What's New in Zoho Payroll 2022 (India)

We are thrilled to bring you all the updates that we were working on over the past months. We have enhanced Zoho Payroll to be intuitive and easy to use so that both employers and employees have a great payroll experience. Here are the significant updates we've brought to Zoho Payroll:

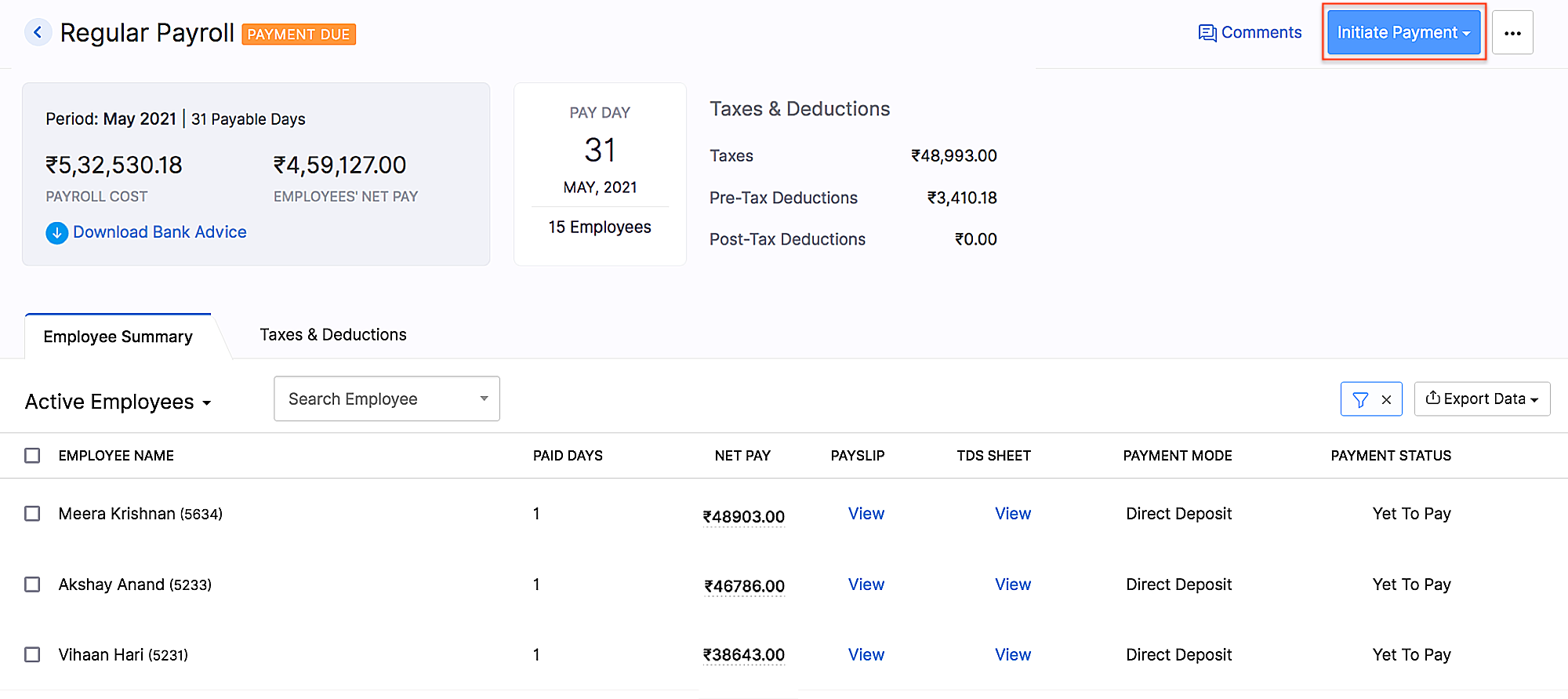

HSBC Direct Deposit

HSBC Direct Deposit

If your organisation has an HSBC corporate account, you can now directly integrate it with Zoho Payroll and deposit salaries directly into your employee bank accounts.

Once you approve the pay run for a particular period, you can initiate the salary payment via HSBC. After the payment is authorized, salaries are transferred to employees immediately. Learn More

Note: NEFT will be the default payment mode for the payments initiated from Zoho Payroll using the HSBC integration. If payments are initiated during non-business hours, the payments will be processed only on the next business day.

HSBC integration

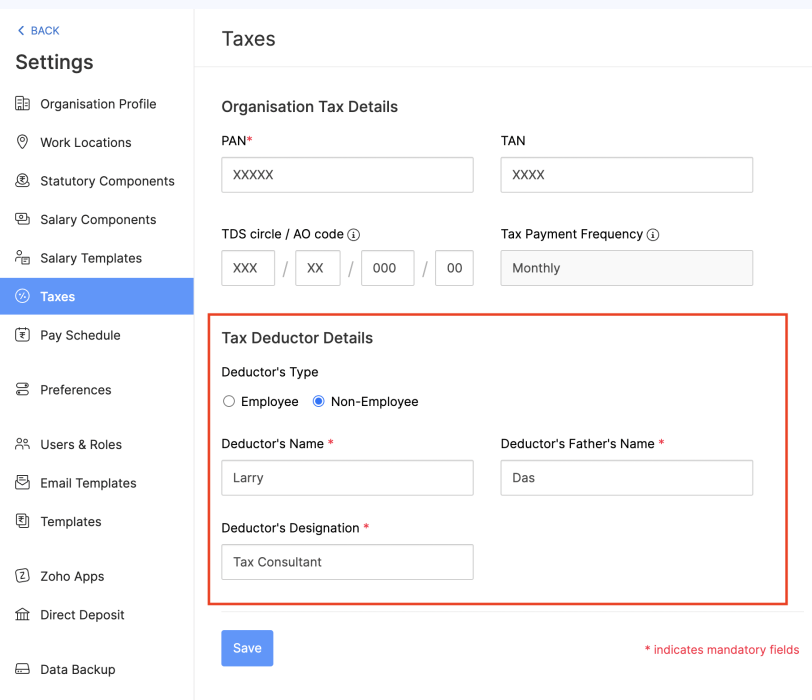

HSBC integrationAdd Non-Employee as Tax Deductor

You can now add a person who is not your employee, such as a third-party accountant or auditor, as a Tax Deductor in Zoho Payroll. The tax deductor will be responsible for remitting your tax to the government. Additionally, you will have to provide details such as the Deductor's name and designation.

To add the tax deductor, go to Settings > Taxes > Select Non-Employee as Tax Deductor.

Adding Non-Employee as Tax Deductor

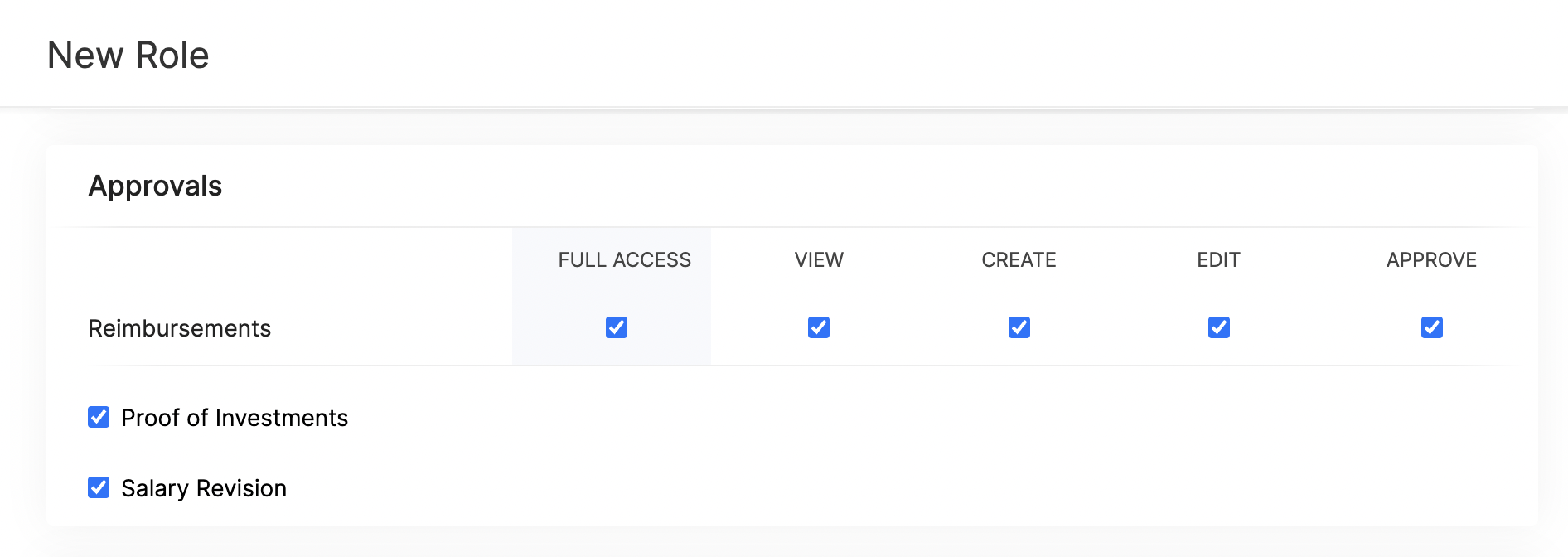

Adding Non-Employee as Tax DeductorUser Permissions for Approvals

Configure permissions such that only users who belong to roles that have approval permissions will be able to access those related modules.

To configure user permissions for approval: Go to Settings > Users & Roles > New Role. Next, select the modules and the level of access you want to provide for the role.

Approval User Permissions

Approval User PermissionsUpdates Related to Proof of Investments

- Filter employees who are yet to submit their Proof of Investments. Once you filter the employees, you can also export them in XLS, XLSX, and CSV formats.

- If you want to remind your employees to submit their Proof of Investments, you can now send them a system-generated email reminder.

- Previously, once admins configured the tax regime, they would not have been able to change it. Admins can now switch between the old and new tax regimes while recording the IT declarations and Proof of Investments, provided you've configured preferences to change regimes.

- You can mandate employees to upload attachments while submitting their Proof of Investments.

- In addition to uploading Proof of Investments in other formats, you can also upload .zip files.

New Form 24Q Format

The Central Board of Direct Taxes (CBDT) has introduced a new Format for Form 24Q. Zoho Payroll now supports the new format and the text files will be generated automatically in the new format.

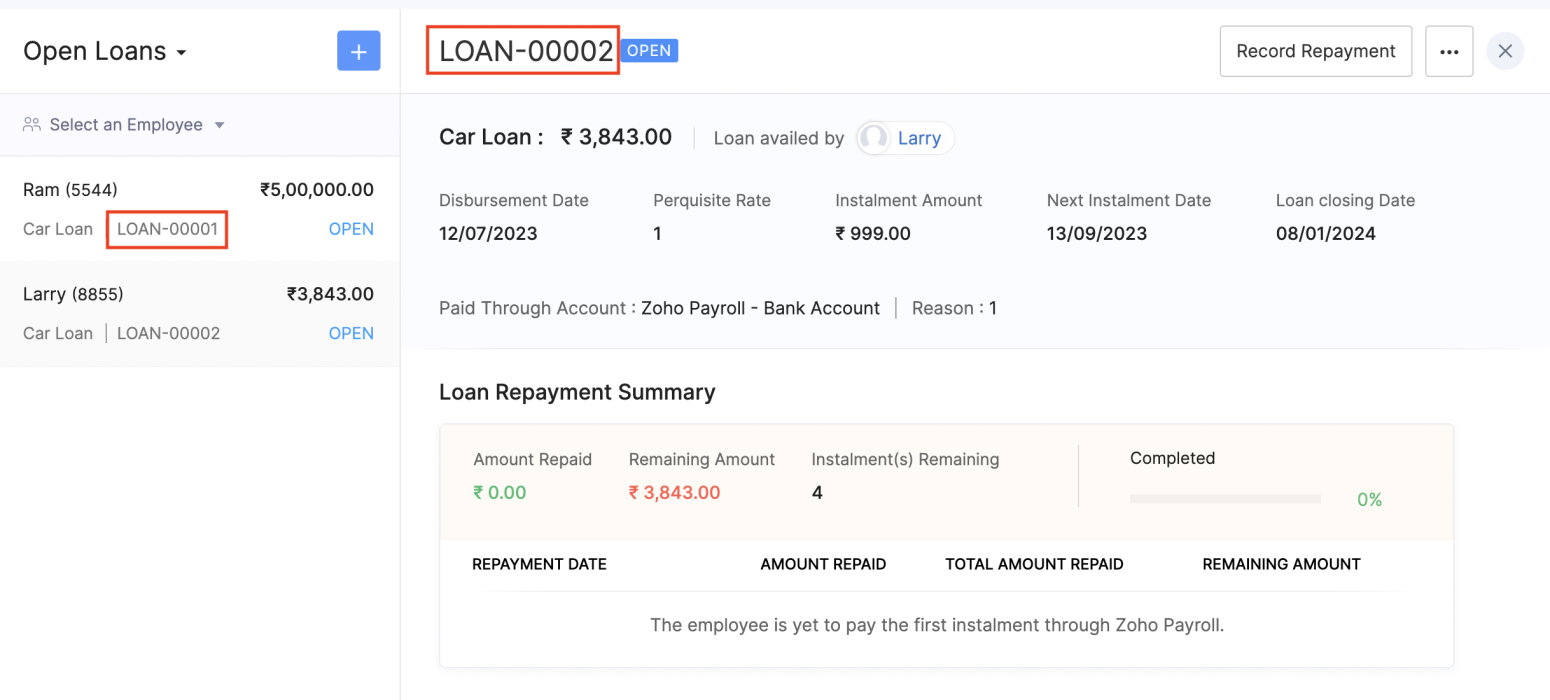

Unique Identifiers for Loans

When you record a loan, Zoho Payroll will automatically assign a unique number to the loan. This number will help you to search and find a particular loan quickly.

If you are importing loans, loan numbers are mandatory. So, ensure the files you upload have loan numbers in them. If the imported loan numbers match the existing loans in Zoho Payroll, the existing loan will be updated with the imported details.

Unique Identifier for Loans

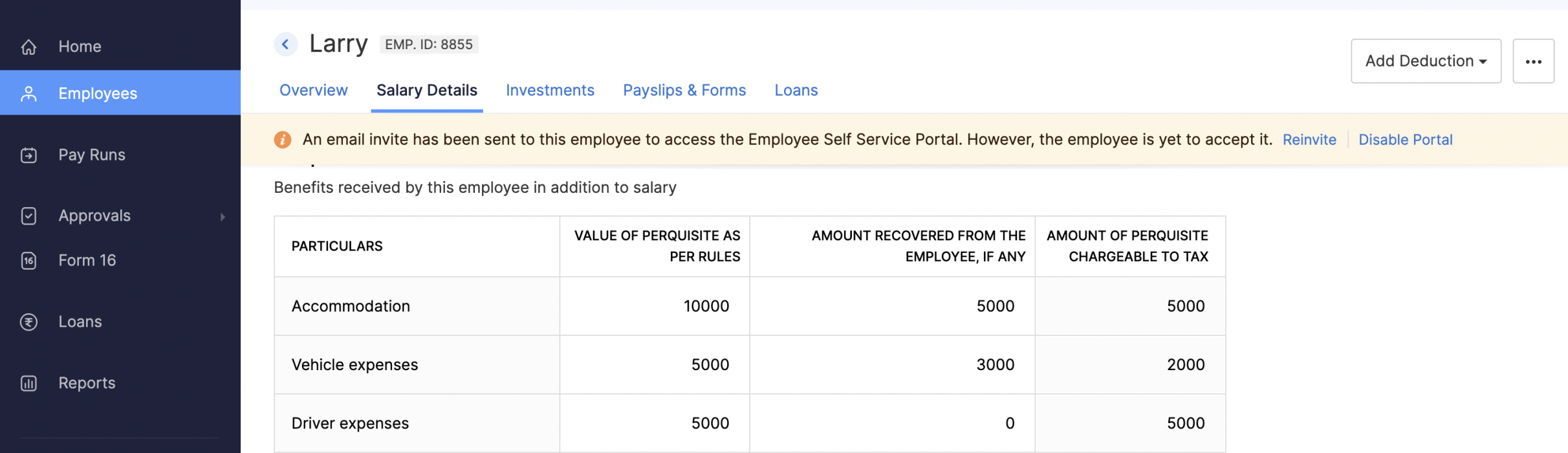

Unique Identifier for LoansView Vehicle and Driver Perquisites

You can view the vehicle and driver perquisites in the Perquisite section of an employee's Salary Details. In this section, you will be able to view the vehicle and driver perquisite that will be added to payroll every month.

To view vehicle and driver expenses, go to Employee > Salary Details > Perquisites.

Viewing Vehicle and Driver Perquisites

Viewing Vehicle and Driver PerquisitesUpdates to Reports

We've added three new reports: the FBP Declaration Report, Investment Declaration Report, and Proof of Investment Report. These reports will help you view employees' declaration and investment details.

- FBP Declaration Report: This report lists the employees who have declared their FBPs. The report also provides the earnings and reimbursement details. You can view the report from any particular date.

- Investment Declaration Report: This report lists the employees who have declared their investments. Additional details such as the Total Chapter VI-A amount, total allowance and HRA income amount, and total Direct Tax amount will also be listed in this report. You can view the report from any particular date.

- Proof of Investment Report: This report lists the employees who have submitted their proof of investments. You can view the report for any given financial year.

Employee Portal Updates

We've made some changes and rearrangements and introduced new modules to enhance your employee portal experience.

- We've now introduced the Documents module in the left sidebar, where your employees can view and download their pay slips and Form 16.

- Your employees can view notifications when Flexible Benefit Plan, Reimbursement Claims, Income Tax Declarations and Proof Of Investments are released or locked and when pay slips are released.

- View the preview of reimbursement when you upload it.

- Employees can now view TDS worksheet and Pay Slip details such as Earnings and Deductions.

- Employees can now add claims for their bills from the home page of the employee portal.

- If you have any queries related to Section 80DDB, you can use the Learn More link in the Investments module for more details.

Note: The product updates listed above are the significant features and enhancements we've released from January 2022 to October 2022. However, you can view all the enhancements from our What's New timeline. From December, we will inform you about the product updates regularly in this space - as and when they happen.

That's a wrap for now! We are always eager to hear your suggestions so we can help you better. If you have a feature request, please share it in the comments below.

If you require assistance, please write to us at support@zohopayroll.com, and we'll get back to you. Stay tuned for more updates from Zoho Payroll!

Regards,

The Zoho Payroll Team

The Zoho Payroll Team

Topic Participants

Bennet Noel L

Recent Topics

Accounting on the Go Series-47: Effortless GSTIN Management- Auto Populate TaxPayer Details in Zoho Books Mobile App

Hello everyone, Welcome back! Today, we're focusing on a feature specifically designed for our Indian users in the Zoho Books-Indian edition, particularly those who deal with GST compliance regularly. We understand the importance of accurate and efficientAccounting on the Go Series-48: Enhance Accuracy with Custom Work Week Start Days in Zoho Books iOS app

Hello everyone, Welcome back! We’re here with another feature spotlight that might seem small but can have a big impact on your daily routine: setting the first day of the work week in the Zoho Books iOS app. Imagine this: You’re a business owner whoTime to Get Paid Report in ZBooks

Hello, One of our customers who has 25 different companies around the world gets 60 days to make payments. Unfortunately, the subject report does not report an average time to get paid (in days) or the ability to look at a custom period of time. CurrentlyHow to prepare a balance sheet for a company that has no operations yet?

.Project Billing Method from Zoho People

Normaly our customers use Zoho Projects to manage projects and timesheet that are being charge to the customer. Using the integration from Zoho Project we can have projects base on different billing method. For example most of our customer use HourlyZoho Books-Accounting on the Go Series!

Dear users, Continuing in the spirit of our 'Function Fridays' series, where we've been sharing custom function scripts to automate your back office operations, we're thrilled to introduce our latest initiative – the 'Zoho Books-Accounting on the Go Series'.Zoho Books | Product updates | July 2025

Hello users, We’ve rolled out new features and enhancements in Zoho Books. From plan-based trials to the option to mark PDF templates as inactive, explore the updates designed to enhance your bookkeeping experience. Introducing Plan Based Trials in ZohoZoho Books | Product updates | August 2025

Hello users, We’ve rolled out new features and enhancements in Zoho Books. From the right sidebar where you can manage all your widgets, to integrating Zoho Payments feeds in Zoho Books, explore the updates designed to enhance your bookkeeping experience.Update or Upsert Records Using Unique Custom Fields

Hello customers, We've enhanced the process of updating records via API. You can now: Update records using unique custom fields Upsert records using unique custom fields Note: Both the features are available in the Zoho Books and Zoho Inventory apps.[Webinar] Understanding the New Invoice Management Systems

Join industry expert CA Pritam Mahure as he discusses the importance of the new Invoice Management System (IMS) and its impact on taxpayers. Topics Covered: - Concept of IMS and pre-requisites - Applicability and Restrictions on Invoices/Records for IMSAccounting on the Go Series-51: Effortless Transactions: Create and Manage Directly from Uploaded Documents

Hello everyone, We’re back with another useful feature that makes working with Zoho Books even easier! This time, we’re simplifying the process of creating transactions directly from uploaded documents. Imagine you’re out meeting clients, and you receive[WEBINAR] Effortless migration to the VAT-ready South Africa edition of Zoho Books

Hello there, If you are one of our early users from South Africa using the older edition of Zoho Books, this webinar is for you! We have now launched a new South Africa edition with VAT support, to which you can migrate your existing data. Join this session,Accounting on the Go Series-52: Capture Receipts on the Go, Right from Your Lock Screen.

Hello everyone, We’re excited to introduce a feature that will make your life so much easier—especially for those constantly on the move! With iOS 18, Zoho Books now allows you to capture receipts directly from your lock screen using Locked Camera Capture.AT - Austrian Accountant familiar with ZOHO

Hello, as I have just migrated to ZOHO and unfortunately have to change my accountant next year, I am looking for an accountant (for Austria) who already has experience with Zoho or who already manages clients using Zoho books. Is there anyone here fromZoho Workflow issue

Dear Zoho Users, I have Zoho Books premium subscription, I have created a email alerts workflow for Invoices and following are the configurations for the same: 1. Workflow for Invoice module 2. Choose when to tigger - created or edited 3. Filter the triggersAccounting on the Go Series-53: Swift Transactions at Your Fingertips-Zoho Books in Your Control Center

Hello again, We’ve all had those moments where you need to get something done quickly, but the process of unlocking your phone, finding the app, and navigating through menus slows you down. Now, with Zoho Books integrated into the iOS 18 Control Center,Update on PDF Download Issues Caused by Antivirus Software

Hello users, Antivirus software is designed to protect your computer from malicious software and threats. However, they may mistakenly identify legitimate files and software as threats at times. This is known as a false positive. We have received reportsAccounting on the Go Series-54: Effortlessly Find Your Zoho Books Customers in Your Phone’s Contact List

Hello Zoho Books users! How are you all ? We’re happy to share a handy new feature in Zoho Books mobile app. Now, you can access your Zoho Books customers right from your phone's contact list, making it easier to stay connected on the go. How this canIntegration of Phase 2 -e-invoicing- KSA

Zoho Team, I want to get a training of integration of phase 2 invoicing KSA in zoho step by step.I can not save new invoice

Hello Now I am trying to save a new invoice but I can not save it because showing unpaid invoice warning which are not overdue. Please let me know how to skip unpaid invoice warning letter and save new invoice. Thank youADD CONDITIONS FOR FIELD IN ZOHO BOOKS TEMPLATE CUSTOMAZATION

HELLO I WANT TO ADD CONDITIONS FOR FIELD IN ZOHO BOOKS TEMPLATE CUSTOMAZATION FOR SALES ORDER . I HAVE SET %StatusStamp% IF APPROVAL I WANT THAT TEXT TO BE DISPLAYED WITH GREEN COLOR OTHERWISE OF OTHERR STATUS RED COLOR AS SHOWN IN CODE BELOW . BUT ITAccounting on the Go Series-55: Seamlessly Add New Vendors While Creating Transactions from Scanned Documents

Hi there! We’ve made handling documents and vendors in Zoho Books even simpler. Now, when you upload a document and scan it, if the app detects a vendor that isn’t already in your organization, you don’t have to leave the page to add them manually. WithAccounting on the Go Series-57: Effortlessly Add and Manage Bank Accounts from the Zoho Books Mobile App

Hi all, Great news for our users in the US and Canada! Managing your finances just got a whole lot easier. Zoho Books has always made it seamless to integrate bank accounts and fetch feeds automatically. Now, we’re taking it up a notch—directly from theAccounting on the Go Series:58-Effortless Compliance: Download XML for Invoices & Credit Notes on Mobile

Hi there! In Mexico, XML files are crucial for electronic invoicing and fulfilling SAT (Tax Administration Service) requirements. These files ensure your transactions are accurately recorded and tax-compliant. Now, you don’t need to rely on the web appAuto Generated Invoice number YEAR

Auto Generated Invoice number shows transaction year as 25 even though it's 24 still.Books generiert keine valide XRechnung

Hallo zusammen, ich möchte hier ein Problem ansprechen, das mir aktuell bei der Nutzung von Books erhebliche Schwierigkeiten bereitet, und hoffe auf Austausch oder Lösungsansätze von anderen Nutzern. Bei der Erstellung von XRechnungen mit Books tretenWHEN UPDATE ORGANIZATION INFO OLD INVOICES ALSO CHANGE INVOICING DATA

Hi We have updated our tax information because we have become a company, up until now we were an individual. The problem is that when updating the data in the zoho books profile all the old invoices change their tax information as well. Is there a wayInvoice import error - duplicate customer name column - there are no duplicates

It is not allowing the importing of any rows because of a duplicate customer name problem, but there are no duplicates in the custoemr name row. Has anyone dealt with this issue before?[WEBINAR][Feb 2025] Automate your entire financial operations from receipts to reconciliation with Zoho Books & Zoho Expense integration

Hello there, We are hosting a free, live webinar on the importance of travel and expense management solutions for businesses, and how Zoho Expense automatically syncs with Zoho Books to simplify your accounting even further. The webinar is on FebruaryCustomize Layout

I am using "Customize Layot" for customize Quotation template but I try to add logo into the header by "%ScaledLogoImage%" code but dont add logo into header. what is problem?Problem - cant add Users (i.e. Zoho one / CRM Users) to BCC or CC in email, i.e. Sales orders or Retainers

I can go to zoho books email templates, and select any email template, and automatically include any Zoho One user, i.e. member of staff. However in the context of sending an email, it will not let us add a member of staff from the user list, insteadUK MTD ITSA

UK Making Tax Digital for Income Tax I have had notice this is to apply from April 2026. What is Zoho doing about this? I will need to start planning to implement this in the next months so need an update as to what I will and will not be able to do inPartial refunds

I am trying to process refund for a one item invoice, however the refund is partial: i am getting this error while creating credit note, can anyone share some wisdom about thisZoho Books Roadshows are back in the UAE!

Hello there, Business owners and accounting professionals of the UAE, we’re coming to your cities! FTA accredited Zoho Books is now officially one of the Digital Tax Integrators in the UAE. With the newly launched direct VAT filing capabilities, we'reNew user After moving over from QBO

New user observations/suggestions. QBO took away a lot of features I was used to with the desktop version. Chaos ensued. Zoho Books has a lot of what I was used to and a bit more. Good deal Some things I have run into and suggest some upgrades. 1: TheSole Trader - Financial Advisor (Appointed Representative) - Paid via Capital Account but no Invoicing...

Hi. I'm about to venture into a new business after 12 months of intensive learning/exams. A little chuffed if I may say so especially at 52! I really like the look of ZoHo Books for my modest enterprise but I'm in need of some guidance, please. My servicesMulti-Unit Inventory with Flexible Unit Selection (Purchase in One Unit, Sell in Another)

We need multi-unit inventory management in Zoho Books with the flexibility to choose units (e.g., Box or Piece) at the time of purchase or sale. For example, if 1 Box = 10 Pieces, we should be able to record purchases in Boxes but sell either in BoxesDisputed Purchase Invoices

We have recently moved to Zoho Books from Sage. In Sage we were able to post a purchase/vendor invoice but mark it as on dispute. This would usually be a pricing query or if something was damaged. It would show in their ledger, so we could agree theirNo TDS Deduction

In some of our case, where we are reselling items at the same rate we purchased. In this scenario, Indian IT Law has a provision to request customer not to deduct TDS if the transaction value is same. TDS is paid by us (intermediary reseller) before weCBSA - GST CHARGES on imports

Hi there, We have a questions about landed cost categorization. We received a shipment from overseas. CBSA invoiced us for the GST on the items. Now we entered the CBSA-GST as a separate bill and attached it as landed cost to the main invoice based onNext Page