What's New in Zoho Books - May 2022

Hello everyone!

We've kickstarted this quarter with a range of new updates that would enhance your overall Zoho Books experience. Here's the list of updates we released over the past month:

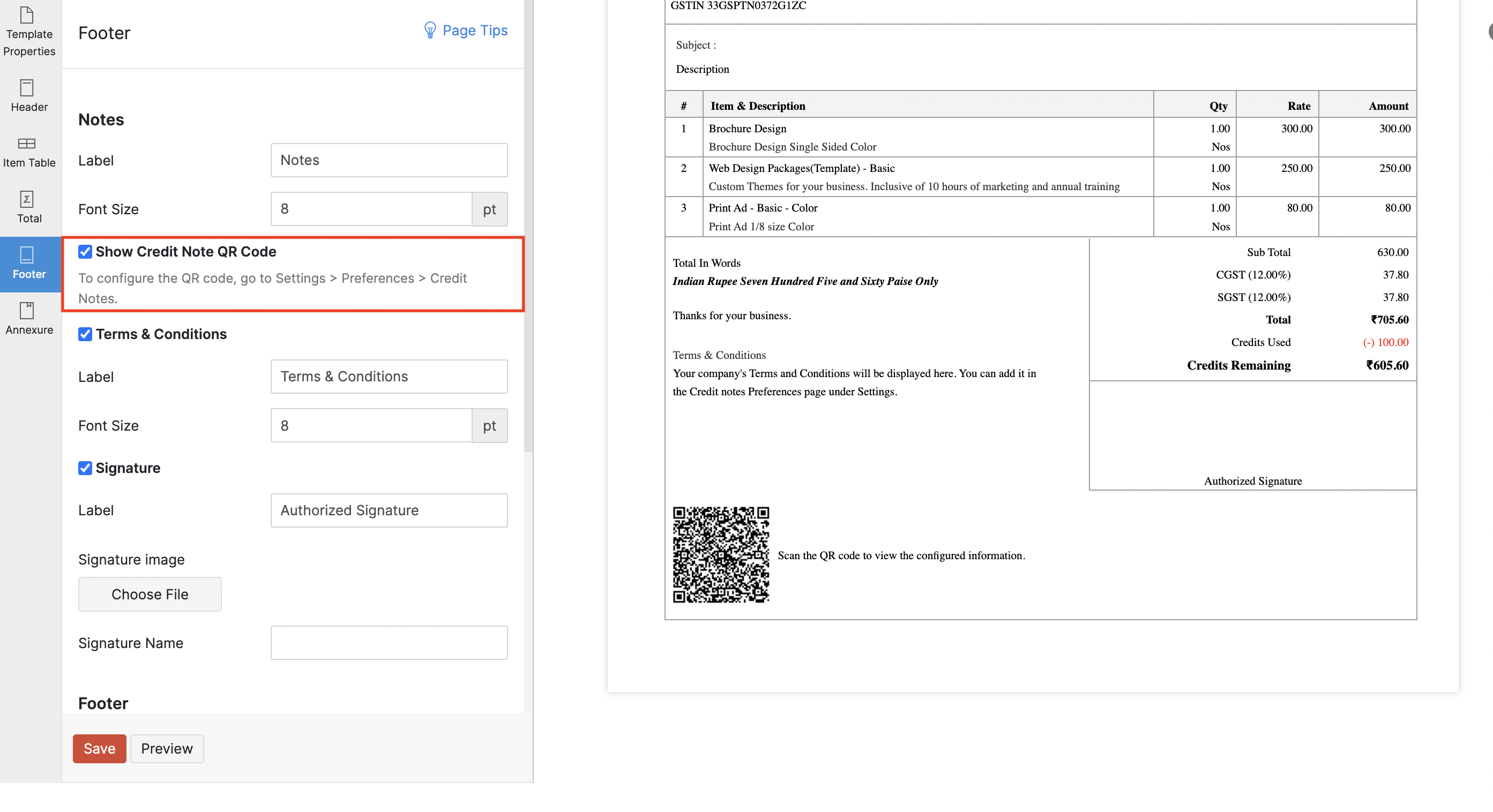

Generate QR Codes for Your Credit Notes

When you send credit notes to your customers, you might want them to have access to vital information that they might not find on your credit note. Your customers can now access such information by scanning the QR code in the credit note's PDF.

You will also be able to enter the description that should be displayed next to the QR code. For example, you can have the description as 'Scan the QR code to visit our website for more details'.

To enable QR code: Go to Settings > Preferences > Credit Notes. Enable the Credit Note QR Code option.

After you enable the feature, you need to configure it in your credit note templates. To do this: Go to Settings > Templates > Credit Notes. Edit a template. In the footer section, check the Show Credit Note QR Code option.

Once you complete the above steps, your QR code will be displayed in the credit note's PDF copy you send to your customers.

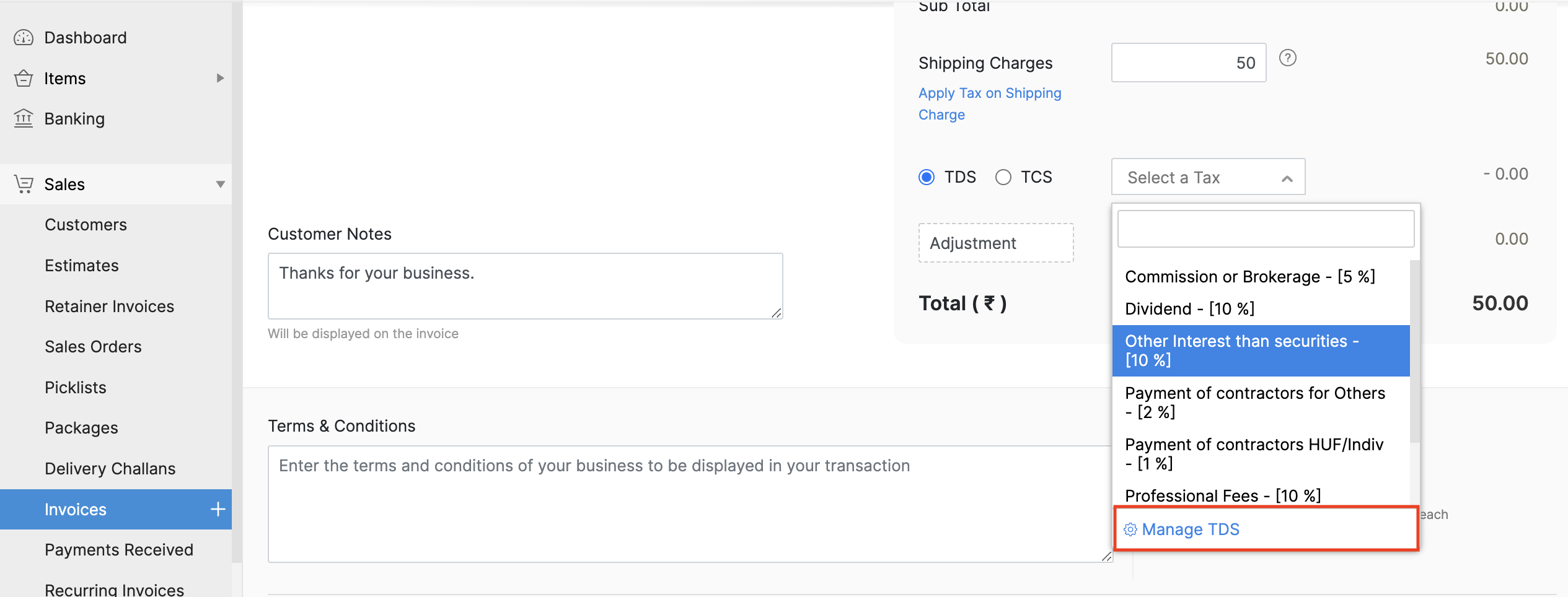

Apply TDS for Invoices, Bills of Supply, and Debit Notes (India edition)

Calculate and apply Tax Deducted at Source (TDS) for your invoices, bills of supply, and debit notes after selecting the TDS section of your choice. You can also choose to edit or delete a particular rate.

If you do not find the TDS section you're looking for, you can create a new TDS section along with the rate by managing TDS. You will also be able to mark your TDS section as a higher TDS after providing a reason.

You can choose to track your TDS payables in your Other Current Liability accounts and your TDS receivables in your Other Current Asset account. If you want to track your TDS receivables and payables in a new account, you can do so by creating a new account in the Chart of Accounts.

To apply TDS: Go to Sales > Invoices. Create a new invoice. Select TDS and select the applicable tax from the dropdown.

Profit and Loss Report Enhancements

1) Choose to show or hide the Year to Date column for your profit and loss report, and compare them based on the period, year, or reporting tags. For these Year to Date columns, you can also choose to display the percentage of income and expenses.

To do this: Go to Reports > Profit and Loss Report. Click Customise Report at the top. Go to the Show/Hide Columns section and click Add Year To Date.

2) Export the current view of your Profit and Loss report in XLS and XLSX formats. If you've customised the report, then that current view will be exported.

To do this: Go to Reports > Profit and Loss report, and click Export As.

3) View the formula that was used to calculate the amount in your Profit and Loss reports after exporting them to Zoho Sheet or Microsoft Excel. You can also tweak the formula in case you need to make any changes.

To do this: Click on any amount cell after exporting the Profit and Loss report to Zoho Sheet or Microsoft Excel.

4) Sort the amounts in the Total column in ascending or descending order based on your choice.

Zoho Books iOS App Updates

1) View the billing and shipping address of a customer on Google Maps.

2) We've introduced new templates; a Compact template for all editions to list more line items, and the Standard and Simplified templates for the Saudi Arabia edition to abide by the government regulations.

You can also check our What's New timeline to see all the small tweaks we've made to enhance your accounting experience.

That's a wrap for this month! We are always eager to hear your suggestions so we can help you better. If you have a feature request, feel free to share it in our forum.

If you require any assistance, please write to us at support@zohobooks.com and we'll get back to you. Stay tuned for more updates from Zoho Books!

Regards,

The Zoho Books Team

New to Zoho Recruit?

Zoho Developer Community

New to Zoho LandingPage?

Zoho LandingPage Resources

New to Bigin?

Topic Participants

Bennet Noel L

Paul S

Mainville

Acts

Mohan R

New to Zoho TeamInbox?

Zoho TeamInbox Resources

Zoho CRM Plus Resources

Zoho Books Resources

Zoho Subscriptions Resources

Zoho Projects Resources

Zoho Sprints Resources

Qntrl Resources

Zoho Creator Resources

Zoho CRM Resources

Zoho Show Resources

Get Started. Write Away!

Writer is a powerful online word processor, designed for collaborative work.

Zoho CRM コンテンツ

-

オンラインヘルプ

-

Webセミナー

-

機能活用動画

-

よくある質問

-

Ebook

-

-

Zoho Campaigns

- Zoho サービスのWebセミナー

その他のサービス コンテンツ

Nederlandse Hulpbronnen

ご検討中の方

Recent Topics

Email was sent out without our permission

Hi there, One customer just reached out to us about this email that we were not aware was being sent to our customers. Can you please check on your end?Zoho OAuth Connector Deprecation and Its Impact on Zoho Desk

Hello everyone, Zoho believes in continuously refining its integrations to uphold the highest standards of security, reliability, and compliance. As part of this ongoing improvement, the Zoho OAuth default connector will be deprecated for all Zoho servicesAutomatically CC an address using Zoho CRM Email Templates

Hi all - have searched but can't see a definitive answer. We have built multiple email templates in CRM. Every time we send this we want it to CC a particular address (the same address for every email sent) so that it populates the reply back into ourUplifted homepage experience

Hello everyone, Creating your homepage is now much easier, more visual, and more impactful. Until now, your homepage allowed you to display custom views, widgets, analytic components, and Kiosk. With the following improvements, the homepage is now a smarter,What are the create bill API line item requiered fields

While the following documentation says that the line items array is requiered it doesn't say what if any files are requiered in the array. Does anyone know? API documentation: https://www.zoho.com/inventory/api/v1/bills/#create-a-bill I'm trying to addTransfer ownership of files and folders in My Folders

People work together as a team to achieve organizational goals and objectives. In an organization, there may be situations when someone leaves unexpectedly or is no longer available. This can put their team in a difficult position, especially if thereFree Webinar: Zoho Sign for Zoho Projects: Automate tasks and approvals with e-signatures

Hi there! Handling multiple projects at once? Zoho Projects is your solution for automated and streamlined project management, and with the Zoho Sign extension, you can sign, send, and manage digital paperwork directly from your project workspace. JoinCustomer ticket creation via Microsoft Teams

Hi all, I'm looking to see if someone could point me in the right direction. I'd love to make it so my customers/ end users can make tickets, see responses and respond within microsoft teams. As Admin and an Agent i've installed the zoho assist app withinIs there a way to update all the start and end dates of tasks of a project after a calendar change?

Hi! Here's my situation. I've built a complete project planning. All its tasks have start dates and due dates. After completing the planning, I've realized that the project calendar was not the right one. So I changed the project calendar. I now haveHow to update task start date when project start date changes?

Hi there, When the start date of a project changes, it's important to update the start dates of the tasks associated with that project to reflect the new timeline. Is there a way to shift the start date of all project tasks when the start date of a projectUnattended - Silent

How can I hide the tray icon / pop up window during unattended remote access for silent unattended remote access?Issue with Picklist Dropdown Not Opening on Mobile

Hello I am experiencing an issue with picklist values on mobile. While the arrow is visible, the dropdown to scroll through the available values often does not open. This issue occurs sporadically, it has worked occasionally, but it is very rare and quiteusing the client script based on the look up filed i wnat to fetch the record details like service number , service rate

based on selected service look up field iwant to fetch the service serial number in the serice form how i achive using client script also how i get the current date in the date field in the on load of the formZoho Books/Square integration, using 2 Square 'locations' with new Books 'locations'?

Hello! I saw some old threads about this but wasn't sure if there were any updates. Is there a way to integrate the Square locations feature with the Books locations feature? As in, transactions from separate Books locations go to separate Square locationsAdd zoho calendar to google calendar

Hi I keep seeing instructions on how to sync Zoho CRM calendar with google calendar but no instructions on how to view Zoho calendar in my google calendar.Zoho Commerce - How To Change Blog Published Date and Author

Hi Commerce Team, I'm discussing a project with a client who wants to move from Woo Commerce / Wordpress to Zoho Commerce. They have around 620 blog posts which will need to be migrated. I am now aware of the blog import feature and I have run some tests.Add RTL and Hebrew Support for Candidate Portal (and Other Zoho Recruit Portals)

Dear Zoho Recruit Team, I hope you're doing well. We would like to request the ability to set the Candidate Portal to be Right-to-Left (RTL) and in Hebrew, similar to the existing functionality for the Career Site. Currently, when we set the Career SiteDoes zoho inventory need Enterprise or Premium subsrciption to make Widgets.

We have Zoho One Enterprise and yet we can't create widgets on inventory.Writing by Hand in "Write" Notes

Hi there! I just downloaded this app a few moments ago, and I was wondering if there was a way to write things by hand in "Write" mode instead of just typing in the keyboard. It would make things a bit more efficient for me in this moment. Thanks!Remove the “One Migration Per User” Limitation in Zoho WorkDrive

Hi Zoho WorkDrive Team, Hope you are doing well. We would like to raise a critical feature request regarding the Google Drive → Zoho WorkDrive migration process. Current Limitation: Zoho WorkDrive currently enforces a hard limitation: A Zoho WorkDriveHow do I add todays date to merge field

I don't see any selection of todays date when creating a letter. Surely the date option of printing is standard? JohnHandling Agent Transfer from Marketing Automation Journey to SalesIQ WhatsApp

We are currently using Marketing Automation for WhatsApp marketing, and the features are great so far We have a scenario where, during a campaign or journey, we give customers an option to chat with our sales team. For this, we are using SalesIQ WhatsAppComment to DM Automation

Comment to DM automation feature in Zoho Marketing Automation, similar to what tools like ManyChat offer. Use case: When a user comments on a social media post (Instagram / Facebook), the system should automatically: Send a private DM to the user CaptureZMA shows as already connected to Zoho CRM, but integration not working

When I try to connect ZMA with Zoho CRM, it shows as already connected, but the integration doesn’t seem to be working. I’ve attached the screen recording for reference.Automatic Email Alerts for Errors in Zoho Creator Logs

Hello, We would like to request a feature enhancement in Zoho Creator regarding error notifications. Currently, Zoho Creator allows users to view logs and errors for each application by navigating to Zoho Creator > Operations > Logs. However, there isCan you default reports/charts to report the current week?

Our data table maintains two years of data. Management wants certain report to automatically filter the report to the latest calendar week. I know I can do this manually with filters but I want the report to automatically default to the latest calendarHow can I check all announce?

Hiii, May I ask how can I check all the announce based on broadcast date instead of reply date based So that I will not will miss out any new functionRecurring Automated Reminders

Hi, The reminders feature in Zoho Books is a really helpful feature to automate reminders for invoices. However, currently we can set reminders based on number of days before/after the invoice date. It would be really helpful if a recurring reminder featureZobot Execution Logs & Run History (Similar to Zoho Flow)

Dear Zoho SalesIQ Team, We would like to request an enhancement for Zoho SalesIQ Zobot: adding an execution log / run history, similar to what already exists in Zoho Flow. Reference: Zoho Flow In Zoho Flow, every execution is recorded in the History tab,Importing into Multiselect Picklist

Hi, We just completed a trade show and one of the bits of information we collect is tool style. The application supplied by the show set this up as individual questions. For example, if the customer used Thick Turret and Trumpf style but not Thin Turret,I need to know the IP address of ZOHO CRM.

The link below is the IP address for Analytics, do you have CRM's? https://help.zoho.com/portal/ja/kb/analytics/users-guide/import-connect-to-database/cloud-database/articles/zoho-analytics%E3%81%AEip%E3%82%A2%E3%83%89%E3%83%AC%E3%82%B9 I would like toPassword Assessment Reports for all users

I'm the super admin and looking at the reporting available for Zoho Vault. I can see that there is a Password Assessment report available showing the passwords/weak and security score by user. However I'm confused at the 'report generated on' value. MonitorAllow people to sign a zoho form by using esign or scanned signature

Allow people to sign a zoho form by using esign or scanned signatureCan't change form's original name in URL

Hi all, I have been duplicating + editing forms for jobs regarding the same department to maintain formatting + styling. The issue I've not run into is because I've duplicated it from an existing form, the URL doesn't seem to want to update with the newHow to Print the Data Model Zoho CRM

I have created the data model in Zoho CRM and I want the ability to Print this. How do we do this please? I want the diagram exported to a PDF. There doesnt appear to be an option to do this. Thanks AndrewSetting certian items to be pickup only

How do we have some items that are pickup only? I have several items in my item's list that I do not ship. But they need to be on the website to be sold, and picked up in store. Need to be able to do this as one of these products is a major seller forUsing gift vouchers

We would like to be able to offer a limited number of gift vouchers, of varying values, to our customers, and are looking for the best way to do this. We have looked at Coupons and Gift Certificates, but neither seem to fit the bill perfectly. Coupons:Automatically updating field(s) of lookup module

I have a lookup field, which also pulls through the Status field from the linked record. When the lookup is first done, the Status is pulled through - this works perfectly. If that Status is later updated, the lookup field does not update as well. AsZoho Commerce and Third-party shipping (MachShip) API integration

We are implementing a third-party shipping (MachShip) API integration for our Zoho Commerce store and have made significant progress. However, we need guidance on a specific technical challenge. Current Challenge: We need to get the customer input toAdding custom "lookup" fields in Zoho Customization

How can I add a second “lookup” field in Zoho? I’m trying to create another lookup that pulls from my Contacts, but the option doesn’t appear in the module customization sidebar. In many cases, a single work order involves multiple contacts. Ideally,Next Page