Tax Setting

Taxes

Add Taxes in Zoho FSM

- Navigate to Setup > Billing > Tax Setting.

- Click New Tax under Taxes tab.

- Enter the following details and click Save.

- Tax Name

- Rate (%)

- Tax Authority

Add Taxes in Zoho Books/Invoice

- Log into your Books/Invoice account.

- Click the Gear [

] icon on the top-right corner, and select Taxes.

- Select the Tax Rates menu and click New Tax.

- In the New Tax overlay, enter the following details and click Save.

- A Tax Name and Rate(%)

- A Tax Type

Tax consideration with Invoice/Books Sync Settings

| Sync Setting |

Tax considered from Module |

| Type I - Companies |

Companies |

| Type II - Contacts |

Contacts |

| Type III - Companies and Contacts |

Companies |

| Type IV - Companies and Contacts (Companies not mandatory) |

Contacts (if not associated with a Company) else Companies |

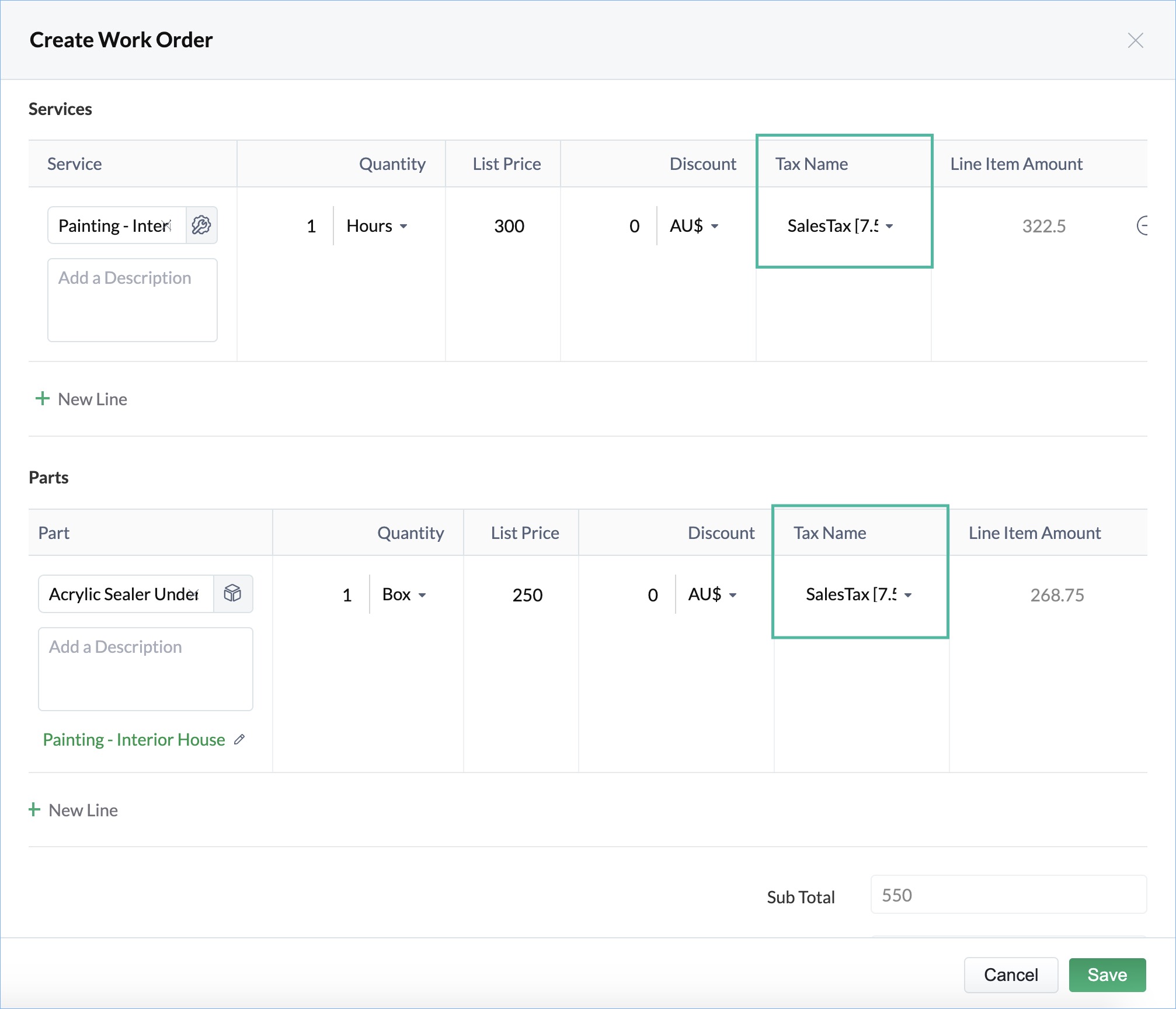

Australia Edition

Services And Parts

- Taxable

- Non-Taxable. An Exemption Reason should be selected if Non-Taxable is chosen.

Contacts

- Taxable. Contact Tax should be selected if Taxable is chosen.

You can add tax rates at Settings > Taxes > Tax Rates in Zoho Invoice. - Non-Taxable. An Exemption Reason should be selected if Non-Taxable is chosen.

Companies

- Taxable. A Company Tax should be selected if Taxable is chosen.

You can add tax rates at Settings > Taxes > Tax Rates in Zoho Invoice. - Non-Taxable. An Exemption Reason should be selected if Non-Taxable is chosen.

Estimates and Work Orders

| IF the Contact tax is |

AND the Service/Part tax is |

THEN the value of Tax Name of Service/Part will be |

Remarks |

| Taxable |

Taxable |

Contact Tax |

Value of Tax Name can be edited |

| Taxable |

Non-Taxable |

Exemption Reason of Service/Part |

Value of Tax Name can be edited |

| Non-Taxable |

Taxable |

Exemption Reason of the Contact |

Value of Tax Name cannot be edited |

| Non-Taxable |

Non-Taxable |

Exemption Reason of the Contact |

Value of Tax Name cannot be edited |

|

Not Available

|

Taxable

|

Default tax from Books/Invoice

|

Value of Tax Name can be edited

|

|

Not Available

|

Non-Taxable

|

Exemption Reason of Service/Part

|

Value of Tax Name can be edited

|

|

Taxable

|

Not Available

|

Contact Tax

|

Value of Tax Name can be edited

|

|

Non-Taxable

|

Not Available

|

Contact Tax

|

Value of Tax Name can be edited

|

Belgium Edition

Services And Parts

Contacts/Companies

- Tax Registration Number

- Tax Rate

Estimates and Work Orders

Canada Edition

- System

- User Defined

System Tax Rules

- Default Rate

Predefined tax rates for all states of Canada are defined here. It also specifies the default tax rate applicable to locations outside of Canada. - Exempt for Contacts

You can use this if you want to choose the tax rule as tax exempt for the Contacts, and Companies in Zoho FSM. - Exempt for Items

You can use this if you want to choose the tax rule as tax exempt for the Services And Parts in Zoho FSM. - Zero Rate

You can use this if you want to choose the tax rule as a zero tax rate for the Services And Parts in Zoho FSM.

User Defined Tax Rules

Estimates and Work Orders

Company/Contact |

Service/Part |

Tax Rule Considered |

Tax rule (Taxable) exists |

- Tax rule (Taxable) exists with a State and Country - No tax rule associated |

The tax rule of the Company will be considered |

Tax rule (Taxable) exists |

Tax rule (Tax Exempt) exists |

- The tax rule of the Company will be considered if the State and Country of the Service Address does not match that of the tax rule of the Service. |

Tax rule (Tax Exempt) exists |

- Tax rule (Taxable) exists with a State and Country - Tax rule (Tax Exempt) exists

- Tax rule does not exist. |

Non-Taxable [0%] |

Tax rule does not exist. |

Tax rule (Taxable) exists with a State and Country |

- The tax rule of the Service will be considered if the State and Country of the Service Address matches that of the tax rule of the Service. |

Tax rule does not exist. |

Tax rule (Tax Exempt) exists |

- The Default Tax Rate of the State will be considered if the State and Country (Canada) of the Service Address do not match that of the tax rule of the Service. |

Tax rule does not exist. |

Tax rule does not exist. |

- If Canada and any of its States are chosen for the Service Address, then the State's default tax rate will be considered. - If any state/country outside Canada is chosen, then the tax rate of All Countries defined in the Default Tax Rate will be considered. |

Germany Edition

- Is your business registered for VAT?

This is to enable VAT for your organization - Enable trade with contacts outside Germany

If you are doing business outside Germany, this option can be used for handling your imports and exports - My business is registered for VAT MOSS or OSS

If you enable the VAT MOSS or OSS scheme, VAT Rules will be enabled for your organization to help you create VAT rates for different EU member countries and apply those VAT rates on the respective transactions automatically.

VAT Enabled

- Standard Rate

- Reduced Rate

- Zero Rate

Trade Outside Germany

- Standard Rate

- Reduced Rate

- Zero Rate

- VAT Treatment of the Contact (or Company, based on the sync type for the FSM-Invoice/Books integration)

- Tax Name of the Service/Part

|

IF the value of VAT Treatment of the Contact is |

AND the value of Tax Name of Service/Part is |

THEN the value of Tax Name of Service/Part line item will be |

|

Home Country |

Standard Rate

Reduced Rate

Zero Rate |

Standard Rate

Reduced Rate

Zero Rate |

|

Custom Rate |

Custom Rate |

|

|

EU - VAT Registered |

Standard Rate

Reduced Rate

Zero Rate |

Zero Rate |

|

Custom Rate |

Zero Rate |

|

|

EU - Non VAT Registered |

Standard Rate

Reduced Rate

Zero Rate |

Standard Rate |

|

Custom Rate |

Standard Rate |

|

|

Overseas |

Standard Rate

Reduced Rate

Zero Rate |

Zero Rate |

|

Custom Rate |

Zero Rate |

VAT according to MOSS or OSS scheme

|

Tax Rule |

Tax Name |

||

|

|

Germany |

EU Countries |

All Countries |

|

Standard Rate - Sales |

Standard Rate [19%] |

Standard Rate [19%] |

Zero Rate [0%] |

|

Reduced Rate - Sales |

Reduced Rate [7%] |

Reduced Rate [7%] |

Zero Rate [0%] |

|

Zero Rate - Sales |

Zero Rate [0%] |

Zero Rate [0%] |

Zero Rate [0%] |

- VAT Treatment of the Contact (or Company, based on the sync type for the FSM-Invoice/Books integration)

- Tax Rule of the Service/Part

|

IF the value of VAT Treatment of the Contact is |

AND the value of Tax Rule of Service/Part is |

THEN the value of Tax Name of Service/Part line item will be |

Remarks |

|

Home Country |

Standard Rate - Sales

Reduced Rate - Sales

Zero Rate - Sales |

VAT defined for Germany in these tax rules |

|

|

User Defined Rule |

VAT defined for Germany in the user defined rule |

If a VAT rate is not defined for Germany, then that defined for EU Countries or All Countries will be used |

|

|

No Rule |

VAT defined for Germany in the Default VAT Rule |

If a VAT rate is not defined for Germany, then that defined for EU Countries or All Countries will be used |

|

|

EU - VAT Registered |

Standard Rate - Sales

Reduced Rate - Sales

Zero Rate - Sales |

Zero Rate |

|

|

User Defined Rule |

Zero Rate |

|

|

|

No Rule |

Zero Rate |

|

|

|

EU - Non VAT Registered

Place of Supply is selected |

Standard Rate - Sales

Reduced Rate - Sales

Zero Rate - Sales |

VAT defined for EU Countries in these tax rules |

|

|

User Defined Rule |

VAT defined for the Place of Supply in the user defined VAT rule |

If a VAT rate is not defined for the Place of Supply, then that defined for EU Countries or All Countries will be used |

|

|

No Rule |

VAT defined for the Place of Supply in the Default VAT Rule |

If a VAT rate is not defined for the Place of Supply, then that defined for EU Countries or All Countries will be used |

|

|

EU - Non VAT Registered

Place of Supply not selected |

Standard Rate - Sales

Reduced Rate - Sales

Zero Rate - Sales |

VAT defined for EU Countries in these tax rules |

|

|

User Defined Rule |

VAT defined for EU Countries or All Countries in the User Defined Rule |

|

|

|

No Rule |

VAT defined for EU Countries or All Countries in the Default VAT Rule |

|

|

|

Overseas |

Standard Rate - Sales

Reduced Rate - Sales

Zero Rate - Sales |

Zero Rate |

|

|

User Defined Rule |

Zero Rate |

|

|

|

No Rule |

Zero Rate |

|

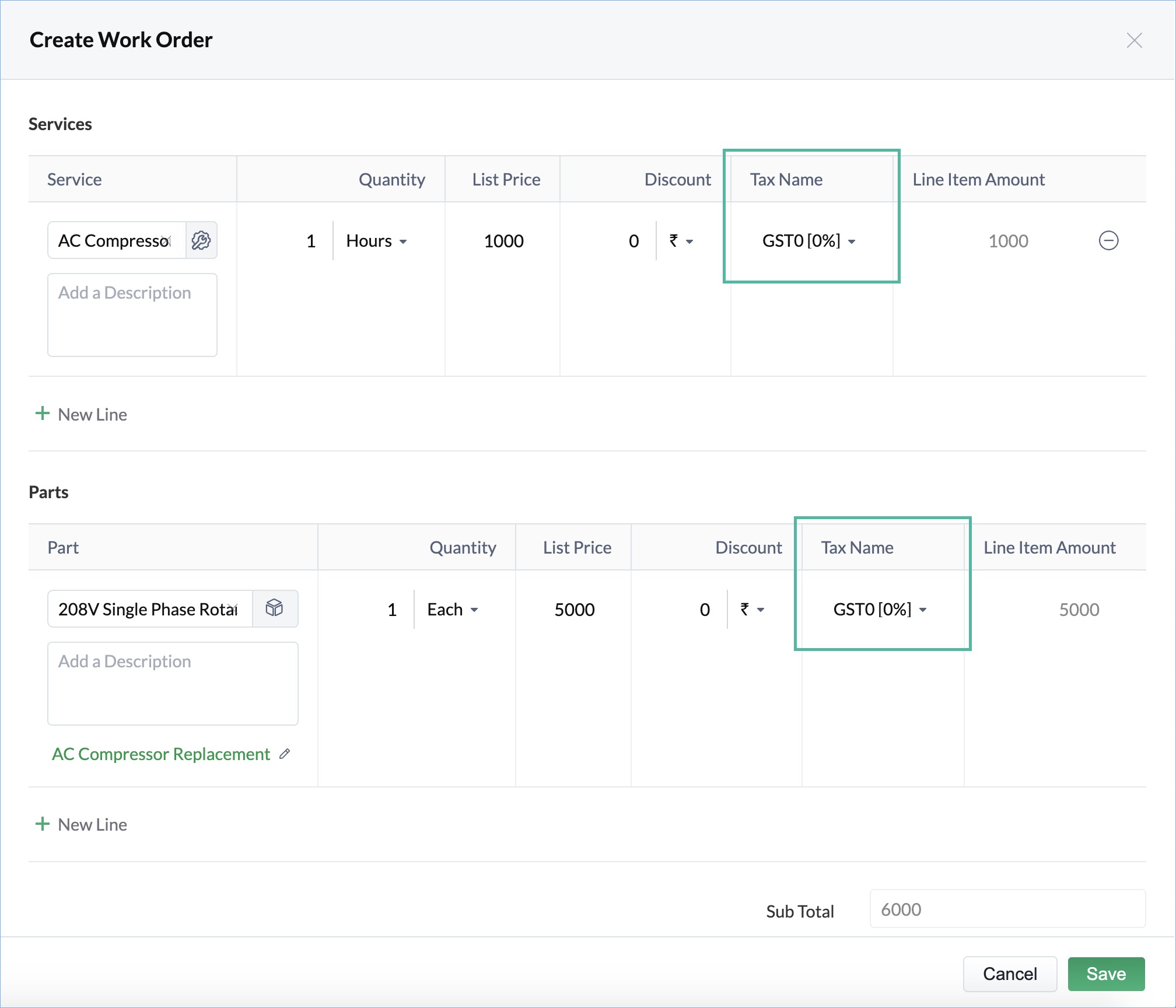

India Edition

Services And Parts

- Taxable. Values for Intra State Tax Rate and Inter State Tax Rate should be selected if Taxable is chosen.

You can add tax rates at Settings > Taxes > Tax Rates in Zoho Invoice.

- Non-Taxable. An Exemption Reason should be selected if Non-Taxable is chosen.

Contacts

- Taxable

- Non-Taxable. An Exemption Reason should be selected if Non-Taxable is chosen.

Companies

- Taxable

- Non-Taxable. An Exemption Reason should be selected if Non-Taxable is chosen.

Estimates and Work Orders

- GST Treatment of the Contact (or Company, based on the sync type for the FSM-Invoice/Books integration)

- Place of Supply of the Work Order

- Taxable of the Contact (or Company, based on the sync type for the FSM-Invoice/Books integration)

- Taxable of the Service/Part

If value of GST Treatment of the Contact is |

and value of the Place of Supply of the Work Order is |

and value of Taxable of Contact is |

and value of Taxable of Service/Part is |

THEN value of Tax Name of Service/Part will be |

Remarks |

Registered Business - Regular Registered Business - Composition Unregistered Business Consumers Deemed Export

|

Same as the organization Place of Supply * |

Taxable |

Taxable |

Intra State Tax Rate of Service/Part |

|

Taxable |

Non-Taxable |

Exemption Reason of Service/Part

|

Value of Tax Name can be edited |

||

Non-Taxable |

Taxable |

Exemption Reason of Service/Part |

Value of Tax Name cannot be edited |

||

Non-Taxable |

Non-Taxable |

Exemption Reason of Service/Part |

Value of Tax Name cannot be edited |

||

Taxable / Non-Taxable |

Not selected |

GST0

|

|

||

Different from the organization Place of Supply * |

Taxable |

Taxable |

Inter State Tax Rate of Service/Part |

|

|

Taxable |

Non-Taxable |

Exemption Reason of Service/Part |

Value of Tax Name can be edited |

||

Non-Taxable |

Taxable |

Exemption Reason of Service/Part |

Value of Tax Name cannot be edited |

||

Non-Taxable |

Non-Taxable |

Exemption Reason of Service/Part |

Value of Tax Name cannot be edited |

||

Taxable / Non-Taxable |

Not selected |

IGST0 IGST12 (for Registered Business - Regular) |

Value of Tax Name can be edited |

||

Overseas |

- |

- |

Taxable / Non-Taxable |

IGST0

|

Value of Tax Name can be edited |

Special Economy Zone Goverment SEZ Developer |

Same as the organization Place of Supply * |

Taxable / Non-Taxable |

Taxable / Non-Taxable |

IGST0

|

Only IGST type tax with 0% rate can be selected |

Different from the organization Place of Supply * |

Taxable / Non-Taxable |

Taxable / Non-Taxable |

IGST0

|

Only IGST type tax with 0% rate can be selected |

Kenya Edition

Enable VAT Settings

- In Zoho Books/Invoice, navigate to Settings > Taxes & Compliance > VAT.

- Enable Is your business registered for VAT?.

- Check Enable trade with contacts outside Kenya if your business does international trade (import or export outside Kenya).

- Enter other necessary details and click Save.

VAT Rates

- General Rate (16%)

- Reduced Rate (8%)

- Zero Rate (0%)

Services And Parts

Tax Rule | Tax Name |

General Rate - Sales | General Rate [16%] |

Reduced Rate - Sales | Reduced Rate [8%] |

Zero Rate - Sales | Zero Rate [0%] |

Exempt - Sales | Exempt |

Contacts/Companies

Transactions

- If tax rule is present for the Service/Part, the tax associated with the rule will be used.

- If tax rule is not present for the Service/Part tax,

- If the VAT Treatment is VAT Registered or Non VAT Registered, then the default tax (set in Zoho Books/Invoice) will be used.

- If the VAT Treatment is Non Kenya, then Zero Rate [0%] will be used.

Kuwait Edition

Mexico Edition

Services And Parts

- Standard Rate (16%)

- Reduced Rate (8%)

- Zero Rate (0%)

Contacts/Companies

- Tax Treatment

- Tax Registration Number

- Tax Regime

- Business Legal Name

Estimates and Work Orders

- Company

- If Company is not available, it will be based on Contact

- Tax of the Service/Part

- Service Address

IF the value of Tax of Service/Part is | AND the Service Address is | THEN the value of Tax Name of Service/Part will be |

Standard Rate (16%) or Reduced Rate (8%) or Zero Rate (0%) | Is not present | Standard Rate (16%) or Reduced Rate (8%) or Zero Rate (0%) |

- | Is not present | Standard Rate (16%) |

- | Is within Mexico | Standard Rate (16%) |

- | Is outside Mexico | Zero Rate (0%) |

Qatar Edition

Saudi Arabia Edition

Services And Parts

Contacts

- Tax Treatment

- Place of Supply

- Tax Registration Number

Tax Treatment |

Place of Supply |

Tax Registration Number |

VAT Registered |

Saudi Arabia |

Required |

Non VAT Registered |

Saudi Arabia |

N/A |

GCC VAT Registered |

All GCC countries* |

Required |

GCC Non VAT Registered |

All GCC countries* |

N/A |

Non GCC |

N/A |

N/A |

The values GCC VAT Registered, GCC Non VAT Registered, and Non GCC will be listed only if international trade is enabled in Zoho Books/Zoho Invoice.

Companies

- Tax Treatment

- Place of Supply

- Tax Registration Number

Tax Treatment |

Place of Supply |

Tax Registration Number |

VAT Registered |

Saudi Arabia |

Required |

Non VAT Registered |

Saudi Arabia |

N/A |

GCC VAT Registered |

All GCC countries* |

Required |

GCC Non VAT Registered |

All GCC countries* |

N/A |

Non GCC |

N/A |

N/A |

The values GCC VAT Registered, GCC Non VAT Registered, and Non GCC will be listed only if international trade is enabled in Zoho Books/Zoho Invoice.

Estimates and Work Orders

- Tax Treatment of the Contact (or Company, based on the sync type for the FSM-Invoice/Books integration)

- Place of Supply of the Estimate/Work Order

- Tax of the Service/Part

IF the value of Tax Treatment of the Contact is |

and value of the Place of Supply of the Work Order is |

AND the value of Tax of Service/Part is |

THEN the value of Tax Name of Service/Part will be |

Remarks |

VAT Registered, Non VAT Registered |

Saudi Arabia |

Standard Rate [5%] or Zero Rate [0%] |

Service/Part Tax |

- Value of Tax Name can be edited. - If you change the Tax Name to Out of Scope, you have to select an Exemption. |

GCC VAT Registered, GCC Non VAT Registered

|

GCC |

Standard Rate [5%] or Zero Rate [0%] |

Zero Rate [0%] |

- Value of Tax Name can be edited. - If you change the Tax Name to Out of Scope, you have to select an Exemption. |

GCC VAT Registered, GCC Non VAT Registered

|

Saudi Arabia |

Standard Rate [5%] or Zero Rate [0%] |

Service/Part Tax |

- Value of Tax Name can be edited. - If you change the Tax Name to Out of Scope, you have to select an Exemption. |

Non GCC |

N/A |

Standard Rate [5%] or Zero Rate [0%] |

Zero Rate [0%] |

- Value of Tax Name can be edited. - If you change the Tax Name to Out of Scope, you have to select an Exemption. |

Out of Scope |

N/A |

N/A |

N/A |

N/A |

Enable trade with contacts outside Saudi Arabia

South Africa Edition

Services And Parts

Tax Rule |

Tax Name |

Standard Rate - Sales |

Standard Rate [15%] |

Zero Rate - Sales |

Zero Rate [0%] |

Exempt - Sales |

Exempt |

Contacts/Companies

Transactions

- VAT Treatment of the Contact (or Company, based on the sync type for the FSM-Invoice/Books integration)

- Tax Rule of the Service/Part

IF the value of VAT Treatment of the Contact is |

AND the value of Tax Rule of Service/Part is |

THEN the value of Tax Name of Service/Part line item will be |

Remarks |

VAT Registered, Non VAT Registered |

Standard Rate - Sales or Zero Rate - Sales |

Service/Part Tax |

Value of Tax Name can be edited. |

VAT Registered, Non VAT Registered |

Exempt - Sales |

Exempt |

Value of Tax Name can be edited. |

VAT Registered, Non VAT Registered |

None |

Default Tax Rule* |

Value of Tax Name can be edited. |

Overseas |

Standard Rate - Sales, Zero Rate - Sales, Exempt - Sales, No Tax Rule |

Zero Rate [0%] |

Value of Tax Name can be edited. |

|

VAT Name |

Rate (in %) |

|

Standard Rate |

15 |

|

Zero Rate |

0 |

|

Exempt |

- |

|

Change in use (Non-taxable supplies) |

15 |

|

Change in use (Taxable supplies) |

15 |

|

Customs VAT |

100 |

|

Export of second hand goods |

15 |

|

Supply of accommodation not exceeding 28 days |

15 |

|

Supply of accommodation exceeding 28 days |

15 |

Spain Edition

Services And Parts

Contacts/Companies

- Tax Name

- Tax Registration Number

Estimates and Work Orders

- If the Company has a tax, then the Company tax will be used.

- If Company is present without tax, then Service/Part tax will be used. If Service/Part also does not have tax, then the default tax (set in Zoho Books/Invoice) will be used.

- If only the Contact is present, then the Contact tax will be used.

- If Contact is present without tax, then Service/Part tax will be used. If Service/Part also does not have tax, then the default tax (set in Zoho Books/Invoice) will be used.

- If both Company and Contact do not have tax, then Service/Part tax will be used.

- If Company, Contact, and Service/Part do not have tax, then the default tax (set in Zoho Books/Invoice) will be used.

United Arab Emirates Edition

Services And Parts

Contacts

- Tax Treatment

- Place of Supply

- Tax Registration

Tax Treatment |

Place of Supply |

Tax Registration Number |

VAT Registered |

UAE Emirates |

Required |

Non VAT Registered |

UAE Emirates |

N/A |

GCC VAT Registered |

All GCC countries |

Required |

GCC Non VAT Registered |

All GCC countries |

N/A |

Non GCC |

N/A |

N/A |

VAT Registered - Designated Zones |

UAE Emirates |

Required |

Non VAT Registered - Designated Zones |

UAE Emirates |

N/A |

GCC - Gulf Cooperation Council

The values GCC VAT Registered, GCC Non VAT Registered, and Non GCC will be listed only if international trade is enabled in Zoho Books/Zoho Invoice.

Companies

- Tax Treatment

- Place of Supply

- Tax Registration Number

Tax Treatment |

Place of Supply |

Tax Registration Number |

VAT Registered |

UAE Emirates |

Required |

Non VAT Registered |

UAE Emirates |

N/A |

GCC VAT Registered |

All GCC countries |

Required |

GCC Non VAT Registered |

All GCC countries |

N/A |

Non GCC |

N/A |

N/A |

VAT Registered - Designated Zones |

UAE Emirates |

Required |

Non VAT Registered - Designated Zones |

UAE Emirates |

N/A |

GCC - Gulf Cooperation Council

The values GCC VAT Registered, GCC Non VAT Registered, and Non GCC will be listed only if international trade is enabled in Zoho Books/Zoho Invoice.

Estimates and Work Orders

- Tax Treatment of the Contact (or Company, based on the sync type for the FSM-Invoice/Books integration)

- Place of Supply of the Estimate/Work Order

- Tax of the Service/Part

IF the value of Tax Treatment of the Contact is |

AND the value of Place of Supply of the Work Order is |

AND the value of Tax of Service/Part is |

THEN the value of Tax Name of Service/Part will be |

Remarks |

VAT Registered, Non VAT Registered, VAT Registered - Designated Zones, Non VAT Registered - Designated Zones |

UAE |

Standard Rate [5%] or Zero Rate [0%] |

Service/Part Tax |

- Value of Tax Name can be edited. - If you change the Tax Name to Out of Scope, you have to select an Exemption. |

GCC VAT Registered, GCC Non VAT Registered

|

GCC |

Standard Rate [5%] or Zero Rate [0%] |

Zero Rate [0%] |

- Value of Tax Name can be edited. - If you change the Tax Name to Out of Scope, you have to select an Exemption. |

GCC VAT Registered, GCC Non VAT Registered

|

UAE |

Standard Rate [5%] or Zero Rate [0%] |

Service/Part Tax |

- Value of Tax Name can be edited. - If you change the Tax Name to Out of Scope, you have to select an Exemption. |

Non GCC |

N/A |

Standard Rate [5%] or Zero Rate [0%] |

Zero Rate [0%] |

- Value of Tax Name can be edited. - If you change the Tax Name to Out of Scope, you have to select an Exemption. |

Out of Scope |

N/A |

N/A |

N/A |

N/A |

Note: While creating an Estimate or Work Order with a Contact having Tax Treatment as GCC VAT Registered or GCC Non VAT Registered, you cannot choose a Place of Supply in Estimate/Work Order that is different from the Place of Supply of Contact or the Organization's Emirate. If you do so, then you will encounter the error shown in the screenshot below.

Enable trade with contacts outside U.A.E

United States Edition

Services And Parts

- Taxable

- Non-Taxable. An Exemption Reason should be selected if Non-Taxable is chosen.

Contacts

- Taxable. Contact Tax should be selected if Taxable is chosen.

You can add tax rates at Settings > Taxes > Tax Rates in Zoho Invoice.

- Non-Taxable. An Exemption Reason and Tax Authority should be selected if Non-Taxable is chosen.

Companies

- Taxable. A Company Tax should be selected if Taxable is chosen.

You can add tax rates at Settings > Taxes > Tax Rates in Zoho Invoice.

- Non-Taxable. An Exemption Reason should be selected if Non-Taxable is chosen.

Estimates and Work Orders

IF the Contact tax is |

AND the Service/Part tax is |

THEN the value of Tax Name of Service/Part will be |

Taxable |

Taxable |

Contact Tax |

Taxable |

Non-Taxable |

Exemption Reason of Service/Part |

Non-Taxable |

Taxable |

Exemption Reason of the Contact |

Non-Taxable |

Non-Taxable |

Exemption Reason of the Contact |

Not Available |

Taxable |

Default tax from Books/Invoice |

Not Available |

Non-Taxable |

Exemption Reason of Service/Part |

Taxable |

Not Available |

Contact Tax |

Non-Taxable |

Not Available |

Contact Tax |

United Kingdom Edition

Services And Parts

Contacts

Companies

Estimates and Work Orders

| IF the value of VAT Treatment of the Contact is |

THEN the value of Tax Name of Service/Part will be |

Remarks |

| United Kingdom |

VAT rate (Tax Name) of Services/Parts |

Value of Tax Name can be edited |

| EU - VAT Registered |

Zero rate |

Value of Tax Name can be edited |

| EU - non VAT Registered |

VAT rate (Tax Name) of Services/Parts |

Value of Tax Name can be edited |

| Non European Union |

- |

Select a value for Tax Name |

Global Edition

Services And Parts

Contacts

Companies

Estimates and Work Orders

Tax Group

- Navigate to Setup > Billing > Tax Setting.

- Click New Tax Group under Taxes tab.

- Perform the following and click Save.

- Enter a Tax Group Name

- Choose taxes in Associate Taxes

Tax Exemption

- Log into your Invoice account

- Click the Gear [

] icon on the top-right corner, and select Taxes.

- Select the Tax Exemptions menu and click New Tax Exemption.

- In the New Tax Exemption overlay, enter the following details and click Save.

- An Exemption Reason.

- A Description of the reason.

- A Type.

Choose whether the exemption reason is applicable for an item or a contact.

Tax Authorities

- Navigate to Setup > Billing > Tax Setting.

- Click New Tax Authority under Tax Authorities tab.

- Enter the following details and click Save.

- Tax Authority

- State

- Description

Zoho CRM Training Programs

Learn how to use the best tools for sales force automation and better customer engagement from Zoho's implementation specialists.

Zoho DataPrep Personalized Demo

If you'd like a personalized walk-through of our data preparation tool, please request a demo and we'll be happy to show you how to get the best out of Zoho DataPrep.

All-in-one knowledge management and training platform for your employees and customers.

You are currently viewing the help pages of Qntrl’s earlier version. Click here to view our latest version—Qntrl 3.0's help articles.

Zoho Sheet Resources

Zoho Forms Resources

Zoho Sign Resources

Zoho TeamInbox Resources

Related Articles

Tax And Discount Preferences

Tax Settings For Service And Parts During Transactions Use these settings to choose how taxes are applied to services and parts in your transactions (Estimates, Work Orders, Service Appointments, and Invoices). The changes that you make will reflect ...Setting up Integration for Zoho Invoice or Zoho Books

Zoho FSM leverages the power of Zoho Invoice/Books to handle and manage all your billing operations. It comes with built-in integration with Zoho Invoice, to handle and manage all the invoices and payments related to the services offered. This ...Tax Editions Supported

Zoho FSM supports region-specific taxes to ensure that your transactions comply with local tax regulations. You can select your preferred tax edition during the initial setup by choosing the appropriate country. The selected edition determines the ...Which countries' tax editions are supported in Zoho FSM?

The tax editions supported in Zoho FSM are: Australia Canada Germany India Kenya Kuwait Mexico Qatar Saudi Arabia South Africa Spain United Arab Emirates United States United Kingdom Global EditionCan I apply discounts to individual service or part items?

Yes. In Zoho FSM, you can apply discounts to individual service or part items by enabling Line Item Level discounts in your transaction settings. These settings are synced with Zoho Books/Zoho Invoice (Settings > Preferences > General > Do you give ...