Shift Differential

Shift Differential is extra compensation paid to employees who work odd hours, such as night shifts, holiday shifts, and weekend shifts. You can create multiple shift differentials under the single pay rule.

You can configure shift differential by,

- Percentage of hourly rate: A fixed percentage per hour is added as extra compensation for employees in addition to the regular wage.

- Fixed amount per hour: A fixed amount per hour is added as extra compensation for employees in addition to the regular wage.

- Fixed amount per shift: A fixed amount for the entire shift is added as extra compensation for employees in addition to the regular wage.

To configure shift differential,

- Click to the Settings icon in the top-right corner, which will open the Settings window.

- Click Pay Rules in the Time and Attendance tab.

- Select Edit on the specific pay rules you want to make changes to.

- Click the Shift Differential tab and select +Shift Differential. Enter shift differential details, either percentage, a fixed amount per hour, or a fixed amount per shift.

- Click Save.

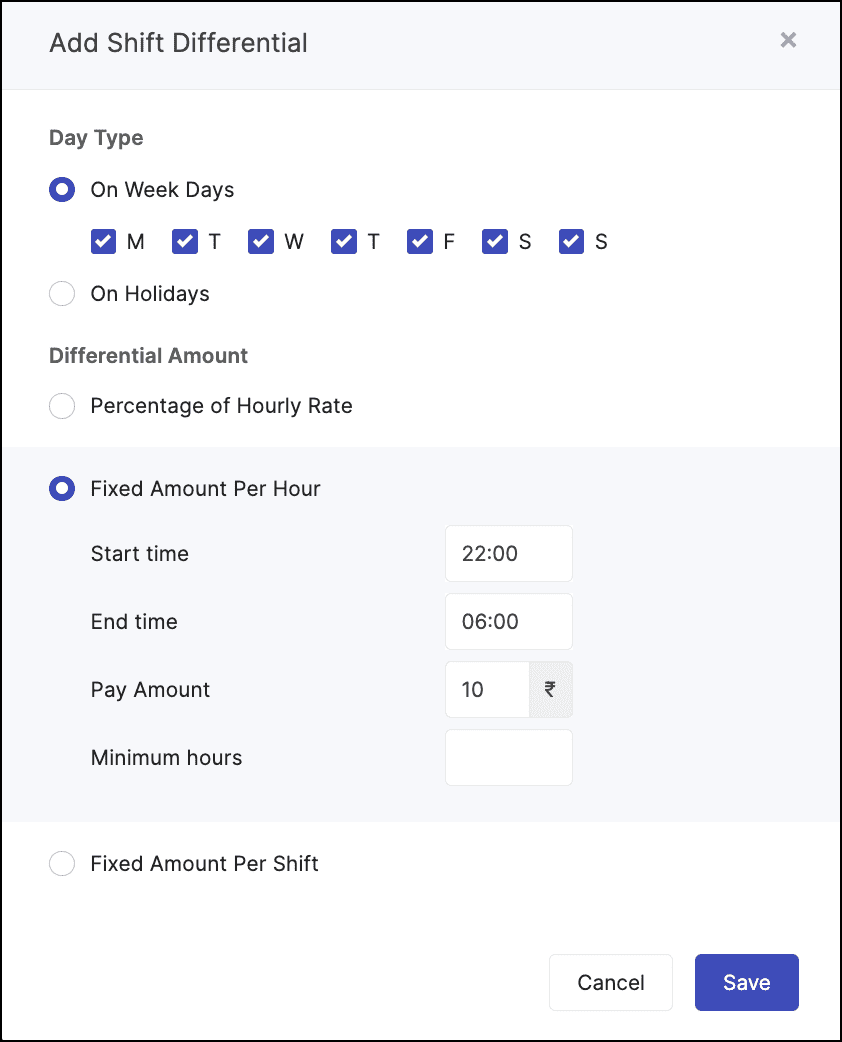

Case 1: Shift differential for night shifts

Shift Differential for night shifts after 10 p.m.

Shift Differential rate: $10 per hour.

Example:

Let's say Amelia is a healthcare professional and works as a nurse. Her base pay is $30 per hour. However, her clinic has fixed a special pay rate for working apart from the usual work hours. The clinic pays an extra $10 per shift for those who are working after 10 p.m., apart from the usual work hours. Calculate the shift differential configuration for the employee who works after 10 p.m.

The time split is as follows:

Start Time | End Time | Pay Rate |

7 p.m. | 10 p.m. | $30 (Base Pay) |

10 p.m. | 3 a.m. | $30 + $10 (Base pay + night shift allowance) |

Calculations:

Regular hours: 3 hrs (7 p.m. - 10 p.m.)

Shift differential hours: 5 hrs (10 p.m. - 3 a.m.)

Regular wage = 3 hrs x $30 = $90

Shift differential wage = 5 hrs x ($30 + $10) = $200

Total wage = $90 + $200 = $290

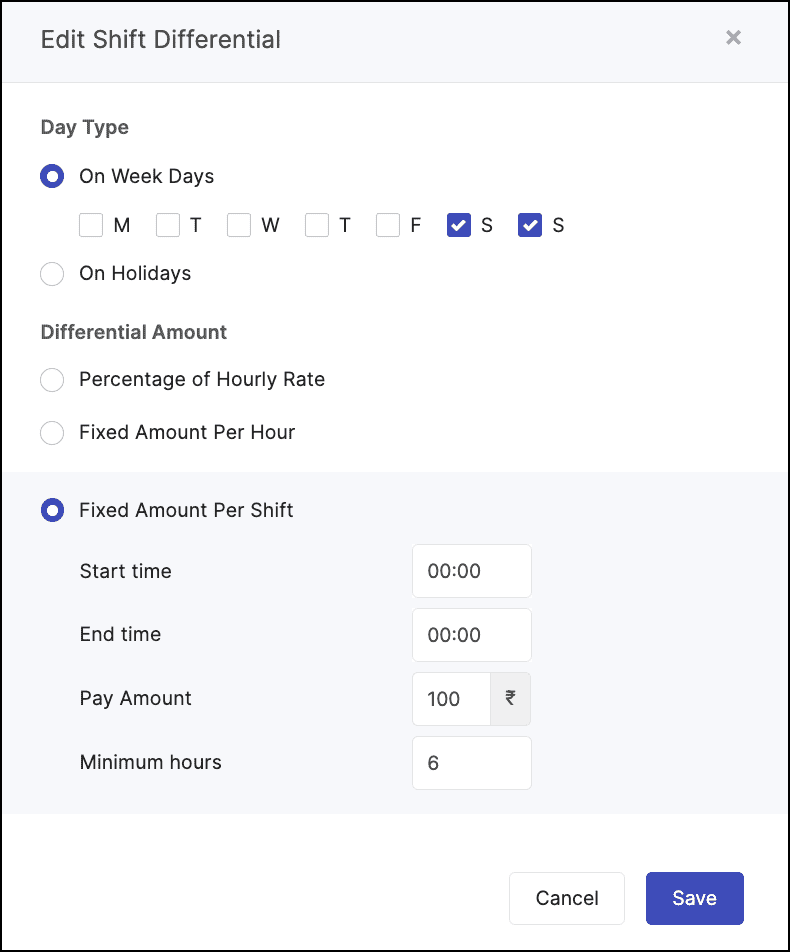

Case 2: Shift differential for weekends

Shift differential for employees who work on weekends for at least six hours.

Shift Differential rate: $100.

Example:

Let's say Patricia works as a senior chef. Patricia works 9 a.m. - 5 p.m. on Saturday with an hourly rate of $30. However, her hotel has fixed a special pay rate for working apart from the usual work hours. The hotel pays an extra $100 per shift when employees work a shift (of at least 6 hours) on Saturday or Sunday. Calculate the shift differential configuration for the employee who works on weekends.

Calculations:

Total hours worked: 8 hrs

Total hours worked: 8 hrs

Regular wage = 8 hrs x $30 = $240

Shift differential wage = $100 (fixed amount per shift)

Total wage = $240 + $100 = $340

Note: When Fixed Amount Per Shift is chosen as Differential Amount type, Minimum hours must be specified.

Note: When Fixed Amount Per Shift is chosen as Differential Amount type, Minimum hours must be specified.Case 3: Shift differential for holidays

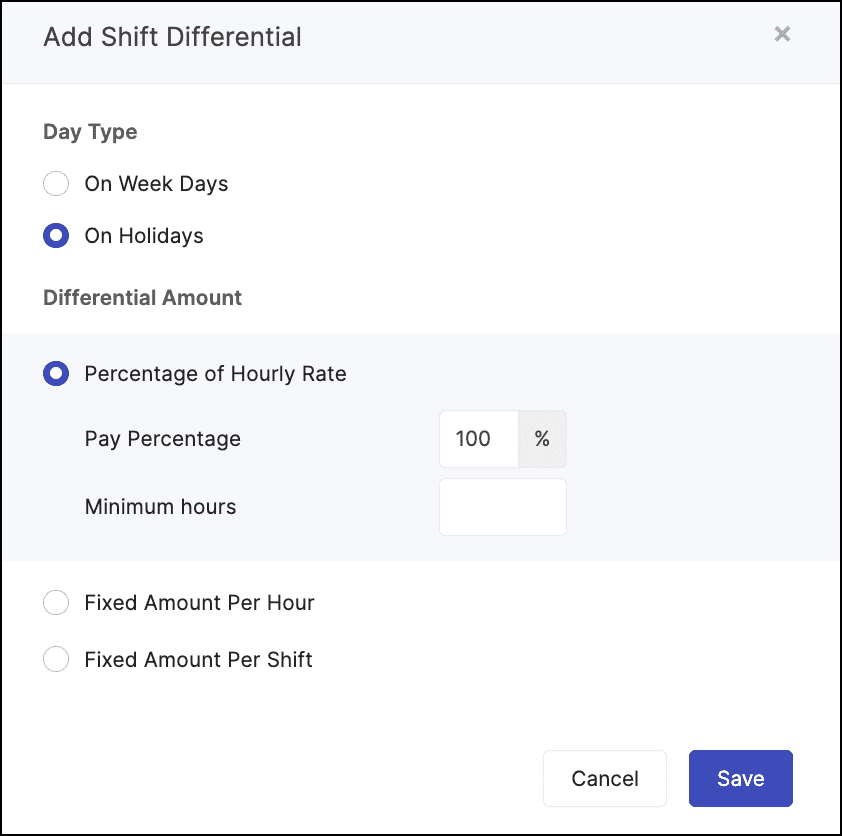

Shift differential for employees who work on holidays.

Shift Differential rate - 100% of the hourly rate.

Example:

Let's say Brad works as a field engineer at Zylker Construction. He works 9 a.m. - 5 p.m. on a holiday with an hourly rate of $30. However his agency has fixed a special pay rate for working apart from the usual work hours. Generally, the agency pays twice their normal wage for working on holidays (100% of the hourly rate).

Let's say Brad works as a field engineer at Zylker Construction. He works 9 a.m. - 5 p.m. on a holiday with an hourly rate of $30. However his agency has fixed a special pay rate for working apart from the usual work hours. Generally, the agency pays twice their normal wage for working on holidays (100% of the hourly rate).

Calculations:

Total hours worked: 8 hrs

Hourly Rate + Differential Amount = $30 + ($30 x 100%) = $30 + $30 = $60

Total wage = 8 hrs x $60 = $480

Note: If the start time of a shift falls on a holiday and the minimum hours criteria is satisfied, the entire shift is eligible for the shift differential.

Note: If the start time of a shift falls on a holiday and the minimum hours criteria is satisfied, the entire shift is eligible for the shift differential.Zoho CRM Training Programs

Learn how to use the best tools for sales force automation and better customer engagement from Zoho's implementation specialists.

Zoho DataPrep Personalized Demo

If you'd like a personalized walk-through of our data preparation tool, please request a demo and we'll be happy to show you how to get the best out of Zoho DataPrep.

New to Zoho Writer?

You are currently viewing the help pages of Qntrl’s earlier version. Click here to view our latest version—Qntrl 3.0's help articles.

Zoho Sheet Resources

Zoho Forms Resources

New to Zoho Sign?

Zoho Sign Resources

New to Zoho TeamInbox?

Zoho TeamInbox Resources

New to Zoho ZeptoMail?

New to Zoho Workerly?

New to Zoho Recruit?

New to Zoho CRM?

New to Zoho Projects?

New to Zoho Sprints?

New to Zoho Assist?

New to Bigin?

Related Articles

Drop a shift

Drop your shifts in Zoho Shifts when you’re unavailable to work, allowing eligible employees to pick them up by making your shift an open shift. Before you start Your administrator must allow dropping shifts in your organization. Depending on the ...Clocking in to your shift

Clocking is how you can track the hours you’ve worked in Zoho Shifts. You can clock in from the mobile app or the web. If your workplace uses a kiosk, check this article for more. On mobile On web On mobile To clock in and out Open the Zoho Shifts ...Clock your shift using Zoho Shifts Kiosk

If your organization has set up the Zoho Shifts Kiosk on a shared device, you can clock in, take breaks, and clock out at your workplace using the app. If you want to clock in using the mobile app or web, check this article for more. Before you start ...Overview

In pay rules, you can configure how overtime and special pay rates are calculated in the payroll report. You can also set different pay rules for different employees. Create a pay rule and assign it to the employees' profiles, then run a payroll ...Copy your schedules, Shift template, and Schedule template

Create tailored schedules with customizable templates and copy them instantly. This helps save your valuable time and efforts. You can create these shifts using Copy your schedules Shift template Schedule template Copy your schedules Fill in ...

New to Zoho LandingPage?

Zoho LandingPage Resources