What's New in Zoho Books - April 2024

Hello users,

We are back with a bunch of new features and enhancements to make your accounting experience seamless. Keep reading to learn more about them.

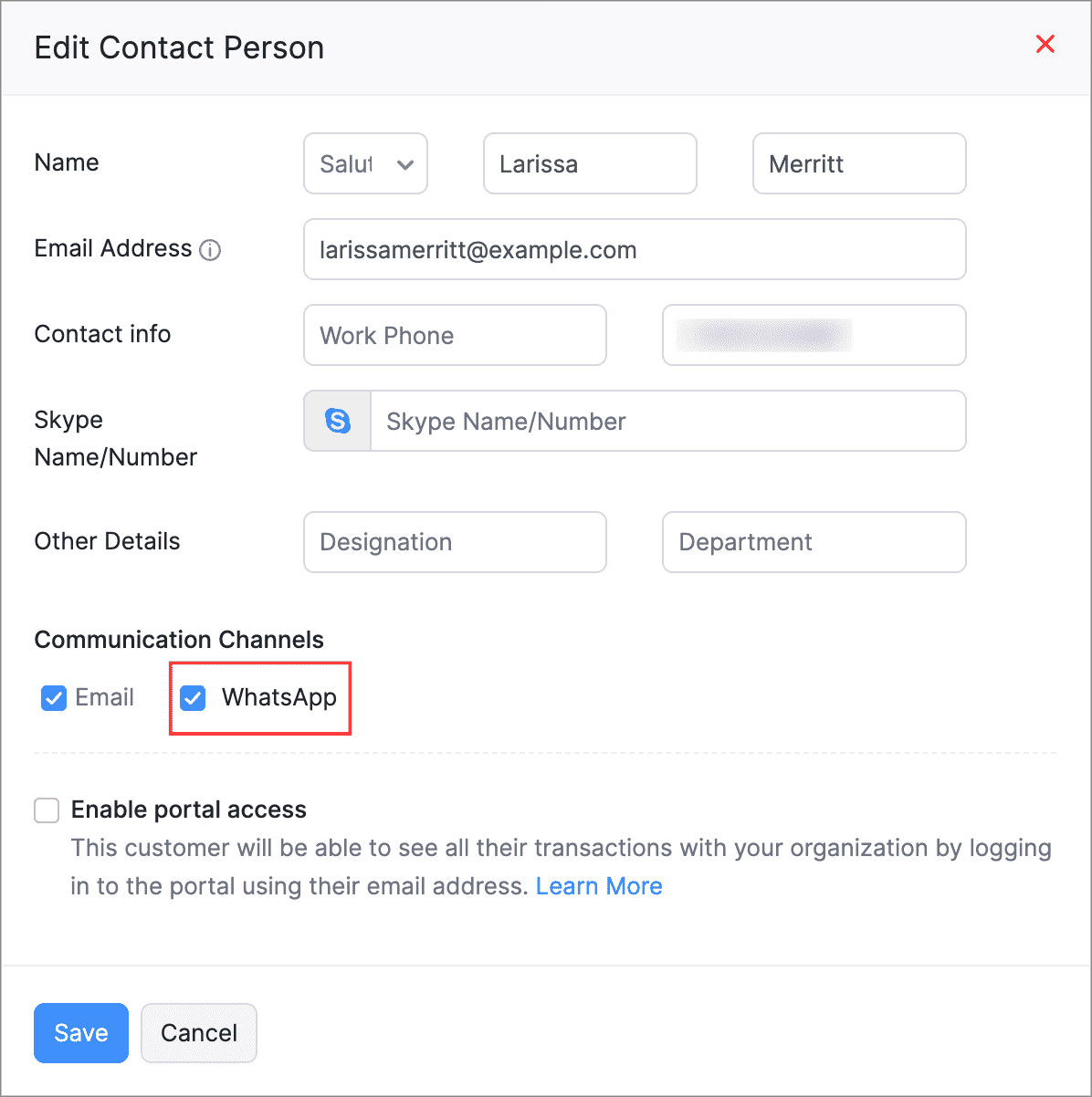

WhatsApp Integration in Zoho Books

You can now connect WhatsApp to your Zoho Books organization to send notifications of payments and sales transactions directly to your customers. You will be able to customize marketing and utility templates for each module to send notifications. You can also initiate conversations with your customers directly from the app.

Learn how to set up WhatsApp integration in Zoho Books in our help document.

To enable WhatsApp for your customers, navigate to Sales > Customers, select a customer, and edit their Primary Contact or Contact Person details on the overview page. Then, enable WhatsApp as their Communication Channel.

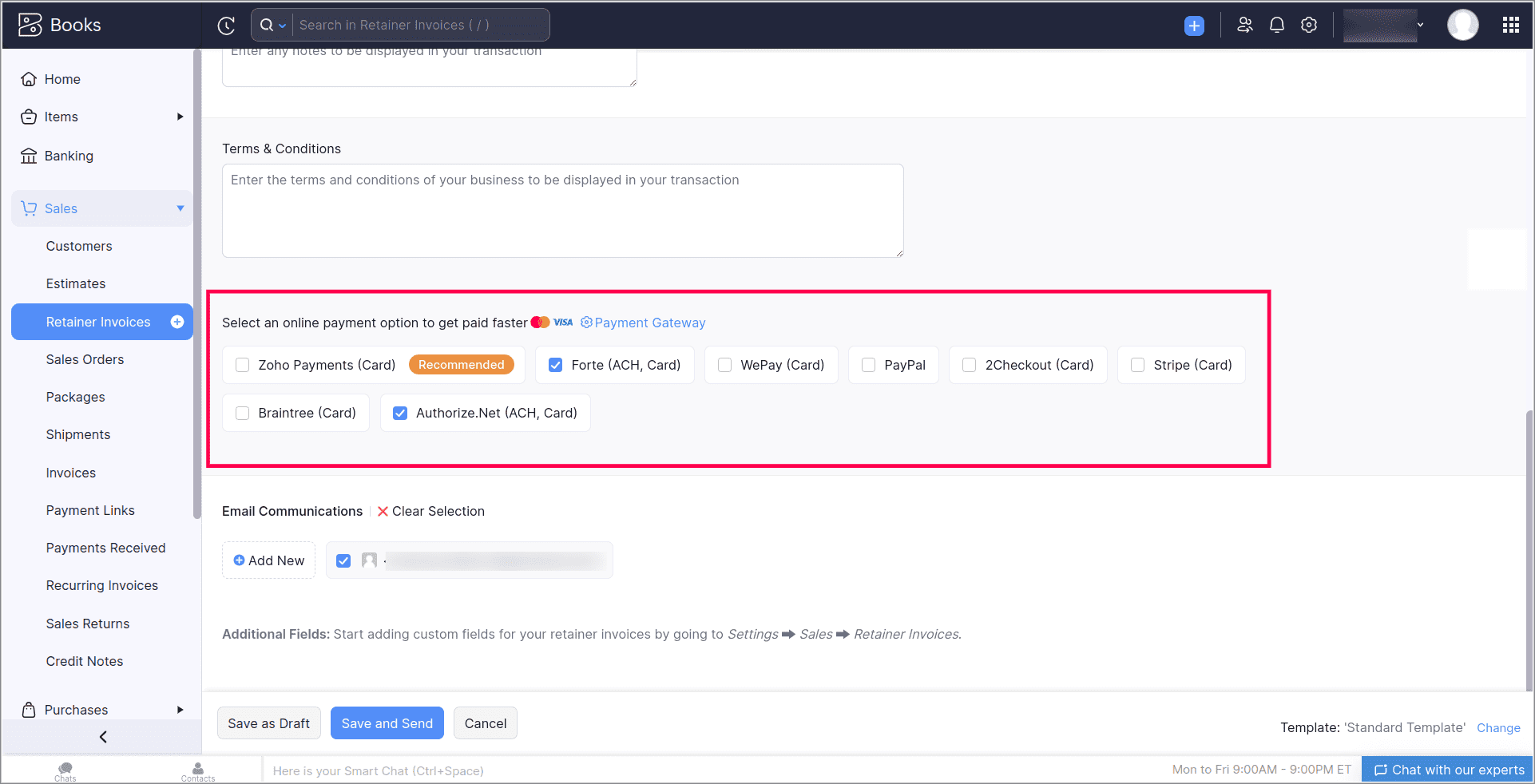

Record ACH Payments for your Retainer Invoices

We have supported ACH payments for your retainer invoices which means, you can record ACH payments for your retainer invoices directly from Zoho Books. Additionally, customers can make ACH payments through external links or in the customer portal. Once the payment clears within 3-5 business days, a payment receipt will be generated for the invoice in Zoho Books.

To record ACH payments, go to Sales > Retainer Invoices. Select your preferred ACH payment gateway when creating or editing an invoice.

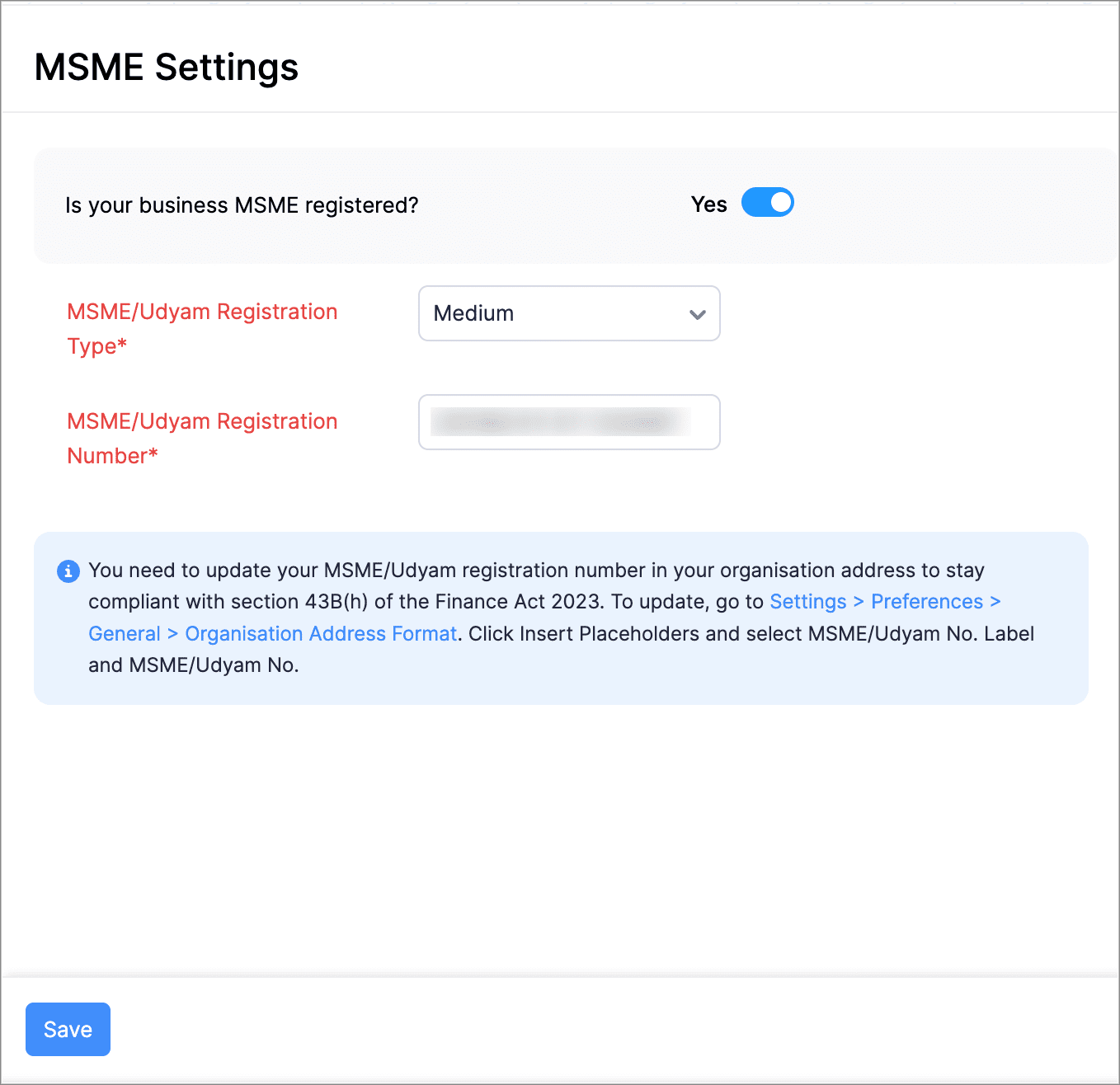

Add your MSME details in Zoho Books [India]

As per Section 43B(h) of the Finance Act 2023, you should make payments for purchases from (Ministry of Micro, Small & Medium Enterprises) MSME registered businesses within 45 days from the date of purchase to ensure timely payments to avoid tax implications.

If your organization is MSME registered, you can add your MSME details in Zoho Books. Simply enter your MSME/Udyam registration number in your organization's address. Additionally, you can add the MSME details of your vendors in Zoho Books, to track and manage unpaid bills from MSME vendors directly from your dashboard and make timely payments within the 45 days.

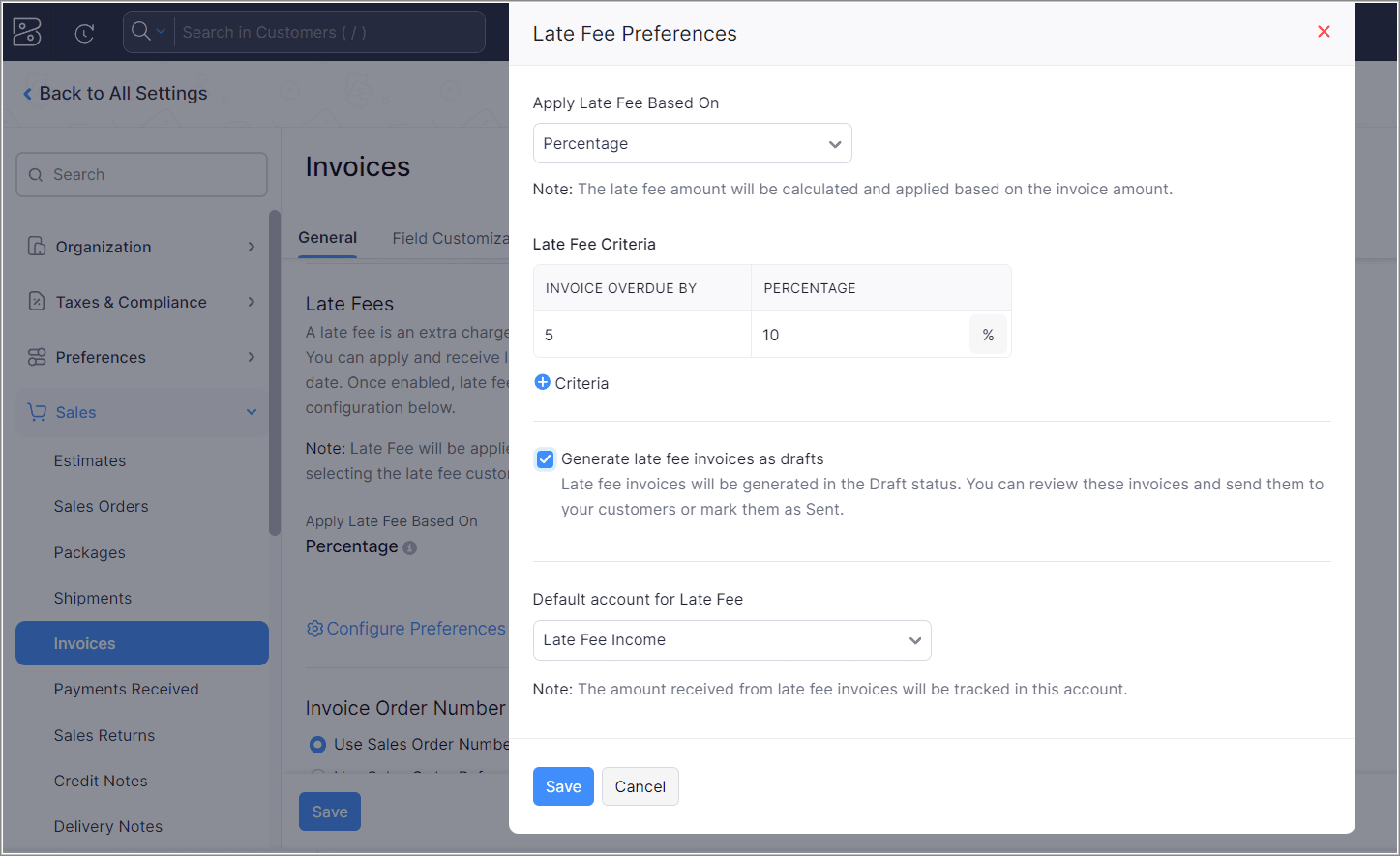

Apply Late Fees to Your Invoices [US Edition]

Now, you have the option to apply a late payment fee if your customer misses the due date for an invoice. You can specify how many days past the due date the fee will be applied and choose the calculation method based on the invoice amount. Additionally, you can track all late fees applied in your organization under a default account.

To enable this feature, go to Settings > Preferences > Invoices and toggle the Late Fee Preference option.

Note: This feature is available only in the Premium, Elite and Ultimate plans of Zoho Books. Visit our pricing page for a comprehensive list of features in each plan.

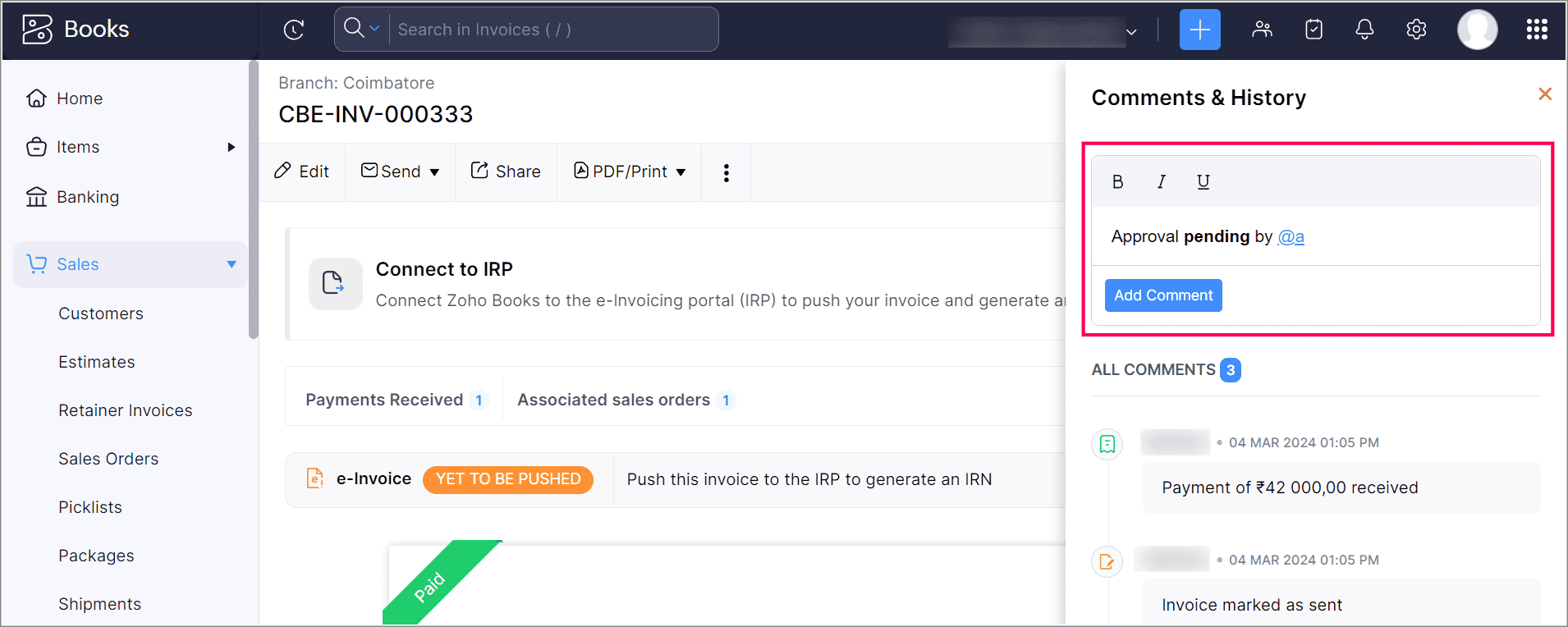

Enhanced Comments & History Section

We've upgraded the Comments & History section of your transactions with new features. Now, you can tag and notify other users about a transaction within your comments. Additionally, you can emphasise your words with style using bold, italic, and underline options.

Zoho Inventory Add-On Updates

Void Option for Transfer Orders

Now, you can easily void transfer orders that have been partially or fully processed, making them inactive. This automatically updates stock levels in both the source and destination branches. You also have the option to convert void transfer orders into drafts for any needed adjustments before resending.

To void a transfer order, go to Items > Transfer Orders, and choose Void from the More dropdown menu on the transfer order's overview page.

Cumulative Stock for Item Groups

You can now efficiently track the total stock in hand of all items within an item group to manage and reorder them easily. View the cumulative stock in hand of each item group in the Item Groups module.

Other Feature Enhancements

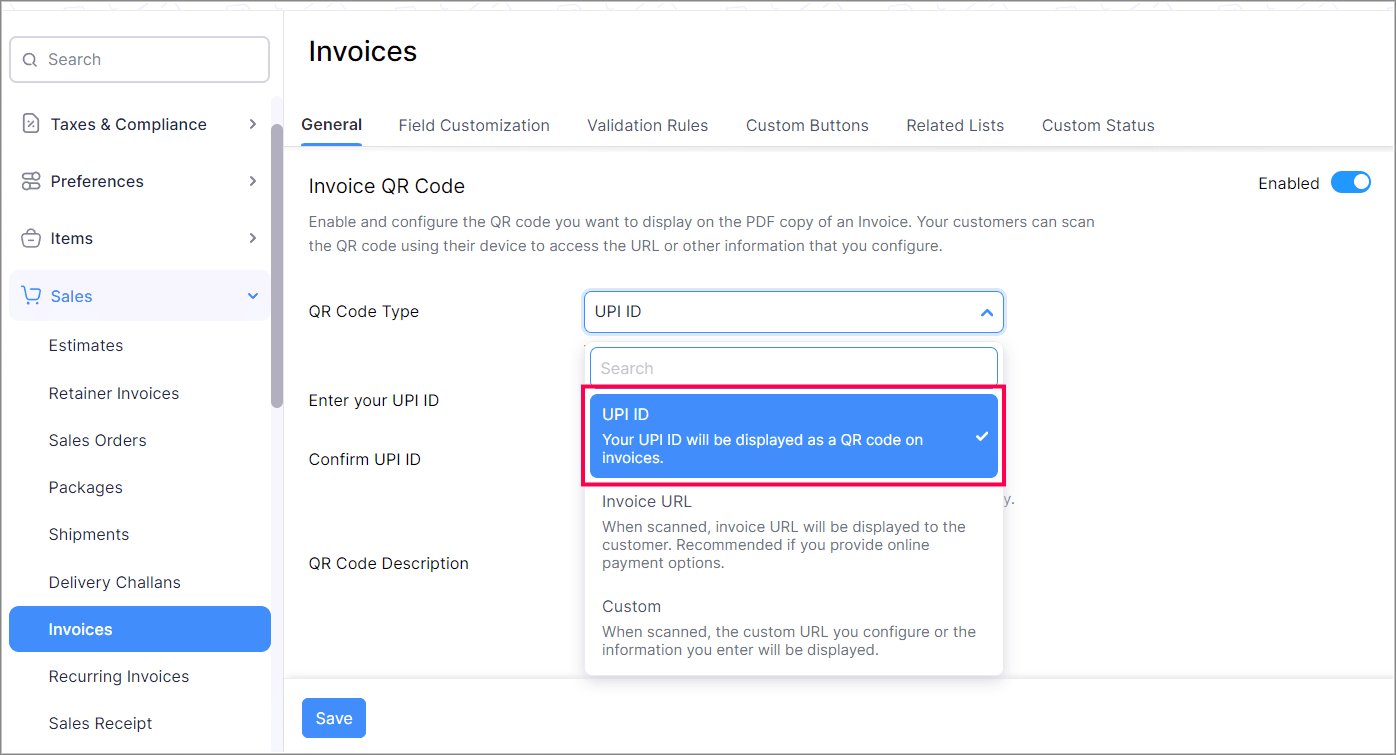

UPI ID Option for Invoice QR Codes

We have introduced the UPI ID option for your invoice QR codes. You can include your UPI ID as a QR code on the PDF of your invoices. This allows your customers to scan the QR code with their device and make payments directly to your UPI ID.

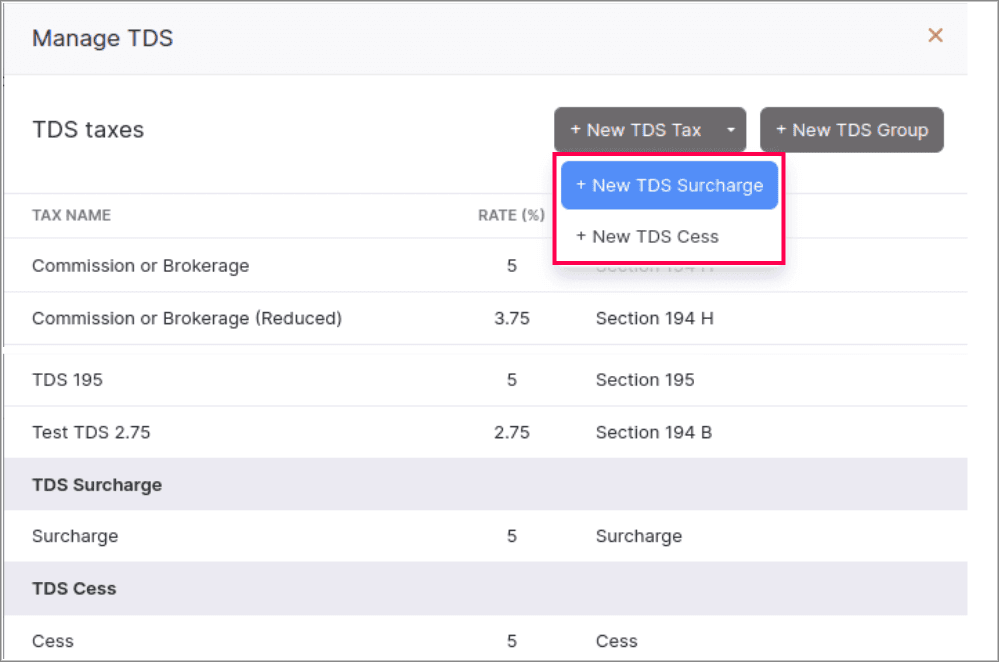

TDS Surcharge and Cess [India Edition]

We have introduced the options to include TDS surcharge and cess within a TDS group tax. Now, when you apply the TDS group tax to a bill, the surcharge and cess amounts will be deducted along with the TDS tax amount.

To add new TDS surcharge and cess rates, navigate to the TDS Rates page in Taxes under Settings.

The Zoho Finance Workshop 2024

That's it from us for this month's product updates! We hope the latest enhancements are helpful for your business. You can also visit the What's New timeline for byte-sized information about our previous feature updates and enhancements.

We'll catch you in next month's product updates. Until then, if you require any assistance or need clarifications, feel free to write to us at support@zohobooks.com, we'd be happy to help!

Best regards,

The Zoho Books Team

Topic Participants

Nikhitha Kashyap

alopez

Centeno

Beau Brewer Digital

MAITHAM HASSAN

Recent Topics

Change Last Name to not required in Leads

I would like to upload 500 target companies as leads but I don't yet have contact people for them. Can you enable the option for me to turn this requirement off to need a Second Name? Moderation update (10-Jun-23): As we explore potential solutions for"Temporary" Field Value?

I have a custom action in Form A report Detail View that passes the Rec ID and updates a Temp Record ID lookup field in the Form B record via openURL (and opens the Form B report in popup) . The updated Temp Record ID field value in Form B is then usedZoho CRM for Everyone's NextGen UI Gets an Upgrade

Hello Everyone We've made improvements to Zoho CRM for Everyone's Nextgen UI. These changes are the result of valuable feedback from you where we’ve focused on improving usability, providing wider screen space, and making navigation smoother so everythingTimesheet invalid data error

Getting the "Invalid Date" error when trying to add a time sheet to an appointment in a work order. I initially though the work order was corrupt or something so I deleted the work order and recreated it. I added the first time sheet to the AP and savedOAuth2 Scope Error - Incorrectly defaulting to CRM instead of Analytics.

Hello Zoho Team, I am trying to connect n8n to Zoho Analytics API V2 for a simple automation project. Despite using the correct Analytics-specific scopes, my OAuth handshake is failing with a CRM-related error. The Problem: The authorization screen shows:Add Custom Reports To Dashboard or Home Tab

Hi there, I think it would be great to be able to add our custom reports to the Home Tab or Dashboards. Thanks! Chad Announcement: The feature is being rolled out across DC's and Edition in phases. To know more refer to the announcement post here.Hiding Pre-defined Views

You can enhance Zoho with custom views - but you cannot hide the pre-defined views. Most users focus on 4 or 5 views. Right now for EVERY user EVERY time they want to move to one of their 4 or 5 views - they have to scroll down past a long list of pre-definedwhy can't agent see accounts & contacts

My new user, with 'Agent' privileges, cannot see records that don't belong to them. How can I give them access? Why isn't this the default configuration in Zoho?Sender Email Configuration Error.

Hello Team, Hope you are all doing well. We are in the process of creating the Zoho FSM environment in the UAE. When we try to add the sender email address “techsupportuae@stryker.com”, we receive the error message: “Error occurred while sending mail【Zoho CRM】フィルター機能のアップデート:ルックアップ項目を使ったデータフィルタリング

ユーザーの皆さま、こんにちは。コミュニティチームの藤澤です。 今回は「Zoho CRM アップデート情報」の中からフィルター機能のアップデートをご紹介します。 ルックアップ項目を使ったデータフィルタリングがより詳細に行えるようになりました。 この機能は詳細フィルターとカスタムビューで利用でき、必要な情報を正確に取得できます。 これにより、タブ間を移動することなく、より深く正確な方法でデータを絞り込むことが可能になります。 ◉できること 詳細フィルターとカスタムビューで、ルックアップ先タブの項目が選択可能This will be long, Please bear with me - Next Gen Layout - Search

In general, I think that Zoho are going in the right direction with the Next Gen UI. The latest update brings some nice improvements and all-in-all from a user's perspective I think the improvements are generally very good. However, there are some areasZoho Books | Product updates | July 2025

Hello users, We’ve rolled out new features and enhancements in Zoho Books. From plan-based trials to the option to mark PDF templates as inactive, explore the updates designed to enhance your bookkeeping experience. Introducing Plan Based Trials in ZohoZoho Books | Product updates | August 2025

Hello users, We’ve rolled out new features and enhancements in Zoho Books. From the right sidebar where you can manage all your widgets, to integrating Zoho Payments feeds in Zoho Books, explore the updates designed to enhance your bookkeeping experience.Quotes Approval

Hey all, Could you please help in the following: When creating quotes, how to configure it in a way, that its approval would work according to the quoted items description, not according to quote information. In my case, the quote should be sent to approvalImportant Update: Facebook Pages API Deprecation

Dear Zoho Analytics users, As of January 26, 2026, Facebook has officially deprecated Facebook Pages API version 18. This update involves the removal of several metrics that were previously supported by the API. As a result, these changes will affectAdding a Deal to and Existing Contact

I want to easily add a Deal to an existing Contact. If I click on New Deal on the Contact page this currently this is what happens: All of the mandatory field (and other field) information exists within the Contact. Is there a simple way for it to automaticallyEmail was sent out without our permission

Hi there, One customer just reached out to us about this email that we were not aware was being sent to our customers. Can you please check on your end?Flexible Partial-Use Coupons (Stored Value Credits)

Subject: Feature Request: Ability for users to apply partial coupon balances per transaction Problem Statement Currently, our coupons are "one-and-done." If a user has a $50 coupon but only spends $30, they either lose the remaining $20 or are forcedPrevent accidental duplicate entry of Customer Ordersome

Zoho Support has confirmed that Zoho currently does not have any method (using Deluge, flow or any other method) to alert a user when a sales order has been entered twice using the same customer reference number (i.e. a duplicate). Most ERP platformsCustomizing Helpcenter texts

I’m customizing the Zoho Desk Help Center and I’d like to change the wording of the standard widgets – for example, the text in the “Submit Ticket” banner that appears in the footer, or other built-in widget labels and messages. So far, I haven’t foundMigrating Brevo Automation Logic to Zoho Campaigns

Hello Zoho Campaigns Support Team, I am in the process of migrating my email marketing from Brevo to Zoho Campaigns. I have around 10,000 contacts, which I have already successfully exported from Brevo and imported into Zoho Campaigns. I now need guidanceIs there a way to delete workspaces?

I want to remove one of the workspaces in my Campaigns account. I don't see any obvious way to do this. Am I missing something?Boost your Zoho Desk's performance by archiving tickets!

The longer your help desk operations are, the more likely it is to accumulate tickets that are no longer relevant. For example, ticket records from a year ago are typically less relevant than currently open tickets. Such old tickets may eventually leadCollapsing and expanding of lists and paragraphs

hello Would you ever implement Collapsing and expanding of lists and paragraphs in zoho writer ? Best regardsNew Custom View -Sorting the Custom fields

While creating a New Custom View in invoice , Customers, Bills ,expense etc , the sorting of custom fields are not available , a query function "order by / sort by " may also be included in Define new criteria module which will be more beneficial toMake CAMPAIGNS email look as simple as possible

Hi there I'm trying to make my Campaigns email look as much like a normal email as possible. I'm a bit stuck with the "justification" of the email email block. Can I LEFT JUSTIFY the "whole email" to make it look "normal"? (Please see screenshot attached)[Webinar] Top 10 Most Used Zoho Analytics Features in 2025

Zoho Analytics has evolved significantly over the past year. Discover the most widely adopted features in Zoho Analytics in 2025, based on real customer usage patterns, best practices, and high-impact use cases. Learn how leading teams are turning dataSorry! we encountered some problems while sending your campaign. It will be sent automatically once we are ready. We apologize for the delay caused.

Hello. Lately we are having problems with some campaigns, which show us this error message. Sorry! we encountered some problems while sending your campaign. It will be sent automatically once we are ready. We apologize for the delay caused. We can't findCan I remove or divert certain contacts from an active Campaigns workflow?

I have created a workflow in Zoho Campaigns, which sends different emails, once contacts have been added to a mailing list. To choose which email to send to the contacts, there are conditions, which divert contacts based on their company type and their company size. There was a subsection of this workflow, where company size wasn't selected correctly, and some contacts have been sent down the wrong path and received the wrong email. The workflow contains a reminder loop and a further series of emails.File Upload field automatically replaces spaces with underscores – support experience

Hi everyone, I want to share my recent experience regarding the File Upload field behavior in Zoho Creator and my interaction with the Zoho support team. When a user uploads a file, the system automatically renames the document by replacing spaces inHow to map fields from Zoho Recruit to Zoho People

I've got these fields from my Job Offer that I'm trying to map to the Work information fields in Zoho People, but they arent showing up. For example, how do I get the department name field (in the job post) to map to the work information field in ZohoUTM in zoho campaigns

Helloo everybody!!! Someone know how IF ZOHO CAMPAIGNS has UTM for tracking the url of any campaigns. thank uFull Context of Zoho CRM Records for Zia in Zoho Desk for efficient AI Usage

Hello everyone, I have a question regarding the use of Zia in Zoho Desk in combination with CRM data. Is it possible to automatically feed the complete context of a CRM record into Zia, so that it can generate automated and highly accurate responses forKnowledge base printing

I saw a posting about printing the knowledge base as I was looking for the answer, but we would like the ability to print out the entire knowledge base with a click, keeping the same organization format. Bonus would include an index of keywords andSearch not working!

I have items in my notebook tagged but when I search for a tag nothing comes up! Any fix for this?Zoho Books | Product updates | January 2026

Hello users, We’ve rolled out new features and enhancements in Zoho Books. From e-filing Form 1099 directly with the IRS to corporation tax support, explore the updates designed to enhance your bookkeeping experience. E-File Form 1099 Directly With theUpdates for Zoho Campaigns: Merge tag, footer, and autoresponder migration

Hello everyone, We'd like to inform you of some upcoming changes with regard to Zoho Campaigns. We understand that change can be difficult, but we're dedicated to ensuring a smooth transition while keeping you all informed and engaged throughout the process.File Upload field not showing in workflow

Hi, I have added a field on Zoho CRM. I want to use it in a workflow where that particular field is updated based on another field, however it is not showing up in the field list to select it in the workflow. Why is this please?Drag 'n' Drop Fields to a Sub-Form and "Move Field To" Option

Hi, I would like to be able to move fields from the Main Page to a Sub-Form or from a Sub-Form to either the Main Page or another Sub-Form. Today if you change the design you have to delete and recreate every field, not just move them. Would be nice toSharing my portal URL with clients outside the project

Hi I need help making my project public for anyone to check on my task. I'm a freelance artist and I use trello to keep track on my client's projects however I wanted to do an upgrade. Went on here and so far I'm loving it. However, I'm having an issue sharing my url to those to see progress. They said they needed an account to access my project. How do I fix this? Without them needing an account.Next Page