What's New in Zoho Expense: August - October 2023

Hello users,

We're back again with our What's New post to inform you about the most exciting feature rollouts over the past three months. An all-new edition, an integration for business travel management, iOS 17 updates, and more are in store for you! Get set to delve into the full details and read everything there is to know about these new features.

New edition - Germany

We're excited to announce the launch of another regional edition—Zoho Expense: Germany. If your organization is operating in Germany, simply select the country as Germany on the sign-up page to get started. You can then enable VAT, and Zoho Expense will preconfigure the applicable tax rates for businesses in Germany. While recording business expenses, users can choose the appropriate VAT treatment and VAT rates from the options provided. You can also access Zoho Expense in Deutsch, if required. Additionally, if mileage is enabled in your organization, the government-suggested mileage rates for the car and motorcycle vehicle types will be automatically fetched to Zoho Expense.

Self-booking through GetThere

If you're an organization that lets your employees book tickets online, then this integration would be a great addition for you! With the GetThere integration, your employees can directly book tickets for their business trips from within Zoho Expense. If you don't want all your employees to self-book, simply select the users who can directly book tickets using GetThere. Additionally, you can easily set up the organization's travel policies in GetThere so employees can book tickets in compliance with the company's policies. Learn more.

Report automation for corporate card expenses

Enable report automation to automatically generate a report that will compile the expenses made using a corporate card. A report will be automatically created on the billing date you've configured and all expenses incurred using your corporate card will be attached to the report. You can set up automatic submission, if required.

To set up report automation for corporate cards: Go to Admin View > Settings > Report Automation. Hover over Corporate Card Expenses and click Configure Now. Set up your preferences and click Save.

Updates in delegate configuration

Now, you can set the start date and the end date by which a delegate should cease having access to your account. This feature will come in handy when you want to assign delegates for future dates. At the same time, you can modify the access given to your account, whenever required. Users can also view the list of previous delegates that were assigned for them in My View and the admins can view the list of all the delegates that have been assigned for a user in the Admin View. The list will have the details of each delegate's Access Type, Duration, and Added By date.

For Admins: Go to Admin View > Settings > Users. Select a user and scroll down to the Delegate Details section to configure the delegate access.

For Submitters and Approvers: Go to My View > My Settings. Scroll down to the My Delegate section to configure the delegate access.

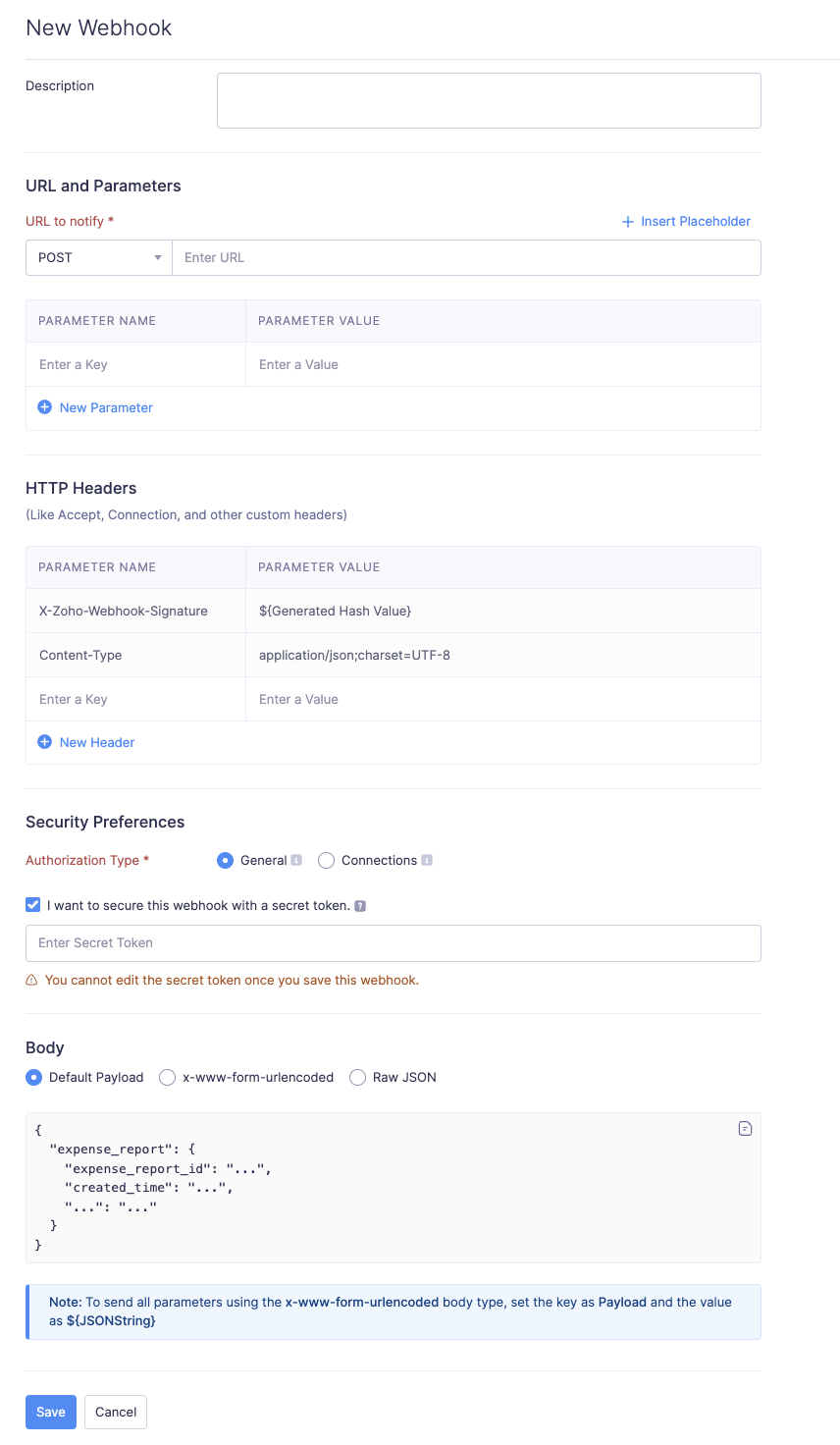

Webhooks revamp

The following changes were made in webhooks:

- Query parameters are now supported.

- Three types of body types are now supported - Default Payload, x-www-form-urlencoded, and raw JSON.

- Secret key support has been added. It will be used to ensure that the API is triggered by Zoho Expense by comparing the hash value in the header (X-Zoho-Webhook-Signature). You need to have the same token on your server in order to compute a hash value.

- Placeholders can now be inserted in the URL field, query parameters, form URL encoded parameters, and raw JSON.

To create a webhook: Go to Admin View > Settings > Actions > Webhooks > + New Webhook.

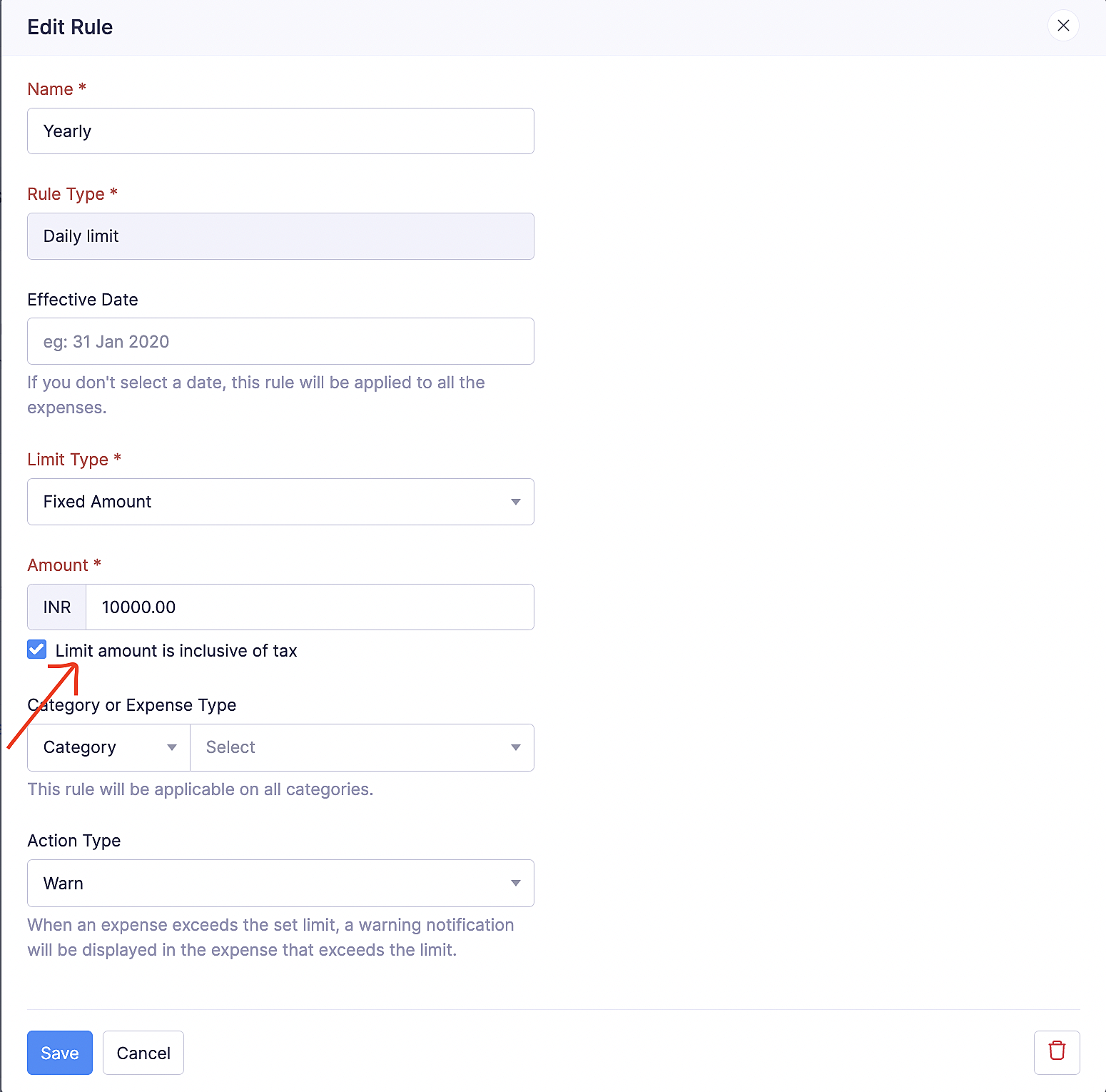

Set up tax-inclusive expense limits

When you configure rules to set up limits for your expenses on the Policies page, you can now mark if the expense amount should be inclusive of tax. If you check the "Limit amount is inclusive of tax" checkbox in Policies, the rule will be executed only if the amount exceeds the sum of the expense amount and tax.

To set up tax inclusive expense limits: Go to Admin View > Settings > Policies. Select a policy and navigate to the Rules tab. Select a rule and check the "Limit is inclusive of tax" option. Click Save.

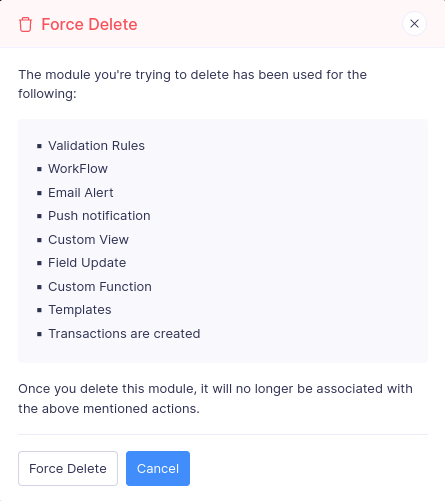

Force delete custom module

Earlier, if you had records under a custom module, you would not have been able to delete the custom module. However, based on popular customer requests, we're now providing an option to delete a custom module even if there are records in it.

To force delete a custom module: Go to Admin View > Settings > Modules. Click the module you want to delete. Click the Gear icon next to the module name and click Delete. In the pop-up that opens, click Delete. A force delete pop-up will open; click Force Delete.

Revert custom status

If you've created your own custom status for a module and have applied it on a record, you can now revert it back to its corresponding default status in Zoho Expense whenever required.

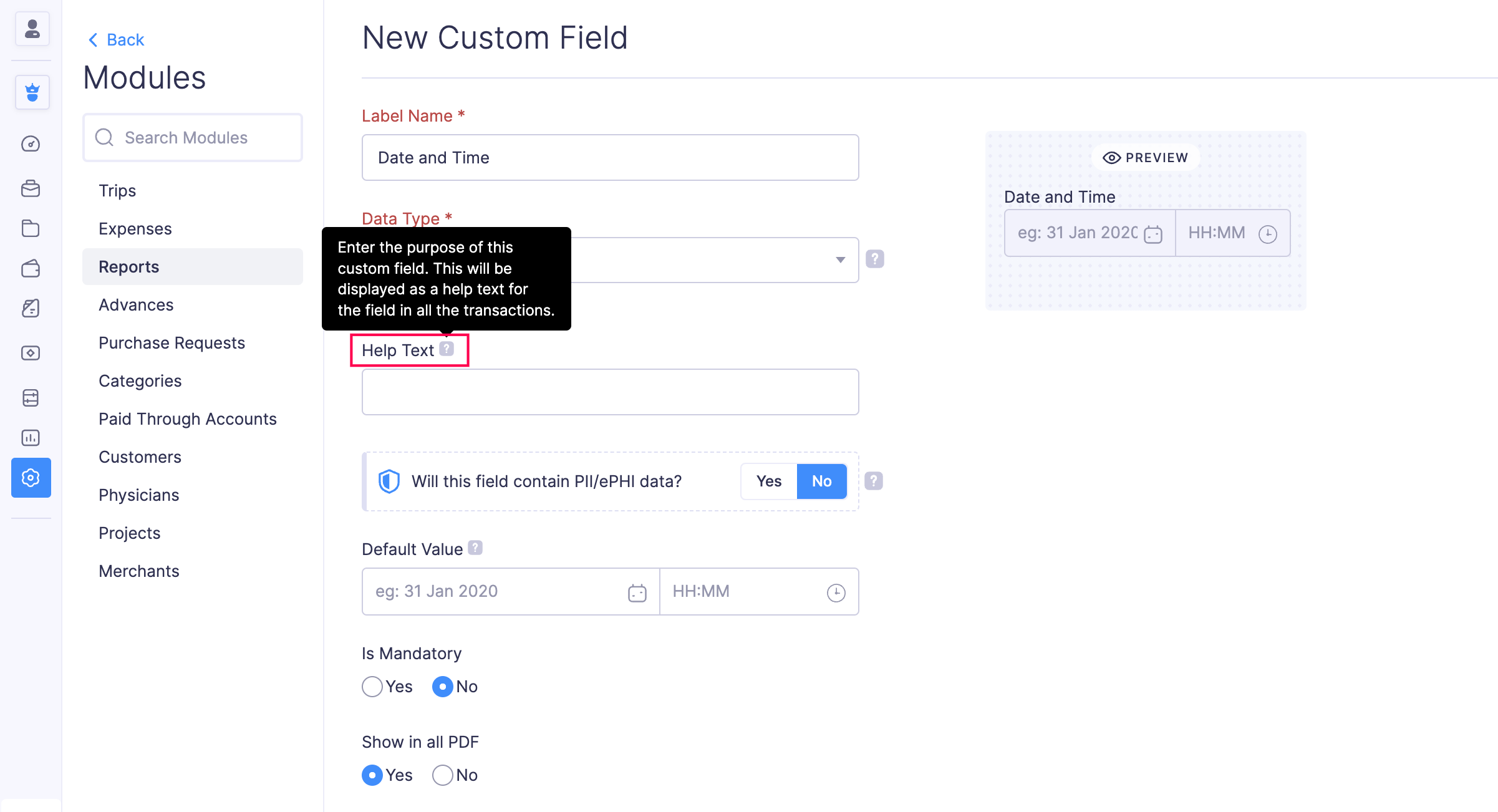

Help text for custom fields

Introducing help text for custom fields! Whenever you create a custom field, you can now add a note in the Help Text field to help users understand the purpose of the field. If you've added help text for a custom field, users will be able to view this text when they hover over the help icon next to the custom field.

To add a help text for custom fields: Go to Admin View > Settings > Modules. Select the module for which you want to add a custom field with help text. Navigate to the Fields tab. Click + New Field. Enter the Label Name and Data Type. The Help Text field will appear. Enter the help text and click Save.

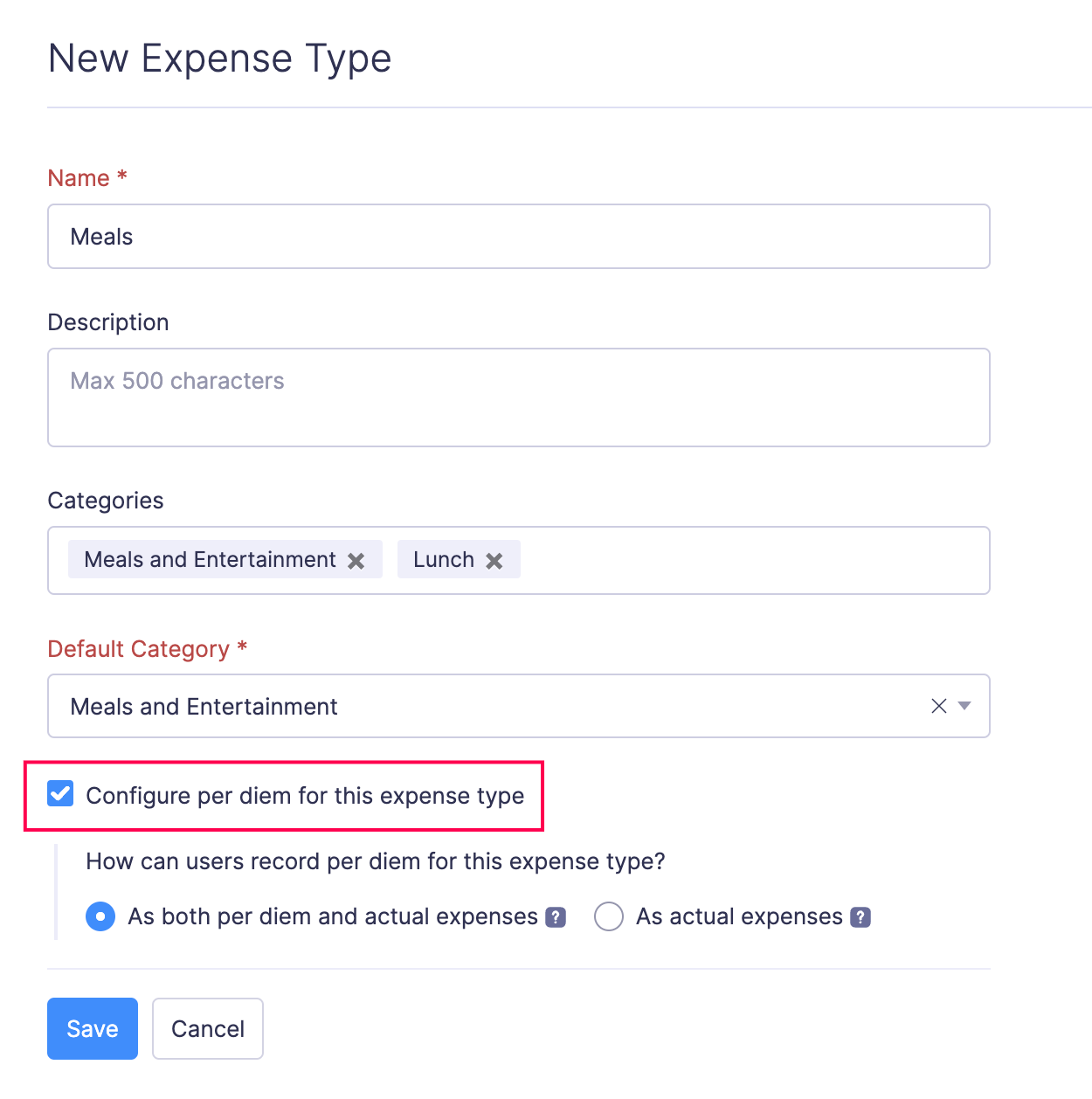

Per diem preferences for expense types

When you create a new expense type, you can now select if you want to configure per diem for the expense type. Additionally, you can choose if you want to record the expense type as a component or a supplement and select the ways by which you can record per diem expenses for this expense type.

To configure per diem preferences for expense types: Go to Admin View > Settings > Modules > Categories. Navigate to Expense Types. Click + New Expense Type. Enter the name and select a default category. Mark the "Configure per diem for this expense type" option and click Save.

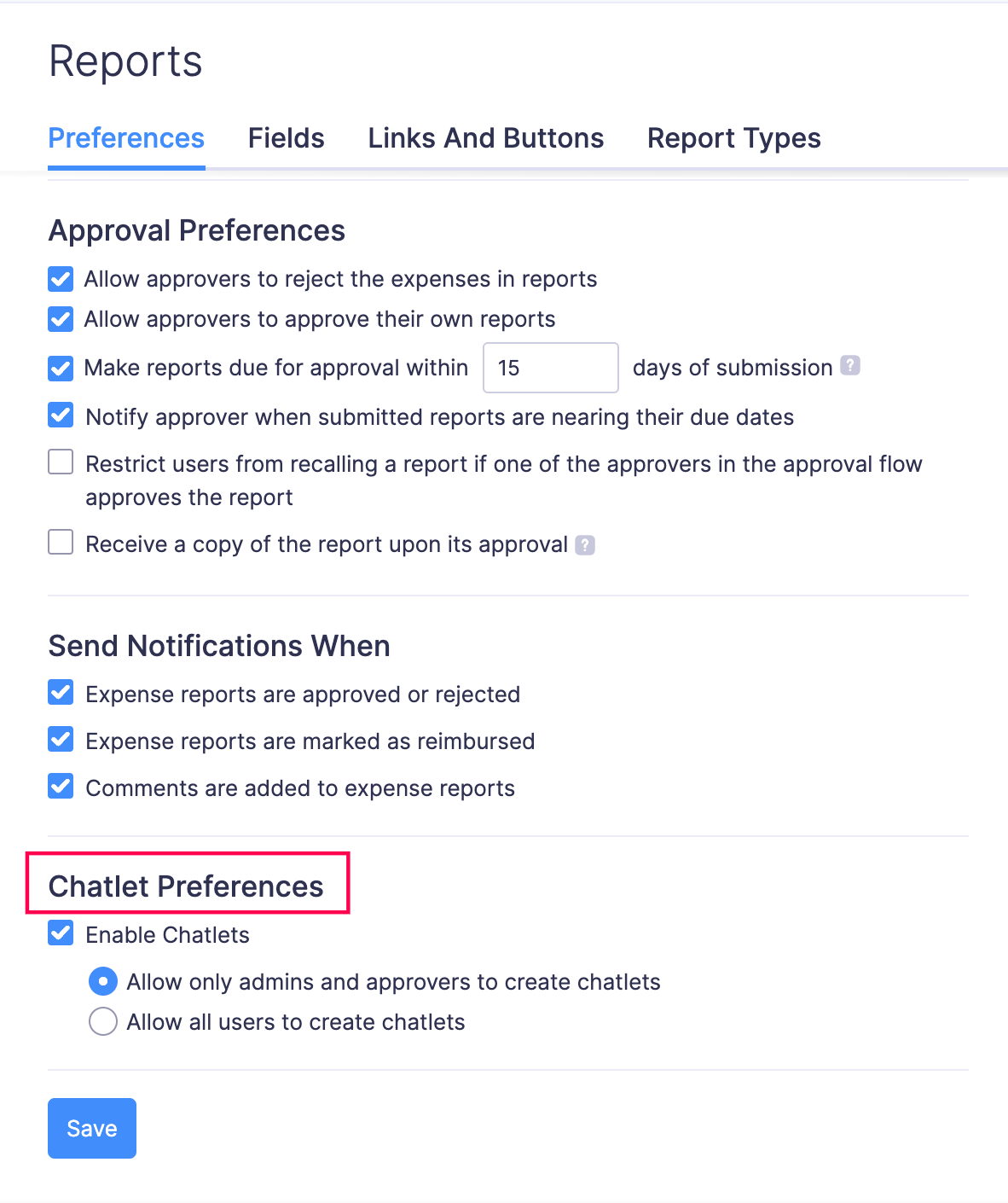

Preferences for chatlets

You can now enable chatlets for reports and trips from the respective Preferences page. If chatlet is enabled, all the admins and approvers can create chatlets by default. However, if you'd like to provide access to all users to create chatlets, you can select that option. This feature is only available for the Premium and Enterprise plans of Zoho Expense.

To configure chatlet preferences: Go to Admin View > Settings > Modules > Reports or Trips. Mark the "Enable Chatlets" option and click Save.

Fetch Canadian tax rates automatically

Zoho Expense can now fetch the Canadian government's tax rates and agencies automatically! If you create a new organization with Canada as the Country and enable "Taxes," all the government-suggested tax rates and agencies will be auto-fetched to allow users to apply them to their expenses. Additionally, if you have custom tax rates, you can create them as well.

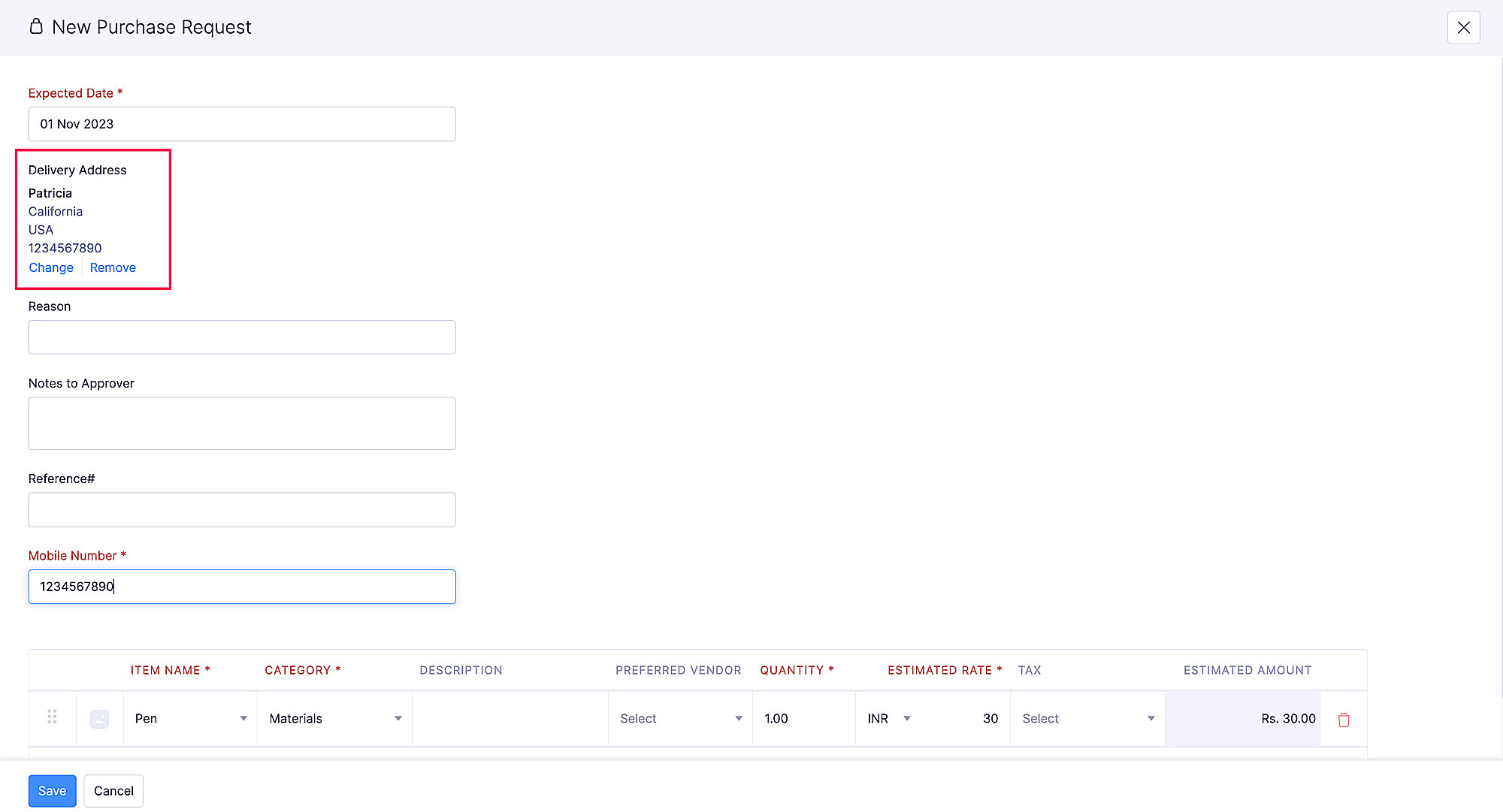

Select a delivery address for purchase requests

When you create a purchase request, you can now choose the delivery address. The organization's primary address will be prefilled by default. However, admins will be able to add a new address or edit the existing address.

iOS app updates

- Zoho Expense is now iOS17, iPadOS 17, and macOS Sonoma ready! Access shortcuts from Spotlight, view real-time updates on the distance covered using GPS, the time left for your flight on your lock screen, Dynamic Island with Live Activities, and view pending tasks by Zia with the interactive widgets.

- For VAT-enabled Germany edition organizations, Zoho Expense will automatically fetch the government tax rates so users can apply them to their expenses. Similarly, the government's mileage rates will also be readily available to apply to your mileage expenses.

Android app updates

- If you've enabled VAT for your Germany edition organizations, the government tax rates will be automatically available, and users can apply them to their expenses.

- Improved accuracy of mileage tracking using GPS.

Explore a more efficient way to manage expenses with these new features. Try them and drop your feedback in the comments. Need assistance? Contact us at support@zohoexpense.com.

Regards,

The Zoho Expense Team

Topic Participants

Vidhya G S

Synergy PSM

Annapoorna

Recent Topics

Add specific field value to URL

Hi Everyone. I have the following code which is set to run from a subform when the user selects a value from a lookup field "Plant_Key" the URL opens a report but i want the report to be filtered on the matching field/value. so in the report there isCRM gets location smart with the all new Map View: visualize records, locate records within any radius, and more

Hello all, We've introduced a new way to work with location data in Zoho CRM: the Map View. Instead of scrolling through endless lists, your records now appear as pins on a map. Built on top of the all-new address field and powered by Mappls (MapMyIndia),Zoho Inventory - Composite Items - Assembly - Single Line Item Quantity of One

Hi Zoho Inventory Team, Please consider relaxing the system rules which prevent an assembly items from consisting of a single line item and outputting a quantity of 1. A client I'm currently working with sells cosmetics and offers testers of their productsEditing the Ticket Properties column

This is going to sound like a dumb question, but I cannot figure out how to configure/edit the sections (and their fields) in this column: For example, we have a custom "Resolution" field, which parked itself in the "Ticket Information" section of thisCliq iOS can't see shared screen

Hello, I had this morning a video call with a colleague. She is using Cliq Desktop MacOS and wanted to share her screen with me. I'm on iPad. I noticed, while she shared her screen, I could only see her video, but not the shared screen... Does Cliq iOS is able to display shared screen, or is it somewhere else to be found ? RegardsWhat's New in Zoho Inventory | Q2 2025

Hello Customers, The second quarter have been exciting months for Zoho Inventory! We’ve introduced impactful new features and enhancements to help you manage inventory operations with even greater precision and control. While we have many more excitingZoho POS App Hanging Issue – Sales Becoming Difficult

The Zoho POS app frequently hangs and becomes unresponsive during billing, making it very difficult to complete sales smoothly. This commonly happens while adding items, during checkout, or at payment time, especially during peak hours. These issues causePlease, make writer into a content creation tool

I'm tired of relying on Google Docs. I'm actually considering moving to ClickUp, but if Writer were a good content creation tool instead of just a word processor, I would finally be able to move all my development within the Zoho ecosystem, rather thanMake Camera Overlay & Recording Controls Visible in All Screen-Sharing Options

Hi Zoho WorkDrive Team, Hope you are doing well. We would like to request an improvement to the screen-recording experience in Zoho WorkDrive. Current Limitation: At the moment the recording controls are visible only inside the Zoho WorkDrive tab. WhenAllow Attaching Quartz Recordings to Existing Zoho Support Tickets

Hi Zoho Team, We would like to request an enhancement to how Zoho Quartz recordings integrate with Zoho Support tickets. Current Behavior: At the moment, each Quartz recording automatically creates a new support ticket. However, in many real-world scenarios:Add Israel & Jewish Holidays to Zoho People Holidays Gallery

Greetings, We hope you are doing well. This feature request is related to Zoho People - please don't move it to zoho one! We are writing to request an enhancement to the Holidays Gallery in Zoho People. Currently, there are several holidays available,Add Israel & Jewish Holidays to Zoho People Holidays Gallery

Greetings, We hope you are doing well. We are writing to request an enhancement to the Holidays Gallery in Zoho People. Currently, there are several holidays available, but none for Israel and none for Jewish holidays (which are not necessarily the sameSync Issue

My Current plan only allows me with 10,000 rows and it is getting sync failure how to control it without upgrading my planNotification to customers when I use a Zoho function

Hi all, I tried searching the community but couldn't find anything about it. I noticed that the customer receives the notification of reopening the old ticket but does not receive the notification of opening a new ticket when I use the function: "separateDesk DMARC forwarding failure for some senders

I am not receiving important emails into Desk, because of DMARC errors. Here's what's happening: 1. email is sent from customer e.g. john@doe.com, to my email address, e.g info@acme.com 2. email is delivered successfully to info@acme.com (a shared inbox"Spreadsheet Mode" for Fast Bulk Edits

One of the challenges with using Zoho Inventory is when bulk edits need to be done via the UI, and each value that needs to be changed is different. A very common use case here is price changes. Often, a price increase will need to be implemented, andEmail Notifications not pushing through

Hi, Notifications from CRM are not reaching my users as they trigger. We have several workflow triggers set up that send emails to staff as well as the notifications users get when a task is created for them or a user is tagged in the notes. For the past 6 days these haven't been coming through in real time, instead users are receiving 30-40 notifications in one push several hours later. This is beginning to impact our daily usage of CRM and is having a negative effect on our productivity becauseTicket layout based on field or contact

Hi! I want to support the following use-case: we are delivering custom IT solutions to different accounts we have, thus our ticket layouts, fields and languages (priority, status field values should be Hungarian) will be different. How should I setupSyncing Bills in Zoho Books to Zoho CRM

Is there any way to sync the Bills in Zoho Books in Zoho CRMSAML in Zoho One vs Zoho Accounts

What is the difference between setting up SAML in Zoho Accounts: https://help.zoho.com/portal/en/kb/accounts/manage-your-organization/saml/articles/configure-saml-in-zoho-accounts ... vs SAML in Zoho One?: https://help.zoho.com/portal/en/kb/one/admin-guide/custom-authentication/setting-up-custom-authentication-with-popular-idps/articles/zohoone-customauthentication-azureHow do I change the order of fields in the new Task screen?

I have gone into the Task module layout, and moving the fields around does not seem to move them in the Create Task screen. Screenshot below. I have a field (Description) that we want to use frequently, but it is inconveniently placed within the MoreZoho Inventory. Preventing Negative Stock in Sales Orders – Best Practices?

Dear Zoho Inventory Community, We’re a small business using Zoho Inventory with a team of sales managers. Unfortunately, some employees occasionally overlook stock levels during order processing, leading to negative inventory issues. Is there a way toDeactivated Zoho One account can sign in

I am concerned by the fact that deactivated users in Zoho One have the ability to sign in even after their account has been deactivated (not deleted). these inactive identities have no access to individual Zoho apps or data. based on my experience theyHow can I reset the password for a user in Zoho Projects

We need to reset the password for a user in Zoho Projects. I am the admin portal owner and there was nothing to be found to do this. very confusing.No funcionan correctamente el calculo de las horas laborales para informe de tickets

Hola, estoy intentando sacar estadísticas de tiempo de primera respuesta y resolución en horario laboral de mis tickets, pero el calculo de horas en horario laboral no funciona correctamente cree los horarios con los feriados : Ajusté los acuerdos deHow can I add a comment to an existing ticket via API?

I need to add comments/notes to the history of an existing ticket using the API without overwriting the original ticket description. Thanks!Internal Error When Accessing Team Inbox.

All our users are seeing this error in teaminbox. Because its a critical tool kindly resolve this issue ASAP.Marketer's Space: Proven tips to improve open rates – Part III

Hello Marketers! Welcome back to another post in Marketer's Space! This is the final post in the "open rate series". In the first and second parts, we discussed topics ranging from sender domains to pre-headers—but we're not done yet. A few more importantMCP no longer works with Claude

Anyone else notice Zoho MCP no longer works with Claude? I'm unable to turn this on in the claude chat. When I try to toggle it on, it just does nothing at all. I've tried in incognito, new browsers, etc. - nothing seems to work.Change Number Field to Decimal Field

Hi, It would be nice to be able to change the field type without having to delete it and create a new one, messing up the database and history. Thanks DanAllow Text within a Formula

Hi, I would like to be able to use this for others things like taking an existing Date Field and copying its value, so by entering getDay(Date)&"-"&getMonth(Date)&"-"&getYear(Date) it results in 01-02-2026. And then when the Date is changed so is thisZoho Social - Feature Request - Reviewer Role

Hi Social Team, I've come across this with a couple of clients, where they need a role which can review and comment on posts but who has no access to create content. This is a kind of reviewer role. They just need to be able to see what content is scheduledZoho Books/Inventory - Update Marketplace Sales Order via API

Hi everyone, Does anyone know if there is a way to update Sales Orders created from a marketplace intigration (Shopify in this case) via API? I'm trying to cover a scenario where an order is changed on the Shopify end and the changes must be reflectedZoho Inventory / Finance Suite - Add feature to prevent duplicate values in Item Unit field

I've noticed that a client has 2 values the same in the Unit field on edit/create Items. This surprised me as why would you have 2 units with the same name. Please consider adding a feature which prevents this as it seems to serve no purpose.Zoho CRM for Everyone's NextGen UI Gets an Upgrade

Hello Everyone We've made improvements to Zoho CRM for Everyone's Nextgen UI. These changes are the result of valuable feedback from you where we’ve focused on improving usability, providing wider screen space, and making navigation smoother so everythingKaizen #224 - Quote-driven Deal Reconciliation Using Zoho CRM Functions and Automation

Hello everyone! Welcome back to another instalment in the Kaizen series. This post covers quote-driven deal reconciliation, emphasizing Functions and Automation to address practical sales challenges. Business Challenge Sales organizations often mark dealsDependent / Dynamic DropDown in ZohoSheets

Has anyone figured out a way to create a Dropdown, the values of which is dependent on Values entered in the other cell ?Directly Edit, Filter, and Sort Subforms on the Details Page

Hello everyone, As you know, subforms allow you to associate multiple line items with a single record, greatly enhancing your data organization. For example, a sales order subform neatly lists all products, their quantities, amounts, and other relevantBARCODE PICKLIST

Hello! Does anyone know how the Picklist module works? I tried scanning the barcode using the UPC and EAN codes I added to the item, but it doesn’t work. Which barcode format does this module use for scanning?Zoho Inventory - Allow Update of Marketplace Generated Sales Orders via API

Hi Inventory Team, I was recently asked by a client to create an automation which updated a Zoho Inventory Sales Order if a Shopify Order was updated. I have created the script but I found that the request is blocked as the Sales Order was generated byNext Page