What's New - March 2025 | Zoho Backstage

Hello there,

We’re thrilled to introduce a much-awaited lineup of powerful features and enhancements designed to fulfill your event management needs. Here's a round-up of the latest updates that will enhance your experience with Zoho Backstage this month.

Offer Tickets

Early bird and limited-time offers are powerful tools to boost ticket sales and generate early revenue. With the new Offer Tickets feature, you can create multiple offers as tiers within a single ticket class, making the process more streamlined and automated.

Previously, you had to create separate ticket classes for each offer and manually manage their availability. Now, you can:

- Add multiple offers under a single ticket class

- Automate the offer start and stop conditions

- Reduce manual intervention

Key benefits

- Increased marketing impact: Time-sensitive discounts create a sense of urgency, encouraging faster ticket purchases.

- Early revenue and cash flow: Early sales provide immediate cash flow to cover event expenses like venue deposits, marketing, and logistics.

- Leverage Psychological Triggers:

- FOMO (Fear of Missing Out): Limited-time availability compels attendees to act quickly.

- Perceived Savings: Attendees feel they are getting a deal, making them more likely to buy.

How to use

Setting up offers

You can add offers as tiers within a ticket class and configure their availability based on:

- Time: Set specific start and end dates for the offer.

- Quantity: Define the number of tickets available at the offer price.

Flexible offer progression

From the second offer onward, you can choose to automatically start the next offer when the previous one ends. Or, set a custom start date for the new offer.

Customizing offer display

You can customize how offers are displayed on your event website using the Website Designer. The offer card can show:

- Current Offer

- Previous Offer

- Next Offer

- Both Previous and Next Offers

This flexibility helps you highlight the most relevant deals and enhance visibility.

Good to know

- During the ticket purchase process, the offer name appears alongside the ticket class name. The order summary clearly displays the applied offer.

- After attendees purchase their tickets, the "Your Orders" section displays the offer name along with the ticket class name. The invoice also reflects the offer name for transparency.

- When manually adding an order, any valid offers associated with the ticket class are applied automatically. There's no need for manual price adjustments.

- During check-in, only the original ticket class amount is displayed.

- Offer-tiered tickets cannot be selected during manual check-in.

Click here to learn more.

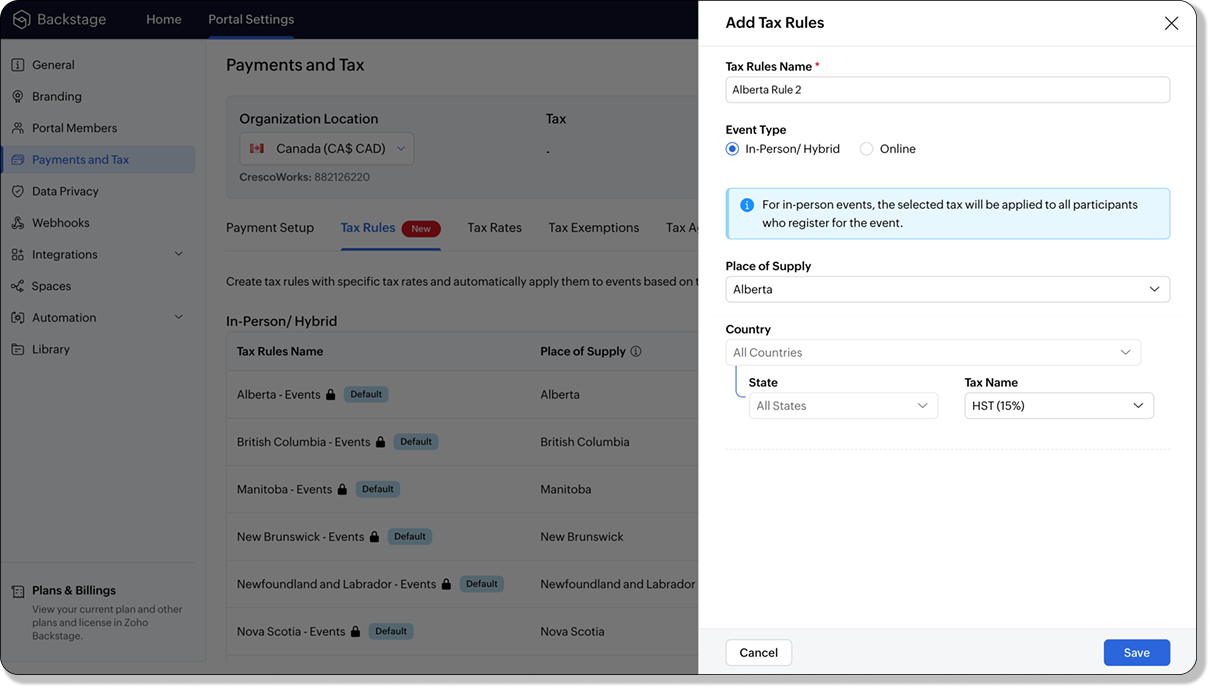

Tax Rules - Canada (Early access)

Accurate tax calculation is essential for ensuring compliance and transparency in event management. With the new Tax Rules feature for Canada, you can automatically apply the correct tax rates based on your event location, making tax management simpler and more efficient. Zoho Backstage now allows you to create tax rules for all 10 provinces and 3 territories, which can be selected and applied to an event automatically, ensuring the correct tax rates are applied without manual adjustments. This feature supports in-person, hybrid, and online events, offering flexibility and accuracy.

The Canadian tax rule engine covers 10 provinces, 3 territories, multiple tax agencies, and 12 sales tax rates, providing a comprehensive solution for handling event-related taxes.

How do taxes work on Canadian events?

For in-person and hybrid events, the tax rate is determined by the event’s physical location, based on the Place of Supply, in compliance with Canada Revenue Agency (CRA) regulations. This ensures attendees are charged the appropriate tax rate according to the province or territory where the event takes place.

For online events, where no physical venue exists, the tax is calculated based on the attendee’s location. This ensures the correct sales tax is applied, even when attendees purchase tickets from different provinces or countries.

How to use

To enable Canada Tax Rules, configure your organization’s location:

- Go to Portal Settings > Payments and Tax.

- Select Canada as the organization location.

Once configured, the system automatically populates:

- 12 default tax rates covering all provinces and territories.

- 13 tax rules (one for each region).

- A default rule for online events, applying the correct tax based on the attendee’s location.

- 5 tax agencies for accurate tax handling.

You can create new tax rates, groups, and authorities to meet your event’s specific needs. Additionally, you can add custom tax rules for both in-person/hybrid and online events, giving you full control over how taxes are applied.

Applying Tax Rules to In-Person and Hybrid events

For in-person and hybrid events, Zoho Backstage automatically suggests tax rules based on the event location. The 13 default tax rules cover all Canadian provinces and territories. If the event location changes, the system automatically updates the relevant tax rules to reflect the new region’s rates.

You can also create custom tax rules by selecting a specific province or territory and applying a custom tax rate, offering greater flexibility for managing event taxes.

Applying Tax Rules to Virtual events

For online events, the system uses a default tax rule that covers all Canadian provinces and territories. Taxes are applied based on the attendee's location.

Canadian attendees are charged the applicable provincial tax rate.

International attendees are assigned a zero tax rate by default.

If you need to apply taxes to international attendees, you can create new tax rules tailored for online events, ensuring compliance with international tax regulations.

- Tax rules in Zoho Backstage are flexible and dynamic. You can modify them at any time during your event setup. However, changes will only apply to new transactions. Existing transactions will retain the original tax rule, ensuring previous purchases remain unaffected.

- If you select a non-Canadian location for your event, the Canada Tax Rule will not be applied. This ensures taxes are only charged where applicable, preventing errors in cross-border events.

Event Category

Categorize and filter events based on custom classifications for organizers and attendees to find and manage events easily. This new addition is aimed at improving event management by giving organizers the flexibility to create, manage, and filter events using custom categories. Organizers can now create up to 100 custom categories when setting up an event, giving them the freedom to define categories that suit their specific needs.

Previously, categories selected in Event Info were not utilized elsewhere, and there was no option to add new/manage categories.

Now, organizers can tailor categories to their specific needs and filter them on the Event Directory.

To access:

- While Creating an Event: On the Event Info page.

- For Category Management: Under Portal Settings > Branding > Event Category.

Permissions:

Portal Owners & Admins:

- Add, edit, and delete custom categories.

- Cannot edit or delete default categories.

Event Organizers:

- Can only add new categories.

- Cannot edit or delete existing custom or default categories.

Other Enhancements

Floor plan Focus Area

The Focus Area in the floor plan refers to designated spaces within the event venue that are visually highlighted to draw attention to specific sections, such as booths, stages, or key locations. These areas allow organizers to emphasize important spots, making navigation easier for attendees and improving the overall flow of the event. Focus areas help guide visitors to essential parts of the venue, enhancing their event experience.

Custom Dates for ticket classes (Early access)

In cases where smaller sessions or events (like welcome events, after-event parties, etc.) occur before or after the main event, this feature allows organizers to assign specific dates to separate ticket classes, ensuring tickets are only valid for the selected dates.

Custom dates can be set within 30 days before or after the main event.

New WhatsApp triggers and templates

The WhatsApp Integration, designed to enhance communication and engagement with all event stakeholders, now includes new triggers and templates to facilitate messaging and ensure timely updates for everyone.

For Purchasers:

- Send Registration Confirmation: Instantly confirm registration to enhance the attendee experience.

- Order Canceled: Notify purchasers promptly in case of any order cancellations.

For Speakers:

- Welcome Speaker: Extend a warm welcome to our speakers and set a positive tone for their participation.

- Speaker Added to a Session: Inform speakers when they’re added to a session, ensuring they are well-prepared.

- Speaker Removed from a Session: Provide timely updates should there be any changes to their session involvement.

For Sponsors:

- Thank a Sponsor Before Website is Live: Show appreciation early on, fostering positive relationships with sponsors.

- Welcome and Thank Sponsor After Website is Live: Acknowledge sponsors publicly once the event website goes live.

- Deny Sponsor Proposal: Deliver sensitive information with professionalism and clarity.

- Acknowledge Sponsor Proposal: Confirm receipt of sponsor proposals, keeping communication open and transparent.

For Participants:

- Event Canceled: Quickly inform participants in the event of cancellations, ensuring they’re kept in the loop.

We are continuously refining Zoho Backstage to make your event management experience even more powerful and intuitive. Stay tuned for more updates in the coming months!

If you have any questions, please contact support@zohobackstage.com.

Centralize Knowledge. Transform Learning.

All-in-one knowledge management and training platform for your employees and customers.

New to Zoho Recruit?

Zoho Developer Community

New to Zoho LandingPage?

Zoho LandingPage Resources

New to Bigin?

Topic Participants

Jithan Raghuraj

New to Zoho TeamInbox?

Zoho TeamInbox Resources

Zoho CRM Plus Resources

Zoho Books Resources

Zoho Subscriptions Resources

Zoho Projects Resources

Zoho Sprints Resources

Qntrl Resources

Zoho Creator Resources

Zoho CRM Resources

Zoho Show Resources

Get Started. Write Away!

Writer is a powerful online word processor, designed for collaborative work.

Zoho CRM コンテンツ

-

オンラインヘルプ

-

Webセミナー

-

機能活用動画

-

よくある質問

-

Ebook

-

-

Zoho Campaigns

- Zoho サービスのWebセミナー

その他のサービス コンテンツ

Nederlandse Hulpbronnen

ご検討中の方

Recent Topics

Actual vs Minimum

Hi all, I am sure I am not the only one having this need. We are implementing billing on a 30-minute increment, with a minimum of 30 minutes per ticket. My question is, is there a way to create a formula or function to track both the minimum bill vs theZoho CRM for Everyone's NextGen UI Gets an Upgrade

Hello Everyone We've made improvements to Zoho CRM for Everyone's Nextgen UI. These changes are the result of valuable feedback from you where we’ve focused on improving usability, providing wider screen space, and making navigation smoother so everythingMultiple header in the quote table???

Hello, Is it possible in Zoho CRM to add multiple headers or sections within the Quote product table, so that when the quote is printed it shows separate sections (for example “Products” and “Services”)? To clarify, I’m asking because: This does not appearOne Support Email Managed By Multiple Departments

Hello, We use one support email (support@company.com). Incoming emails come to the "Support Department" and based on what the customer is asking, we route that ticket to different departments (billing, technical support, etc.). When users in these differentbig 5 accounts

how do you find what accounts are listed as Big 5 ?RSC Connectivity Linkedin Recruiter RPS

It seems there's a bit of a push from Linkedin Talent Solutions to keep integrations moving. My Account Manager confirmed that Zoho Recruit is a Certified Linkedin Linkedin Partner but does not have RSC as of yet., (we knew that :-) She encouraged meError AS101 when adding new email alias

Hi, I am trying to add apple@(mydomain).com The error AS101 is shown while I try to add the alias.New UI in Zoho One CRM

Hello, Just switched to the new UI for Zoho One CRM, do not like it, especially the search functions. What are the steps to backstep to the previous UI? UPDATE: I found it.ZOHO.CRM.UI.Record.open not working properly

I have a Zoho CRM Widget and in it I have a block where it will open the blocks Meeting like below block.addEventListener("click", () => { ZOHO.CRM.UI.Record.open({ Entity: "Events", RecordID: meeting.id }).catch(err => { console.error("Open record failed:",Python - code studio

Hi, I see the code studio is "coming soon". We have some files that will require some more complex transformation, is this feature far off? It appears to have been released in Zoho Analytics already🚀 WorkDrive 6.0 (Phase 1): Empowering Teams with Content Intelligence, Automation, Accessibility, and Control

Hello, everyone! WorkDrive continues to evolve from a robust file management solution into an intelligent, secure, and connected content collaboration platform for modern businesses. Our goal remains unchanged: to simplify teamwork, strengthen data security,Introducing Workqueue: your all-in-one view to manage daily work

Hello all, We’re excited to introduce a major productivity boost to your CRM experience: Workqueue, a dynamic, all-in-one workspace that brings every important sales activity, approval, and follow-up right to your fingertips. What is Workqueue? SalesDepartment Overview by Modified Time

We are trying to create visuals to show the work our agents do in Zoho Desk. Using Zoho Analytics how can we create a Department Overview per modified time and not ticket created time? In order for us to get an accurate view of the work our agents areZoho Commerce

Hi, I have zoho one and use Zoho Books. I am very interested in Zoho Commerce , especially with how all is integrated but have a question. I do not want my store to show prices for customers that are not log in. Is there a way to hide the prices if notSupport Custom Background in Zoho Cliq Video Calls and Meetings

Hello Zoho Cliq Team, We hope you are doing well. We would like to request an enhancement to the video background capabilities in Zoho Cliq, specifically the ability to upload and use custom backgrounds. Current Limitation At present, Zoho Cliq allowsUpload own Background Image and set Camera to 16:9

Hi, in all known online meeting tools, I can set up a background image reflecting our corporate design. This doesn't work in Cliq. Additionally, Cliq detects our cameras as 4:3, showing black bars on the right and left sides during the meeting. WhereISO 27001 Compliance

What are people doing to ensure ISO 27001 compliance for their Zoho environments? It would make sense for Log360 Cloud to integrate natively with the Zoho suite, but that is not the case. It requires a gateway cluster, which is not an option for a fullyZoho People - Retrieve the Leave Details - get("LeaveCount")

Hi, Zoho People I need to collect all of an employee's leave requests for the calendar year and check how many half-days they have taken. If I run the script on the query he just modified, I can retrieve the information related to that query and use theExport blueprint as a high-resolution PDF or image file

This would be a good feature for organizations that want to share the blueprint process with their employees but don't want them to have access to the blueprint in the system settings. At the moment all that users can do is screenshot the blueprint orImporting into Multiselect Picklist

Hi, We just completed a trade show and one of the bits of information we collect is tool style. The application supplied by the show set this up as individual questions. For example, if the customer used Thick Turret and Trumpf style but not Thin Turret,What's new in Zoho Sheet: Simplify data entry and collaboration

Hello, Zoho Sheet community! Last year, our team was focused on research and development so we could deliver updates that enhance your spreadsheet experience. This year, we’re excited to deliver those enhancements—but we'll be rolling them out incrementallyMarketer's Space: New to Campaigns? Some common early mistakes that might occur

Hello Marketers, Welcome back to another post in Marketer's Space. If you're just getting started with Zoho Campaigns, things can feel exciting and slightly confusing at the same time. You're not alone. Most early frustrations come from setup gaps ratherThis user is not allowed to add in Zoho. Please contact support-as@zohocorp.com for further details

Hello, Just signed up to ZOHO on a friend's recommendation. Got the TXT part (verified my domain), but whenever I try to add ANY user, I get the error: This user is not allowed to add in Zoho. Please contact support-as@zohocorp.com for further details I have emailed as well and writing here as well because when I searched, I saw many people faced the same issue and instead of email, they got a faster response here. My domain is: raisingreaderspk . com Hope this can be resolved. Thank youNew 2026 Application Themes

Love the new themes - shame you can't get a little more granular with the colours, ie 3 different colours so one for the dropdown menu background. Also, I did have our logo above the application name but it appears you can't change logo placement positionWorkflow Rule - Field Updates: Ability to use Placeholders

It will be great if you can use placeholder tags to update fields. For example if we want to update a custom field with the client name we can use ${CONTACT.CONTACT_FIRSTNAME}${CONTACT.CONTACT_LASTNAME}, etcNeed a Universal Search Option in Zohobooks

Hello Zoho, Need a Universal Search Option in Zohobooks to search across all transactions in our books of accounts. Please do the needful ThanksImplement Date-Time-Based Triggers in Zoho Desk

Dear Zoho Desk Support Team, We are writing to request a new feature that would allow for the creation of workflows triggered by specific date-time conditions. Currently, Zoho Desk does not provide native support for date-time-based triggers, limitingWhy is my Lookup field not being set through Desk's API?

Hello, I'm having trouble setting a custom field when creating a Ticket in Zoho Desk. The endpoint I'm consulting is "https://desk.zoho.com/api/v1/tickets" and even though my payload has the right format, with a "cf" key dedicated to all custom fields,How exactly does "Reply assistance" work in Zoho Desk? What context is sent to the LLM?

Hi, Im trying to better understand the technical behavior of the feature "Reply assistance" in Zoho Desk, and I couldn’t find detailed information in the current documentation. Specifically, I have questions about what data is actually being sent to theDeletion Workflows

Hello, Unless I missed it, we can't create deletion workflows. My usecase is to auto-delete junk leads. We have field called lead status, and an agent qualify all our new leads. When it's a junk lead she chose the correspondant value in the picklist. My goal is that the system delete them automatically. Is that possible? Planed ?URGENTImpossible to book an appointement

J'essaie plusieurs fois mais aucun créneau n''est disponible Message d'erreur lorsque j'essaie de sélectionner une dateSendpulse SMTP/IMAP Issues

It’s possible Zoho made some changes on their side. Sometimes, even if your regular password works, Zoho requires an app-specific password for external apps like SendPulse to connect via IMAP. You can create this in Zoho’s security settings and use itInsane mail security

I cannot access my email... anywhere. For some reason the password for the Mail app on my Mac is being rejected, it worked yesterday but now it doesn't? Ok let's try the web interface. I can access my general Zoho login with the password but if I wantUI issue with Organize Tabs

When looking at the organize Tabs window (bellow) you can see that some tabs are grayed out. there is also a "Add Module/Web Tab" button. When looking at this screen it's clear that the grayed out tabs can not be removed from the portal user's screenTask list flag Internal/External for all phases

Phases are commonly used in projects to note milestones in the progression of a project, while task lists can be used to group different types of tasks together. It makes sense to be able to define a task list as either internal or external however theHAVING PROBLEM WITH SENDING EMAIL

Hi all, I'm unable to receive emails on info@germanforgirls.eu. I'm getting an error code 550. 5.1.1. invalid email recipients. Moreso, I would like info@germanforgirls.eu to be the default "send from" email and not solomon@germanforgirls.eu. Kindly seeSharing my portal URL with clients outside the project

Hi I need help making my project public for anyone to check on my task. I'm a freelance artist and I use trello to keep track on my client's projects however I wanted to do an upgrade. Went on here and so far I'm loving it. However, I'm having an issue sharing my url to those to see progress. They said they needed an account to access my project. How do I fix this? Without them needing an account.Different Task Layouts for Subtasks

I was wondering how it would be possible for a subtask to have a different task layout to the parent task.Subscription went to default (@zoho.com) address instead for custom domain

Hello! So I bought a lite sub to test things out, wanting to use my own domain. However, after passing through all the verification steps (completed now), it seems that the sub I bought was assigned to the default email that I already had with Zoho andCanvas templates and font-family

i dont understant why its always the smallest things that waste all of my time! why in some videos i see they have tamplates in the Canvas editor and i cant seem to fint it? and why oih why cant i cange the font? i just want simple Arial! help meeeeeeeeeeNext Page