#13 Zoho Books Digest

Hello Readers,

We are back with the 13th edition of Zoho Books Digest. Here's what we have in store for the community this month.

Upcoming Events

Zoho Finance Roadshow 2022 (GCC)

We're coming to your favourite cities in the Middle East! Join our session where we walk you through our powerful financial platforms that cater to all your financial needs. This roadshow is a wonderful opportunity to meet with Zoho solution experts, gain insights from industry influencers, network with peers, and learn from customer success stories.

Save your spot in a city near you today!

Feature Spotlight

Managing your business accounting and banking on separate platforms can be an herculean task. From reconciling bank accounts to making vendor payments, working in silos can reduce your teams productivity and efficiency.

With the Zoho Books connected banking initiative, we aim to bring the world of accounting and banking under one roof. Adding to the long list of banks, we would like to highlight the Zoho Books and HSBC integration.

With this integration you can:

- Initiate payments to your vendors

- Initiate GST payments directly from Zoho Books

- Fetch bank feeds and reconcile transactions effortlessly

- View transaction statuses and real-time account balances

Check out our help document and how-to video to learn how to set up this integration for your organization.

What's New

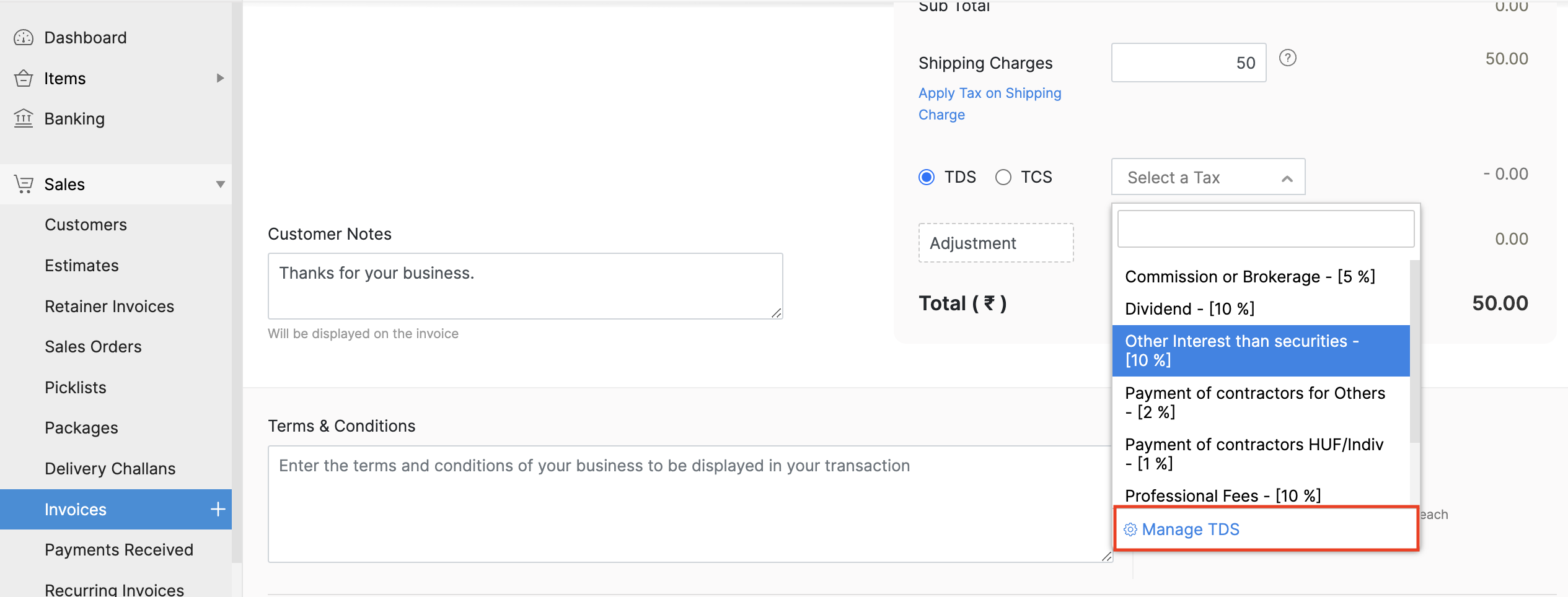

Apply TDS for Invoices, Bills of Supply, and Debit Notes (India edition)

Calculate and apply Tax Deducted at Source (TDS) for your invoices, bills of supply, and debit notes after selecting the TDS section of your choice. You can also choose to edit or delete a particular rate.

If you do not find the TDS section you're looking for, you can create a new TDS section along with the rate by managing TDS. You will also be able to mark your TDS section as a higher TDS after providing a reason.

You can choose to track your TDS payables in your Other Current Liability accounts and your TDS receivables in your Other Current Asset account. If you want to track your TDS receivables and payables in a new account, you can do so by creating a new account in the Chart of Accounts.

To apply TDS:

- Go to Sales > Invoices.

- Create a new invoice.

- Select TDS and select the applicable tax from the dropdown.

In case you missed it

We successfully completed the second session of our Solutions Talks, "Reimagining Business Finance SELISE's Digital Transformation Journey," where Julian Weber, CEO of SELISE Digital platforms, shared industry insights and his 10-year Zoho Books journey with the audience.

Check out the recording of the session here.

Customer Corner

In this edition of Digest, we are thrilled to share the success story of Therapedic Mattress India, a leading company in the mattress industry with over 60 years of experience. Here is what Ashish Mehta, director of the firm, has to say about Zoho Books:

"Our company has multiple branches spread across India. Monitoring the financial activities of all these branches was impossible on Tally and Busy. In 2017, we came across Zoho Books, which helped us view our financial data in real time. With features to handle branches and multiple GSTINs, we were able to maintain the accounts of all our branches in a single organisation. Since the product is intuitive to use and requires no special training, it was easy to switch to Zoho Books."

We're eager to hear and share more stories about businesses using Zoho Books. If you would like to share your story with us, let us know in the comments, and we'll get in touch with you!

PS: Follow us on Twitter, Instagram, and LinkedIn, and subscribe to our YouTube Channel. Turn on your notifications to stay up to date on what we're doing.

Until next time!

Cheers,

Saranya GaneshMurthy

Customer Relations | Zoho Books

Centralize Knowledge. Transform Learning.

All-in-one knowledge management and training platform for your employees and customers.

New to Zoho Recruit?

Zoho Developer Community

New to Zoho LandingPage?

Zoho LandingPage Resources

New to Bigin?

Topic Participants

Saranya GaneshMurthy

DANC

ab

PRAGEU EVENTS AND MARKETING SERVICES PVT. LTD.

finance

New to Zoho TeamInbox?

Zoho TeamInbox Resources

Zoho CRM Plus Resources

Zoho Books Resources

Zoho Subscriptions Resources

Zoho Projects Resources

Zoho Sprints Resources

Qntrl Resources

Zoho Creator Resources

Zoho CRM Resources

Zoho Show Resources

Get Started. Write Away!

Writer is a powerful online word processor, designed for collaborative work.

Zoho CRM コンテンツ

-

オンラインヘルプ

-

Webセミナー

-

機能活用動画

-

よくある質問

-

Ebook

-

-

Zoho Campaigns

- Zoho サービスのWebセミナー

その他のサービス コンテンツ

Nederlandse Hulpbronnen

ご検討中の方

Recent Topics

Can't scroll the page down unless I refresh the page

Hello, This issue has been going on with me and a lot of other users in my organization, we can't scroll down! the scrolling side bar doesn't appear and scrolling down through mouse or keyboard keys doesn't work, it seems that the page just ends in thePrice List

II want to restrict the items to display in sales, quote, etc for which custom rates are added in price list. How I can do the same in Zoho booksLet’s Talk Recruit: Still switching tabs to source?

Welcome back to the Let’s Talk Recruit series. Let’s talk about how you actually source talent. Do you open multiple job boards every single time a role opens? Run the same keyword searches you ran yesterday? Download, upload, rename, and then do it againKaizen #231 - Embedding Zoho Desk Tickets in Zoho CRM

Hello, CRM Wizards! This week, let us enhance cross-team visibility between Zoho CRM and Zoho Desk. We will use the Zoho Request Client inside a Related List widget to display open Zoho Desk tickets directly within the Contact record in Zoho CRM. ThisEU Problem

Hi all, we've been facing issues with the Europe data center for two days. It's starting to disrupt our daily workflow. Any word on when this will be resolved?Introducing a smarter, faster, and more flexible charting experience

Hello Zoho Sheet users, We're delighted to share the latest news about a major update to charts in Zoho Sheet! The new version supports dynamic data ranges, granular styling options, faster loading, and other interesting enhancements that allow you toCreate custom rollup summary fields in Zoho CRM

Hello everyone, In Zoho CRM, rollup summary fields have been essential tools for summarizing data across related records and enabling users to gain quick insights without having to jump across modules. Previously, only predefined summary functions wereIntroducing Job Alerts

Keeping candidates engaged beyond their first application is one of the most consistent hiring challenges. Many interested candidates simply do not revisit career sites regularly, which can result in missed opportunities and reduced re-applications. ToWhere is the settings option in zoho writer?

hi, my zoho writer on windows has menu fonts too large. where do i find the settings to change this option? my screen resolution is correct and other apps/softwares in windows have no issues. regardsClient Script | Update - Client Script Support For Custom Buttons

Hello everyone! We are excited to announce one of the most requested features - Client Script support for Custom Buttons. This enhancement lets you run custom logic on button actions, giving you greater flexibility and control over your user interactions.Enhance Sign CRM integration

Hello all, I'm working on a custom Deluge script to enhance the integration between Zoho CRM and Sign by using a writer merge template for additional flexibility. I want to replicate the post-sign document integration that exists between CRM and SignTask status - completed - other options

I have a dumb question I know i can make custom statuses for the tasks - but is there anyway to make additional "completed" statuses like for instance if i have a task "call back customer" and i leave a vm for them to call back marking it "completed -Bank feed integration First Abu Dhabi Bank (FAB) to Zoho? (UAE)

Hello everyone, Is First Abu Dhabi Bank in the list of banks available for bank feed integration with Zoho Books? Thank you.push notification to Cliq when user is @mentioned in CRM notes

push notification to Cliq when user is @mentioned in CRM notes. Currently users that is @mentioned gets an email to be notified. User/s that is @mentioned should get a Cliq notification.How to Export Filtered List of Contacts?

This seems like it should be simple, but I'm stymied. I'm trying to export a filtered list of my Contacts for analysis in a spreadsheet. The use case is that I'm an ecom business based in the US. The bulk of our customers are individuals stored as Contacts.Possible to Turn Off Automatic Notifications for Approvals?

Hello, This is another question regarding the approval process. First a bit of background: Each of our accounts is assigned a rank based on potential sales. In Zoho, the account rank field is a drop-down with the 5 rank levels and is located on the accountQuick Create needs Client Script support

As per the title. We need client scripts to apply at a Quick Create level. We enforce logic on the form to ensure data quality, automate field values, etc. However, all this is lost when a user attempts a "Quick Create". It is disappointing because, fromcan we add product images in Zoho CRM Quote PDF template?

I want to create a quotation format in Zoho CRM similar to the attached PDF, where each product is displayed in a table with rpoduct image I need the product image to appear inside the line items section of the quote. However, while checking the QuoteDoes Zoho Writer have Dropdowns

I want to add a drop down field in Zoho writer. Is this possible?system not picking my default custom service report template

Can you tell me why when we create a service report always pick the (standard old) template? Even when I have a custom service report selected as Default.Facturation électronique 2026 - obligation dès le 1er septembre 2026

Bonjour, Je me permets de réagir à divers posts publiés ici et là concernant le projet de E-Invoicing, dans le cadre de la facturation électronique prévue très prochainement. Dans le cadre du passage à la facturation électronique pour les entreprises,Connecting Multiple WooCommerce Stores to a Single Zoho Marketing Automation Account

Is it possible to connect multiple WooCommerce stores to a single Zoho Marketing Automation account?Service Title in Service Report Template Builder

I am currently working on the Service Report Template Builder in Zoho FSM. I have created three separate service report templates for different workflows: Preventive Maintenance Report Requested Service Report Installation Report My issue is that I cannotOne Support Email Managed By Multiple Departments

Hello, We use one support email (support@company.com). Incoming emails come to the "Support Department" and based on what the customer is asking, we route that ticket to different departments (billing, technical support, etc.). When users in these differentUpdate: New Security Admin Role

Hello Zoho Directory Admins! This post is to highlight the recent role and permission changes introduced as part of the security enhancements. Previously, Helpdesk Admins had the security permissions and were responsible for managing the security configurationsClient Script | Update #14 - Client Script Support for Quick Create

Hello Everyone! We are back with another exciting and highly awaited update in Client Script! Over the past months, many of you shared your insights and requests, asking for the power to extend Client Script functionality to Quick Create forms. This capabilityEmpty folders are now appearing in the sidebar...

...and the folder list is now auto-collapsed by default with no way to change. Neither of these recent updates are useful or user-friendly. ==================== Powered by Haiku https://www.haiku.co.uk ====================Upload from Zoho Creator File Upload field to OpenAI Vector Store

I’ve struggled for quite a while to get this working properly. For a long time we relied on Azure Functions as a workaround to handle file transfers between Zoho Creator and OpenAI Vector Stores. It worked, but added unnecessary infrastructure and complexity.Career site URL - Suggestion to modify URL of non-english job posting

Hi, I would like to suggest making a few modification to career sites that are not in english. Currently, the URL are a mix of different languages and are very long. It makes for very unprofessional looking URLs... Here is an example of one of our URLI'd like to suggest a feature enhancement for SalesIQ that would greatly improve the user experience across different channels.

Hello Zoho Team, Current Limitation: When I enable the pre-chat form under Brands > Flow Controls to collect the visitor’s name and email, it gets applied globally across all channels, including WhatsApp, Messenger, and Instagram. This doesn't quite alignThe Social Playbook - February edition: Why moment marketing works (and how brands use it)

Imagine the final season of your favorite series is about to drop. Your entire feed is talking about it. Trailers everywhere. Fan theories. Hype at 100%. Now your go-to burger place launches a limited-edition meal box themed around that series—customPDF Attachment Option for Service Reports

Hello Team, I would like to check with you all if there is an option to attach PDF documents to the service reports. When I try to attach a file, the system only allows the following formats: JPEG, JPG, and PNG. Could you please confirm whether PDF attachmentsManage Every Customer Conversation from Every Channel inside Zoho SalesIQ

Your customers message you from everywhere. But are you really able to track, manage, and follow through on every conversation, without missing anything? With interactions coming in from websites, mobile apps, and messaging platforms like WhatsApp andApprovals in Zoho Creator

Hi, This is Surya, in one of my creator application I have a form called job posting, and I created an approval process for that form. When a user submits that form the record directly adding to that form's report, even it is in the review for approval.Cliq Bots - Post message to a bot using the command line!

If you had read our post on how to post a message to a channel in a simple one-line command, then this sure is a piece of cake for you guys! For those of you, who are reading this for the first time, don't worry! Just read on. This post is all about howDepositing funds to account

Hello, I have been using Quickbooks for many years but am considering moving to Zoho Books so I am currently running through various workflows and am working on the Invoicing aspect. In QB, the process is to create an invoice, receive payment and then【Zoho CRM】営業日のロジックに関するアップデート

ユーザーの皆さま、こんにちは。コミュニティチームの中野です。 今回は「Zoho CRM アップデート情報」の中から、営業日のロジックに関するアップデートをご紹介します。 本アップデートにより、ワークフローにおける営業日の計算方法が改善されました。 週末などの非営業日にワークフローのトリガーが発生した場合でも、 「+0」「+1」「+2 営業日」といった設定が、意図どおりに正確に動作するようになりました。 営業日に基づくワークフローでは、日付項目を基準に「何営業日後に処理を実行するか」を指定します。Merged cells are unmerging automatically

Hello, I have been using Zoho sheets from last 1 year. But from last week facing a issue in merged cells. While editing all merged cells in a sheet became unmerged. I merged it again, but it again unmerged. In my half an hour work I have to do this 3-4Introducing Built-in Telephony in Zoho Recruit

We’re excited to introduce Built-in Telephony in Zoho Recruit, designed to make recruiter–candidate communication faster, simpler, and fully traceable. These capabilities help you reduce app switching, handle inbound calls efficiently, and keep everyJust want email and office for personal use

I am unclear as how to how I would have just a personal email (already do have it and love it) and get to use docs, notebook, workdrive etc. In other words mostly everything I had a google. I find gocs can be free with 5gb and so can mail with 5gb. AreNext Page