Zoho Payroll | Quarterly Product Updates For 2024

As we navigate through the ever-changing payroll landscape, we bring you the latest updates that span the first quarter of 2024, tailored to meet the diverse needs of employers and employees in India, the UAE, and the US. From useful integrations to refined functionalities, each enhancement aims to simplify your day-to-day payroll operations.

Zoho Payroll - Zoho Sales IQ Integration

In today's fast-paced world, effective communication and instant support are crucial for employers and employees. That's why we're excited to introduce the Zoho Payroll - Zoho Sales IQ integration, designed to streamline communication and support between you and your employees in the employee portal.

How? The integrations enables your employees to reach out to you in real-time for queries or concerns regarding payroll via chat or call, from the Zoho Payroll employee portal ensuring immediate support.

That's not all. You can also attach relevant help documents and frequently asked questions (FAQs) are readily accessible within the chat interface. You will also be able to automate conversations with the enterprise-ready AI Sales IQ chatbot platform.

Introducing Ohio state support (Early Access)

We're thrilled to announce the latest addition to Zoho Payroll's US edition: support for the Ohio state. This update ensures that businesses operating in Ohio can effortlessly navigate the intricacies of payroll management specific to this region.

Note: Currently, Zoho Payroll is tailored to support businesses operating within a single state. We understand that operating across multiple states presents unique challenges, and while we're continuously enhancing our platform, multi-state support is not yet available.

Here's the list of all the states we support in US:

- California

- Florida

- Illinois

- Kansas

- New Hampshire

- New York

- North Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Washington

- Alaska (Early Access)

- Georgia (Early Access)

- Minnesota (Early Access)

- Montana (Early Access)

- Nevada (Early Access)

- North Dakota (Early Access)

- South Carolina (Early Access)

- Wyoming (Early Access)

- Wisconsin (Early Access)

- Virginia (Early Access)

- Ohio (Early Access)

If you'd like to access Zoho Payroll for your business in the Ohio state or the other states in the early access mentioned above, submit a request, and we'll enable it for you. And yes, we are working on a lot more states, and we'll share it with you in this space.

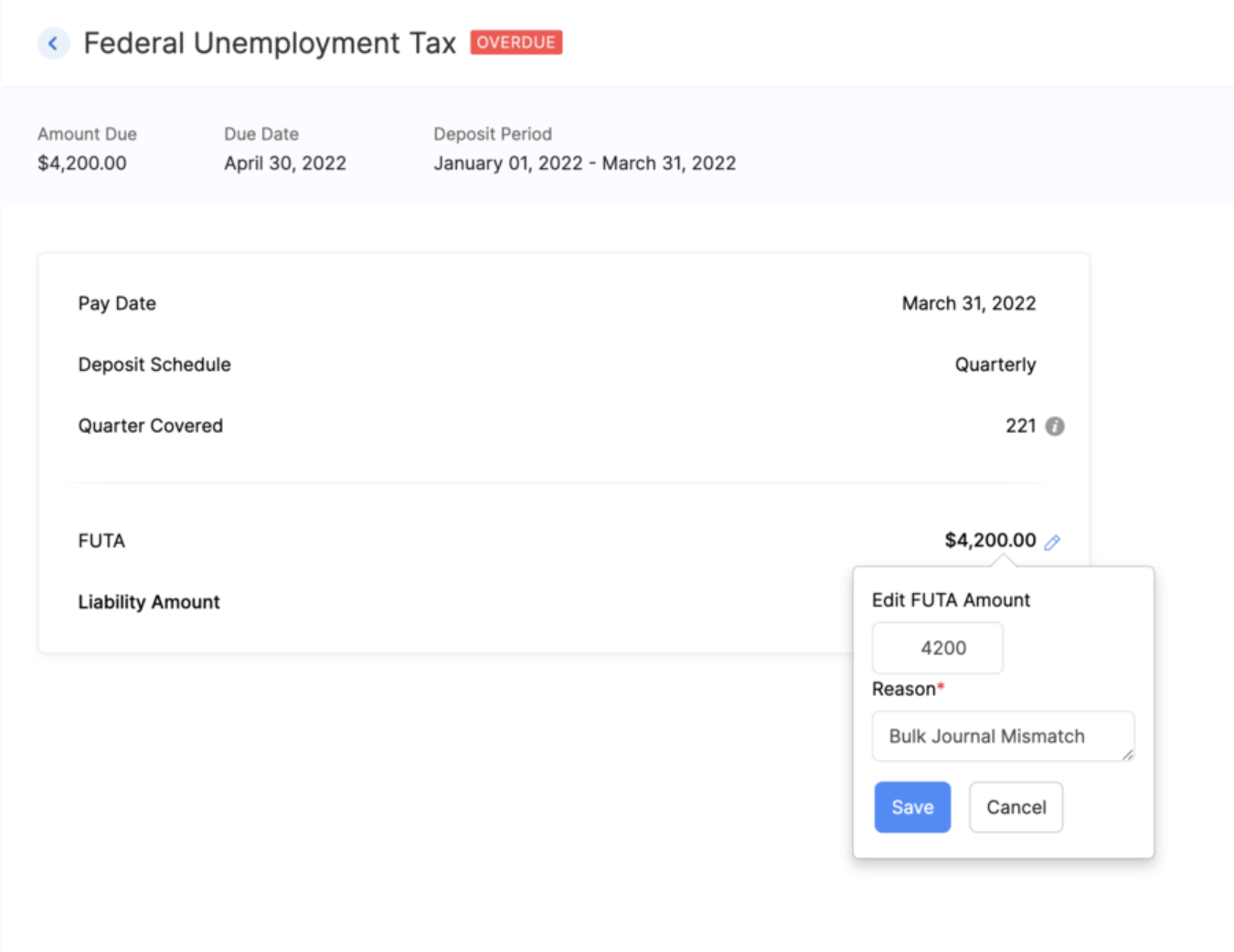

Edit FUTA Rate

You now have the option to edit the FUTA rate in the Taxes section of Zoho Payroll, according to your specific requirements, ensuring accuracy and compliance.

Notable Enhancements in India and UAE:

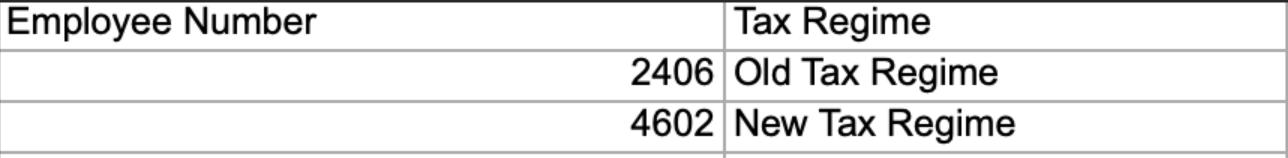

1) Import/Export Tax Regime Preferences of Employees

Now, you can import and export tax regime preferences for your employees in bulk via CSV or XLS files, eliminating the need for manual entry for every employee.

Here's a sample CSV file which you can use as a reference for the import file you upload in Zoho Payroll.

2) View Pre-Tax Deductions/Benefits in the Employee Portal [IN, UAE]

Your employees can now view the pre-tax deductions or benefits in the salary structure section of the employee portal.

3) Enhanced Filtering Options

We've introduced new filters in the employee list page. Users can now filter employees based on their work location, department, and designation, streamlining the search process for specific criteria. Similarly, in the Approvals section, for proof of investments, users can now filter employees based on their tax regime, whether it's old or new, allowing for more efficient management of investment approvals.

4) Annual CTC Projection

You now have the ability to project employee CTC details annually. By default, users can view monthly earnings, gross pay, and CTC. Click Show Yearly Projection to reveal the annual projection, providing comprehensive financial insights at your fingertips.

5) Petty Cash Account for Employee Payments

Organisations using the Zoho Payroll-Zoho Books integration to post journal entries for their payroll, can nowselect petty cash as the designated account for employee payments.

6) Cost of Goods Sold Account for Payroll Earnings

Another enhancement for users utilizing the Zoho Payroll-Zoho Books integration, is the capability to select Cost Of Goods Sold as the credit account for syncing payroll earnings.

7) Customizable Headers and Footers for Payslips (Early Access)

You can now personalize the headers and footers of the payslips sent to your employees. Customize important details such as company logo, address, and contact information in the header while adding legal disclaimers or special messages in the footer. With placeholders and other customization options available, you have full control over the look and feel of your employees' payslips.

Dive into our What's New page if you'd like to see all the features and enhancements we've released so far.

That's a wrap for now! We are always eager to hear your suggestions so we can help you better. If you have a feature request, please share it in the comments below.

If you require assistance, please write to us at support@zohopayroll.com, and we'll get back to you. Stay tuned for more updates from Zoho Payroll!

With a shared purpose,

The Zoho Payroll Team

Topic Participants

Bennet Noel L

Sticky Posts

Zoho Payroll | Quarterly Product Updates For 2024

As we navigate through the ever-changing payroll landscape, we bring you the latest updates that span the first quarter of 2024, tailored to meet the diverse needs of employers and employees in India, the UAE, and the US. From useful integrations to refinedIntroducing Academy 🎉: your go-to hub for all things payroll

Hello! We're thrilled to launch our newest payroll resource hub - Academy by Zoho Payroll [for India] - the information repository where you can go to learn everything about payroll. Introducing Academy by Zoho Payroll Why did we build Academy? Payroll

Recent Topics

Looking For Recruit Developer

Hi everyone, I am looking for a Zoho Certified Developer to assist with a development project for MetalXpert. We are building a software system designed to bridge the gap between a candidate mobile app and an employer web portal using Zoho Recruit assales IQ issue on website

i integrated the zoho sales IQ code on the website but it is comming in distroted form i am sharing the screenshot below the website is bulit in wix platformFull Context of Zoho CRM Records for Zia in Zoho Desk for efficient AI Usage

Hello everyone, I have a question regarding the use of Zia in Zoho Desk in combination with CRM data. Is it possible to automatically feed the complete context of a CRM record into Zia, so that it can generate automated and highly accurate responses forMulti-currency and Products

One of the main reasons I have gone down the Zoho route is because I need multi-currency support. However, I find that products can only be priced in the home currency, We sell to the US and UK. However, we maintain different price lists for each. ThereDeprecation of the Zoho OAuth connector

Hello everyone, At Zoho, we continuously evaluate our integrations to ensure they meet the highest standards of security, reliability, and compliance. As part of these ongoing efforts, we've made the decision to deprecate the Zoho OAuth default connectorI need to know the IP address of ZOHO CRM.

The link below is the IP address for Analytics, do you have CRM's? IP address for Analytics I would like to know the IP address of ZOHO CRM to allow communication as the API server I am developing is also run from CRM. Moderation Update: The post belowImportant Update: Google Ads & YouTube Ads API Migration

To maintain platform performance and align with Google's newest requirements, we are updating the Google Ads and YouTube Ads integrations by migrating from API v19 to the newer v22, before the official deprecation of v19 on February 11, 2026. Reference:Zoho CRM for Everyone's NextGen UI Gets an Upgrade

Hello Everyone We've made improvements to Zoho CRM for Everyone's Nextgen UI. These changes are the result of valuable feedback from you where we’ve focused on improving usability, providing wider screen space, and making navigation smoother so everythingImporting into the 'file upload' field

Can you import attachments into the file upload field. I would expect it to work the same way as attachments do, But can't seem to get it to work.Zoho recruit's blueprint configuration is not functioning as mapped

Current Status: Zoho Blueprint is not functioning as configured. Issue: We are moving a Candidate status in Zoho Recruit "for active file" but we encountered: "Status cannot be changed for records involved in Blueprint." This happens to various clientSuper Admin Logging in as another User

How can a Super Admin login as another user. For example, I have a sales rep that is having issues with their Accounts and I want to view their Zoho Account with out having to do a GTM and sharing screens. Moderation Update (8th Aug 2025): We are workingBlocklist candidates in Zoho Recruit

We’re introducing Block Candidate, which helps recruiters to permanently restrict a candidate from applying to current/future job openings. Once the candidate is blocked, they will no longer be able to participate in the recruitment process. This willLayout Rules Don't Apply To Blueprints

Hi Zoho the conditional layout rules for fields and making fields required don't work well with with Blueprints if those same fields are called DURING a Blueprint. Example. I have field A that is used in layout rule. If value of field A is "1" it is supposed to show and make required field B. If the value to field A is "2" it is supposed to show and make required field C. Now I have a Blueprint that says when last stage moves to "Closed," during the transition, the agent must fill out field A. NowFrom Zoho CRM to Paper : Design & Print Data Directly using Canvas Print View

Hello Everyone, We are excited to announce a new addition to your Canvas in Zoho CRM - Print View. Canvas print view helps you transform your custom CRM layouts into print-ready documents, so you can bring your digital data to the physical world withAdmin asked me for Backend Details when I wanted to verify my ZeptoMail Account

Please provide the backend details where you will be adding the SMTP/API information of ZeptoMail Who knows what this means?Zoho Desk - Upsert Ticket

Hi Desk Team, It is common to request more information from end-users. Using forms is a great way to ensure all the required information is collected. It would be great if there were an "upsert" option on the Zoho Form -> Zoho Desk integration which wouldAll new Address Field in Zoho CRM: maintain structured and accurate address inputs

The address field will be available exclusively for IN DC users. We'll keep you updated on the DC-specific rollout soon. It's currently available for all new sign-ups and for existing Zoho CRM orgs which are in the Professional edition. Latest updateClient Side Scripts for Meetings Module

Will zoho please add client side scripting support to the meetings module? Our workflow requires most meeting details have a specific format to work with other software we have. So we rely on a custom function to auto fill certain things. We currentlyIntroducing Multiple Sandbox Types and Support for Module's Data Population

Register here for the upcoming Focus Group webinar on Multiple Sandbox | Help documentation to learn more about the new enhancements Hello everyone, Sandbox in CRM is a testing environment for users to create and test new configurations like workflowCRM x WorkDrive: File storage for new CRM signups is now powered by WorkDrive

Availability Editions: All DCs: All Release plan: Released for new signups in all DCs. It will be enabled for existing users in a phased manner in the upcoming months. Help documentation: Documents in Zoho CRM Manage folders in Documents tab Manage filesCreator Offline

We had online access setup and working on our iphones. We have just set it up on an 'Android Tablet' and it is not downloading all the images? We use it to show customers our catalogue. Any ideas. Offline components all setup on both devicesDrag 'n' Drop Fields to a Sub-Form and "Move Field To" Option

Hi, I would like to be able to move fields from the Main Page to a Sub-Form or from a Sub-Form to either the Main Page or another Sub-Form. Today if you change the design you have to delete and recreate every field, not just move them. Would be nice toEnable or disable any Field Rule!

Hello Zoho Forms Community, We are excited to announce a powerful new enhancement to Field Rules that gives you greater control and flexibility in managing your form logic! Previously, if you wanted to temporarily deactivate a field rule, you had twoMarketing Tip #20: Increase traffic with strong meta titles and descriptions

Meta titles and descriptions are what people see first on search results before they ever click through to your website. If your pages use generic titles or basic descriptions, you miss the chance to stand out, and search engines may not know which pageDifferent form submission results for submitter and internal users

I'm looking for suggestions on how to show an external submitter a few results while sending internal users all the results from the answers provided by the external user. The final page of our form has a section with detailed results and a section withKanban view on Zoho CRM mobile app!

What is Kanban? The name doesn't sound English, right? Yes, Kanban is a Japanese word which means 'Card you can see'. As per the meaning, Kanban in CRM is a type of list view in which the records will be displayed in cards and categorized under the givenNot able to delete a QC nor able to revert or create a cycle of manufacturing for QC failed Jobs

Not able to delete a QC nor able to revert or create a cycle of manufacturing for QC failed JobsDheeraj Sudan and Meenu Hinduja-How do I customize Zoho apps to suit my needs?

Hi Everyone, I'm Meenu Hinduja and my husband Dheeraj Sudan, run a business. I’m looking to tweak a few things to fit my needs, and I’d love to hear what customizations others have done. Any tips or examples would be super helpful! Regards Dheeraj SudanZoho Desk blank screen

opened a ticket from my email, zoho desk comes up blank, nothing loads. our receptionist also gets the same thing under her login on her computer. our sales rep also gets same thing on zoho desk at his home on a different computer. I tried clearing cache/history/cookies,is there any way to change the "chat with us now" to custom message?

is there any way to change the "chat with us now" to custom message? I want to change this textDeprecation Notice: OpenAI Assistants API will be shut down on August 26, 2026

I recieved this email from openAI what does it means for us that are using the integration and what should we do? Earlier this year, we shared our plan to deprecate the Assistants API once the Responses API reached feature parity. With the launch of Conversations,Capture Last check-in date & days since

I have two custom fields on my Account form, these are "Date of Last Check-In" and "Days Since Last Contact" Using a custom function how can I pull the date from the last check-in and display it in the field "Date of Last Check-In"? and then also display the number of days since last check-in in the "Days SInce Last Contact" field? I tried following a couple of examples but got myself into a bit of a muddle!Any recommendations for Australian Telephony Integration providers?

HI, I am looking for some advice on phone providers as we are looking to upgrade our phone system, does anybody have experience with any of the Australian providers that integrate with CRM Telephony? So far we are looking at RingCentral and Amazon Connect, and would love to hear feedback on any of the other providers you might have tried. Thank youWhy is the ability Customize Calls module so limited?

Why can't I add additional sections? why can't I add other field types than the very limited subset that zoho allows? Why can I only add fields to the outbound/inbound call sections and not to the Call Information section?PDF Annotation is here - Mark Up PDFs Your Way!

Reviewing PDFs just got a whole lot easier. You can now annotate PDFs directly in Zoho Notebook. Highlight important sections, add text, insert images, apply watermarks, and mark up documents in detail without leaving your notes. No app switching. NoCRM gets location smart with the all new Map View: visualize records, locate records within any radius, and more

Hello all, We've introduced a new way to work with location data in Zoho CRM: the Map View. Instead of scrolling through endless lists, your records now appear as pins on a map. Built on top of the all-new address field and powered by Mappls (MapMyIndia),Enhance Appointment Buffers in Zoho Bookings

There was previously a long-standing feature request related to enhancing the way appointment buffers work in Zoho Bookings, but it looks like the original post has been deleted. I am therefore adding a new request that Zoho Bookings adjust how appointmentSubscriptions for service call

So we install products and we want to offer a service contract for the customers yearly service calls to be billed monthly. So ideally at some point we want to email them a quote for their needs. WE will choice it our end based on the equipment. It wouldAdd RTL and Hebrew Support for Candidate Portal (and Other Zoho Recruit Portals)

Dear Zoho Recruit Team, I hope you're doing well. We would like to request the ability to set the Candidate Portal to be Right-to-Left (RTL) and in Hebrew, similar to the existing functionality for the Career Site. Currently, when we set the Career SiteDelay in rendering Zoho Recruit - Careers in the ZappyWorks

I click on the Careers link (https://zappyworks.zohorecruit.com/jobs/Careers) on the ZappyWorks website expecting to see the job openings. The site redirects me to Zoho Recruit, but after the redirect, the page just stays blank for several seconds. I'mNext Page