Zoho Payroll: Product Updates | April 2025

At Zoho Payroll, we’re always working to make every payday feel effortless. And sometimes, that means listening closely to your unique needs.

This month, we’ve focused on adding features that give you the flexibility to pay your employees based on your organization's special requirements. Here’s what’s new:

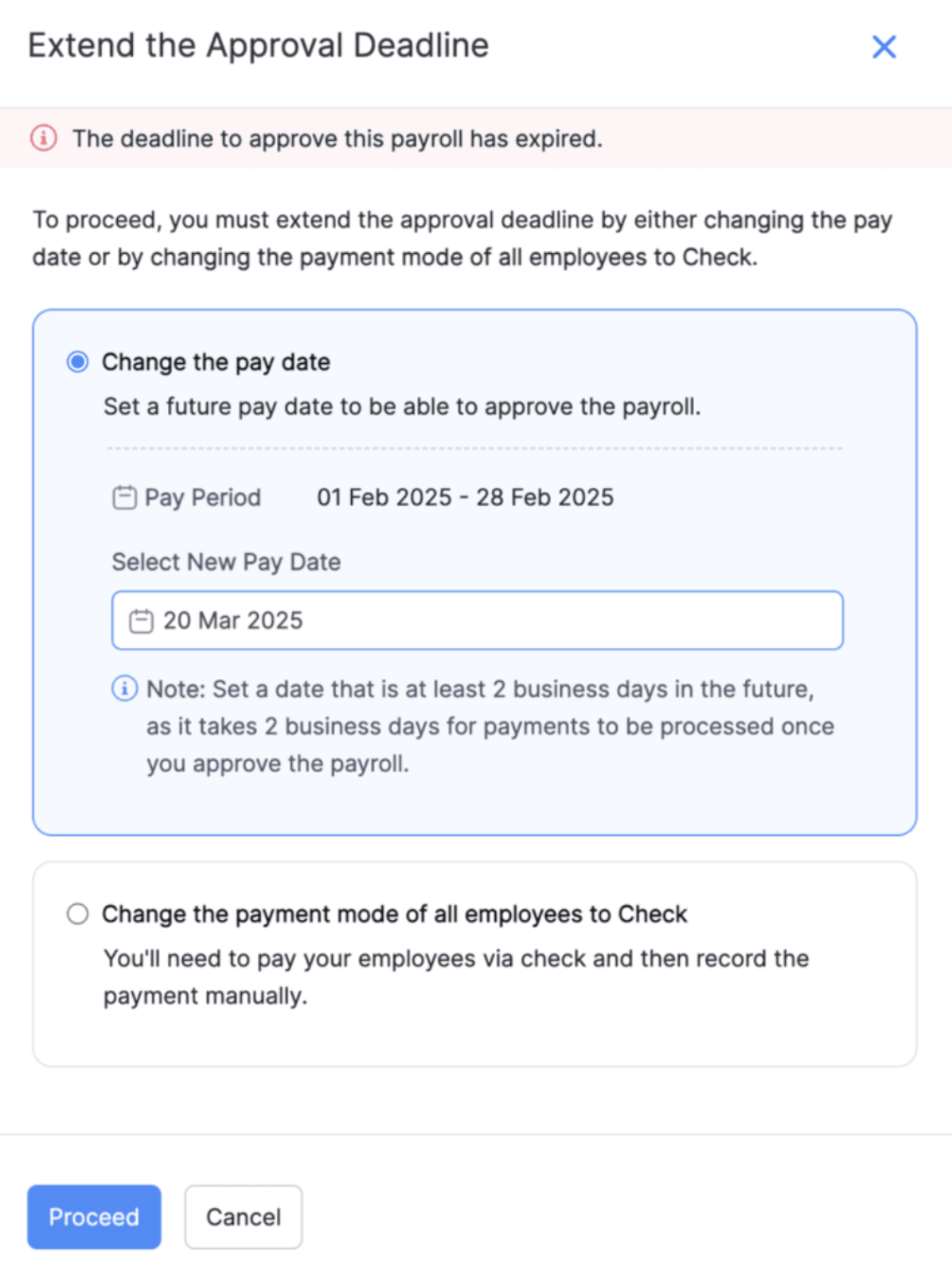

Extend The Deadline To Approve Your Pay Run (US)

If you have missed the deadline to approve the pay run, you can extend the deadline by:

- Changing the pay date

- Changing the payment mode to Check (Only allowed till 5PM EST on Pay Day)

When adjusting your pay date, ensure you select a date at least two working days after the current pay date. However, if you don't want to change the pay date, you can change the payment mode of employees in the pay run to Check. Once changed, you can record the check payments after approving the pay run.

Extend Approval Deadline

Extend Approval DeadlineChange Payment Mode to Check While Processing Pay Runs (US)

If your employees' direct deposit information is pending verification, you can add them to the pay run and proceed with the pay run by changing their payment mode to Check. This change of payment mode to Check will only be applicable for the current pay run you're working on.

Insight: If you don't want to change the payment mode, you can choose to skip the employees for whom the direct deposit information isn't verified.

Share Screen Recordings with our Support Team

While reaching out to the support team to have your issues resolved, you can now share a screen recording of the issue with us as well. This helps reduce the time it takes to get back to you as it helps our support team to quickly understand your query based on the screen recording you've shared with us.

Other Enhancements

Full Tax Exemptions (India): According to Section Section 10(26) of the Income Tax Act, employees who not only reside but also work from certain regions of India are eligible for full tax exemption. If your organisation has employees who meet the criteria, you can select the This employee qualifies for a full income tax exemption option while creating an employee.

Add Employees' SWIFT codes (UAE, KSA): A SWIFT code (also referred as BIC number) is used to identify banks and other financial institutions globally. You can add the your organisation's bank SWIFT code details by navigating to Settings > Bank Accounts. You can also now save the employees' SWIFT code information while creating or editing an employee's details.

Pro-rate Employer & Employee Contributions: You can now opt to calculate your organization's and employees contributions towards social security benefits based on the number of days employees have worked.

That's a wrap for now! We are always eager to hear your suggestions so we can help you do payroll better. Feel free to share them in the comments below.

If you need any assistance, please write to us at support@zohopayroll.com, and we'll help you. Stay tuned for more updates from Zoho Payroll.

With a shared purpose,

The Zoho Payroll Team

Topic Participants

Bennet Noel L

admin

Rebecca Hardy,

Rich Brandwein

Subash T

Sticky Posts

Zoho Payroll | Quarterly Product Updates For 2024

As we navigate through the ever-changing payroll landscape, we bring you the latest updates that span the first quarter of 2024, tailored to meet the diverse needs of employers and employees in India, the UAE, and the US. From useful integrations to refinedIntroducing Academy 🎉: your go-to hub for all things payroll

Hello! We're thrilled to launch our newest payroll resource hub - Academy by Zoho Payroll [for India] - the information repository where you can go to learn everything about payroll. Introducing Academy by Zoho Payroll Why did we build Academy? Payroll

Recent Topics

Appreciation to Qntrl Support Team

We are writing this topic to appreciate the outstanding level of support from Qntrl Team. We have been using Qntrl since 2022 after shifting from another similar platform. Since we joined Qntrl, the team has shown a high level of professionalism, support,How can I hide "My Requests" and "Marketplace" icon from the side menu

Hello everybody, We recently started using the new Zoho CRM for Everyone. How can I hide "My Requests" and "Marketplace" from the side menu? We don't use these features at the moment, and I couldn't find a way to disable or remove them. Best regards,Whatsapp Integration on Zoho Campaign

Team: Can the messages from Zoho Campaign delivered through Whatsapp... now customers no longer are active on email, but the entire campaign module is email based.... when will it be available on whatsapp.... are there any thirdparty providers who canQuotes Approval

Hey all, Could you please help in the following: When creating quotes, how to configure it in a way, that its approval would work according to the quoted items description, not according to quote information. In my case, the quote should be sent to approvalMandatory Field - but only at conversion

Hello! We use Zoho CRM and there are times where the "Lead Created Date & Time" field isn't populated into a "Contractor" (Account is the default phrase i believe). Most of my lead tracking is based on reading the Lead Created field above, so it's importantDifferent Task Layouts for Subtasks

I was wondering how it would be possible for a subtask to have a different task layout to the parent task.Enable Free External Collaboration on Notecards in Zoho Notebook

Hi Zoho Notebook Team, I would like to suggest a feature enhancement regarding external collaboration in Zoho Notebook. Currently, we can share notes with external users, and they are able to view the content without any issue. However, when these externalUsing data fields in Zoho Show presentations to extract key numbers from Zia insights based on a report created

Is it possible to use data fields in Zoho Show presentations along with Zoho Analytics to extract key numbers from Zia insights based on a report created? For example, using this text below: (note that the numbers in bold would be from Zia Insights) RevenueFree webinar: AI-powered agreement management with Zoho Sign

Hi there! Does preparing an agreement feel like more work than actually signing it? You're definitely not alone. Between drafting the document, managing revisions, securing internal approvals, and rereading clauses to make sure everything still reflectsWhatsApp Channels in Zoho Campaigns

Now that Meta has opened WhatsApp Channels globally, will you add it to Zoho Campaigns? It's another top channel for marketing communications as email and SMS. Thanks.CRM For Everyone - Bring Back Settings Tile View

I've been using CRM for Everyone since it was in early access and I just can't stand the single list settings menu down the left-hand side. It takes so much longer to find the setting I need. Please give users the option to make the old sytle tile viewLets have Dynamics 365 integration with Zohobooks

Lets have Dynamics 365 integration with ZohobooksAdd notes in spreadsheet view

It would be great if we could Add/edit notes in the spreadsheet view of contacts/leads. This would enable my sales teams to greatly increase their number of calls. Also viewing the most recent note in the Contact module would also be helpful.Opening balances - Accounts Receivable and Payable

Our accounting year starts on 1st August 2013 and I have a Trial Balance as at that date, including Accounts Receivableand Accounts Payable balances, broken down by each customer and supplier. Q1 - do I show my opening balance date as 31st July 2013 orAnnouncing Kiosk 1.1 - Customize screen titles, configure new fields & actions, use values from your Kiosk to update fields, and more.

Hello all We are back again with more enhancements to Kiosk. So what's new? Enhancements made to the Components Add titles for your Kiosk screens and adjust its width to suit your viewing preferences. Three new fields can be added to your screen: Percentage,Limited System because of Limited Number of Fields for Car Dealership

Dear Zoho Support, we want to have all the information about a car inside of a car record. We want to have Zoho CRM as our single source of truth for our data, but the limited number of fields are not allowing that. The data consist of: technical dataCancel Subscription

Hi , Im want to cancel my account but without success please help me to do itMaking an email campaign into a Template

I used a Zoho Campaign Template to create an email. Now I want to use this email and make it a new template, but this seems to be not possible. Am I missing something?Direct Access and Better Search for Zoho Quartz Recordings

Hi Zoho Team, We would like to request a few enhancements to improve how Zoho Quartz recordings are accessed and managed after being submitted to Zoho Support. Current Limitation: After submitting a Quartz recording, the related Zoho Support ticket displaysMultiple Cover Letters

We are using the staffing firm edition of Recruit and we have noticed that candidates cannot add more than one cover letter. This is a problem as they might be applying for multiple jobs on our career site and when we submit their application to a client,URGENT: Deluge issue with Arabic text Inbox

Dear Deluge Support, We are facing an issue that started on 12/Feb/2026 with custom functions written using Deluge within Qntrl platform. Currently, custom functions do not accept Arabic content; it is replaced with (???) characters. Scenario 1: If weFile Conversion from PDF to JPG/PNG

Hi, I have a question did anyone every tried using custom function to convert a PDF file to JPG/PNG format? Any possibility by using the custom function to achieve this within zoho apps. I do know there are many third parties API provide this withPrevent accidental duplicate entry of Customer Ordersome

Zoho Support has confirmed that Zoho currently does not have any method (using Deluge, flow or any other method) to alert a user when a sales order has been entered twice using the same customer reference number (i.e. a duplicate). Most ERP platformsNow in Zoho One: Orchestrate customer journeys across apps with Zoho CommandCenter

Hello Zoho One Community! We’re excited to introduce Zoho CommandCenter as a new capability available in Zoho One. For the whole customer journey As Zoho One customers adopt more apps across sales, marketing, finance, and support, a common challenge emerges:annualy customer report

we need a report per customer that looks like this invoic number cleaning laundry repair management 01 january xxx euro xx euro xx euro xxx euro 02 february xxx euro xxx euro x euro xxxx euro and so on the years 12 months is that possible to make andTotals for Sales Tax Report

On the sales tax report, the column totals aren't shown for any column other than Total Tax. I can't think of a good reason that they shouldn't be included for the other columns, as well. It would help me with my returns, for sure. It seems ludicrousFree Webinar: Zoho Sign for Zoho Projects: Automate tasks and approvals with e-signatures

Hi there! Handling multiple projects at once? Zoho Projects is your solution for automated and streamlined project management, and with the Zoho Sign extension, you can sign, send, and manage digital paperwork directly from your project workspace. JoinExported Report File Name

Hi, We often export reports for information. It is time consuming to rename all the reports we export on a weekly basis, as when exported their default name is a seemingly random string of numbers. These numbers may be important, I'm not sure, but I amAutomatic Refresh on Page?

Hi everyone, We use a page as a dashboard which shows data for the laboratory and tasks pending etc. Is there a way to set the page to automatically refresh on a X time? Many thanks TOGFull Context of Zoho CRM Records for Zia in Zoho Desk for efficient AI Usage

Hello everyone, I have a question regarding the use of Zia in Zoho Desk in combination with CRM data. Is it possible to automatically feed the complete context of a CRM record into Zia, so that it can generate automated and highly accurate responses forHiding Pre-defined Views

You can enhance Zoho with custom views - but you cannot hide the pre-defined views. Most users focus on 4 or 5 views. Right now for EVERY user EVERY time they want to move to one of their 4 or 5 views - they have to scroll down past a long list of pre-defined views - we don't use ANY of the pre-defined views. Adding the feature to allow a predefined view to be hidden completely or only visible to certain users would be a big improvement in usability for Zoho CRM. This feature is already available[Webinar] Top 10 Most Used Zoho Analytics Features in 2025

Zoho Analytics has evolved significantly over the past year. Discover the most widely adopted features in Zoho Analytics in 2025, based on real customer usage patterns, best practices, and high-impact use cases. Learn how leading teams are turning dataHow do I edit the Calendar Invite notifications for Interviews in Recruit?

I'm setting up the Zoho Recruit Interview Calendar system but there's some notifications I don't have any control over. I've turned off all Workflows and Automations related to the Calendar Scheduling and it seems that it's the notification that is sentAdd RTL and Hebrew Support for Candidate Portal (and Other Zoho Recruit Portals)

Dear Zoho Recruit Team, I hope you're doing well. We would like to request the ability to set the Candidate Portal to be Right-to-Left (RTL) and in Hebrew, similar to the existing functionality for the Career Site. Currently, when we set the Career SiteApp for Mac OS X please!

It would be awesome to have a mail app for Mac OS X that included all the cool features such as steams, calendar, tasks, contacts, etc. Most people prefer native apps, rather than running it through a web browser. I know that we can use the IMAP, CalDAV,How to integrate Zoho CRM, Zoho Forms and a WIX Web Site

Attached video demonstrates how to use Zoho Forms included in Zoho One, to design a Contact Us form to be embedded into a WIX web site and integrated into Zoho CRM.CRM x WorkDrive: File storage for new CRM signups is now powered by WorkDrive

Availability Editions: All DCs: All Release plan: Released for new signups in all DCs. It will be enabled for existing users in a phased manner in the upcoming months. Help documentation: Documents in Zoho CRM Manage folders in Documents tab Manage filesIntroducing Workqueue: your all-in-one view to manage daily work

Hello all, We’re excited to introduce a major productivity boost to your CRM experience: Workqueue, a dynamic, all-in-one workspace that brings every important sales activity, approval, and follow-up right to your fingertips. What is Workqueue? SalesDefault Reminder Time in New Tasks or New Event?

Any way to change this from 1:00am? Thanks, Gary Moderation Update (February 2026): With the Calendar preferences, the default reminder time for Meetings, Appointments and All-Day Meetings can be set. Read more: Calendar preferences in Zoho CRM RegardingExporting All Custom Functions in ZohoCRM

Hello, All I've been looking for a way to keep about 30 functions that I have written in Zoho CRM updated in my own repository to use elsewhere in other instances. A github integration would be great, but a way to export all custom functions or any wayNext Page