Implementation of the ABRY Scheme in Zoho Payroll

Hello everyone!

The Government of India has introduced the ABRY (Aatmanirbhar Bharat Rojgar Yojana) Scheme to increase employment and to reduce the financial burden of employers in various industries during the COVID-19 pandemic. This scheme is implemented through the Employees' Provident Fund Organization (EPFO), and the Government will be contributing the EPF amount on behalf of the employer and the employee (based on the employment strength of the organisation) for two years from the date of registration.

Who is eligible for the ABRY scheme?

- Employees who were recruited on or after 1 October 2020 and on or before 30 June 2021.

- Employees who did not have an EPF account previously. If they already had an account, they must have been terminated from their job between 01 March 2020 and 30 September 2020 to qualify.

- Employees who receive a monthly salary of less than ₹15,000.

For eligible employees, the Government will pay the employee's share (12% of wages) and employer's share (12% of wages) of contribution to the EPFO for two years from the date of registration.

Note: The deadline for ABRY scheme registration has been extended until 31 March 2022.

How to enable the ABRY scheme

In Zoho Payroll, you can enable the ABRY scheme for your employees so that the Government can pay the EPF contribution. Here’s how:

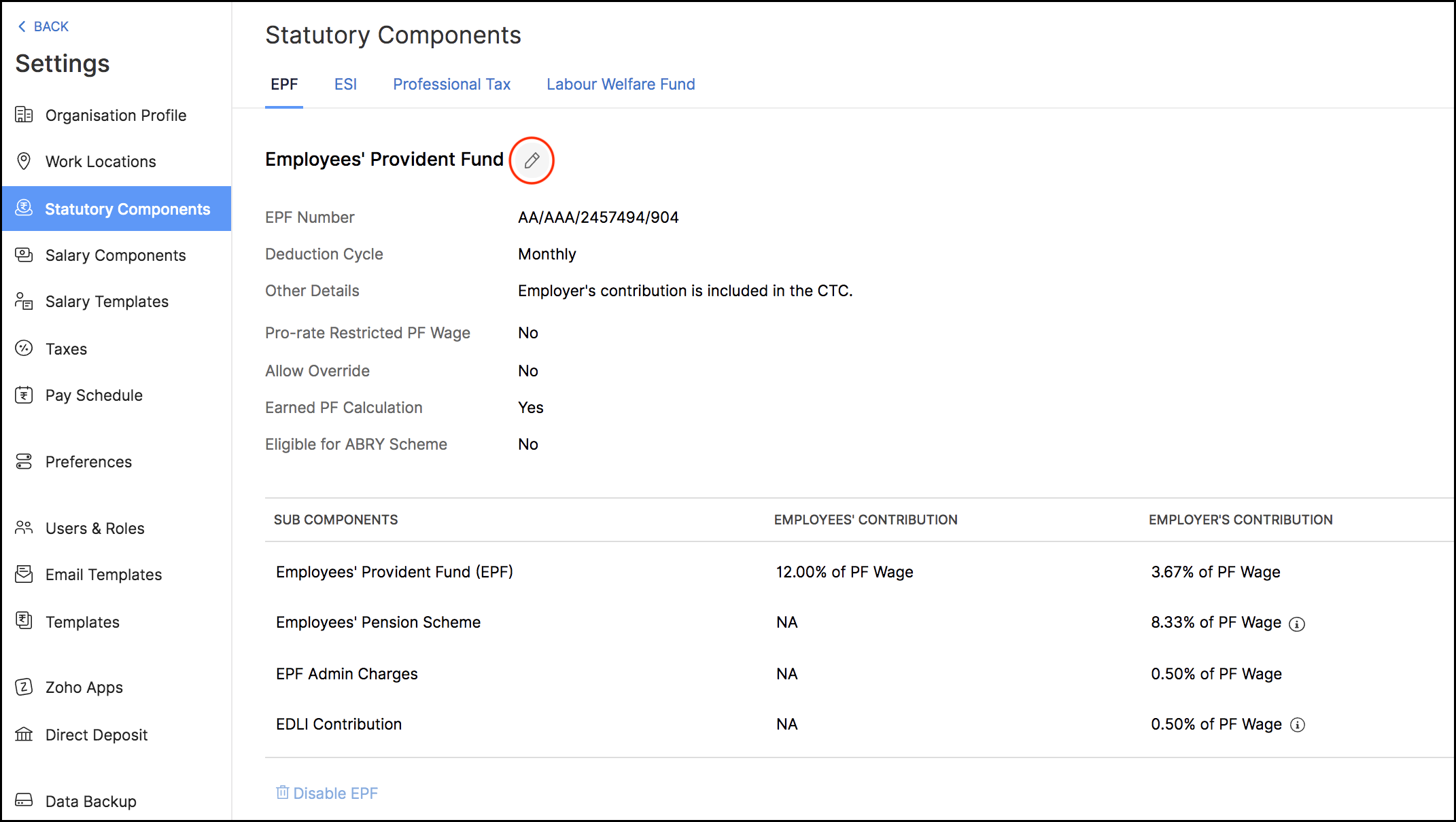

- Click the Settings icon in the top right corner of the homepage.

- Navigate to Statutory Components and click EPF.

- Click the Edit icon.

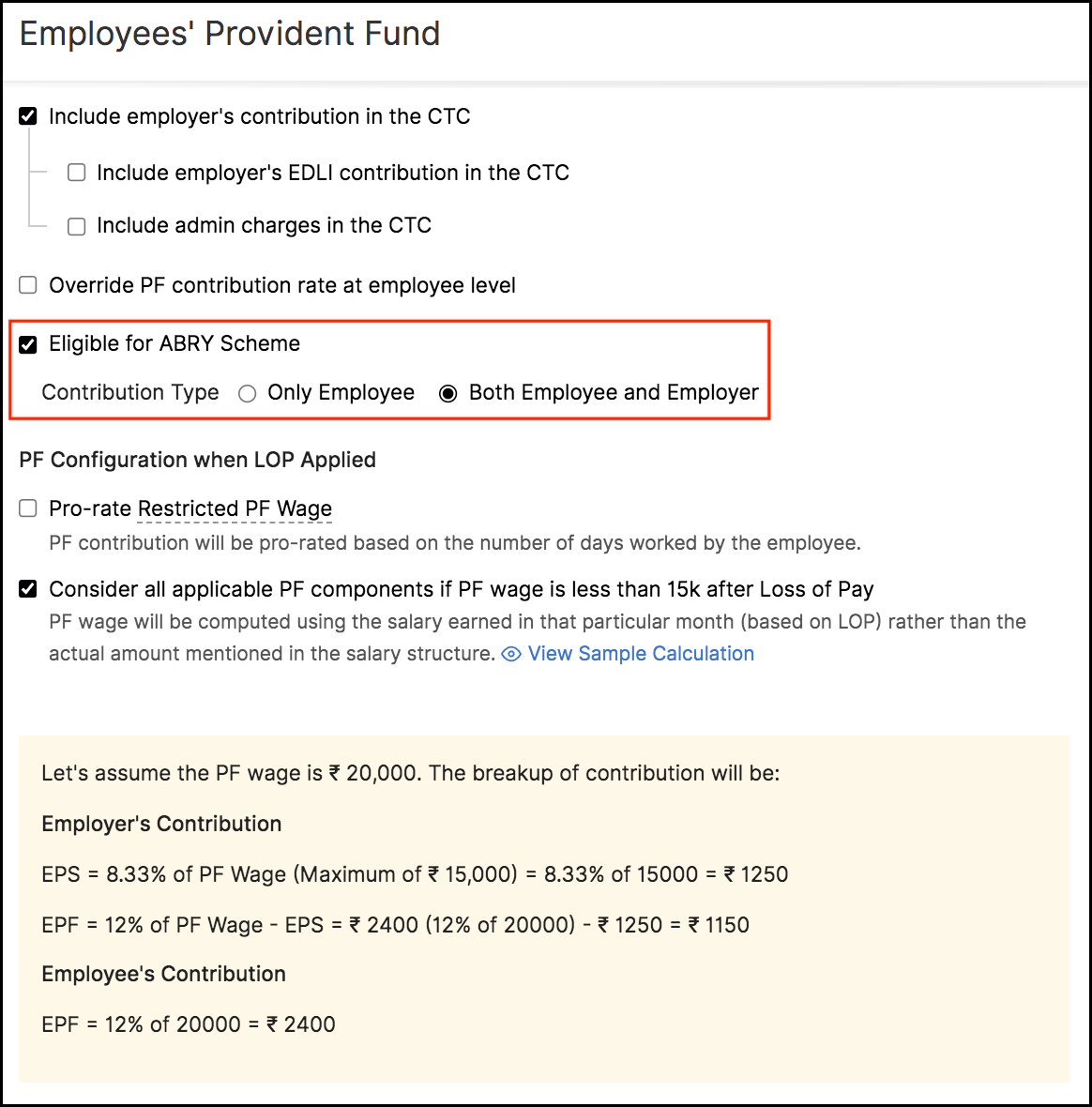

- Check the box next to Eligible for ABRY Scheme.

- Check the appropriate Contribution Type: Only Employee or Both Employee and Employer option.

- Click Save.

You can now enable the ABRY scheme for individual employees.

To include the ABRY scheme in the EPF configuration for an individual employee:

To include the ABRY scheme in the EPF configuration for an individual employee:

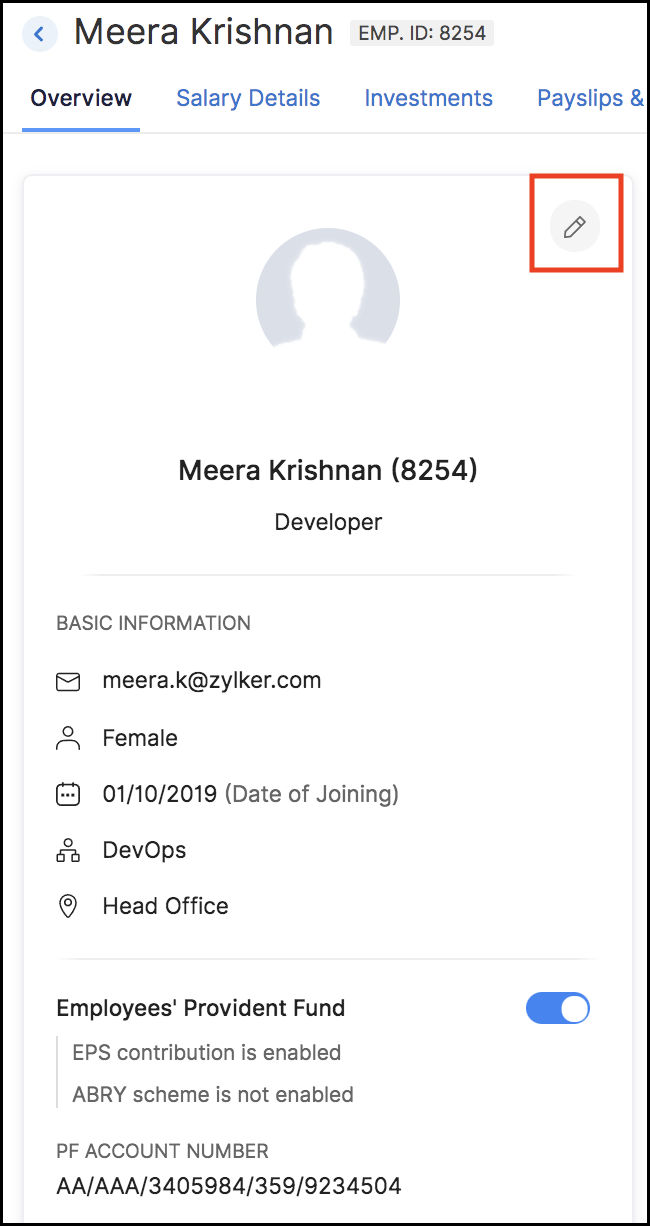

- Go to the Employees module.

- Click the employee for whom you want to enable EPF.

- In the Overview tab, click the Edit icon next to Basic Information.

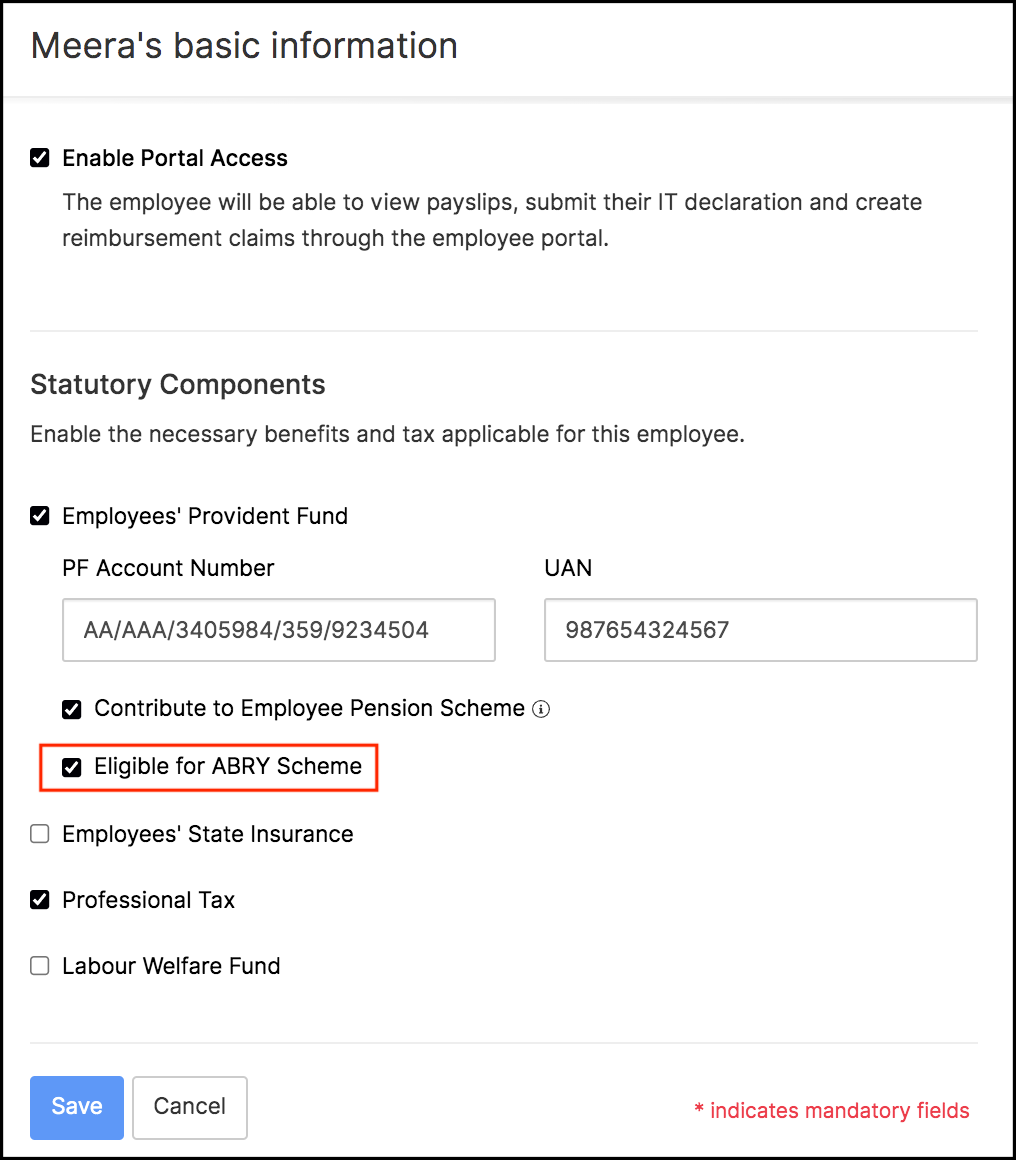

- Under Statutory Components, enable the Employees' Provident Fund, if it is not enabled already.

- Check the box next to Eligible for ABRY Scheme.

- Click Save.

The ABRY scheme can also be enabled for new employees while you are adding them to Zoho Payroll, under Basic Information > Employees' Provident Fund.

Employers can find the EPF contribution amount of their employees in all the statutory reports related to EPF under Reports > Statutory Reports.

Employers can find the EPF contribution amount of their employees in all the statutory reports related to EPF under Reports > Statutory Reports.

In case you have any queries regarding the ABRY scheme implementation, write to support@zohopayroll.com and we will gladly help you out.

Sincerely,

Supriya A

The Zoho Payroll Team

New to Zoho Recruit?

Zoho Campaigns Resources

Topic Participants

Supriya A

Zoho CRM Plus Resources

Zoho Books Resources

Zoho Subscriptions Resources

Zoho Projects Resources

Zoho Sprints Resources

Zoho Orchestly Resources

Zoho Creator Resources

Zoho WorkDrive Resources

Zoho CRM Resources

Get Started. Write Away!

Writer is a powerful online word processor, designed for collaborative work.

Zoho CRM コンテンツ

-

オンラインヘルプ

-

Webセミナー

-

機能活用動画

-

よくある質問

-

Ebook

-

-

Zoho Campaigns

- Zoho サービスのWebセミナー

その他のサービス コンテンツ

ご検討中の方

Recent Topics

Add deluge function to shorten URLs

Zoho Social contains a nice feature to shorten URLs using zurl.co. It would be really helpful to have similar functionality in a Deluge call please, either as an inbuilt function or a standard integration. My Creator app sends an email with a personalisedArchiving Contacts

How do I archive a list of contacts, or individual contacts?Edit default "We are here to help you" text in chat SalesIQ widget

Does anyone know how this text can be edited? I can't find it anywhere in settings. Thanks!Quick way to add a field in Chat Window

I want to add Company Field in chat window to lessen the irrelevant users in sending chat and set them in mind that we are dealing with companies. I request that it will be as easy as possible like just ticking it then typing the label then connectingHow to create a two way Sync with CRM Contacts Module?

Newbie creator here (but not to Zoho CRM). I want to create an app that operates on a sub-set of CRM Contacts - only those with a specific tag. I want the app records to mirror the tagged contacts in CRM. I would like it to update when the Creator appHide/Show Subform Fields On User Input

Hello, Are there any future updates in Hide/Show Subform Fields "On User Input"?Zoho Sheet for Desktop

Does Zoho plans to develop a Desktop version of Sheet that installs on the computer like was done with Writer?Allow Manual Popup Canvas Size Control

Hello Zoho PageSense Team, We hope you're doing well. We would like to request an enhancement to the PageSense popup editor regarding popup sizing. Current Limitation: Currently, the size (width and height) of a popup is strictly controlled by the selectedWhere is the settings option in zoho writer?

hi, my zoho writer on windows has menu fonts too large. where do i find the settings to change this option? my screen resolution is correct and other apps/softwares in windows have no issues. regardsHow to set page defaults in zoho writer?

hi, everytime i open the zoho writer i have to change the default page settings to - A4 from letter, margins to narrow and header and footer to 0. I cannot set this as default as that option is grayed out! so I am unable to click it. I saved the documentDevelop and publish a Zoho Recruit extension on the marketplace

Hi, I'd like to develop a new extension for Zoho Recruit. I've started to use Zoho Developers creating a Zoho CRM extension. But when I try to create a new extension here https://sigma.zoho.com/workspace/testtesttestest/apps/new I d'ont see the option of Zoho Recruit (only CRM, Desk, Projects...). I do see extensions for Zoho Recruit in the marketplace. How would I go about to create one if the option is not available in sigma ? Cheers, Rémi.Critical Issue: Tickets Opened for Zoho Support via the Zoho Help Portal Were Not Processed

Hi everyone, We want to bring to your attention a serious issue we’ve experienced with the Zoho support Help Portal. For more than a week, tickets submitted directly via the Help Portal were not being handled at all. At the same time no alert was postedHow to import data from PDF into Zoho Sheet

I am looking to import Consolidated Account Statement (https://www.camsonline.com/Investors/Statements/Consolidated-Account-Statement) into zoho sheet. Any help is appreciated. The pdf is received as attachment in the email, this document is passwordZoho Projects Android app: Integration with Microsoft Intune

Hello everyone! We’re excited to announce that Zoho Projects now integrates with Microsoft Intune, enabling enhanced security and enterprise app management. We have now added support for Microsoft Intune Mobile Application Management (MAM) policies throughCant't update custom field when custom field is external lookup in Zoho Books

Hello I use that : po = zoho.books.updateRecord("purchaseorders",XXXX,purchaseorder_id,updateCustomFieldseMap,"el_books_connection"); c_f_Map2 = Map(); c_f_Map2.put("label","EL ORDER ID"); c_f_Map2.put("value",el_order_id); c_f_List.add(c_f_Map2); updateCustomFieldseMapWrapping up 2025 on a high note: CRM Release Highlights of the year

Dear Customers, 2025 was an eventful year for us at Zoho CRM. We’ve had releases of all sizes and impact, and we are excited to look back, break it down, and rediscover them with you! Before we rewind—we’d like to take a minute and sincerely thank youAbout Zoneminder (CCTV) and Zoho People

Hi team I would like to implement a CCTV service for our branches, with the aim of passively detecting both the entry and exit of personnel enrolled in Zoho Peeple, but my question is: It is possible to integrate Zoho People with Zoneminder, I understandIntroducing the Zoho Projects Learning Space

Every product has its learning curve, and sometimes having a guided path makes the learning experience smoother. With that goal, we introduce a dedicated learning space for Zoho Projects, a platform where you can explore lessons, learn at your own pace,Create CRM Deal from Books Quote and Auto Update Deal Stage

I want to set up an automation where, whenever a Quote is created in Zoho Books, a Deal is automatically created in Zoho CRM with the Quote amount, customer details, and some custom fields from Zoho Books. Additionally, when the Sales Order is convertedHow to show branch instead of org name on invoice template?

Not sure why invoices are showing the org name not the branch name? I can insert the branch name using the ${ORGANIZATION.BRANCHNAME} placeholder, but then it isn't bold text anymore. Any other ideas?Admin asked me for Backend Details when I wanted to verify my ZeptoMail Account

Please provide the backend details where you will be adding the SMTP/API information of ZeptoMail Who knows what this means?Unable to remove the “Automatically Assigned” territory from existing records

Hello Zoho Community Team, We are currently using Territory Management in Zoho CRM and have encountered an issue with automatically assigned territories on Account records. Once any account is created the territory is assigned automatically, the AutomaticallyKaizen #223 - File Manager in CRM Widget Using ZRC Methods

Hello, CRM Wizards! Here is what we are improving this week with Kaizen. we will explore the new ZRC (Zoho Request Client) introduced in Widget SDK v1.5, and learn how to use it to build a Related List Widget that integrates with Zoho WorkDrive. It helpsSet connection link name from variable in invokeurl

Hi, guys. How to set in parameter "connection" a variable, instead of a string. connectionLinkName = manager.get('connectionLinkName').toString(); response = invokeurl [ url :"https://www.googleapis.com/calendar/v3/freeBusy" type :POST parameters:requestParams.toString()Possible to connect Zoho CRM's Sandbox with Zoho Creator's Sandbox?

We are making some big changes on our CRM so we are testing it out in CRM's Sandbox. We also have a Zoho Creator app that we need to test. Is it possible to connect Zoho CRM's Sandbox to Zoho Creator's Sandbox so that I can perform those tests?I Need Help Verifying Ownership of My Zoho Help Desk on Google Search Console

I added my Zoho desk portal to Google Search Console, but since i do not have access to the html code of my theme, i could not verify ownership of my portal on Google search console. I want you to help me place the html code given to me from Google searchTimeline Tracker

Hi Team, I am currently using Zoho Creator – Blueprint Workflows, and I would like to know if there is a way to track a timeline of the approval process within a Blueprint. Specifically, I am looking for details such as: Who submitted the record Who clickedPrimary / Other Billing Contacts

If you add an additional contact to a Zoho Billing Customer record, and then mark this new contact as the primary contact, will both the new primary and old primary still receive notifications? Can you stop notifications from going to the additional contactsMissing Import Options

Hello, do I miss something or is there no space import option inside of this application? In ClickUp, you can import from every common application. We don't want to go through every page and export them one by one. That wastes time. We want to centralizeCRM x WorkDrive: File storage for new CRM signups is now powered by WorkDrive

Availability Editions: All DCs: All Release plan: Released for new signups in all DCs. It will be enabled for existing users in a phased manner in the upcoming months. Help documentation: Documents in Zoho CRM Manage folders in Documents tab Manage filesIs it possible to enforce a single default task for all users in a Zoho Projects ?

In Zoho Projects, the Tasks module provides multiple views, including List, Gantt, and Kanban. Additionally, users can create and switch to their own custom views. During project review meetings, this flexibility creates confusion because different users[Free Webinar] Zoho Creator webinars - Learning Table and Creator Tech Connect Series in 2026

Hello everyone, Wishing you all a wonderful new year! May 2026 and the years ahead bring more opportunities, growth, and learning your way 🙂 We’re excited to kick off the 2026 edition of the Learning Table Series and Creator Tech Connect Series ! LearningReply and react to comments

Hi everyone! We're excited to bring to you a couple of new features that'll make your sprint process simpler. A cloud application brings with it an array of social media features that can be efficiently used in your organizational setup. As an agile scrumRestrict Users access to login into CRM?

I’m wanting my employees to be able to utilize the Zoho CRM Lookup field within Zoho Forms. For them to use lookup field in Zoho Forms it is my understanding that they need to be licensed for Forms and the CRM. However, I don’t want them to be able toModule Customisation - Lookup function not available

Good evening, Within my business, I can have multiple customers, who have multiple mobile assets. When I set these assets up, I enter information such as vehicle registration, Vehicle identification number (VIN), Unit number, YOM, in addition to others.zoho click, and nord VPN

Unfortunately, we've been having problems with Zoho Click, where essentially the line cuts off after about a minute's worth of conversation every time we are on VPN. Is there a way we can change this within the settings so it does not cut the line offZoho Calender

a) does the clanender in zoho project allow you to see the name of the event in the celnder view, it currently says either "Task (1) or "Milestoen (1)" b) Alternatively does the calender in Zoho project integrate with zoho calender?Matching ZOHO Payments in Banking

Our company has recently integrated ZOHO Payments into our system. This seemed really convenient at first because our customers could pay their account balance by clicking on a link imbedded in the emailed invoice. Unfortunately, we can't figure out howTeam Gamification

Would love to motivate, engage and encourage our team with our social media posts. Would like to include Gamification features of Social Media in Zoho Social or Marketing Automation. And also bring in Social Advocacy tools/tracking/management to these,Power up your Kiosk Studio with Real-Time Data Capture, Client Scripts & More!

Hello Everyone, We’re thrilled to announce a powerful set of enhancements to Kiosk Studio in Zoho CRM. These new updates give you more flexibility, faster record handling, and real-time data capture, making your Kiosk flows smarter and more efficientNext Page