What's New in Zoho Invoice | May - July 2024

Hello everyone!

We're excited to bring you the latest set of features and enhancements made to Zoho Invoice from May to July. Continue reading to learn more about them.

In this, you'll learn more about the following features:

- TDS in Quotes, Credit Notes, and Recurring Invoices [India Edition]

- Klarna Payment Method via Stripe

- TDS Receivables Report [India Edition]

- Associate Payment Forms to Invoices [Mexico Edition]

- Overwrite Items Based On Custom Fields While Importing

- Customize Keyboard Shortcuts

- Filter Option for Notifications

- Resize the Width of Columns in List Pages

TDS in Quotes, Credit Notes, and Recurring Invoices [India Edition]

You can now apply Tax Deducted at Source (TDS) in quotes, credit notes, and recurring invoices. Select a default TDS rate from the dropdown or create a new one by clicking Manage TDS.

To apply a TDS rate to your transaction, go to a transaction, for example Quotes > + New > TDS > Select a Tax.

You can also edit or override the applied TDS amount, if required. This is helpful when you'd like to update the TDS amount for various reasons such as business-specific agreements, international transactions, etc.

To adjust the TDS amount, click the Edit icon next to the TDS amount in transactions.

Klarna Payment Method via Stripe

This feature is not available for users using the India edition of Zoho Invoice.

The Klarna payment method is now available via Stripe. Klarna is a global payment method that offers customers a range of payment options like Buy Now Pay Later, installment payments, and more.

Based on your Stripe account's location, you can transact in AUD, CAD, CHF, CZK, DKK, EUR, GBP, NOK, NZD, PLN, SEK and USD through Klarna.

To enable this payment method, go to Settings > Online Payments > Payment Gateways, and click Edit Settings under Stripe. Then, click the Edit icon next to Payment Methods and select Klarna.

TDS Receivables Report [India Edition]

We've introduced the TDS Receivables report that you can use to track the TDS applied in invoices, credit notes and debit notes. You can group the report either by customers or the TDS rates, and also customize the columns of the report by clicking Customize Report Columns at the top.

To access the TDS Receivables report, go to Reports and click TDS Receivables under Taxes.

Associate Payment Forms to Invoices [Mexico Edition]

For e-invoicing, it is mandatory to include a payment form to specify how a transaction will be settled. You can now use the Payment Form field to associate payment forms such as cash, nominal check, etc., while creating invoices.

The default payment form in PPD invoices will be prefilled as Not Specified while you can manually select a payment form for PUE invoices. This helps you stay compliant with SAT while stamping invoices.

To associate a payment form, create or edit an invoice. After entering the necessary details, click the Payment Form dropdown under Payment Details.

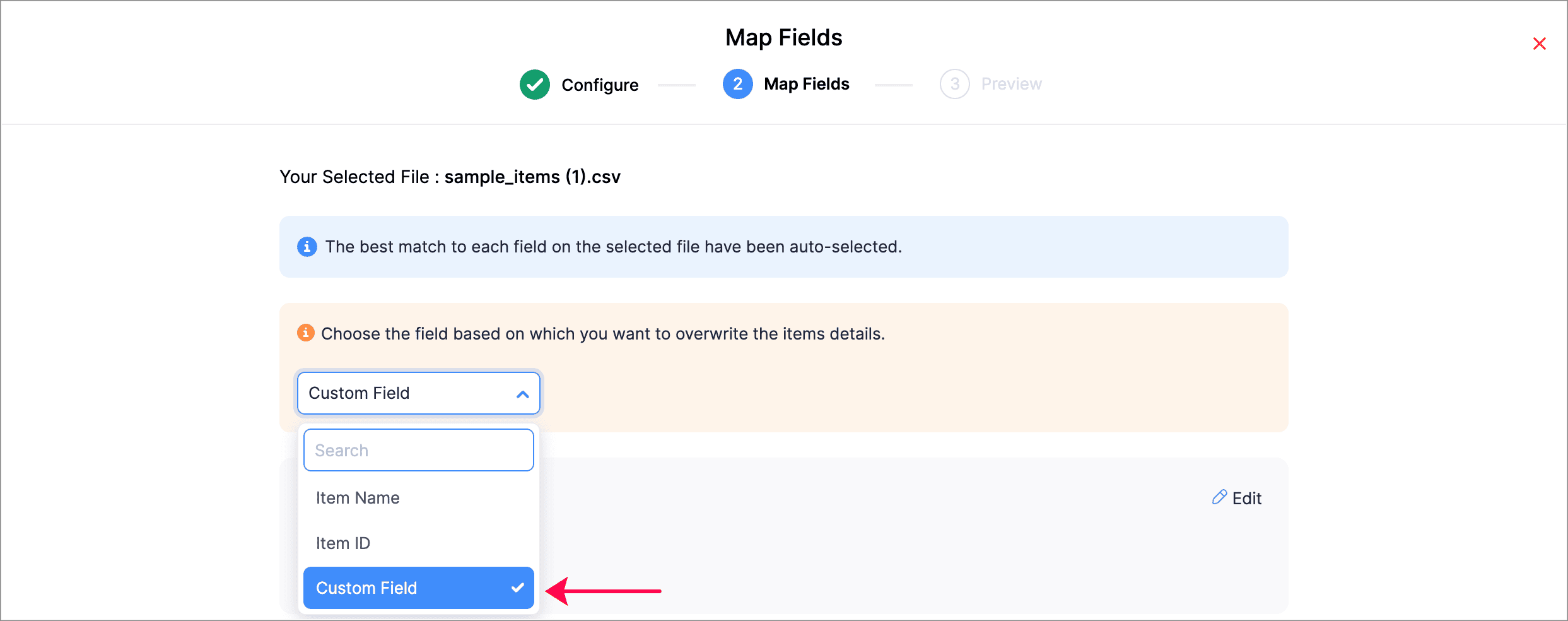

Overwrite Items Based on Custom Fields While Importing

While importing items, you can now choose to overwrite items based on custom fields. If you've created a custom field for an item with the Prevent Duplicate Values option enabled, it appears in the dropdown based on which you can overwrite imported items.

To do this, click Items > More > Import Items. Select Overwrite Items under Duplicate Handling. In the Map Fields page, you can choose the field based on which you want to overwrite items.

Customize Keyboard Shortcuts

You can now configure personalized keyboard shortcuts in Zoho Invoice. This way, you can quickly access the modules you frequently use or customize shortcuts to align with your specific workflows. You can also reset the configured shortcuts to their original settings or disable it altogether. Note that the keyboard shortcuts you configure will not be applicable for other users in your organization.

Filter Option for Notifications

We've introduced a filter option for notifications. You can now view your notifications based on criteria such as Mentions or Unread notifications. This way, you can easily view notifications related to you and never miss any updates.

To apply filters, click the Notifications icon from the top band and select the filter from the dropdown next to Notifications.

Resize the Width of Columns in List Pages

Adjust the width of columns in list pages that have more than eight columns. You can do this in the Customers, Invoices, Quotes, Credit Notes, and Expenses modules. After resizing, you can save the changes by clicking Save at the top. You can also reset the columns to their original widths by clicking Reset Column Width under More in the list page.

We regularly update our mobile apps, so visit the App Store, Google Play, or Microsoft Store to ensure you're using the latest version.

That's all for our latest product updates! We hope the latest enhancements are beneficial for your business. You can also visit the What's New timeline for byte-sized information about our previous feature updates and enhancements.

We will catch you in the next product updates! Until then, if you require any assistance or need clarifications, feel free to write to us at support@zohoinvoice.com, we'd be happy to help!

Best regards,

The Zoho Invoice Team

Topic Participants

SELVAPRIYA V

AFL Enterprises

Peo

Kevin

Sticky Posts

Charting the 2025 Voyage: Zoho Invoice's Year in Review

2025 has been a year of progress, productivity, and purposeful growth for Zoho Invoice. From expanding into new regions to refining everyday workflows, each update was designed to help businesses stay compliant, get paid faster, and work with confidence.

Recent Topics

Bigin’s 2025 Evolution: Highlights from 2025 and What’s Ahead in 2026

Dear Biginners, Wishing you a very happy New Year! As we stand at the cusp of endless possibilities in 2026, we would like to take a moment to reflect on what we achieved together in 2025. Your continued support, thoughtful feedback, and kind words ofSend Supervisor Rule Emails Within Ticket Context in Zoho Desk

Dear Zoho Desk Team, I hope this message finds you well. Currently, emails sent via Supervisor Rules in Zoho Desk are sent outside of the ticket context. As a result, if a client replies to such emails, their response creates a new ticket instead of appendingZoho Desk - Change Time Zone for all users and set default for new user

Hi, Is there a way to set a default time zone so that when user creates an account via the Zoho Desk invitation, they don't need to select the time zone via the hundreds of choice? And, for already created users, can we edit the incorrect time zone selected by the user at the account creation ? Thanks ! FredIntroducing WhatsApp integration in Bigin

Greetings! In today's business landscape, messaging apps play a significant role in customer operations. Customers can engage with businesses, seek support, ask questions, receive personalized recommendations, read reviews, and even make purchases—allWhy is Zoho Meeting quality so poor?

I've just moved from Office 365 to Zoho Workplace and have been generally really positive about the new platform -- nicely integrated, nice GUI, good and easy-to-understand control and customisation, and at a reasonable price. However, what is going onAllow Manual Popup Canvas Size Control

Hello Zoho PageSense Team, We hope you're doing well. We would like to request an enhancement to the PageSense popup editor regarding popup sizing. Current Limitation: Currently, the size (width and height) of a popup is strictly controlled by the selectedWhy does Zoho’s diff viewer highlight parts of unchanged lines?

Hi everyone, I’ve noticed something odd in the Zoho editor’s diff view. When I delete a single line, the diff doesn’t just mark that line as removed. Instead, it highlights parts of the next line as if they changed, even though they are identical. Example:All new Address Field in Zoho CRM: maintain structured and accurate address inputs

The address field will be available exclusively for IN DC users. We'll keep you updated on the DC-specific rollout soon. It's currently available for all new sign-ups and for existing Zoho CRM orgs which are in the Professional edition. Latest updateCRM x WorkDrive: File storage for new CRM signups is now powered by WorkDrive

Availability Editions: All DCs: All Release plan: Released for new signups in all DCs. It will be enabled for existing users in a phased manner in the upcoming months. Help documentation: Documents in Zoho CRM Manage folders in Documents tab Manage filesWrapping up 2025 on a high note: CRM Release Highlights of the year

Dear Customers, 2025 was an eventful year for us at Zoho CRM. We’ve had releases of all sizes and impact, and we are excited to look back, break it down, and rediscover them with you! Before we rewind—we’d like to take a minute and sincerely thank youPassing the CRM

Hi, I am hoping someone can help. I have a zoho form that has a CRM lookup field. I was hoping to send this to my publicly to clients via a text message and the form then attaches the signed form back to the custom module. This work absolutely fine whenWhere can we specify custom CSS in Zoho Forms custom theme ?

I'm using a form with a dark theme. The OTP popup window is unreadable, because for some reason, the OTP popup background fixes color to white, but still takes the font color specified in the custom theme. This ends up as white on white for me, renderingAutomating Employee Birthday Notifications in Zoho Cliq

Have you ever missed a birthday and felt like the office Grinch? Fear not, the Cliq Developer Platform has got your back! With Zoho Cliq's Schedulers, you can be the office party-cipant who never forgets a single cake, balloon, or awkward rendition ofDrop Down Value

Hi, May I know why Zoho Flow treat this drop down as number and not as string. If so, how can I fetch the right value for filtering. This field is from Creator, in Creator upon checking by default it is a string since it's not a lookup field.Create PO from an invoice

We are a hardware and software sales company which receives orders over the internet. We drop ship most of our products from a warehouse outside of our company. Our orders get sync'd into Zoho from our store via onesaas as invoices. It would be greatSMS to customers from within Bigin

Hi All, Is there anyone else crying out for Bigin SMS capability to send an SMS to customers directly from the Bigin interface? We have inbuilt telephony already with call recordings which works well. What's lacking is the ability to send and receiveZoho Survey reminder settings are extremely confusing

Hi, I just want to set 3 reminders, one week apart from the first email out. Your form is too confusing and I don't understand. Can you simplify and be more specific regarding the language used on the form ?Add deluge function to shorten URLs

Zoho Social contains a nice feature to shorten URLs using zurl.co. It would be really helpful to have similar functionality in a Deluge call please, either as an inbuilt function or a standard integration. My Creator app sends an email with a personalisedAdd specific field value to URL

Hi Everyone. I have the following code which is set to run from a subform when the user selects a value from a lookup field "Plant_Key" the URL opens a report but i want the report to be filtered on the matching field/value. so in the report there isform data load issue when saving as duplicate record is made

Hello. I have a form with a lookup when a value is selected the data from the corresponding record is filled into all of the fields in the form. But the form is loaded in such a state that if any value is changed it will take all of the values pre loadedRecurring Tasks and Reminders in Projects

Recurring tasks are tasks that are created once, and then recreated automatically after a designated time period. For example, the invoice for your billable tasks is due every week. You can set that task to recreate itself every week. Also, the futureUnable to remove the “Automatically Assigned” territory from existing records

Hello Zoho Community Team, We are currently using Territory Management in Zoho CRM and have encountered an issue with automatically assigned territories on Account records. Once any account is created the territory is assigned automatically, the AutomaticallyTrack online, in-office, and client location meetings separately with the new meeting venue option

Hello everyone! We’re excited to announce meeting enhancements in Zoho CRM that bring more clarity and structure to how meetings are categorized. You can now specify the meeting venue to clearly indicate whether a meeting is being held online, at theGoogle Fonts Integration in Pagesense Popup Editor

Hello Zoho Pagesense Team, We hope you're doing well. We’d like to submit a feature request to enhance Zoho Pagesense’s popup editor with Google Fonts support. Current Limitation: Currently, Pagesense offers a limited set of default fonts. Google FontsImproved Contact Sync flow in Google Integration with Zoho CRM

Hello Everyone, Your contact sync in Google integration just got revamped! We have redesigned the sync process to give users more control over what data flows into Google and ensure that this data flows effortlessly between Zoho CRM and Google. With thisCRM Canvas - Upload Attachments

I am in the process of changing my screens to Canvas. On one screen, I have tabs with related lists, one of which is attachments. There doesn't appear to be a way to upload documents though. Am I missing something really obvious? Does anyone havePro Lite Upgrade - Quick Access Tray

Hello, I was going to upgrade to Pro Lite but the Quick Access Tray feature isn't available for Windows. Of the four features not available for Windows, the QAT is what I'm most interested in. Are there plans to add this feature for Windows anytime soon?Custom Fonts in Zoho CRM Template Builder

Hi, I am currently creating a new template for our quotes using the Zoho CRM template builder. However, I noticed that there is no option to add custom fonts to the template builder. It would greatly enhance the flexibility and branding capabilities ifImproved Functionality PO Bill SO Invoice

Hello, I need to enter over 100 items, it's frustrating to scroll a few item rows and wait for more to load, then scroll again. It would be nice to have buttons that scroll to the top or bottom with one click. Furthermore, these items I'm adding are VATCamera access

My picture doesn't appear in a group discussion. (The audio is fine.) The guide says "Click the lock icon on address bar," but I can't find it. Advise, pleaseWishes for 2026

Hello, and a happy new year 2026! Let's hope it's better for everyone. I'd like to share some thoughts on Zoho One and what could be useful in the short, medium, and long term. Some things are already there, but not applied to Zoho One. Others seem likeHow to Integrate Zoho Books with Xero (No Native Connection Available)

Hi everyone, I’m currently facing an issue with integrating Zoho Books invoices with Xero, as I’ve noticed Zoho does not provide a native integration with Xero at this time. I would like to ask: What are the common or recommended solutions for syncingHow to install Widget in inventory module

Hi, I am trying to install a app into Sales Order Module related list, however there is no button allow me to do that. May I ask how to install widget to inventory module related list?Picklist field shows "none" as default

Hello, Is there an option to avoid showing "none" as the default value in a picklist field? I also don't want to see any option displayed. My expectation is to have a blank bar, and then when I display the drop-down list, I can choose whichever I waerror while listing mails

I can't access email in any of my folders: Oops, an error occurred - retry produces the second error response: error while listing mails (cannot parse null string). I've signed in and out of Zoho, restarted my iMac.Unlocking New Levels: Zoho Payroll's Journey in 2025

Every year brings its own set of challenges and opportunities to rethink how payroll works across regulations and teams. In 2025, Zoho Payroll continued to evolve with one clear focus: giving businesses more flexibility, clarity, and control as they grow.Introducing Connected Records to bring business context to every aspect of your work in Zoho CRM for Everyone

Hello Everyone, We are excited to unveil phase one of a powerful enhancement to CRM for Everyone - Connected Records, available only in CRM's Nextgen UI. With CRM for Everyone, businesses can onboard all customer-facing teams onto the CRM platform toCRM project association via deluge

I have created a workflow in my Zoho CRM for closing a deal. Part of this workflow leverages a deluge script to create a project for our delivery team. Creating the project works great however, after or during the project creation, I would like to associateZoho Browser??

hai guys, this sounds awkward but can v get a ZOHO BROWSER same as zoho writer, etc. where i can browse websites @ home and continue browsing the same websites @ my office, as v have the option in Firefox, once i save and close the browser and again when i open it i will be getting the same sites. If u people r not clear with my explanation, plz let me know. Thanks, SandeepSync desktop folders instantly with WorkDrive TrueSync (Beta)

Keeping your important files backed up and accessible has never been easier! With WorkDrive desktop app (TrueSync), you can now automatically sync specific desktop folders to WorkDrive Web, ensuring seamless, real-time updates across devices. Important:Next Page