What's New in Zoho Payroll [India Edition]: December 2021

Hello everyone,

We are excited to bring you all the new features and enhancements we've rolled out in Zoho Payroll last month. Here are the major updates:

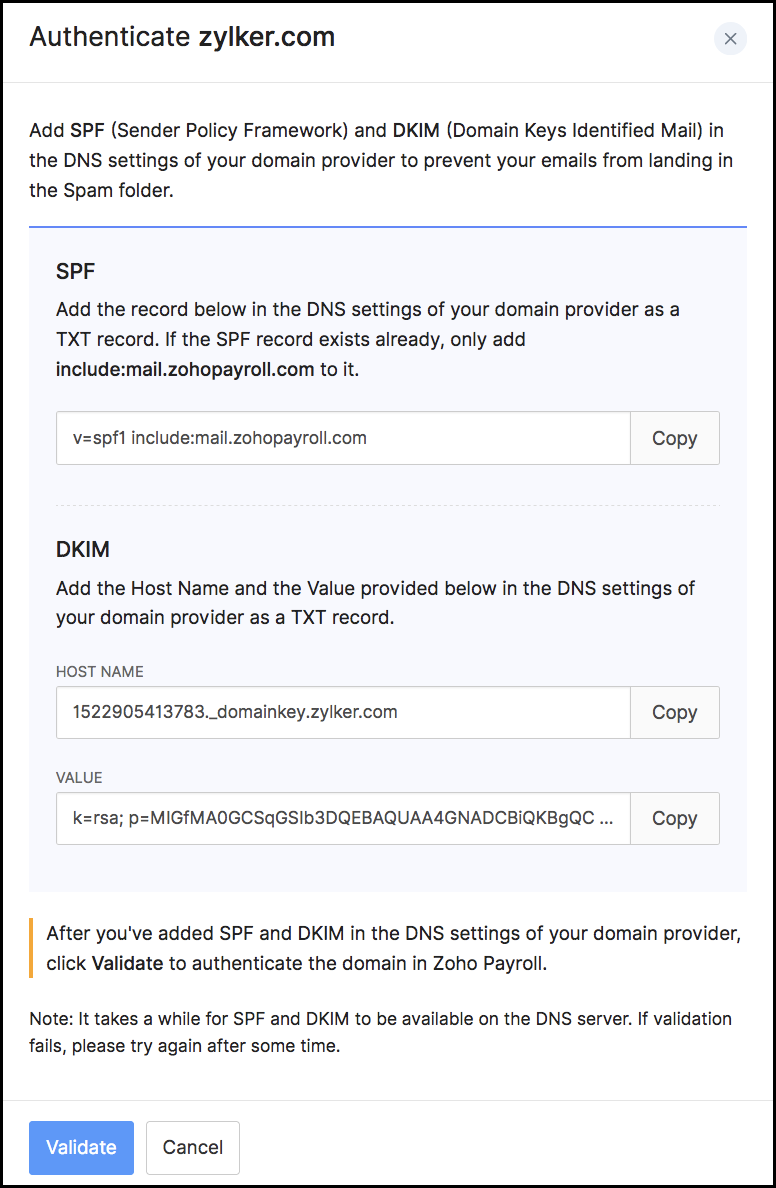

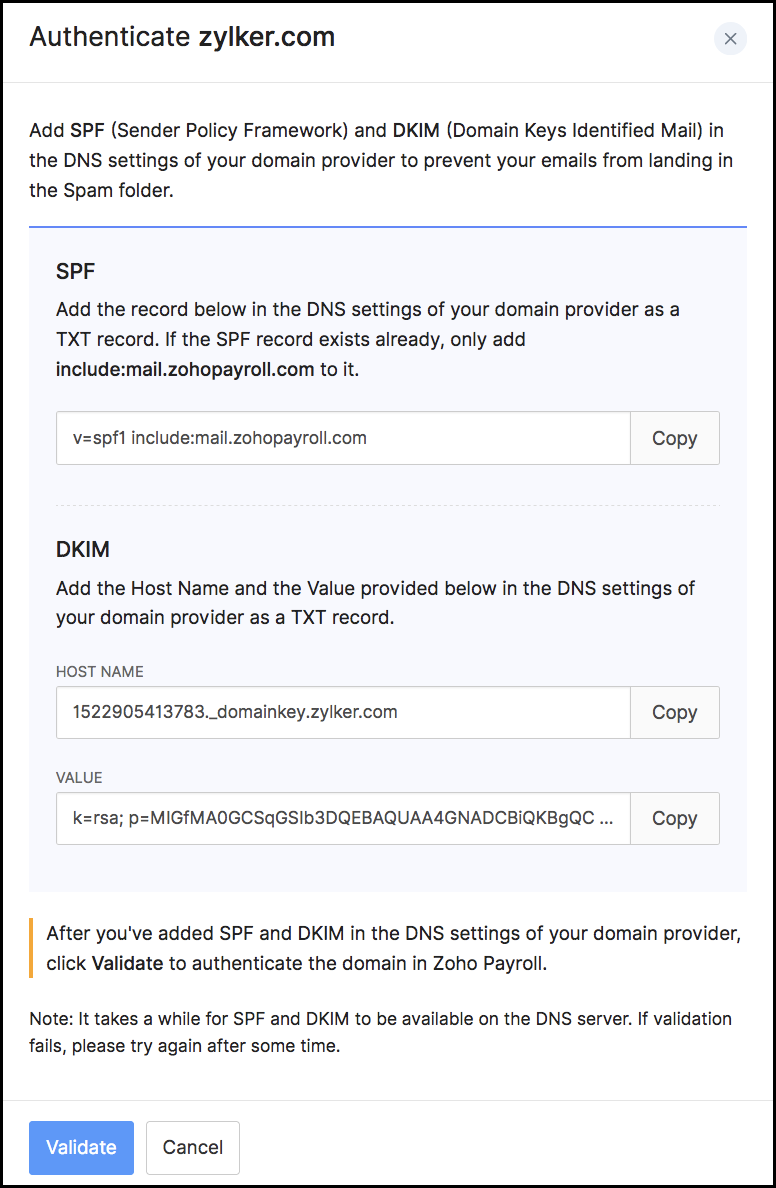

Authenticate your email address domain in Zoho Payroll

In Zoho Payroll, you can configure the email address your organisation uses to send reminder emails, payslips, and portal invitations. When you send these emails using email addresses with unauthenticated domains, they may end up in the recipient's spam folder. This means your employees may miss out on important reminders, or it may pave the way for hackers to phish your employees easily. To avoid this, we have introduced an option to authenticate your email address domain by adding the domain's SPF and DKIM records.

Here’s how:

Here’s how:

- Go to Settings > Preferences > Sender Email Preferences.

- Click Authenticate Now → next to the domain that you want to authenticate.

Now, copy the SPF record from the pop-up that follows and add it to the DNS settings of your domain name provider (e.g. GoDaddy).

Next, copy the Host Name and Value for the DKIM record and add it to the DNS settings of your domain name provider.

Once you’ve added both the SPF and DKIM records, click Validate.

Next, copy the Host Name and Value for the DKIM record and add it to the DNS settings of your domain name provider.

Once you’ve added both the SPF and DKIM records, click Validate.

Note: It will take a while for your newly added records to reflect on the DNS server. If your validation fails, wait for a while and try again. Also, you can continue to use Zoho Payroll while the records are being validated.

To learn more about sender email preferences, visit our help documentation.

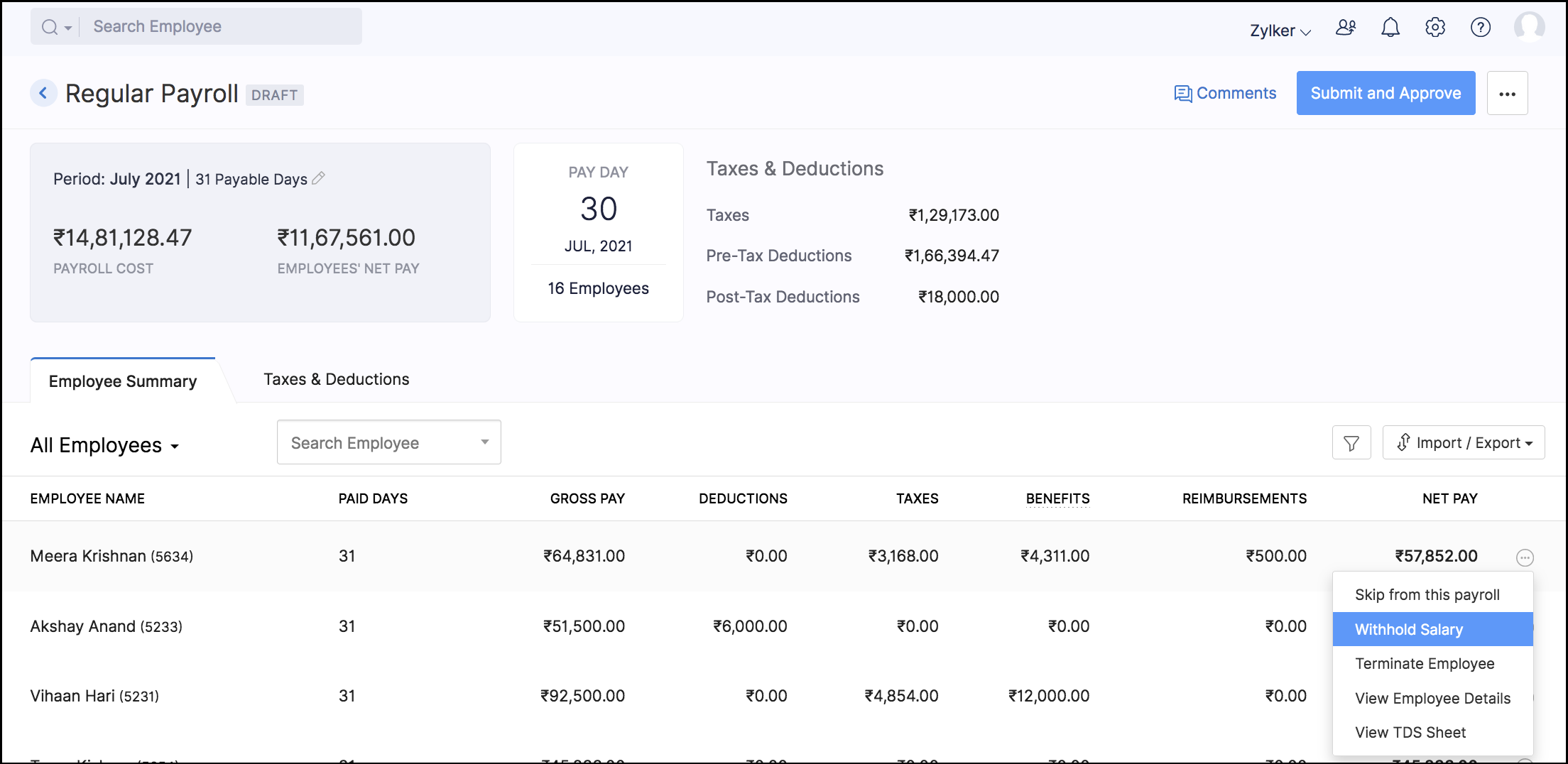

Withhold salary for employees

We have introduced a salary withhold feature, which enables you to halt an employee's pay for a particular duration. This feature would be especially useful when you have a new employee who has joined in the last week of the payroll month and you want to process their pay along with the next month's salary. When you withhold your employee's salary, they will be skipped from the current payroll cycle and their earnings will be paid as arrears when they are released in the subsequent months.

Here's how you can withhold and release an employee's salary in Zoho Payroll:

Here's how you can withhold and release an employee's salary in Zoho Payroll:

- Go to the Pay Runs module.

- Click Create Pay Run.

- In the pay run draft, click the Overflow icon (…) next to the employee’s name and click Withhold Salary.

- Enter the reason for withholding the salary and click Proceed.

- Once you’ve added all the inputs, click the Submit and Approve button in the top-right corner of the page.

- If you have enabled the Zoho Books integration, you can choose to post the journal entry for the payroll transaction in Books. The transaction will be recorded under the account you had configured while setting up the integration.

- After the pay run is approved, you can record payment on or after the payday.

The withheld salary can then be released in subsequent pay runs.

Note: All the statutory components such as EPF, ESI, etc. will be calculated and deducted from the employee's salary. Only the Net Pay will be withheld when you use the salary withhold feature.

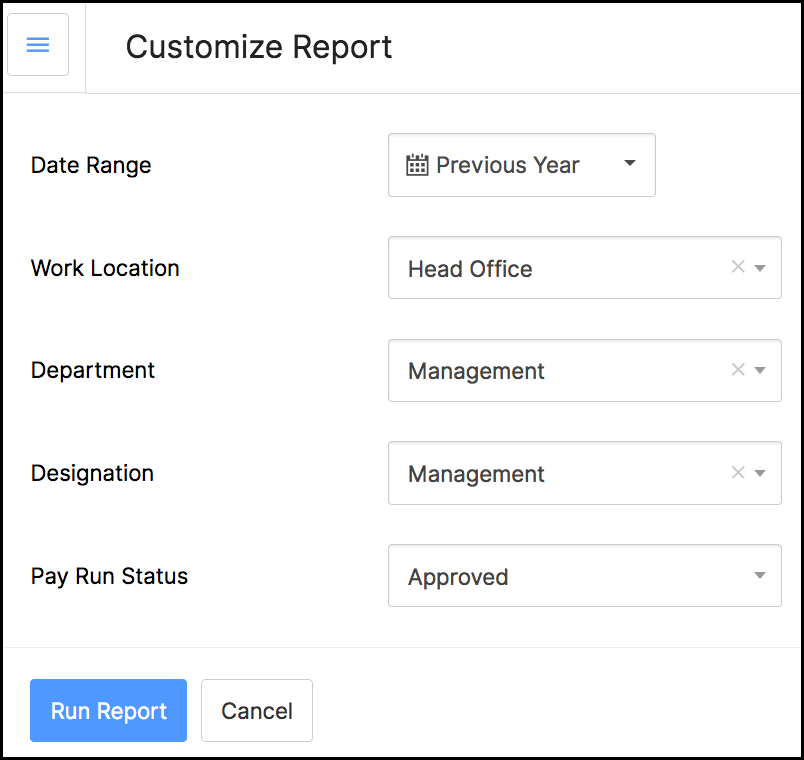

View reports based on approved pay runs

You can now generate reports based on your approved pay runs. Based on these reports, you can analyse your statutory costs and other payroll expenses for the month before you even pay your employees. You can filter and view approved pay run based reports in the Reports module. This option is available only for the reports under Payroll Overview (except Employees' Pay Summary), Statutory Reports, and Deduction Reports.

To view approved pay run reports:

- Go to the Pay Runs tab on the left sidebar.

- Click Create Pay Run or View Details if you already have a pay run drafted.

- Once you’ve added all the inputs, click the Submit and Approve button in the top-right corner of the page.

- Next, go to the Reports module on the left sidebar.

- Choose a report from Payroll Overview (except Employees' Pay Summary), Statutory Reports, or Deduction Reports.

- Click Customise Report on top of the page.

- Select Approved as the Pay Run Status.

- Click Run Report.

Your report will be generated based on the approved pay runs in the selected date range.

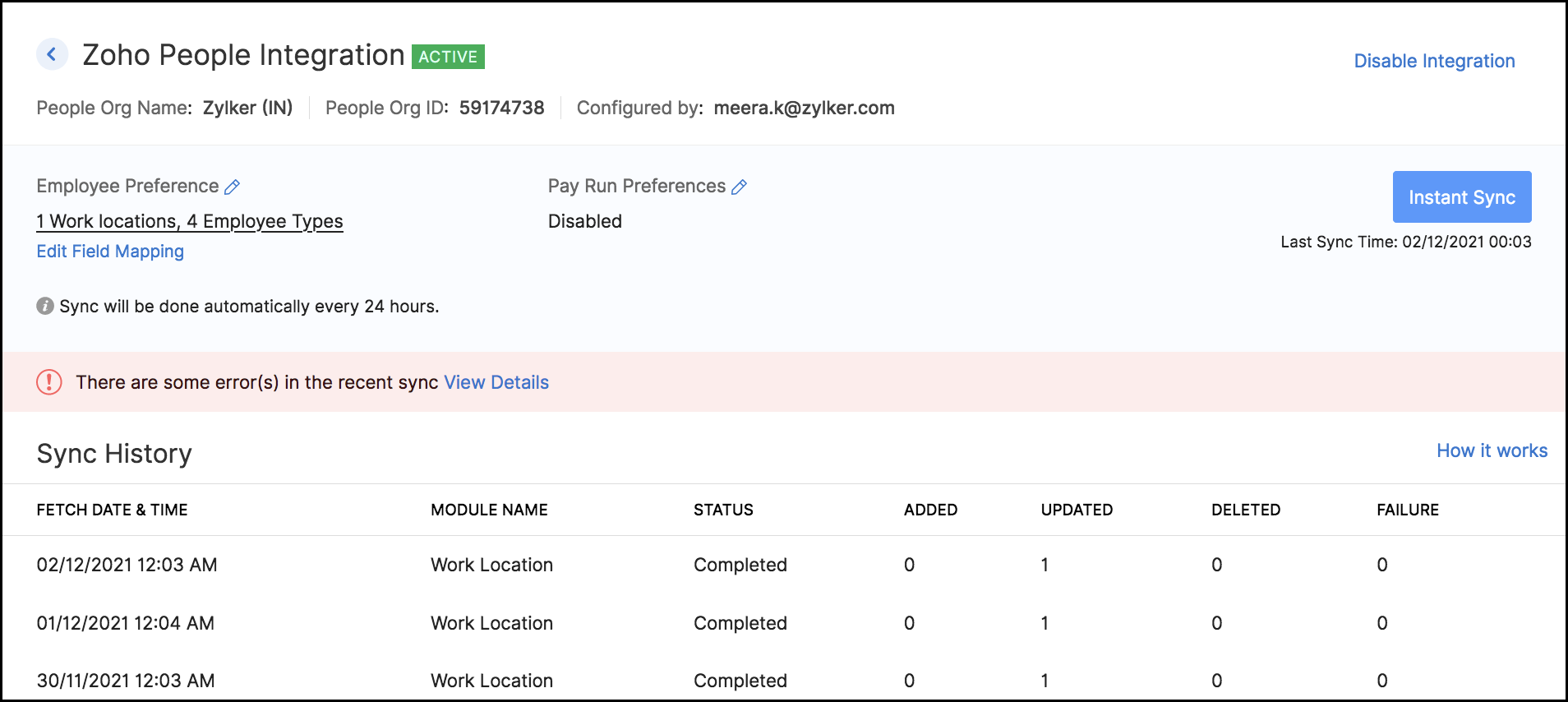

New enhancements introduced on the Zoho People integration page

You can now export the errors that occur during the Zoho People – Zoho Payroll data synchronisation to resolve multiple "data missing" errors. Using the error report, you will be able to map the missing data to the employees in an excel sheet and then import the details to Zoho Payroll.

To view the synchronisation errors:

- Click the Settings icon in the top right corner of the home page.

- Go to Zoho Apps.

- Click View Details next to Zoho People.

- On the Integration Details page, you will find the option to view sync errors. Click View Details.

On the next page you will find all the errors that occurred during the synchronisation process.

- Click Export Data in the top right corner of the page.

- On the next page you will find all the errors that occurred during the synchronisation process.

- Click Export Data in the top right corner of the page.

You can access this page under Settings > Zoho Apps > Zoho People.

Give these features a try and let us know your feedback in the comments below.

If you need any assistance, you can write to us at support@zohopayroll.com and we will get back to you. Check out all our updates on our What's New timeline.

Season's Greetings!

Regards,

Supriya A

Give these features a try and let us know your feedback in the comments below.

If you need any assistance, you can write to us at support@zohopayroll.com and we will get back to you. Check out all our updates on our What's New timeline.

Season's Greetings!

Regards,

Supriya A

The Zoho Payroll Team

New to Zoho Recruit?

Zoho Campaigns Resources

Topic Participants

Supriya A

Sticky Posts

Zoho Payroll | Quarterly Product Updates For 2024

As we navigate through the ever-changing payroll landscape, we bring you the latest updates that span the first quarter of 2024, tailored to meet the diverse needs of employers and employees in India, the UAE, and the US. From useful integrations to refinedIntroducing Academy 🎉: your go-to hub for all things payroll

Hello! We're thrilled to launch our newest payroll resource hub - Academy by Zoho Payroll [for India] - the information repository where you can go to learn everything about payroll. Introducing Academy by Zoho Payroll Why did we build Academy? Payroll

Zoho CRM Plus Resources

Zoho Books Resources

Zoho Subscriptions Resources

Zoho Projects Resources

Zoho Sprints Resources

Zoho Orchestly Resources

Zoho Creator Resources

Zoho WorkDrive Resources

Zoho CRM Resources

Get Started. Write Away!

Writer is a powerful online word processor, designed for collaborative work.

Zoho CRM コンテンツ

-

オンラインヘルプ

-

Webセミナー

-

機能活用動画

-

よくある質問

-

Ebook

-

-

Zoho Campaigns

- Zoho サービスのWebセミナー

その他のサービス コンテンツ

ご検討中の方

Recent Topics

Wishes for 2026

Hello, and a happy new year 2026! Let's hope it's better for everyone. I'd like to share some thoughts on Zoho One and what could be useful in the short, medium, and long term. Some things are already there, but not applied to Zoho One. Others seem likeHow to Integrate Zoho Books with Xero (No Native Connection Available)

Hi everyone, I’m currently facing an issue with integrating Zoho Books invoices with Xero, as I’ve noticed Zoho does not provide a native integration with Xero at this time. I would like to ask: What are the common or recommended solutions for syncingHow to install Widget in inventory module

Hi, I am trying to install a app into Sales Order Module related list, however there is no button allow me to do that. May I ask how to install widget to inventory module related list?Add specific field value to URL

Hi Everyone. I have the following code which is set to run from a subform when the user selects a value from a lookup field "Plant_Key" the URL opens a report but i want the report to be filtered on the matching field/value. so in the report there iserror while listing mails

I can't access email in any of my folders: Oops, an error occurred - retry produces the second error response: error while listing mails (cannot parse null string). I've signed in and out of Zoho, restarted my iMac.Unlocking New Levels: Zoho Payroll's Journey in 2025

Every year brings its own set of challenges and opportunities to rethink how payroll works across regulations and teams. In 2025, Zoho Payroll continued to evolve with one clear focus: giving businesses more flexibility, clarity, and control as they grow.Introducing Connected Records to bring business context to every aspect of your work in Zoho CRM for Everyone

Hello Everyone, We are excited to unveil phase one of a powerful enhancement to CRM for Everyone - Connected Records, available only in CRM's Nextgen UI. With CRM for Everyone, businesses can onboard all customer-facing teams onto the CRM platform toSend Supervisor Rule Emails Within Ticket Context in Zoho Desk

Dear Zoho Desk Team, I hope this message finds you well. Currently, emails sent via Supervisor Rules in Zoho Desk are sent outside of the ticket context. As a result, if a client replies to such emails, their response creates a new ticket instead of appendingform data load issue when saving as duplicate record is made

Hello. I have a form with a lookup when a value is selected the data from the corresponding record is filled into all of the fields in the form. But the form is loaded in such a state that if any value is changed it will take all of the values pre loadedCRM project association via deluge

I have created a workflow in my Zoho CRM for closing a deal. Part of this workflow leverages a deluge script to create a project for our delivery team. Creating the project works great however, after or during the project creation, I would like to associateZoho Browser??

hai guys, this sounds awkward but can v get a ZOHO BROWSER same as zoho writer, etc. where i can browse websites @ home and continue browsing the same websites @ my office, as v have the option in Firefox, once i save and close the browser and again when i open it i will be getting the same sites. If u people r not clear with my explanation, plz let me know. Thanks, SandeepWhere can we specify custom CSS in Zoho Forms custom theme ?

I'm using a form with a dark theme. The OTP popup window is unreadable, because for some reason, the OTP popup background fixes color to white, but still takes the font color specified in the custom theme. This ends up as white on white for me, renderingMCP no longer works with Claude

Anyone else notice Zoho MCP no longer works with Claude? I'm unable to turn this on in the claude chat. When I try to toggle it on, it just does nothing at all. I've tried in incognito, new browsers, etc. - nothing seems to work.Enable History Tracking for Picklist Values Not Available

When I create a custom picklist field in Deals, the "Enable History Tracking for Picklist Values" option is not available in the Edit Properties area of the picklist. When I create a picklist in any other Module, that option is available. Is there a specific reason why this isn't available for fields in the Deals Module?The reason I switched away from Zoho Notebook

My main reason for switching to Zoho was driven by three core principles: moving away from US-based products, keeping my data within India as much as possible, and supporting Indian companies. With that intent, I’ve been actively de-Googling my digitalAdd RTL and Hebrew Support for Candidate Portal (and Other Zoho Recruit Portals)

Dear Zoho Recruit Team, I hope you're doing well. We would like to request the ability to set the Candidate Portal to be Right-to-Left (RTL) and in Hebrew, similar to the existing functionality for the Career Site. Currently, when we set the Career SiteAbility to Edit YouTube Video Title, Description & Thumbnail After Publishing

Hi Zoho Social Team, How are you? We would like to request an enhancement to Zoho Social that enables users to edit YouTube video details after the video has already been published. Your team confirmed that while Zoho Social currently allows editing theFree Webinar : Unlock AI driven business insights with Zoho Inventory + Zoho Analytics

Are you tired of switching between apps and exporting data to build customized reports? Say hello to smarter & streamlined insights! Join us for this exclusive webinar where we explore the power of the Zoho Inventory–Zoho Analytics integration. LearnCritical Issue: Tickets Opened for Zoho Support via the Zoho Help Portal Were Not Processed

Hi everyone, We want to bring to your attention a serious issue we’ve experienced with the Zoho support Help Portal. For more than a week, tickets submitted directly via the Help Portal were not being handled at all. At the same time no alert was postedHide/Show Subform Fields On User Input

Hello, Are there any future updates in Hide/Show Subform Fields "On User Input"?Cloning Item With Images Or The Option With Images

Hello, when I clone an item, I expect the images to carry over to the cloned item, however this is not the case in Inventory. Please make it possible for the images to get cloned or at least can we get a pop up asking if we want to clone the images asArchiving Contacts

How do I archive a list of contacts, or individual contacts?WorkDrive and CRM not in sync

1/ There is a CRM file upload field with WorkDrive file set as the source: 2/ Then the file is renamed in WorkDrive (outside CRM): 3/ The File in CRM is not synced after the change in WorkDrive; the file name (reference) in CRM record is not updated (hereCustom validation in CRM schema

Validation rules in CRM layouts work nicely, good docs by @Kiran Karthik P https://help.zoho.com/portal/en/kb/crm/customize-crm-account/validation-rules/articles/create-validation-rules I'd prefer validating data input 'closer to the schema'Adding Default Module Image into mail merge field

As with most people finding their way to these forums i have a specific requirement that doesn't seem to be supported by Zoho I have created 2 custom modules to suit my purpose 1 is an inventory type module that lists aluminium extrusions, and all relevantSync Data from MA to CRM

Currently, it's a one-way sync of data from the CRM to MA. I believe we should have the ability to select fields to sync from MA to the CRM. The lead score is a perfect example of this. In an ideal world we would be able to impact the lead score of aIs it possible to roll up all Contact emails to the Account view?

Is there a way to track all emails associated with an Account in one single view? Currently, email history is visible when opening an individual Contact record. However, since multiple Contacts are often associated with a single Account, it would be beneficialUpdate CRM record action

Currently, MA only offers a "Push Data" action to push data to a CRM module. This action is built to cover the need to both create a new record and update an existing record. Because it has been implemented this way all required fields on the CRM moduleNotes badge as a quick action in the list view

Hello all, We are introducing the Notes badge in the list view of all modules as a quick action you can perform for each record, in addition to the existing Activity badge. With this enhancement, users will have quick visibility into the notes associatedWhat's new in Zoho One 2025

Greetings! We hope you have all had a chance by now to get hands-on with the new features and updates released as part of ZO25. Yes, we understand that you may have questions and feedback. To ensure you gain a comprehensive understanding of these updates,Good news! Calendar in Zoho CRM gets a face lift

Dear Customers, We are delighted to unveil the revamped calendar UI in Zoho CRM. With a complete visual overhaul aligned with CRM for Everyone, the calendar now offers a more intuitive and flexible scheduling experience. What’s new? Distinguish activitiesAdd deluge function to shorten URLs

Zoho Social contains a nice feature to shorten URLs using zurl.co. It would be really helpful to have similar functionality in a Deluge call please, either as an inbuilt function or a standard integration. My Creator app sends an email with a personalisedEdit default "We are here to help you" text in chat SalesIQ widget

Does anyone know how this text can be edited? I can't find it anywhere in settings. Thanks!Quick way to add a field in Chat Window

I want to add Company Field in chat window to lessen the irrelevant users in sending chat and set them in mind that we are dealing with companies. I request that it will be as easy as possible like just ticking it then typing the label then connectingHow to create a two way Sync with CRM Contacts Module?

Newbie creator here (but not to Zoho CRM). I want to create an app that operates on a sub-set of CRM Contacts - only those with a specific tag. I want the app records to mirror the tagged contacts in CRM. I would like it to update when the Creator appZoho Sheet for Desktop

Does Zoho plans to develop a Desktop version of Sheet that installs on the computer like was done with Writer?Allow Manual Popup Canvas Size Control

Hello Zoho PageSense Team, We hope you're doing well. We would like to request an enhancement to the PageSense popup editor regarding popup sizing. Current Limitation: Currently, the size (width and height) of a popup is strictly controlled by the selectedWhere is the settings option in zoho writer?

hi, my zoho writer on windows has menu fonts too large. where do i find the settings to change this option? my screen resolution is correct and other apps/softwares in windows have no issues. regardsHow to set page defaults in zoho writer?

hi, everytime i open the zoho writer i have to change the default page settings to - A4 from letter, margins to narrow and header and footer to 0. I cannot set this as default as that option is grayed out! so I am unable to click it. I saved the documentDevelop and publish a Zoho Recruit extension on the marketplace

Hi, I'd like to develop a new extension for Zoho Recruit. I've started to use Zoho Developers creating a Zoho CRM extension. But when I try to create a new extension here https://sigma.zoho.com/workspace/testtesttestest/apps/new I d'ont see the option of Zoho Recruit (only CRM, Desk, Projects...). I do see extensions for Zoho Recruit in the marketplace. How would I go about to create one if the option is not available in sigma ? Cheers, Rémi.Next Page