What's New in Zoho Books - October 2023

Hello users!

We've rolled out a new set of features and enhancements. These updates bring you new features related to taxes, and other enhancements that will help improve your accounting experience with us. Read on to learn more about what's new in Zoho Books this October.

Feature Updates Related to Taxes

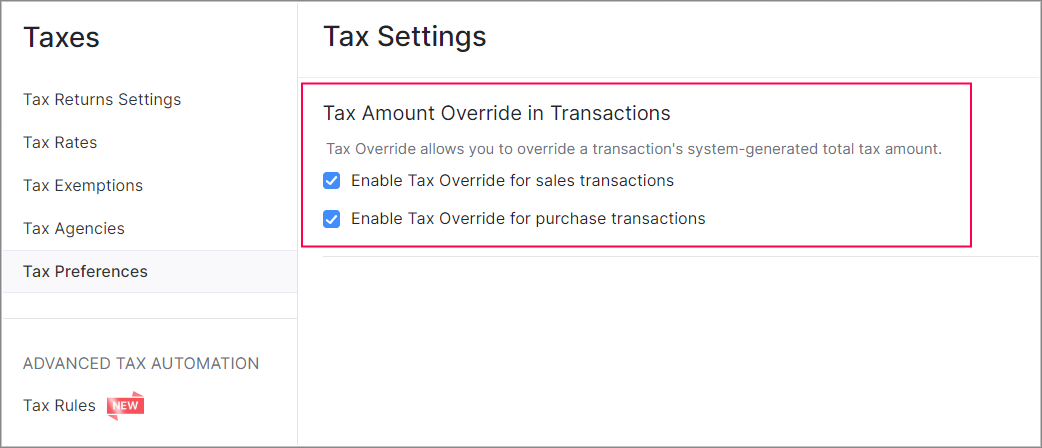

Tax Amount Override [Canada Edition]

You can now edit the system-generated tax amount in Sales and Purchases transactions. You can also remove the amount altogether by entering 0 in the Total Tax Amount field. You can choose to do this for Sales, Purchases, or both Sales and Purchases transactions. This can help you correct differences, if any, between the system-generated tax amount and the preferred tax amount.

To configure Tax Override, go to Settings > Taxes > Tax Preferences. Select the required option under Tax Amount Override in Transactions.

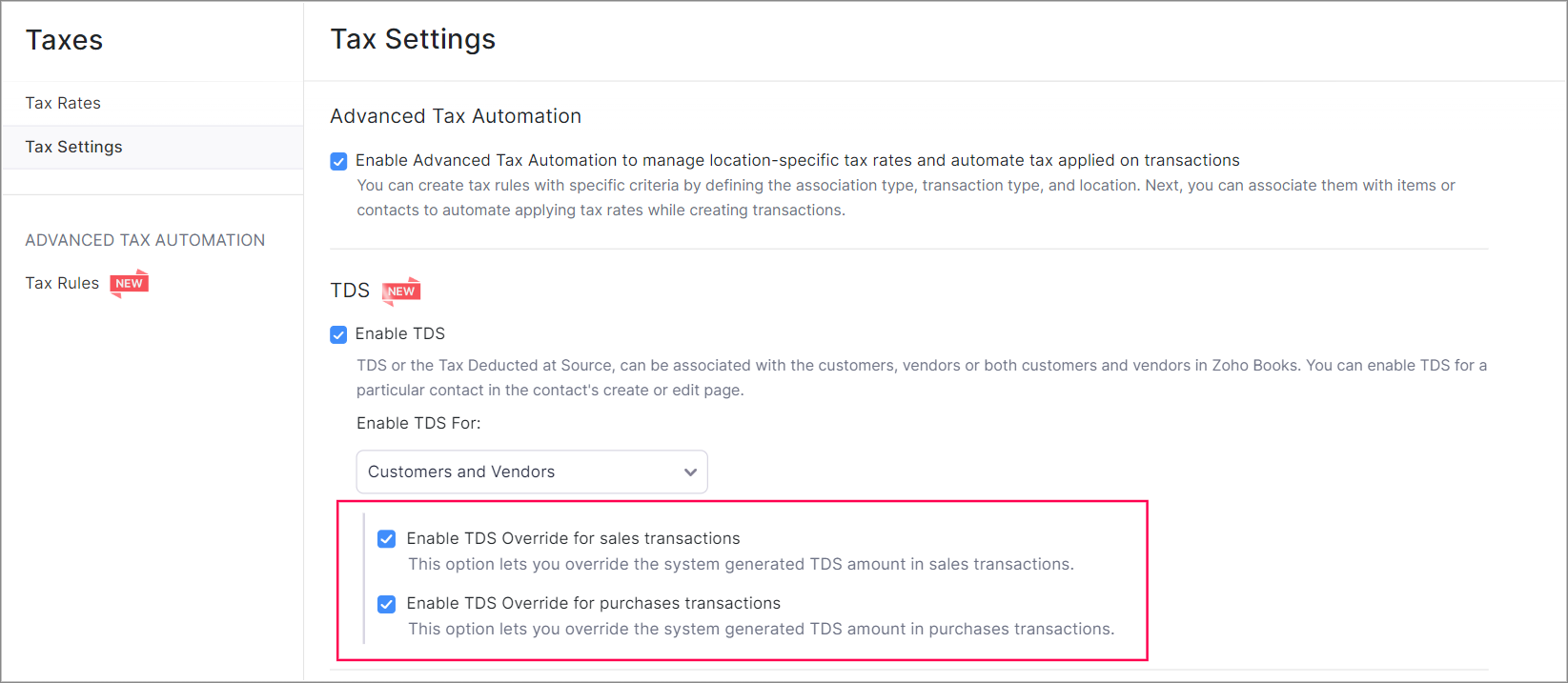

TDS Amount Override [Global Edition]

Similar to the tax amount override feature, you can configure TDS Override in your organization and enable users to edit the system-generated TDS amount in transactions.

Similar to the tax amount override feature, you can configure TDS Override in your organization and enable users to edit the system-generated TDS amount in transactions.

To configure TDS Override, go to Settings > Taxes > Tax Settings. Select the required option under TDS.

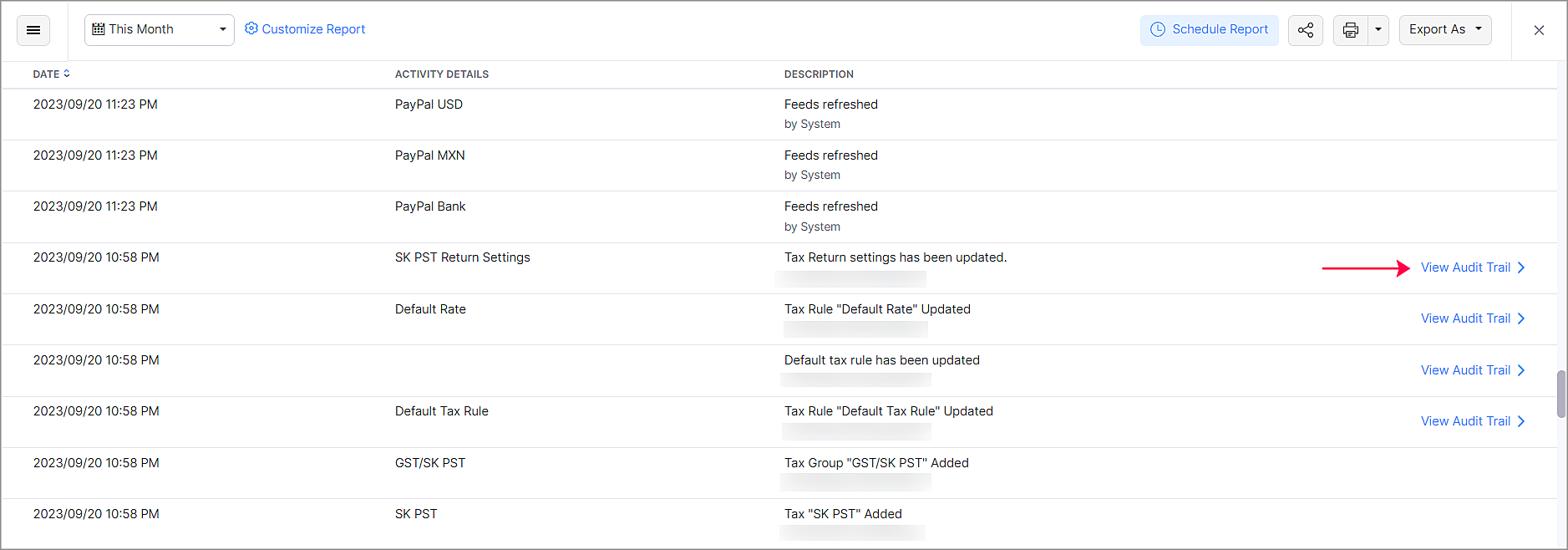

Audit Trail [Canada Edition]

We've supported Audit Trail which you can use to track every activity related to taxes like the date and time of when the activity occurred. Click View Audit Trail next to the specific activity related to taxes to drill down into the details of the activity. You can also view previous versions and compare two versions if required. This helps you easily identify and stay on top of the changes made to the tax configurations in your organization.

We've supported Audit Trail which you can use to track every activity related to taxes like the date and time of when the activity occurred. Click View Audit Trail next to the specific activity related to taxes to drill down into the details of the activity. You can also view previous versions and compare two versions if required. This helps you easily identify and stay on top of the changes made to the tax configurations in your organization.

You can access audit trails from Reports: Go to Activity and Audit Trail report under Activity in Reports.

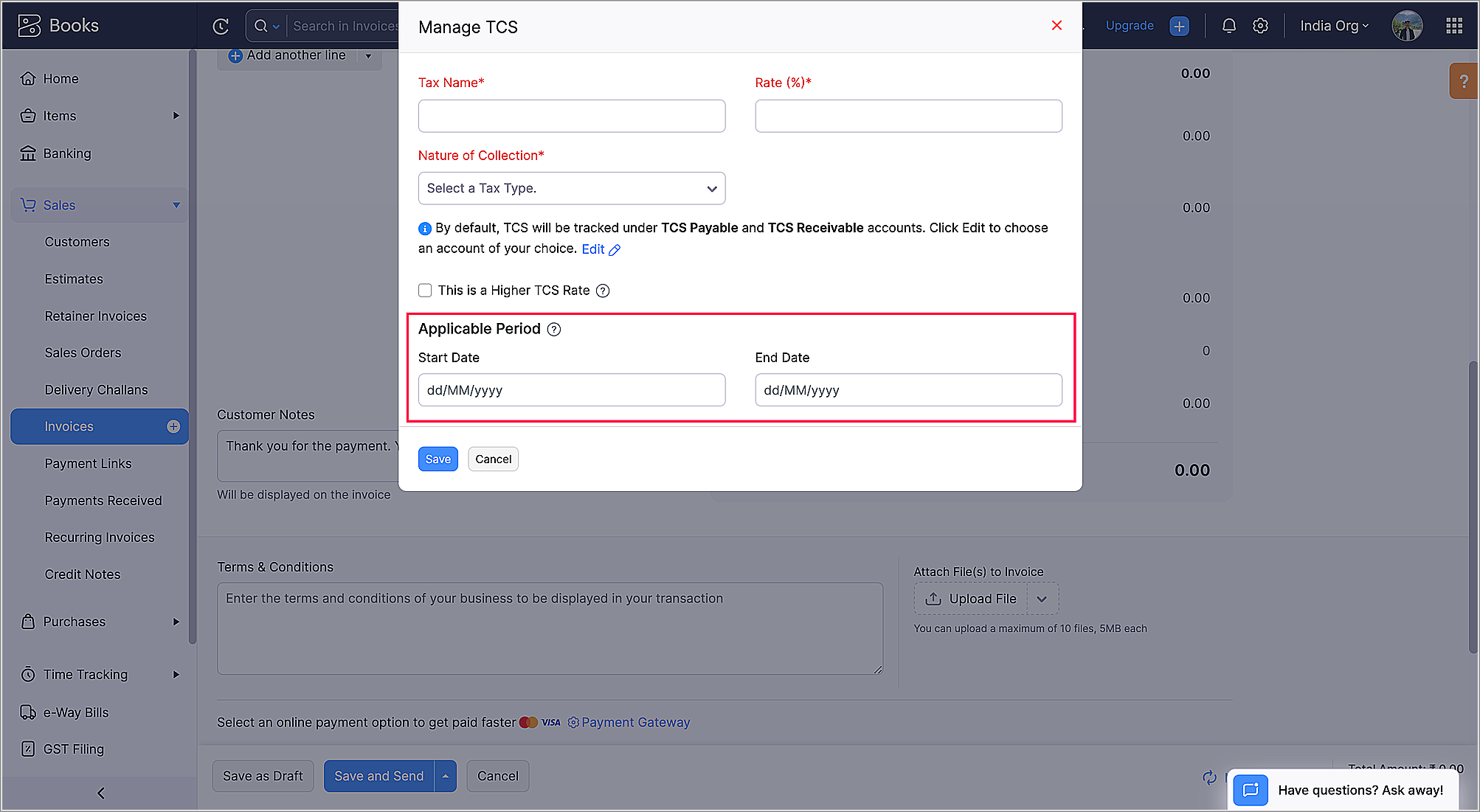

Configure Date Range for TCS Rates [India Edition]

Keeping up with the constantly changing TCS (Tax Collected At Source) rates in India and associating the correct tax rates in transactions can be tedious at times. We've introduced an option in the Manage TCS section where you can configure specific date ranges for TCS rates by associating a start date and/or end date. Once associated, the specific TCS rate can be applied to all transactions within the configured date range. This helps you avoid associating old or invalid TCS rates in transactions. You can also track the status of the configured TCS rates to view if it's active or expired.

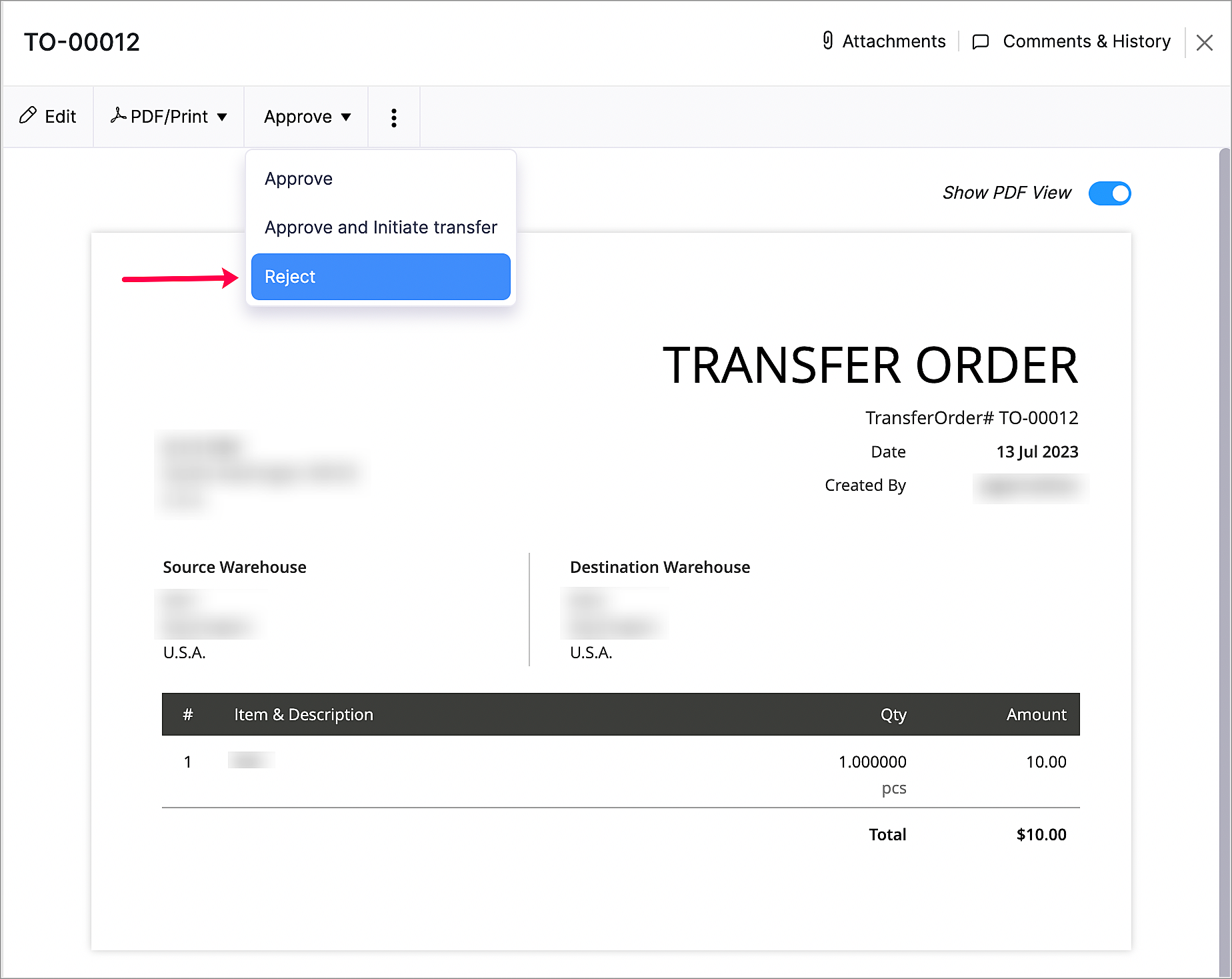

Reject Transfer Orders And Inventory Adjustments

Users with the necessary permissions (permission to approve transactions) now have the option to reject transfer orders and inventory adjustments that were submitted for approval. The rejected transactions can also be resubmitted by users. In addition to this, you can also edit the Quantity Adjusted in inventory adjustments that are in the Approval Pending or Approved statuses.

Note: Transfer Orders are only available for organizations in which the Zoho Inventory Add-on in enabled.

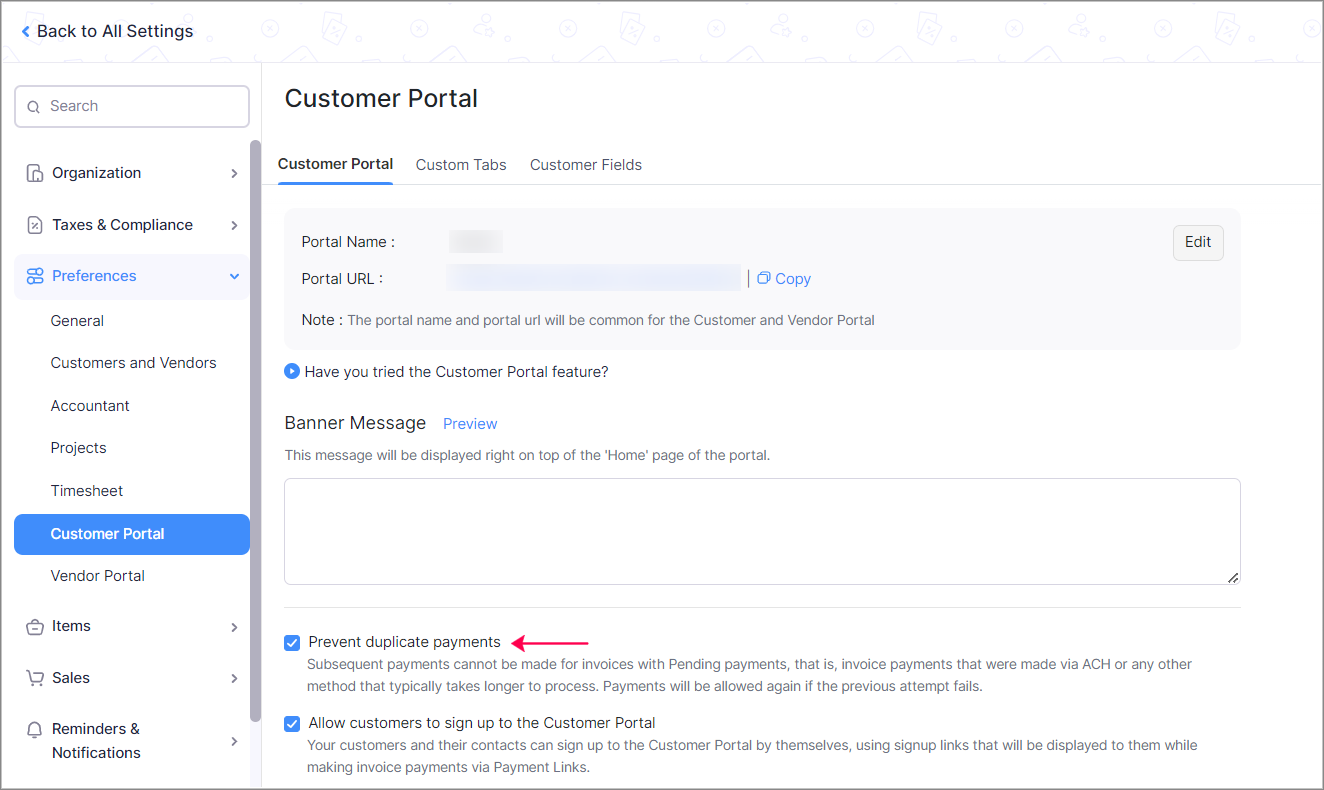

Prevent Duplicate Payments

Some payment methods like ACH or direct debit payments typically take about 2-3 days or longer to get processed. During this time, the related invoice's payment will be pending and your customers might try to re-initiate duplicate payments for the same invoice.

You can now restrict such duplicate payments for invoices using the Prevent Duplicate Payments preference. Once enabled, the Pay Now button won't be shown for invoices for which payment is still being processed. Your customers can make subsequent payments only if the first payment attempt fails. Thus, saving you the trouble of refunding duplicate payments.

This preference will be applied to all payments via transaction PDFs, email notifications, payment links and the Customer Portal.

That marks the end of this month's updates! We hope you found them helpful. Let us know what you think in the comments below. You can also visit the What's New timeline for byte-sized information on the previous feature updates and enhancements.

We'll catch you in next month's product updates. Until then, if you require any assistance or need clarifications, feel free to write to us at support@zohobooks.com, we'd be happy to help!

Best regards,

The Zoho Books Team

The Zoho Books Team

New to Zoho Recruit?

Zoho Developer Community

New to Zoho LandingPage?

Zoho LandingPage Resources

New to Bigin?

Topic Participants

Subhashri Kamaraj

Asha Kanta Sharma

alopez

Piyush Goyal

Subramanyam P

New to Zoho TeamInbox?

Zoho TeamInbox Resources

Zoho CRM Plus Resources

Zoho Books Resources

Zoho Subscriptions Resources

Zoho Projects Resources

Zoho Sprints Resources

Qntrl Resources

Zoho Creator Resources

Zoho CRM Resources

Zoho Show Resources

Get Started. Write Away!

Writer is a powerful online word processor, designed for collaborative work.

Zoho CRM コンテンツ

-

オンラインヘルプ

-

Webセミナー

-

機能活用動画

-

よくある質問

-

Ebook

-

-

Zoho Campaigns

- Zoho サービスのWebセミナー

その他のサービス コンテンツ

Nederlandse Hulpbronnen

ご検討中の方

Recent Topics

From Zoho CRM to Paper : Design & Print Data Directly using Canvas Print View

Hello Everyone, We are excited to announce a new addition to your Canvas in Zoho CRM - Print View. Canvas print view helps you transform your custom CRM layouts into print-ready documents, so you can bring your digital data to the physical world withCan the Product Image on the Quote Template be enlarged

Hello, I am editing the Quote Template and added ${Products.Product Image} to the line item and the image comes up but it is very tiny. Is there anyway that you can resize this to be larger? Any help would be great! ThanksWe Asked, Zoho Delivered: The New Early Access Program is Here

For years, the Zoho Creator community has requested a more transparent and participatory approach to beta testing and feature previews. Today, I'm thrilled to highlight that Zoho has delivered exactly what we asked for with the launch of the Early AccessAnalytics <-> Invoice Connection DELETED by Zoho

Hi All, I am reaching out today because of a big issue we have at the moment with Zoho Analytics and Zoho Invoice. Our organization relies on Zoho Analytics for most of our reporting (operationnal teams). A few days ago we observed a sync issue with theCreating Parent Child relationship in Accounts

We have customers with multiple locations, I setup the HQ as an account, then I setup the different sites marking the HQ as the parent to that location. If I then do a Deal for one of the locations, is there a way to show by looking at the parent accountclick to call feature

I've Zoho CRM and in that i want click to call feature.Learner transcript Challenges.

Currently i am working on a Learner Transcript app for my employer using Zoho Creator. The app is expected to accept assessment inputs from tutors, go through an approval process and upon call up, displays all assessments associated with a learner inClient and Vendor Portal

Some clients like keeping tabs on the developments and hence would like to be notified of the progress. Continuous updates can be tedious and time-consuming. Zoho Sprints has now introduced a Client and Vendor Portal where you can add client users andWhat's new in Zoho Sheet: Simplify data entry and collaboration

Hello, Zoho Sheet community! Last year, our team was focused on research and development so we could deliver updates that enhance your spreadsheet experience. This year, we’re excited to deliver those enhancements—but we'll be rolling them out incrementally#7 Tip of the week: Delegating approvals in Zoho People

With Zoho People, absences need not keep employees waiting with their approval requests. When you are not available at work, you can delegate approvals that come your way to your fellow workmate and let them take care of your approvals temporarily. Learn more!Admin Tip: Manage sub-domain emails using sub-domain stripping

As an admin, you may need separate domains for different departments such as sales, support, and marketing. While this approach offers flexibility, creating and managing multiple domains can quickly become overwhelming, especially since each domain requiresBring Zoho Shifts Capabilities into Zoho People Shift Module

Hello Zoho People Product Team, After a deep review of the Zoho People Shift module and a direct comparison with Zoho Shifts, we would like to raise a feature request and serious concern regarding the current state of shift management in Zoho People.Quick Copy Column Name

Please add the ability to quickly copy the name of a column in a Table or Query View. When you right-click the column there should be an option to copy the name, or if you left-click the column and use the Ctrl+C keyboard shortcut it should copy theAbility to Edit YouTube Video Title, Description & Thumbnail After Publishing

Hi Zoho Social Team, How are you? We would like to request an enhancement to Zoho Social that enables users to edit YouTube video details after the video has already been published. Your team confirmed that while Zoho Social currently allows editing theHow do I remove a data source from Zoho Analytics?

I am unable to find a delte option on a datasource that i put in the system as an error. On teh web it refers to a setup icon but I do not see that on my interface?Add Employee Availability Functionality to Zoho People Shift Module

Hello Zoho People Product Team, Greetings and hope you are doing well. We would like to submit a feature request to enhance the Zoho People Shift module by adding employee availability management, similar to the functionality available in Zoho Shifts.Bigin, more powerful than ever on iOS 26, iPadOS 26, macOS Tahoe, and watchOS 26.

Hot on the heels of Apple’s latest OS updates, we’ve rolled out several enhancements and features designed to help you get the most from your Apple devices. Enjoy a refined user experience with smoother navigation and a more content-focused Liquid GlassReally want the field "Company" in the activities module!

Hi team! Something we are really missing is able to see the field Company when working in the activities module. We have a lot of tasks and need to see what company it's related to. It's really annoying to not be able to see it.🙈 Thx!Delay in rendering Zoho Recruit - Careers in the ZappyWorks

I click on the Careers link (https://zappyworks.zohorecruit.com/jobs/Careers) on the ZappyWorks website expecting to see the job openings. The site redirects me to Zoho Recruit, but after the redirect, the page just stays blank for several seconds. I'mIs Desk Down?

Across department - always an error. [Status Mode] - error [Table View and the rest] - workingHow do I change the wording of the tile of SignForm?

When my user opens a SignForm url, the title that is presented is always "SignForm signer Information" and a form is displayed asking for the username and email address. This can be confusing to the end user. How can I change the title at least (Or atHow to link tickets to a Vendor/Vendor Contact (not Customer) for Accounting Department?

Hi all, We’re configuring our Accounting department to handle tickets from both customers and vendors (our independent contractors). Right now, ticket association seems to be built around linking a ticket to a Customer / Customer Contact, but for vendor-originatedProblem with CRM Connection not Refreshing Token

I've setup a connection with Zoom in the CRM. I'm using this connection to automate some registrations, so my team doesn't have to manually create them in both the CRM and Zoom. Connection works great in my function until the token expires. It does not refresh and I have to manually revoke the connection and connect it again. I've chatted with Zoho about this and after emailing me that it couldn't be done I asked for specifics on why and they responded. "The connection is CRM is not a feature toAutomatic Matching from Bank Statements / Feeds

Is it possible to have transactions from a feed or bank statement automatically match when certain criteria are met? My use case, which is pretty broadly applicable, is e-commerce transactions for merchant services accounts (clearing accounts). In theseClone Recurring Expenses

Our bookkeeping practices make extensive use of the "clone" feature for bills, expenses, invoices, etc. This cuts down significantly on both the amount of typing that needs to be done manually and, more importantly, the mental overhead of choosing theUnify Overlapping Functionalities Across Zoho Products

Hi Zoho One Team, We would like to raise a concern about the current overlap of core functionalities across various Zoho applications. While Zoho offers a rich suite of tools, many applications include similar or identical features—such as shift management,Automation #7 - Auto-update Email Content to a Ticket

This is a monthly series where we pick some common use cases that have been either discussed or most asked about in our community and explain how they can be achieved using one of the automation capabilities in Zoho Desk. Email is one of the most commonlyTicket to article and Ticket to template

Hello! I would like to know if it is possible (and how) to do the following actions: 1. To generate an article from a ticket (reply + original message) 2. Easy convert an answer to an email templateIs there API Doc for Zoho Survey?

Hi everyone, Is there API doc for Zoho Survey? Currently evaluating a solution - use case to automate survey administration especially for internal use. But after a brief search, I couldn't find API doc for this. So I thought I should ask here. ThanWindows Desktop App - request to add minimization/startup options

Support Team, Can you submit the following request to your development team? Here is what would be optimal in my opinion from UX perspective: 1) In the "Application Menu", add a menu item to Exit the app, as well as an alt-key shortcut for these menusKaizen #225 - Making Query-based Custom Related Lists Actionable with Lookups and Links

Hello everyone! Welcome back to another post in the Kaizen series! This week, we will discuss an exciting enhancement in Queries in Zoho CRM. In Kaizen #190, we discussed how Queries bridge gaps where native related lists fall short and power custom relatedWebDAV / FTP / SFTP protocols for syncing

I believe the Zoho for Desktop app is built using a proprietary protocol. For the growing number of people using services such as odrive to sync multiple accounts from various providers (Google, Dropbox, Box, OneDrive, etc.) it would be really helpfulCRM x WorkDrive: We're rolling out the WorkDrive-powered file storage experience for existing users

Release plan: Gradual rollout to customers without file storage add-ons, in this order: 1. Standalone CRM 2. CRM Plus and Zoho One DCs: All | Editions: All Available now for: - Standalone CRM accounts in Free and Standard editions without file storageNon-responsive views in Mobile Browser (iPad)

Has anyone noticed that the creator applications when viewed in a mobile browser (iPad) lost its responsiveness? It now appears very small font size and need to zoom into to read contents. Obviously this make use by field staff quite difficult. This is not at all a good move, as lots of my users are depending on accessing the app in mobile devices (iPads), and very challenging and frustrating.[Free Webinar] Learning Table Series - AI-Enhanced Logistics Management in Zoho Creator

Hello Everyone! We’re excited to invite you to another edition of Learning Table Series, where we showcase how Zoho Creator empowers industries with innovative and automated solutions. About Learning Table Series Learning Table Series is a free, 45-60Customizable UI components in pages | Theme builder

Anyone know when these roadmap items are scheduled for release? They were originally scheduled for Q4 2025. https://www.zoho.com/creator/product-roadmap.htmlFeature Request - Set Default Values for Meetings

Hi Zoho CRM Team, I would be very useful if we could set default values for meeting parameters. For example, if you always wanted Reminder 1 Day before. Currently you need to remember to choose it for every meeting. Also being able to use merge tags toHow to use Rollup Summary in a Formula Field?

I created a Rollup Summary (Decimal) field in my module, and it shows values correctly. When I try to reference it in a Formula Field (e.g. ${Deals.Partners_Requested} - ${Deals.Partners_Paid}), I get the error that the field can’t be found. Is it possibleZoho Creator to Zoho CRM Images

Right now, I am trying to setup a Notes form within Zoho Creator. This Notes will note the Note section under Accounts > Selected Account. Right now, I use Zoho Flow to push the notes and it works just fine, with text only. Images do not get sent (thereCRM gets location smart with the all new Map View: visualize records, locate records within any radius, and more

Hello all, We've introduced a new way to work with location data in Zoho CRM: the Map View. Instead of scrolling through endless lists, your records now appear as pins on a map. Built on top of the all-new address field and powered by Mappls (MapMyIndia),Next Page