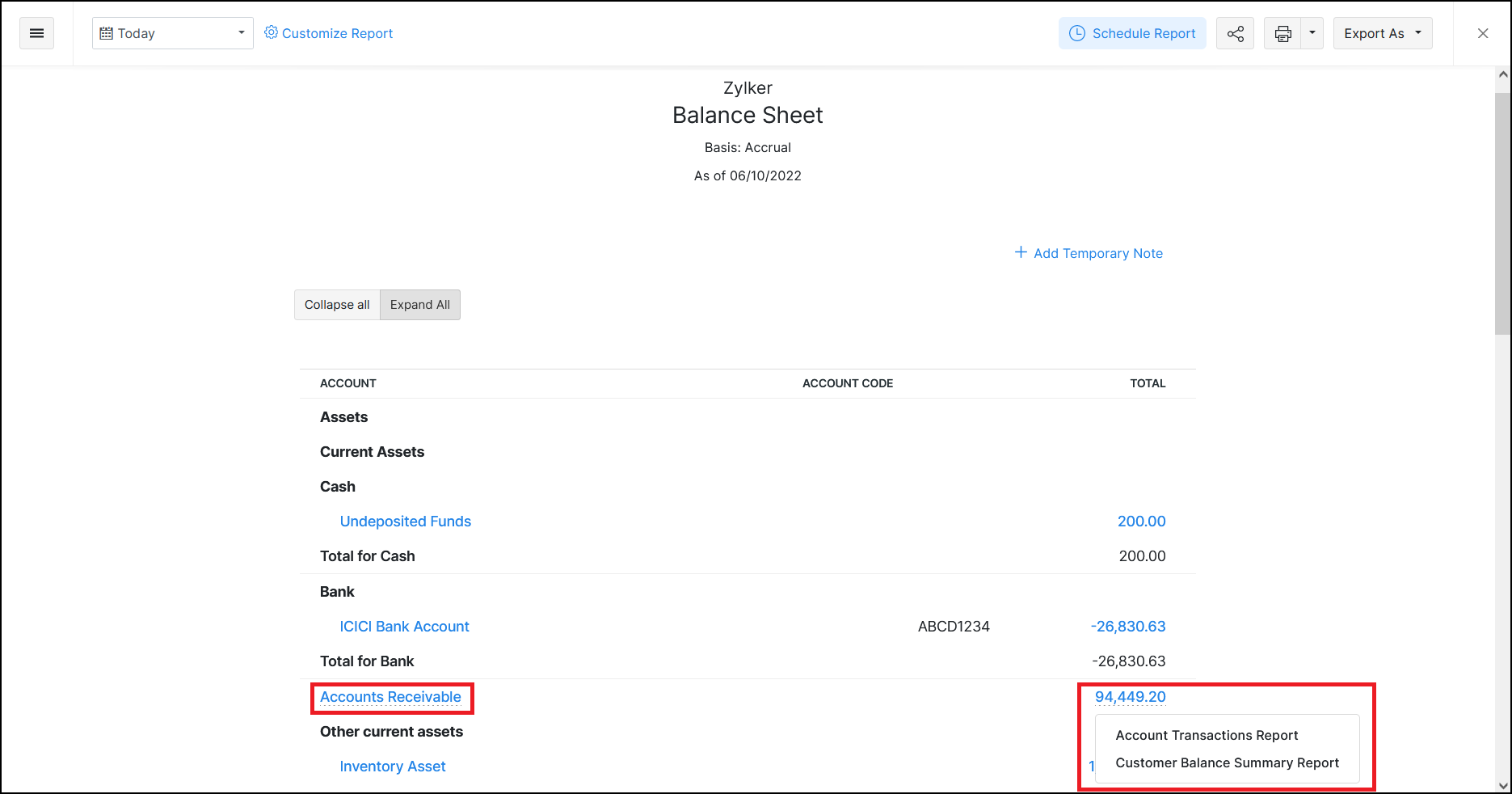

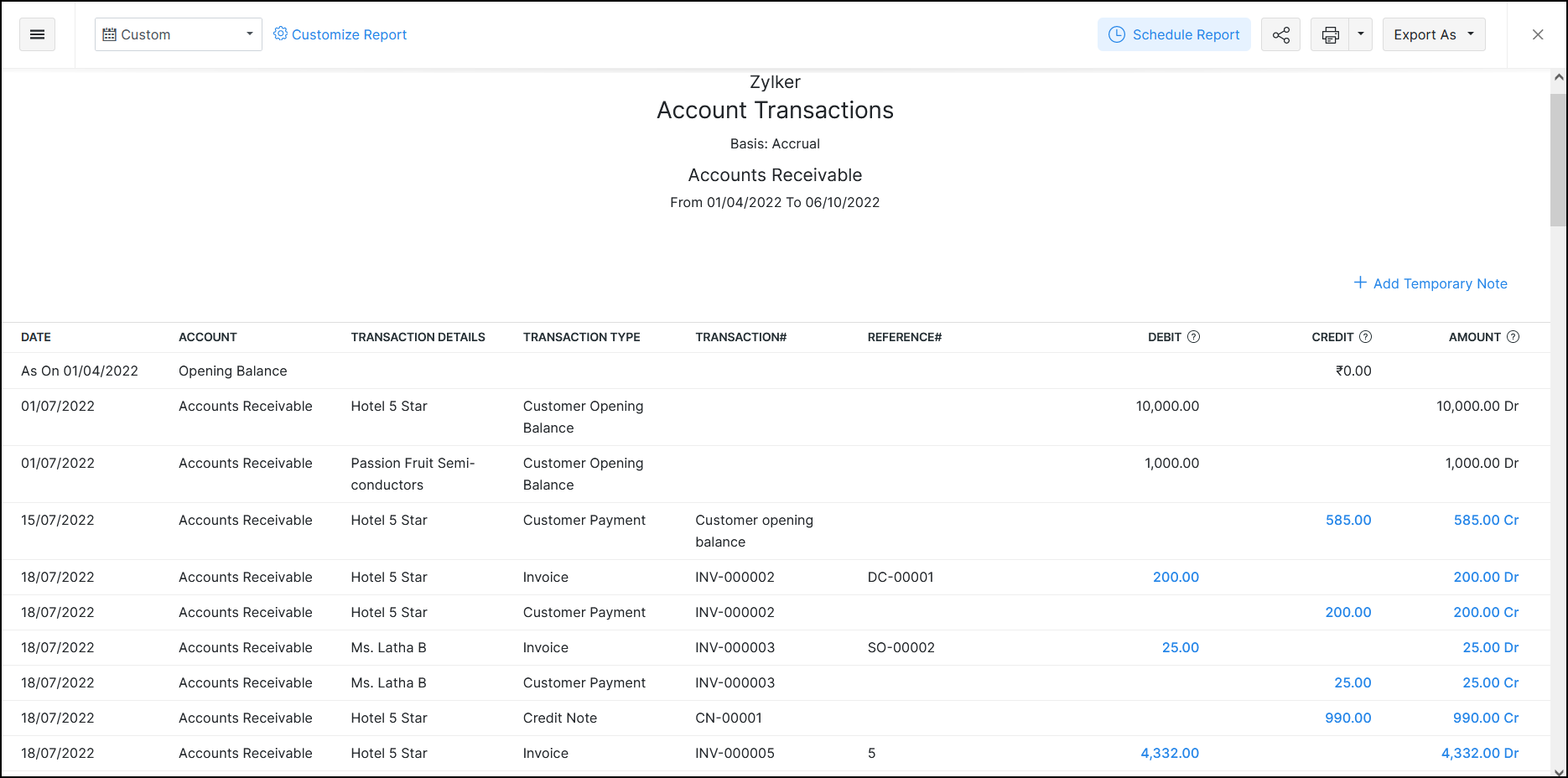

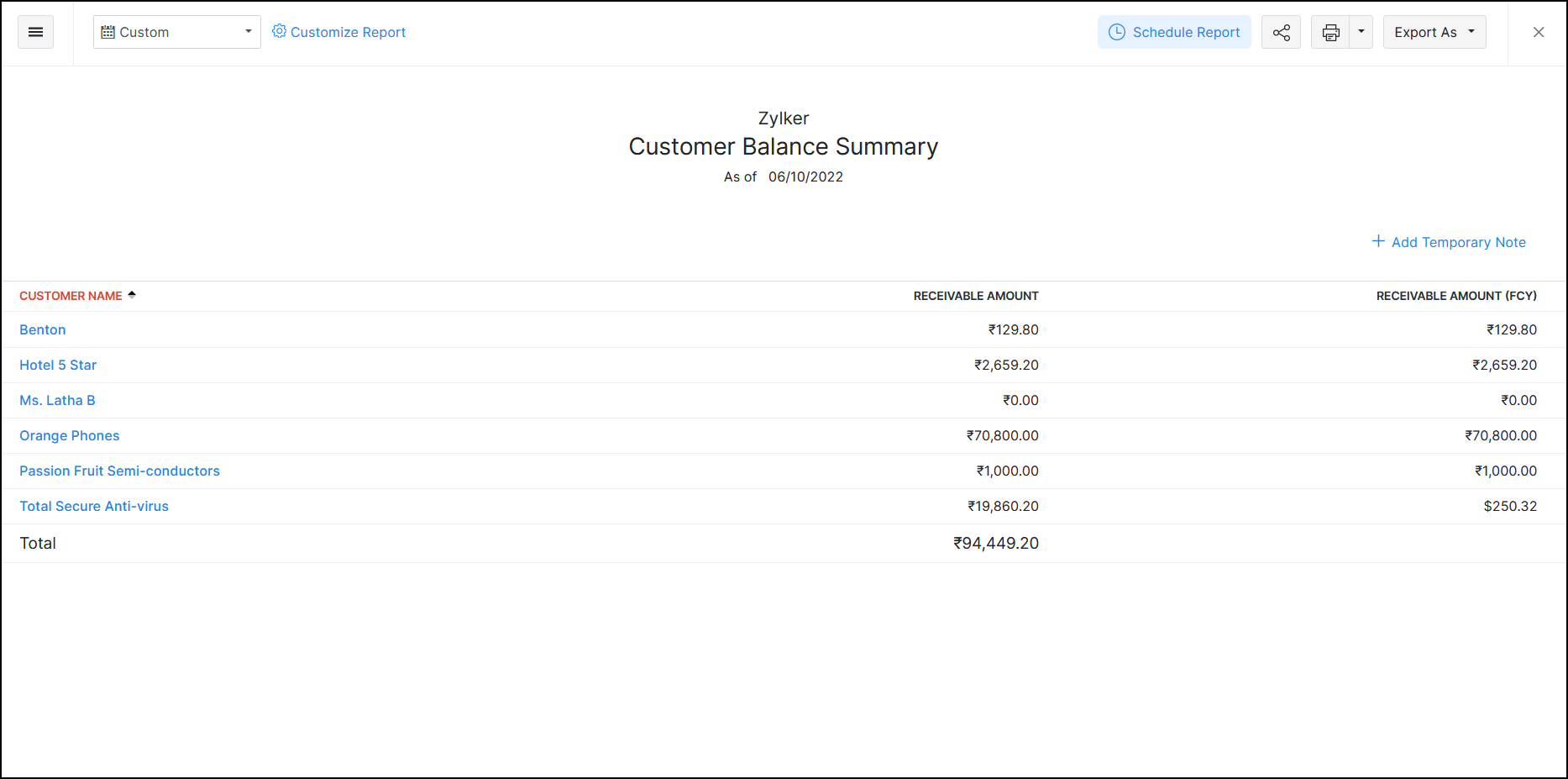

Accounts Receivable and Payable in Balance Sheet Report (India)

We have added the option to view the Account Transactions report and Customer Balance Summary report by clicking Accounts Receivable. Similarly, you can also view the Account Transactions report and Vendor Balance Summary report by clicking Accounts Payable.

To view this report, go to the Reports module. Select the Balance Sheet report under Business Overview. Select the period for which you want to view the report.

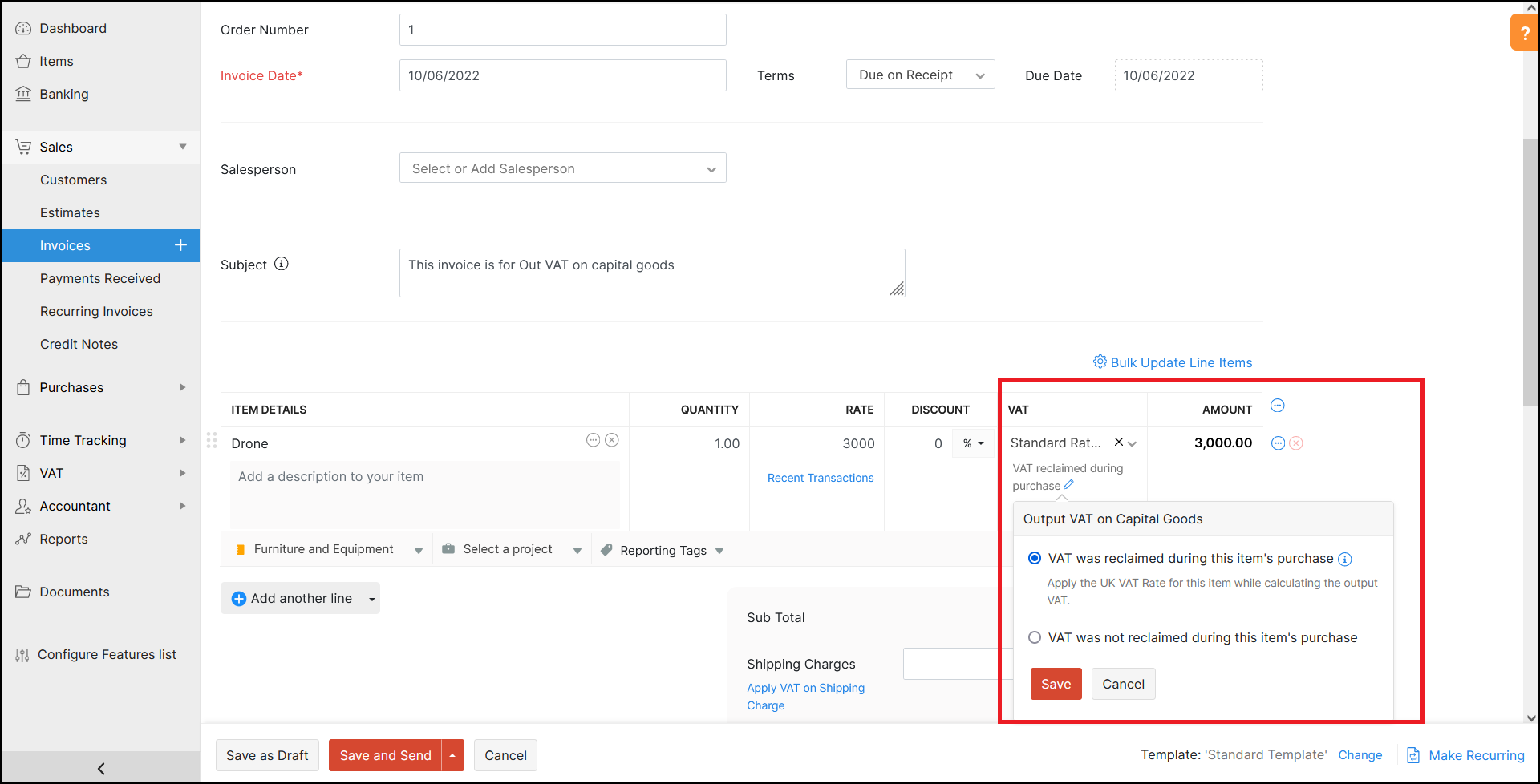

Output VAT on Capital Goods (UK)

Suppose you have enabled the Flat Rate Scheme for your organization. In that case, you can claim VAT on purchasing capital expenditure goods if the value of the item, including VAT, is more than £2,000.

However, if you select VAT was reclaimed during this item's purchase option, the UK VAT rate will be applied for this item while calculating output VAT.

If you had reclaimed VAT while recording a bill, the output VAT for this item would be calculated based on the UK VAT Rate. If not, the output VAT would be calculated at a flat rate.

Note: You can reclaim VAT for an item's purchase only for items whose account type is Fixed Asset.

Note: You can reclaim VAT for an item's purchase only for items whose account type is Fixed Asset.

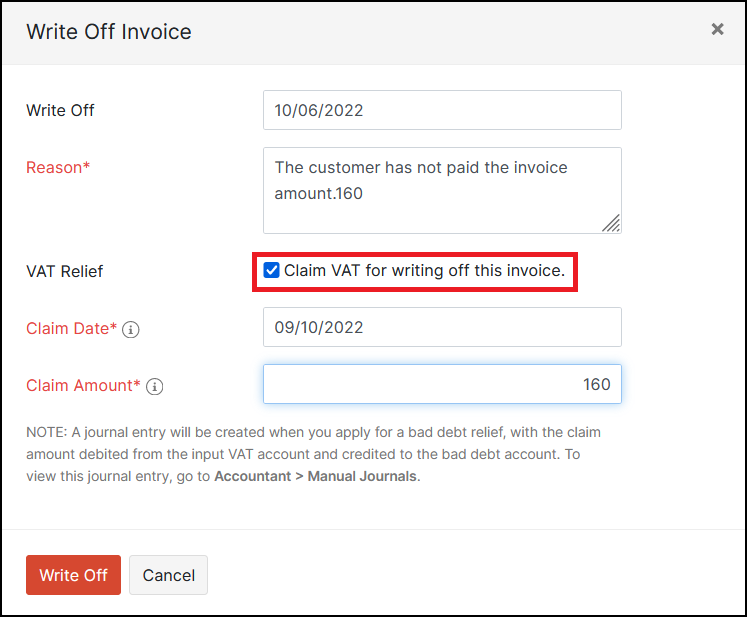

Claim VAT for Writing Off An Invoice (UK)

If the customer does not pay for the goods or services you sold, you can write off the invoice as Bad Debt. You can claim the VAT you paid for this invoice from HMRC, six months after the invoice's due date. A journal entry will be created, and the claim amount will be debited from Input VAT account and credited to Bad Debt account.

To claim VAT for a written off invoice:

- Go to Sales > Invoices and select the invoice.

- Click Record Payment and select Write Off.

- Enter the Reason and check the Claim VAT for writing off this invoice option.

- Enter the Claim Date and Claim Amount.

- Click Write Off.

Note: You can claim VAT for written-off invoices only if accrual based accounting is enabled for your organization.

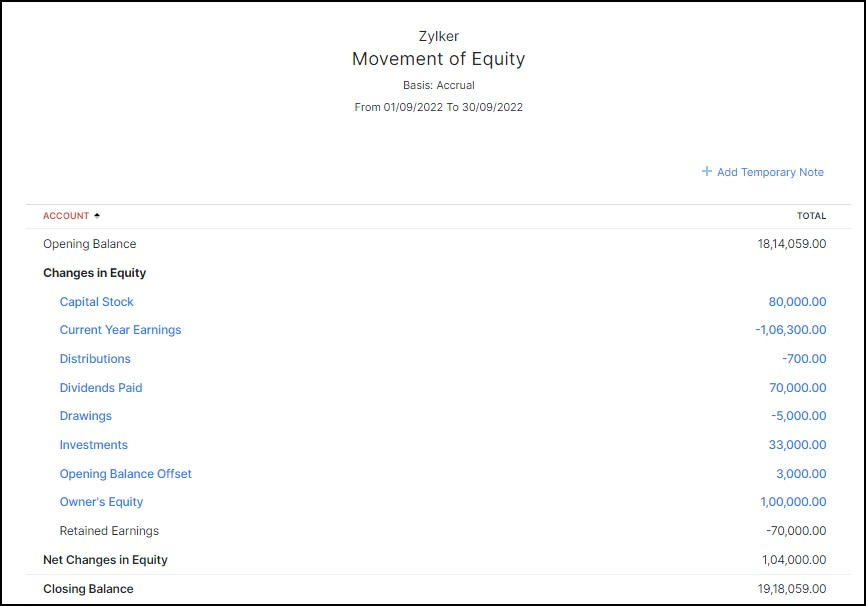

Movement of Equity Report

The Movement of Equity report is a comparative statement that shows the changes in the business's equity for the period of your choice.

To view this report, go to the Reports module. Select the Movement of Equity report under Business Overview. Select the period for which you want to view the report.

To view this report, go to the Reports module. Select the Movement of Equity report under Business Overview. Select the period for which you want to view the report.

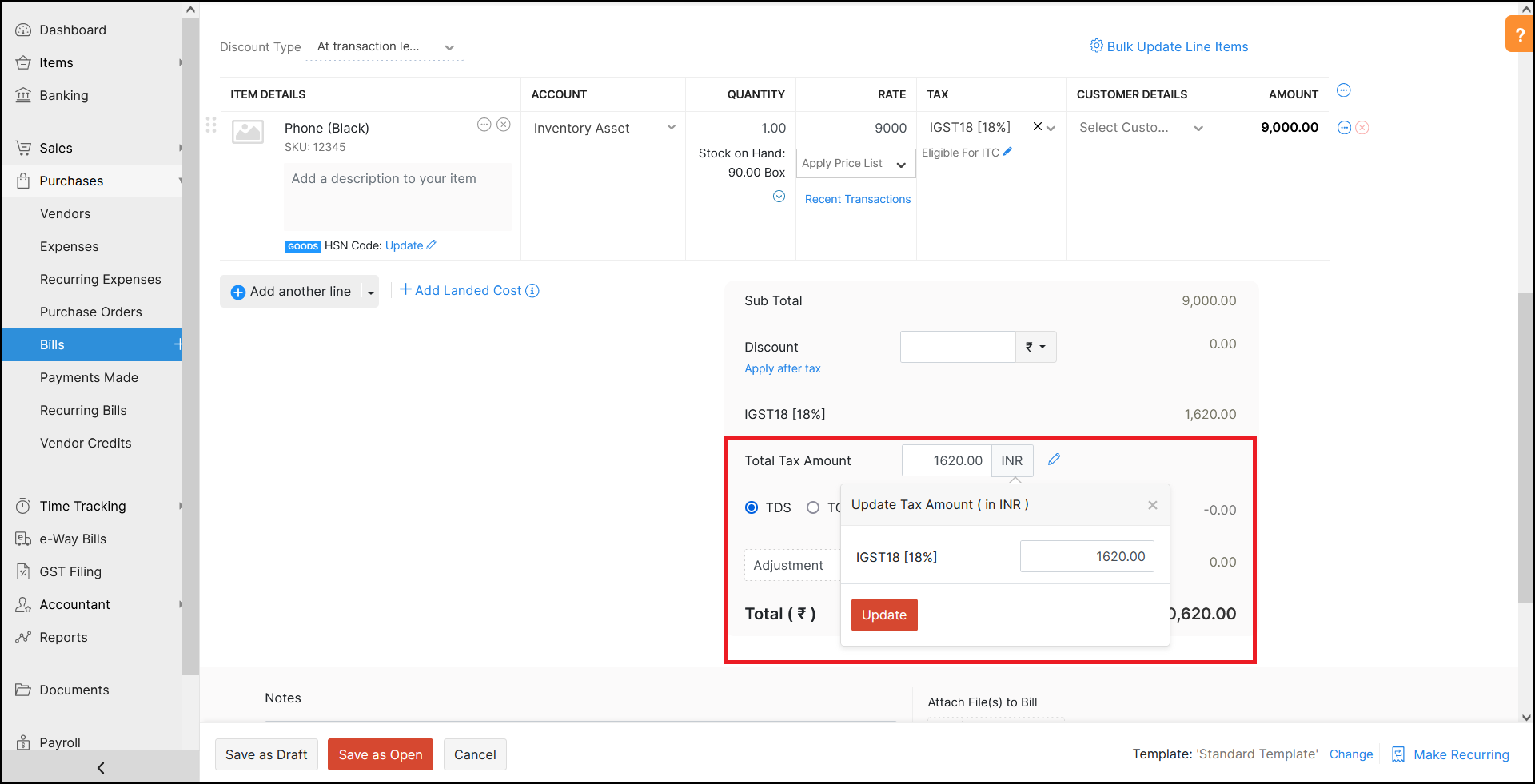

Tax Override in Purchases Module (India)

There might be cases wherein the tax amount in an expense varies because your vendor calculates the tax applied to the transaction differently.

Zoho Books allows you to account for these minor variations by manually changing the automatically calculated tax amount once you apply tax to a transaction.

You can manually change the tax amount for expenses, bills and purchase orders.

Updates for Organizations Integrated with Zoho Inventory

- Create shipments directly from the shipments list page. Carrier-enabled organizations can create a shipment through carriers by default. Other organizations can create shipments manually. This feature is available for organizations with the the Zoho Inventory add-on enabled.

- You can now fulfill or unfulfill a sales order completely or partially. You can choose to fulfill or unfulfill each line item and the quantity in partial fulfillment or unfulfillment.

iOS Updates

- To stay in compliance with Apple's new App Store Review Guidelines, we have provided the option to delete your Zoho account.

- Add Zoho Books Widget to your lock screen, create new invoices and timesheets, and track the time spent on a project.

- Using Live Text, copy text such as reference numbers and notes from receipts and paste them into respective fields while creating expenses.

- You can ask Siri to carry out specific commands in Zoho Books using App Intents.

Read our blog on Zoho Finance Suite's iOS 16 and watchOS 9 to know more.

Give these features a try, and let us know what you think in the comments below.

If you have any feature requests or questions, contact us at support@zohobooks.com.

Cheers,

The Zoho Books Team

Give these features a try, and let us know what you think in the comments below.

If you have any feature requests or questions, contact us at support@zohobooks.com.

Cheers,

The Zoho Books Team

Topic Participants

Nandha Krishna B

Jaleef Abdulrahuman

Karun Saxena

tlewis

sameer

Recent Topics

Font breakage in Zoho Mail Desktop Lite application for Mac

Dear Zoho Mail and Workplace Community, With the latest update of macOS Sequoia and macOS Tahoe, there has been font breakages in the email preview of Zoho Mail Desktop Lite application for Mac. This breakage is due to the corruption of the System fontsFeature request - image resizing on sales orders

I need to be able to show the items on the sales orders, currently the item image shows really small and no way to resize it, need the ability to make the image larger to showcase the product on the pdfsMail Merge is not working properly as far as the AUTOMATE section is concerned

Hi there, I created a Mail Merge template for the Deal module. I would like Deal owners to mail merge their Deal records, download the Mail Merge document as a Word doc and make a few changes before sending it to the customer. Thing is, neither the "MergeSupport for Custom Fonts in Zoho Recruit Career Site and Candidate Portal

Dear Zoho Recruit Team, I hope you're doing well. We would like to request the ability to use custom fonts in the Zoho Recruit Career Site and Candidate Portal. Currently only the default fonts (Roboto, Lato, and Montserrat) are available. While theseWhat's new in Zoho Sheet: Simplify data entry and collaboration

Hello, Zoho Sheet community! Last year, our team was focused on research and development so we could deliver updates that enhance your spreadsheet experience. This year, we’re excited to deliver those enhancements—but we'll be rolling them out incrementallyNueva edición de "Ask The Expert" en Español Zoho Community

¡Hola Comunidad! ¿Te gustaría obtener respuestas en directo sobre Zoho CRM, Zoho Desk u otra solución dentro de nuestro paquete de CX (Experiencia del Cliente? Uno de nuestros expertos estará disponible para responder a todas tus preguntas durante nuestraAutomation Series: Auto-Notify External Users on Issue Closure

Hello Folks! In Zoho Projects, you can notify external issue reporters via email when an issue is marked as Closed. This helps the users avoid manual follow-ups and keeps the reporter updated. In this post, we’ll walk through a simple setup using a WebIssue with open-rate reporting in Zoho Campaigns

Hello, Since yesterday I’ve been experiencing an issue with the open-rate reports in Zoho Campaigns. The campaigns I send appear in the reports as if none of the emails have been opened, even though I know they have. To verify this, I replicated the campaignTurn chat conversations into real action with Integration Blocks in Guided Conversations

When a Guided Conversation fails, it's usually not because the logic is wrong. They fail because the conversation stops moving. A customer starts a chat with a clear goal: report an issue, check a status, or confirm something. At first, the flow doesBasic Mass Update deluge schedule not working

I'm trying to create a schedule that will 'reset' a single field to 0 every morning - so that another schedule can repopulate with the day's calculation. I thought this would be fairly simple but I can't work out why this is failing : 1) I'm based inSpecial characters (like â, â, æ) breaking when input in a field (encoding issue)

Hey everyone, We are currently dealing with a probably encoding issue when we populate a field (mostly but not exclusively, 'Last Name' for Leads and Contracts). If the user manually inputs special characters (like ä, â, á etc.) from Scandinavian languages,click to call feature

I've Zoho CRM and in that i want click to call feature.We Asked, Zoho Delivered: The New Early Access Program is Here

For years, the Zoho Creator community has requested a more transparent and participatory approach to beta testing and feature previews. Today, I'm thrilled to highlight that Zoho has delivered exactly what we asked for with the launch of the Early AccessFrom Zoho CRM to Paper : Design & Print Data Directly using Canvas Print View

Hello Everyone, We are excited to announce a new addition to your Canvas in Zoho CRM - Print View. Canvas print view helps you transform your custom CRM layouts into print-ready documents, so you can bring your digital data to the physical world withCan the Product Image on the Quote Template be enlarged

Hello, I am editing the Quote Template and added ${Products.Product Image} to the line item and the image comes up but it is very tiny. Is there anyway that you can resize this to be larger? Any help would be great! ThanksAnalytics <-> Invoice Connection DELETED by Zoho

Hi All, I am reaching out today because of a big issue we have at the moment with Zoho Analytics and Zoho Invoice. Our organization relies on Zoho Analytics for most of our reporting (operationnal teams). A few days ago we observed a sync issue with theCreating Parent Child relationship in Accounts

We have customers with multiple locations, I setup the HQ as an account, then I setup the different sites marking the HQ as the parent to that location. If I then do a Deal for one of the locations, is there a way to show by looking at the parent accountLearner transcript Challenges.

Currently i am working on a Learner Transcript app for my employer using Zoho Creator. The app is expected to accept assessment inputs from tutors, go through an approval process and upon call up, displays all assessments associated with a learner inClient and Vendor Portal

Some clients like keeping tabs on the developments and hence would like to be notified of the progress. Continuous updates can be tedious and time-consuming. Zoho Sprints has now introduced a Client and Vendor Portal where you can add client users and#7 Tip of the week: Delegating approvals in Zoho People

With Zoho People, absences need not keep employees waiting with their approval requests. When you are not available at work, you can delegate approvals that come your way to your fellow workmate and let them take care of your approvals temporarily. Learn more!Admin Tip: Manage sub-domain emails using sub-domain stripping

As an admin, you may need separate domains for different departments such as sales, support, and marketing. While this approach offers flexibility, creating and managing multiple domains can quickly become overwhelming, especially since each domain requiresBring Zoho Shifts Capabilities into Zoho People Shift Module

Hello Zoho People Product Team, After a deep review of the Zoho People Shift module and a direct comparison with Zoho Shifts, we would like to raise a feature request and serious concern regarding the current state of shift management in Zoho People.Quick Copy Column Name

Please add the ability to quickly copy the name of a column in a Table or Query View. When you right-click the column there should be an option to copy the name, or if you left-click the column and use the Ctrl+C keyboard shortcut it should copy theAbility to Edit YouTube Video Title, Description & Thumbnail After Publishing

Hi Zoho Social Team, How are you? We would like to request an enhancement to Zoho Social that enables users to edit YouTube video details after the video has already been published. Your team confirmed that while Zoho Social currently allows editing theHow do I remove a data source from Zoho Analytics?

I am unable to find a delte option on a datasource that i put in the system as an error. On teh web it refers to a setup icon but I do not see that on my interface?Add Employee Availability Functionality to Zoho People Shift Module

Hello Zoho People Product Team, Greetings and hope you are doing well. We would like to submit a feature request to enhance the Zoho People Shift module by adding employee availability management, similar to the functionality available in Zoho Shifts.Bigin, more powerful than ever on iOS 26, iPadOS 26, macOS Tahoe, and watchOS 26.

Hot on the heels of Apple’s latest OS updates, we’ve rolled out several enhancements and features designed to help you get the most from your Apple devices. Enjoy a refined user experience with smoother navigation and a more content-focused Liquid GlassReally want the field "Company" in the activities module!

Hi team! Something we are really missing is able to see the field Company when working in the activities module. We have a lot of tasks and need to see what company it's related to. It's really annoying to not be able to see it.🙈 Thx!Delay in rendering Zoho Recruit - Careers in the ZappyWorks

I click on the Careers link (https://zappyworks.zohorecruit.com/jobs/Careers) on the ZappyWorks website expecting to see the job openings. The site redirects me to Zoho Recruit, but after the redirect, the page just stays blank for several seconds. I'mIs Desk Down?

Across department - always an error. [Status Mode] - error [Table View and the rest] - workingHow do I change the wording of the tile of SignForm?

When my user opens a SignForm url, the title that is presented is always "SignForm signer Information" and a form is displayed asking for the username and email address. This can be confusing to the end user. How can I change the title at least (Or atHow to link tickets to a Vendor/Vendor Contact (not Customer) for Accounting Department?

Hi all, We’re configuring our Accounting department to handle tickets from both customers and vendors (our independent contractors). Right now, ticket association seems to be built around linking a ticket to a Customer / Customer Contact, but for vendor-originatedProblem with CRM Connection not Refreshing Token

I've setup a connection with Zoom in the CRM. I'm using this connection to automate some registrations, so my team doesn't have to manually create them in both the CRM and Zoom. Connection works great in my function until the token expires. It does not refresh and I have to manually revoke the connection and connect it again. I've chatted with Zoho about this and after emailing me that it couldn't be done I asked for specifics on why and they responded. "The connection is CRM is not a feature toAutomatic Matching from Bank Statements / Feeds

Is it possible to have transactions from a feed or bank statement automatically match when certain criteria are met? My use case, which is pretty broadly applicable, is e-commerce transactions for merchant services accounts (clearing accounts). In theseClone Recurring Expenses

Our bookkeeping practices make extensive use of the "clone" feature for bills, expenses, invoices, etc. This cuts down significantly on both the amount of typing that needs to be done manually and, more importantly, the mental overhead of choosing theUnify Overlapping Functionalities Across Zoho Products

Hi Zoho One Team, We would like to raise a concern about the current overlap of core functionalities across various Zoho applications. While Zoho offers a rich suite of tools, many applications include similar or identical features—such as shift management,Automation #7 - Auto-update Email Content to a Ticket

This is a monthly series where we pick some common use cases that have been either discussed or most asked about in our community and explain how they can be achieved using one of the automation capabilities in Zoho Desk. Email is one of the most commonlyTicket to article and Ticket to template

Hello! I would like to know if it is possible (and how) to do the following actions: 1. To generate an article from a ticket (reply + original message) 2. Easy convert an answer to an email templateIs there API Doc for Zoho Survey?

Hi everyone, Is there API doc for Zoho Survey? Currently evaluating a solution - use case to automate survey administration especially for internal use. But after a brief search, I couldn't find API doc for this. So I thought I should ask here. ThanWindows Desktop App - request to add minimization/startup options

Support Team, Can you submit the following request to your development team? Here is what would be optimal in my opinion from UX perspective: 1) In the "Application Menu", add a menu item to Exit the app, as well as an alt-key shortcut for these menusNext Page