What's New in Zoho Books - August 2024

Hello users,

We've rolled out new features and enhancements to elevate your accounting experience in Zoho Books. Dive in to discover what's new in Zoho Books this August.

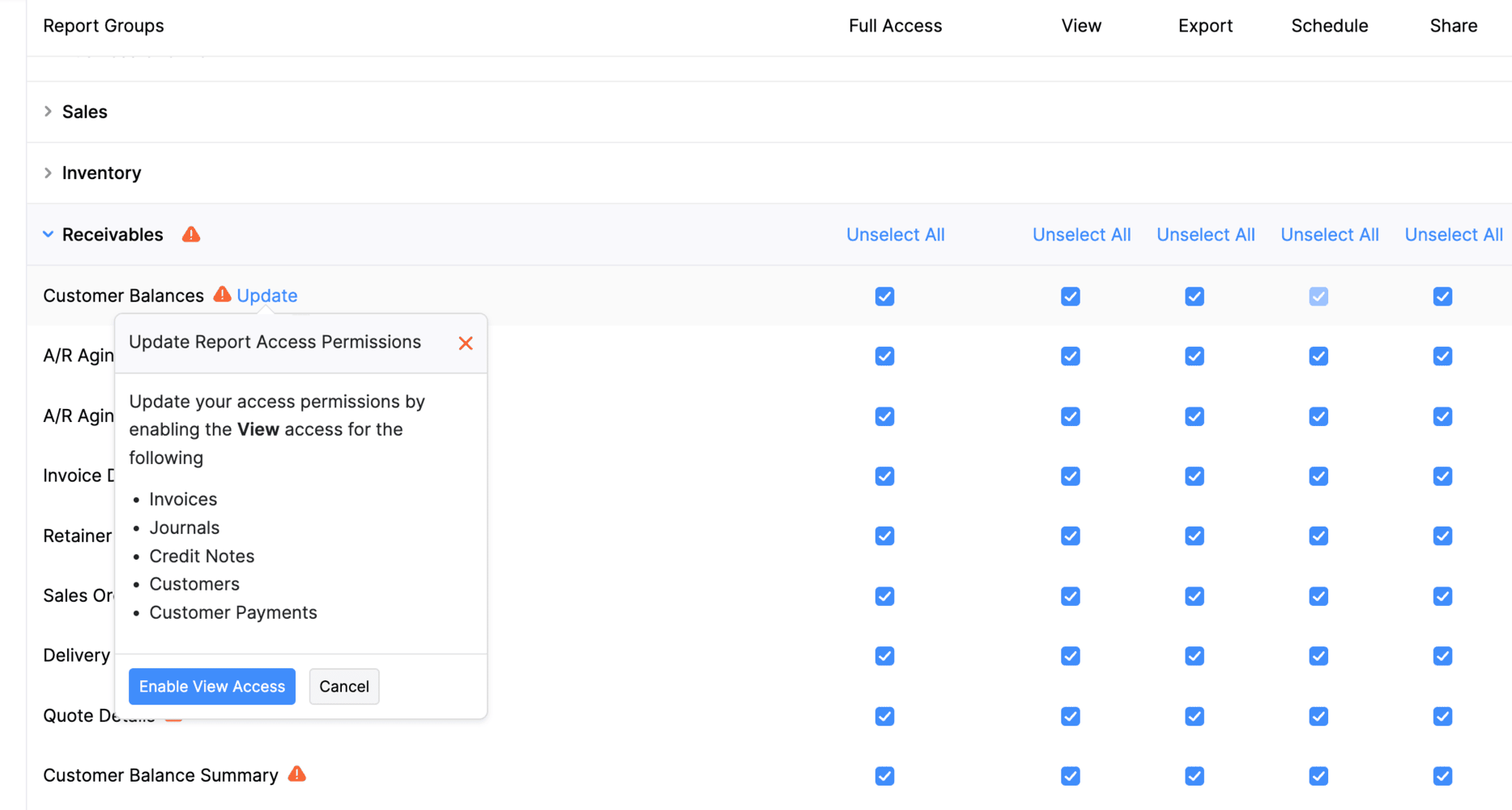

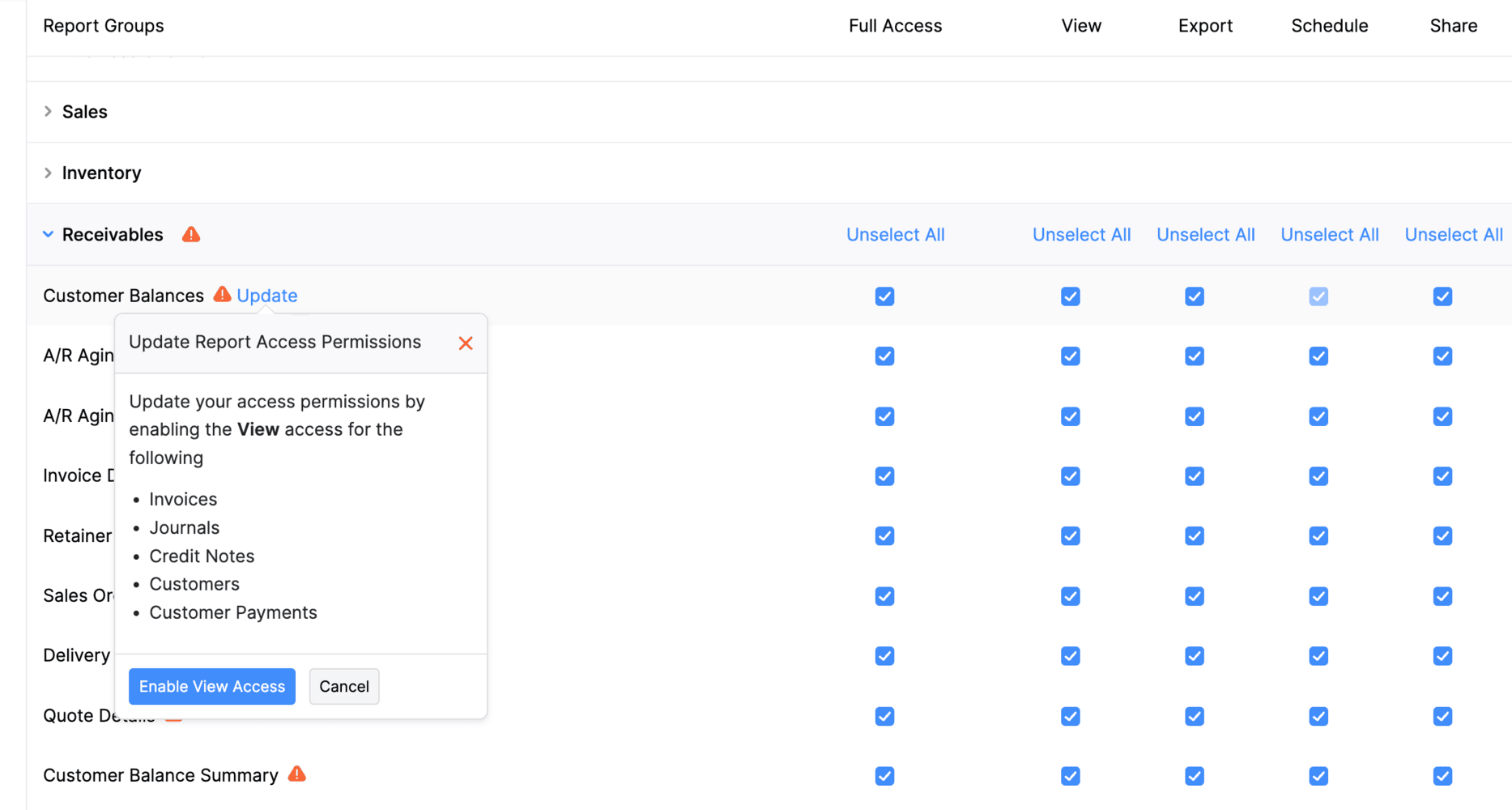

Update Reports Permissions

We’ve enhanced report permissions in Zoho Books to make your organization more secure. For new organizations, you will need to give access to both reports and the related modules while creating roles. For existing organizations, you will get a notification and should edit the roles missing these permissions. We’ve also added a "Skip Module Access" option so you can share reports with specific users without enabling module permissions for them.

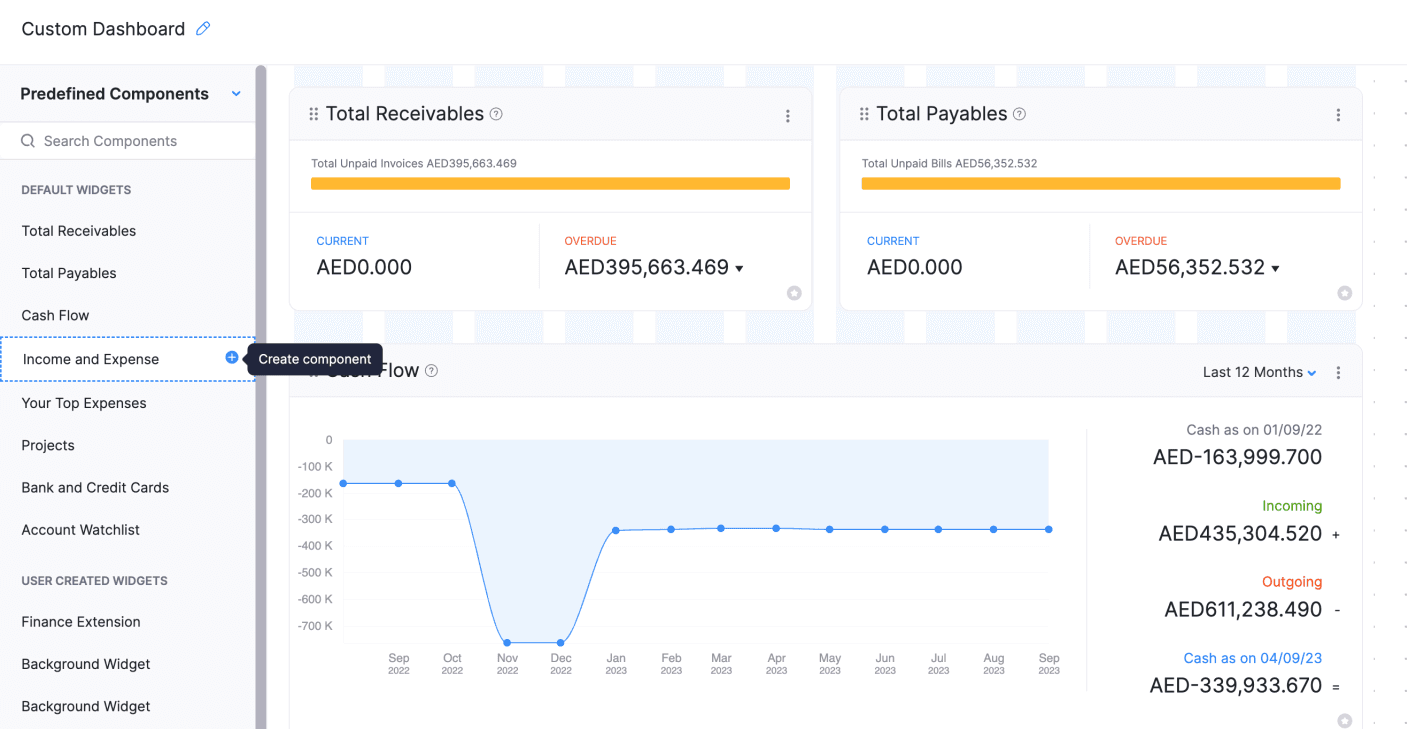

Create Custom Dashboards

You can now customize your dashboards using predefined components, marketplace widgets, and reports. You will be able to reorder, edit, delete, and resize the charts and components in the dashboard. You can also mark your custom dashboards as favorites and manage dashboard permissions for your users. Please note that this feature is only available for the Elite and Ultimate plans of Zoho Books.

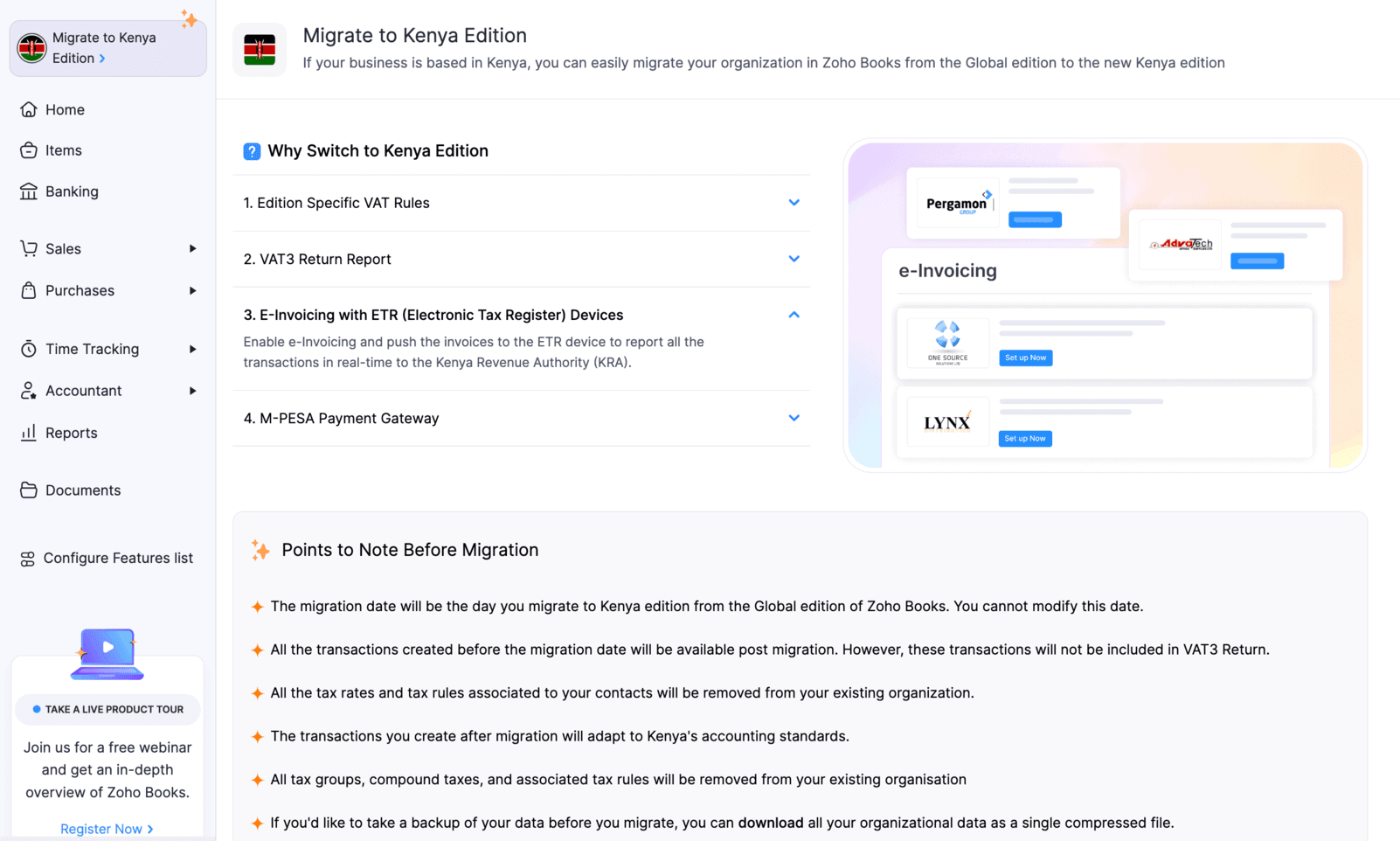

Migrate to Kenya Edition [Kenya Edition]

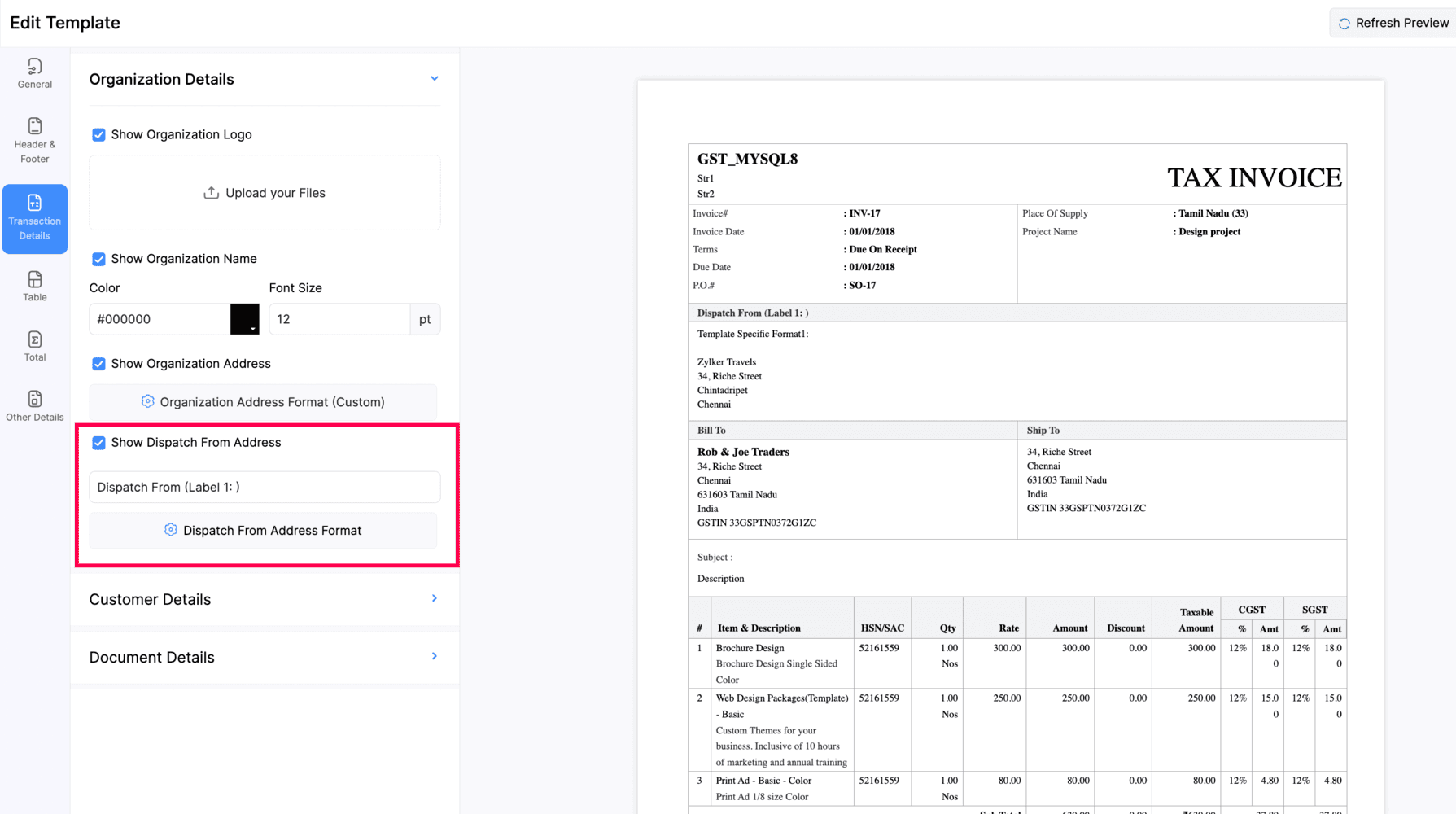

Add Dispatch From Address [India Edition]

To enable this feature, go to Settings > Customization > PDF Templates > Templates > Invoices/Credit Notes. Edit a template that supports dispatch addresses and check the Show Dispatch From Address box in the Transaction Details section.

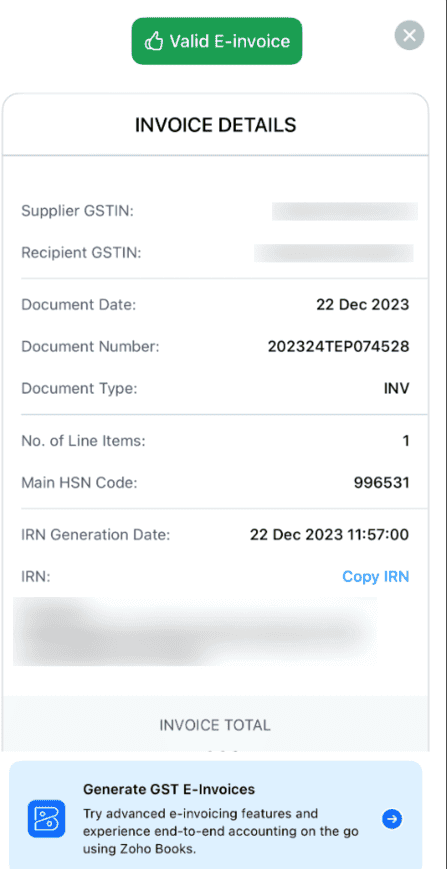

e-Invoice QR Reader App [India Edition]

We have introduced the e-Invoice QR Reader app for iOS and iPadOS users of Zoho Books. This app scans, decrypts, and validates your e-Invoice QR codes in compliance with India's tax regulations.

Every e-invoice generated in the GST portal has a unique QR code containing crucial details such as the GSTIN and seller information. When you scan a valid QR code using the app, it displays essential invoice details like the organization name, GSTIN invoice date, total, and tax total. If an invalid QR code is scanned, the app immediately notifies the user. Download the E-invoice QR Reader app today to streamline your e-invoicing process.

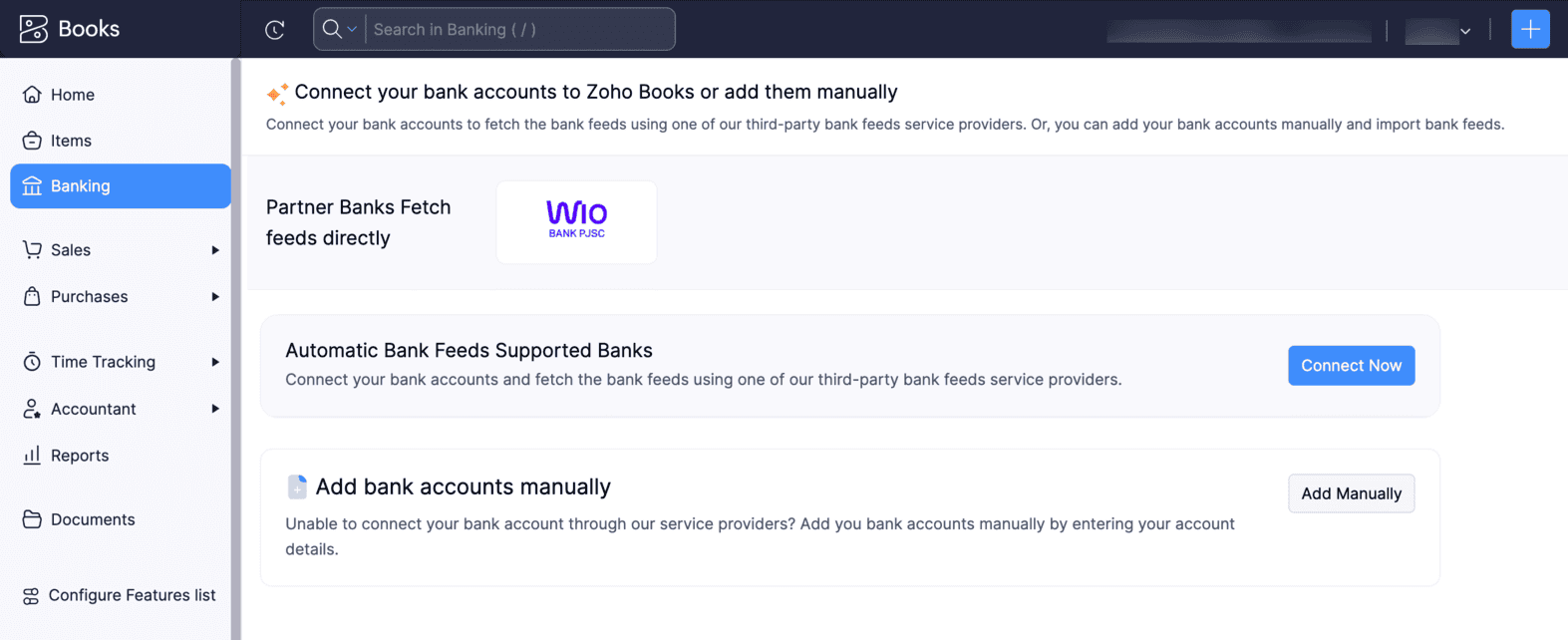

Wio Bank Integration [United Arab Emirates, Saudi Arabia, Bahrain, Kuwait, Qatar, Oman Editions]

Wio is a digital finance platform licensed by the Central Bank of the UAE that offers personal and business banking services. If you have an account with Wio Bank, you can connect it with your Zoho books organization. Once you connect your bank account, you will be able to automatically fetch your bank feeds to Zoho Books without a third-party service provider.

To connect your Wio Bank account with Zoho Books, go to Banking > Add Bank or Credit Card > Wio Bank PJSC and then click Yes, Configure bank account in the popup that appears.

VAT Carry Forward [Kenya Edition]

Zoho Books now supports VAT carry forward in the VAT3 return, which allows you to carry forward excess VAT from one tax period to the next. If the current VAT value is claimable, you can select the carry forward option, and the amount will be reflected in Box 17. This allows businesses to use the extra VAT from past periods to reduce their future VAT payments and report taxes accurately.

Late Payment Penalties for VAT [Kenya Edition]

In Kenya, late VAT payments incur a 10% penalty, and the Kenya Revenue Authority (KRA) adds another 20% penalty on unpaid amounts. To handle this in the VAT3 return, we've introduced a new flow. First, the total tax due is recorded in the VAT Payable Account, whereas the penalties and interest will be tracked in an expense account. Finally, these amounts will be settled using a specific bank account to ensure financial balance.

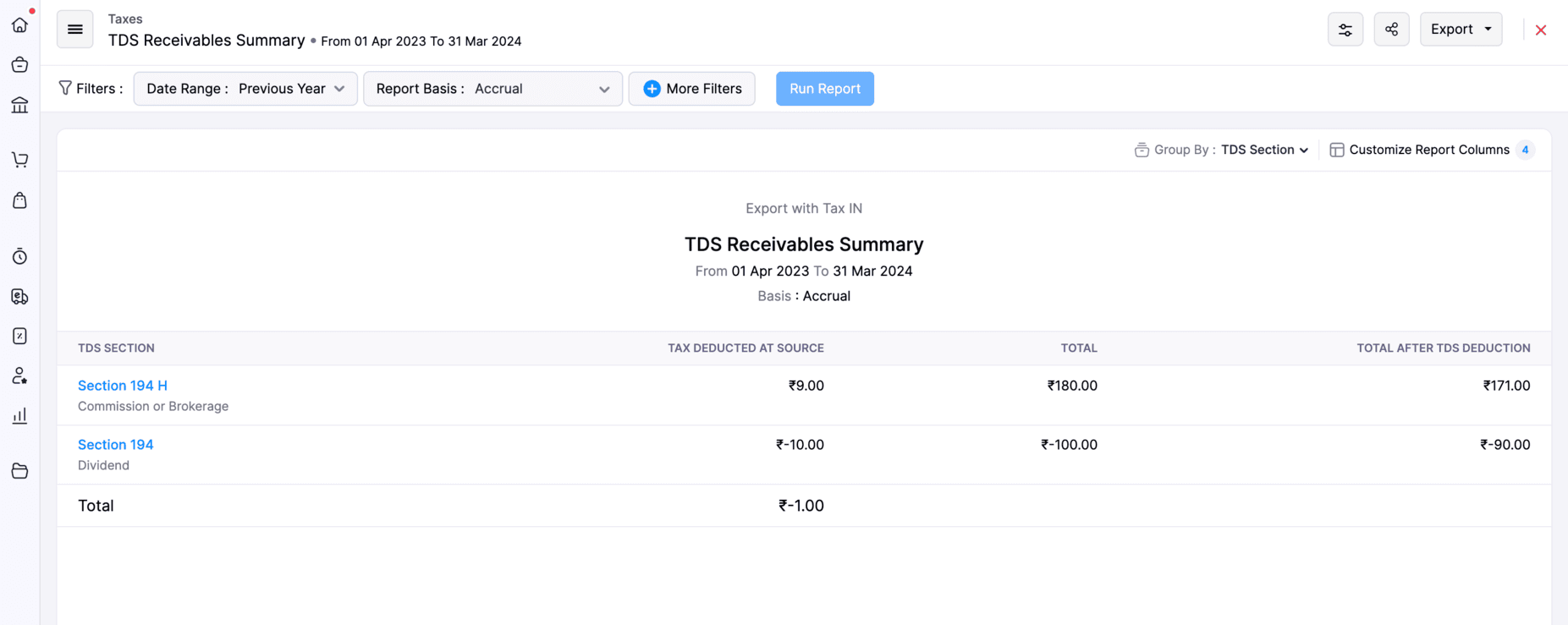

TDS Receivables Summary Report [India Edition]

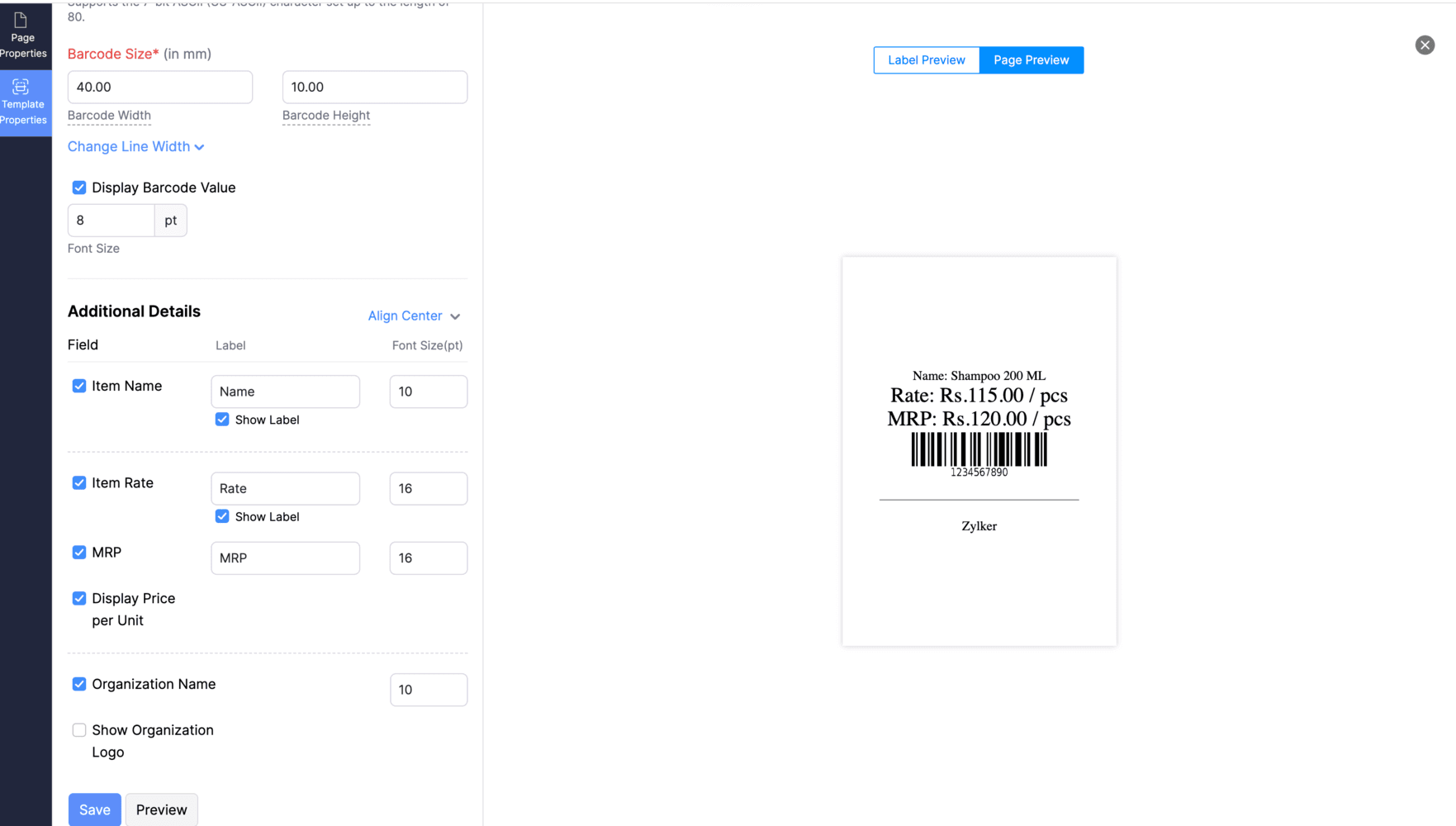

Enhanced Barcode Templates

We have made some enhancements to the barcodes in Zoho Books. Now, you can add fields like MRP (Maximum Retail Price), Organization Name, and Company Logo to your barcode templates. Additionally, you can now add units (e.g., kg, litres, pieces) to barcodes, displaying the item's measurement information along with your organization name.

To enable these features in your barcode templates, go to Settings > Items > Field Customization.

Other Feature Enhancements

Use custom fields to search for manual journals in the advanced search bar.

You can now calculate custom formula fields for all existing records, not just new or edited ones. Once the existing records are updated, you'll receive a notification.

Export your manual journals in bulk faster by processing files in the background and sending them to your primary email.

You can now include the Maximum Retail Price (MRP) of an item while creating or editing it. [India Edition]

You can now apply Tax Deducted at Source (TDS) in your quotes, sales orders, credit notes, recurring invoices, purchase orders, and vendor credits. [India Edition]

That's it from us for this month's product updates! We hope the latest enhancements are helpful for your business. You can also visit the What's New timeline for byte-sized information about our previous feature updates and enhancements.

We'll catch you in next month's product updates. Until then, if you require any assistance or need clarifications, feel free to write to us at support@zohobooks.com, we'd be happy to help!

Best regards,

The Zoho Books Team

Zoho Developer Community

Topic Participants

Nikhitha Kashyap

Storytelling BeanCounter - www.storytellingbeancounter.com

Mitch Scoggins

Marc

nick

Zoho TeamInbox Resources

Zoho CRM Plus Resources

Zoho Books Resources

Zoho Subscriptions Resources

Zoho Projects Resources

Zoho Sprints Resources

Qntrl Resources

Zoho Creator Resources

Zoho CRM Resources

Zoho Show Resources

Get Started. Write Away!

Writer is a powerful online word processor, designed for collaborative work.

-

オンラインヘルプ

-

Webセミナー

-

機能活用動画

-

よくある質問

-

Ebook

-

-

Zoho Campaigns

- Zoho サービスのWebセミナー

その他のサービス コンテンツ

Nederlandse Hulpbronnen

ご検討中の方

Recent Topics

Unify Overlapping Functionalities Across Zoho Products

Hi Zoho One Team, We would like to raise a concern about the current overlap of core functionalities across various Zoho applications. While Zoho offers a rich suite of tools, many applications include similar or identical features—such as shift management,Automation #7 - Auto-update Email Content to a Ticket

This is a monthly series where we pick some common use cases that have been either discussed or most asked about in our community and explain how they can be achieved using one of the automation capabilities in Zoho Desk. Email is one of the most commonlyTicket to article and Ticket to template

Hello! I would like to know if it is possible (and how) to do the following actions: 1. To generate an article from a ticket (reply + original message) 2. Easy convert an answer to an email templateCentralize and Streamline Zobot and Flow Control Settings in Zoho SalesIQ

Dear Zoho SalesIQ Team, We would like to suggest a crucial improvement to the current setup and configuration experience within SalesIQ. Problem Statement Zoho SalesIQ currently offers three primary mechanisms for handling customer chats: Answer Bot –Is there API Doc for Zoho Survey?

Hi everyone, Is there API doc for Zoho Survey? Currently evaluating a solution - use case to automate survey administration especially for internal use. But after a brief search, I couldn't find API doc for this. So I thought I should ask here. ThanWindows Desktop App - request to add minimization/startup options

Support Team, Can you submit the following request to your development team? Here is what would be optimal in my opinion from UX perspective: 1) In the "Application Menu", add a menu item to Exit the app, as well as an alt-key shortcut for these menusKaizen #225 - Making Query-based Custom Related Lists Actionable with Lookups and Links

Hello everyone! Welcome back to another post in the Kaizen series! This week, we will discuss an exciting enhancement in Queries in Zoho CRM. In Kaizen #190, we discussed how Queries bridge gaps where native related lists fall short and power custom relatedWebDAV / FTP / SFTP protocols for syncing

I believe the Zoho for Desktop app is built using a proprietary protocol. For the growing number of people using services such as odrive to sync multiple accounts from various providers (Google, Dropbox, Box, OneDrive, etc.) it would be really helpfulCRM x WorkDrive: We're rolling out the WorkDrive-powered file storage experience for existing users

Release plan: Gradual rollout to customers without file storage add-ons, in this order: 1. Standalone CRM 2. CRM Plus and Zoho One DCs: All | Editions: All Available now for: - Standalone CRM accounts in Free and Standard editions without file storageNon-responsive views in Mobile Browser (iPad)

Has anyone noticed that the creator applications when viewed in a mobile browser (iPad) lost its responsiveness? It now appears very small font size and need to zoom into to read contents. Obviously this make use by field staff quite difficult. This is not at all a good move, as lots of my users are depending on accessing the app in mobile devices (iPads), and very challenging and frustrating.[Free Webinar] Learning Table Series - AI-Enhanced Logistics Management in Zoho Creator

Hello Everyone! We’re excited to invite you to another edition of Learning Table Series, where we showcase how Zoho Creator empowers industries with innovative and automated solutions. About Learning Table Series Learning Table Series is a free, 45-60Learner transcript Challenges.

Currently i am working on a Learner Transcript app for my employer using Zoho Creator. The app is expected to accept assessment inputs from tutors, go through an approval process and upon call up, displays all assessments associated with a learner inCustomizable UI components in pages | Theme builder

Anyone know when these roadmap items are scheduled for release? They were originally scheduled for Q4 2025. https://www.zoho.com/creator/product-roadmap.htmlFeature Request - Set Default Values for Meetings

Hi Zoho CRM Team, I would be very useful if we could set default values for meeting parameters. For example, if you always wanted Reminder 1 Day before. Currently you need to remember to choose it for every meeting. Also being able to use merge tags toWe Asked, Zoho Delivered: The New Early Access Program is Here

For years, the Zoho Creator community has requested a more transparent and participatory approach to beta testing and feature previews. Today, I'm thrilled to highlight that Zoho has delivered exactly what we asked for with the launch of the Early AccessAnalytics <-> Invoice Connection DELETED by Zoho

Hi All, I am reaching out today because of a big issue we have at the moment with Zoho Analytics and Zoho Invoice. Our organization relies on Zoho Analytics for most of our reporting (operationnal teams). A few days ago we observed a sync issue with theHow to use Rollup Summary in a Formula Field?

I created a Rollup Summary (Decimal) field in my module, and it shows values correctly. When I try to reference it in a Formula Field (e.g. ${Deals.Partners_Requested} - ${Deals.Partners_Paid}), I get the error that the field can’t be found. Is it possibleZoho Creator to Zoho CRM Images

Right now, I am trying to setup a Notes form within Zoho Creator. This Notes will note the Note section under Accounts > Selected Account. Right now, I use Zoho Flow to push the notes and it works just fine, with text only. Images do not get sent (thereCRM gets location smart with the all new Map View: visualize records, locate records within any radius, and more

Hello all, We've introduced a new way to work with location data in Zoho CRM: the Map View. Instead of scrolling through endless lists, your records now appear as pins on a map. Built on top of the all-new address field and powered by Mappls (MapMyIndia),Error Logs / Failure logs for Client Scripts Functions

Hi Team, While we are implementing client scripts for the automation, it is working fine in few accounts but not working for others. So, it would be great if we can have error Logs for client scripts also just like custom functions. Is there any way thatAutomate pushing Zoho CRM backups into Zoho WorkDrive

Through our Zoho One subscription we have both Zoho CRM and Zoho WorkDrive. We have regular backups setup in Zoho CRM. Once the backup is created, we are notified. Since we want to keep these backups for more than 7 days, we manually download them. TheyZoho Books blocks invoicing without VeriFactu even though it is not mandatory until 2027

I would like to highlight a very serious issue in Zoho Books for Spain. 1. The Spanish government has postponed the mandatory start of VeriFactu to January 1st, 2027. This means that during all of 2026 businesses are NOT required to transmit invoicesProblem : Auto redirect from zoho flow to zoho creator

Hi there, I've been waiting for zoho team to get back on this for last couple of days. Anyone else have the problem to access zoho flow? everytime I click on zoho flow it redirects me to zoho creator. I tried incognito mode but it still direct me to zohoHow to link tickets to a Vendor/Vendor Contact (not Customer) for Accounting Department?

Hi all, We’re configuring our Accounting department to handle tickets from both customers and vendors (our independent contractors). Right now, ticket association seems to be built around linking a ticket to a Customer / Customer Contact, but for vendor-originatedClient and Vendor Portal

Some clients like keeping tabs on the developments and hence would like to be notified of the progress. Continuous updates can be tedious and time-consuming. Zoho Sprints has now introduced a Client and Vendor Portal where you can add client users and#7 Tip of the week: Delegating approvals in Zoho People

With Zoho People, absences need not keep employees waiting with their approval requests. When you are not available at work, you can delegate approvals that come your way to your fellow workmate and let them take care of your approvals temporarily. Learn more!Trouble with using Apostrophe in Name of Customers and Vendors

We have had an ongoing issue with how the system recognizes an apostrophe in the name of customers and vendors. The search will not return any results for a name that includes the mark; ie one of our vendors names is "L'Heritage" and when entering theWhy am I seeing deleted records in Zoho Analytics syncing with Zoho CRM?

I have done a data sync between Zoho CRM and Zoho Analytics, and the recycle bin is empty. Why do I see deleted leads/deals/contacts in Zoho Analytics if it doesn't exist in Zoho CRM? How can I solve this problem? ThanksNueva edición de "Ask The Expert" en Español Zoho Community

¡Hola Comunidad! ¿Te gustaría obtener respuestas en directo sobre Zoho CRM, Zoho Desk u otra solución dentro de nuestro paquete de CX (Experiencia del Cliente? Uno de nuestros expertos estará disponible para responder a todas tus preguntas durante nuestraHow to use MAIL without Dashboard?

Whenever I open Mail, it opens Dashboard. This makes Mail area very small and also I cannot manage Folders (like delete/rename) etc. I want to know if there is any way to open only Mail apps and not the Dashboard.Peppol: Accept Bill (Belgium)

Hi, This topic might help you if you're facing the same in Belgium. We are facing an issue while accepting a supplier bill received by Peppol in Zoho Books. There is a popup with an error message: This bill acceptance could not be completed, so it wasZoho Books is now integrated with Zoho Checkout

Hello everyone, We're glad to be announcing that Zoho Books is now integrated with Zoho Checkout. With this integration, you can now handle taxes and accounting on your payment pages with ease. An organization you create in Zoho Checkout can be added to Zoho Books and vice-versa. Some of the key features and benefits you will receive are: Seamless sync of customer and invoice data With the end-to-end integration, the customer and invoice details recorded via the payment pages from Zoho CheckoutSync Issue

My Current plan only allows me with 10,000 rows and it is getting sync failure how to control it without upgrading my planAdd Zoho PDF to Zoho One Tool Applications

It should be easy to add from here without the hassle of creating a web tab:JOB WISE INVOICE PROCESS

I WANT TO ENABLE JOB WISE TRACKING OF ALL SALES AND PURCHASEPDF Template have QTY as first column

I want to have the QTY of an item on the sales orders and invoices to be the first column, then description, then pricing. Is there a way to change the order? I went to the Items tab in settings but don't see how to change the order of the columns onRAG (Retrieval Augmented Generation) Type Q+A Environment with Zoho Learn

Hi All, Given the ability of Zoho Learn to function as a knowledge base / document repository type solution and given the rapid advancements that Zoho is making with Zia LLM, agentic capabilities etc. (not to mention the rapid progress in the broaderWelcome to the Zoho ERP Community Forum

Hello everyone, We are thrilled to launch Zoho ERP (India edition), a software to manage your business operations from end to end. We’ve created this community forum as a space for you to ask questions, comment answers, provide feedback, and share yourIn App Auto Refresh/Update Features

Hi, I am trying to use Zoho Creator for Restaurant management. While using the android apps, I reliased the apps would not auto refresh if there is new entries i.e new kitchen order ticket (KOT) from other users. The apps does received notification but would not auto refresh, users required to refresh the apps manually in order to see the new KOT in the apps. I am wondering why this features is not implemented? Or is this feature being considered to be implemented in the future? With theConsolidated report for multi-organisation

I'm hoping to see this feature to be available but couldn't locate in anywhere in the trial version. Is this supported? The main aim to go to ERP is to have visibility of the multi-organisation in once place. I'm hopeful for this.Next Page